[ad_1]

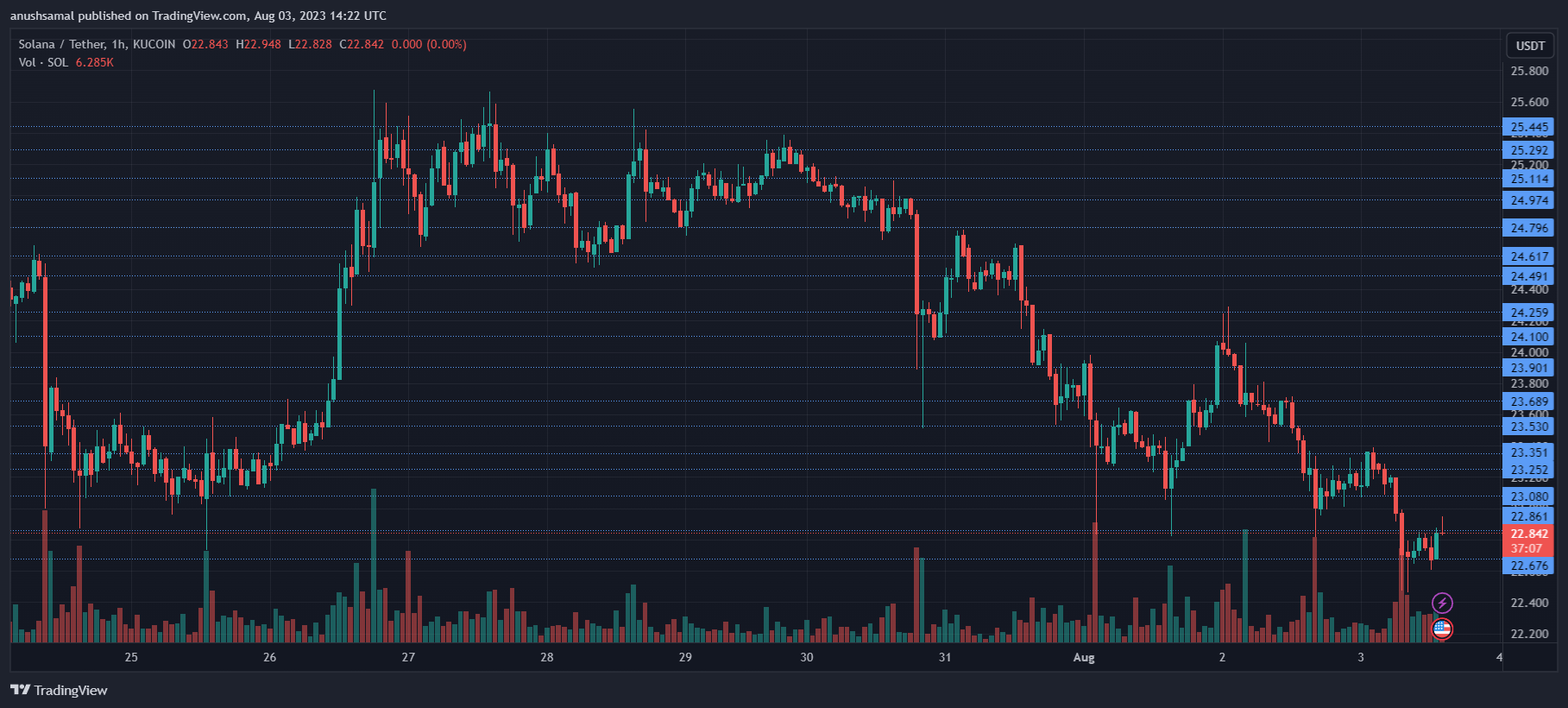

The Solana value skilled notable positive aspects in mid-June, however a latest correction section has pulled it right down to $22, which has discovered robust assist. The technical outlook at the moment leans in direction of the bears, suggesting a possible slight dip earlier than a potential turnaround.

The altcoin tried to rise from the assist stage up to now week, however the bullish momentum waned. Regardless of the prospect of a rally as a consequence of a requirement zone under $22, a brand new resistance on the $25 stage could pose a problem.

As Bitcoin slipped into the $29,000 vary, different altcoins additionally confronted downward stress on their charts. For SOL to reverse its pattern, total market energy is important. The falling market capitalization of SOL signifies continued management by sellers over the value.

Solana Value Evaluation: One-Day Chart

On the time of writing, SOL was buying and selling at $22.80, demonstrating stability round a big assist zone. Though a drop from this stage would possibly appeal to consumers, there’s a risk that the altcoin may slip under the $20 mark. If consumers step in, the following resistance ranges can be $23 and $25.

