[ad_1]

Bitcoin worth was buying and selling increased on Wednesday, hitting an intraday excessive of $30,000 earlier than pulling again. At press time, the digital asset was buying and selling barely decrease at $29,477. BTC’s whole market cap has jumped by greater than 2% over the past day to $572 billion, with the full quantity of the asset traded over the identical interval up by 49.59%.

Fundamentals

Bitcoin worth has been in consolidation mode for the previous few days amid immense market strain and macroeconomic headwinds. World uncertainty, market volatility, and financial considerations in america and the UK have been weighing on the broader crypto market, pushing the Bitcoin worth decrease, under the important thing resistance degree of $31,000.

With rate of interest hikes by international central banks and protracted inflation, the worldwide crypto market is prone to be beneath strain within the coming days. Final week, the US Federal Reserve introduced 1 / 4 share level enhance in its rate of interest in its July assembly, taking benchmark borrowing prices to their highest degree in additional than twenty years.

The European Central Financial institution additionally raised its rates of interest final week, hitting its highest degree in 15 years. The Financial institution of England (BoE) can be anticipated to hike its funds fee on the finish of its assembly on Thursday. An setting of upper rates of interest tends to be bearish for danger property reminiscent of shares and significantly, cryptocurrencies.

A take a look at the Crypto Worry and Greed Index, which measures the important thing feelings driving the cryptocurrency market, exhibits a decline in danger urge for food by traders. The index has been hovering round a impartial degree of 53, down from the Greed degree of 64 seen just a few weeks in the past. A impartial studying exhibits that traders are in conservation mode and could possibly be prompted to shift to conventional monetary investments with lesser dangers.

Bitcoin Value Technical Evaluation

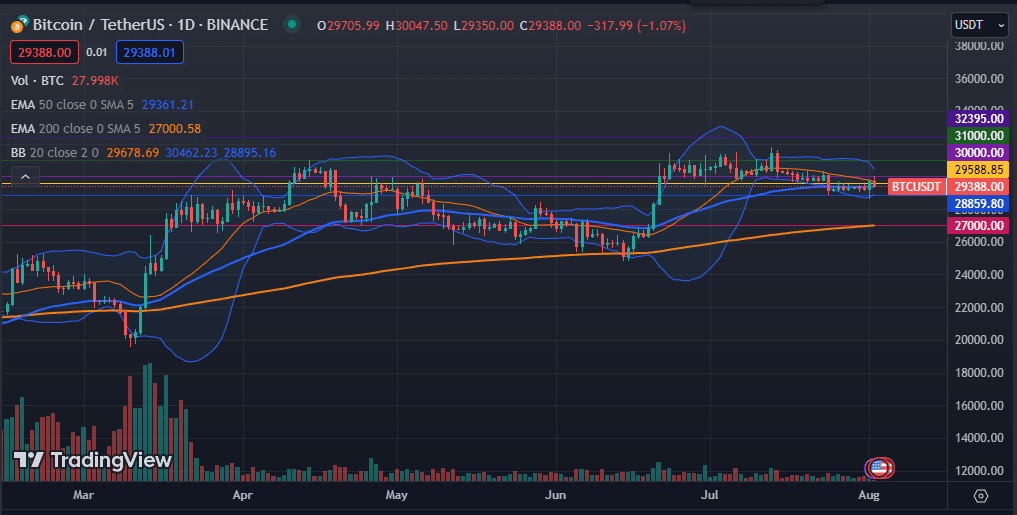

The day by day chart exhibits that the Bitcoin worth has been buying and selling sideways for the previous few days amid international financial uncertainty and market volatility. The digital forex briefly retested the important thing essential degree of $30,000 on Wednesday earlier than pulling again. Bitcoin, the most important cryptocurrency by market cap, slipped to its lowest degree since June 21, 2023, earlier than a minor upward worth reversal.

Bitcoin is buying and selling barely above the 50-day and 200-day exponential shifting averages however stays under the 50-day easy shifting averages. Its Relative Power Index (RSI) has dropped under the impartial degree, signaling a rise in promoting strain. The Transferring Common Convergence Divergence (MACD) indicator, in addition to the Momentum indicator, is pointing to extra draw back. The Bollinger Bands have additionally narrowed, displaying a decline in volatility.

Subsequently, the Bitcoin worth is prone to proceed shifting sideways within the ensuing periods because it struggles to search out path. A transfer above the bullish assist at $29,588.85 will pave the best way for additional features as bulls eye the important thing resistance degree of $30,000. Nevertheless, we can not rule out a slip to the assist degree at $28,859.80 which is able to result in additional losses.

[ad_2]

I’m extremely inspired with your writing skills as well as with the layout on your weblog. Is that this a paid subject or did you customize it yourself? Either way stay up the excellent quality writing, it is rare to look a great blog like this one today!

Your article helped me a lot, is there any more related content? Thanks!

https://t.me/s/ef_beef

https://t.me/s/site_official_1win/228

https://t.me/s/officials_pokerdom/3273

https://t.me/s/iGaming_live/4867

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Хотите знать, кому можно доверять в мире онлайн-казино? Наш справочник проводит независимую экспертизу: проверяем лицензии, процесс выплат и качество игр. Рейтинги объективны — мы не торгуем позициями. Принципы оценки открыты для всех. Подойдёт как новичкам, так и опытным игрокам. Следим за изменениями и регулярно обновляем информацию. Узнать о рейтингах казино