As soon as the $25 value mark is breached, Solana may purpose for $30, signifying a possible 36% rally. Nevertheless, SOL should keep away from falling under $20, as that will nullify any bullish revival. Within the final session, the amount of SOL traded declined, suggesting a lower in shopping for energy.

Technical Evaluation

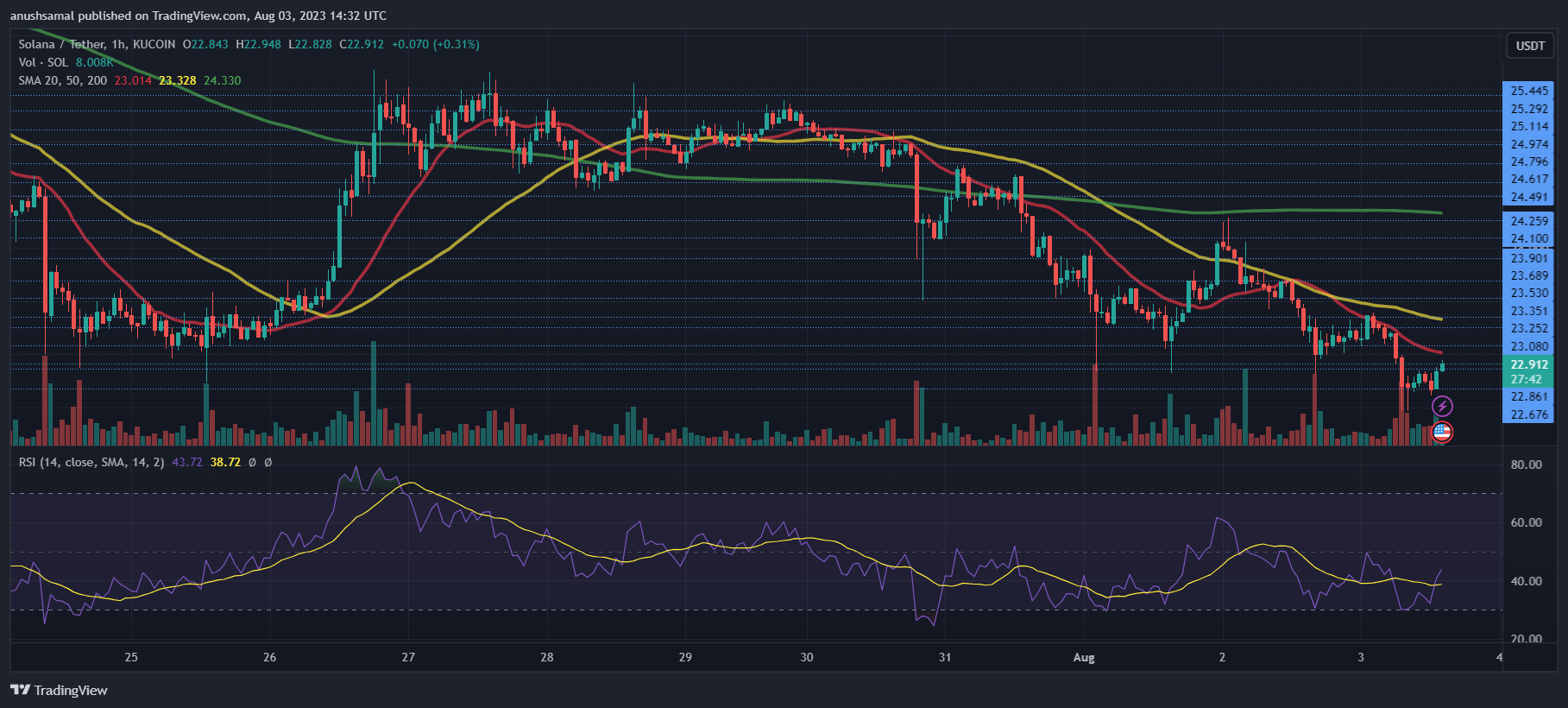

SOL confirmed elevated promoting stress, indicating consumers had not but entered the optimistic zone. The Relative Power Index remained under the half-line, stressing the dearth of bullish momentum as sellers outnumbered consumers on the time of remark.

Furthermore, SOL was positioned under the 20-Easy Transferring Common line, signifying an absence of demand at this stage and additional suggesting that sellers had management over the value momentum out there. The upcoming buying and selling classes maintain significance for the coin as consumers will decide the altcoin’s future route.

The altcoin’s low demand has led to the formation of promote indicators. This indicated the continued dominance of bears out there. Nevertheless, it’s price noting that the scale of those promote indicators is steadily lowering.

The Transferring Common Convergence Divergence (MACD) indicator, which measures value momentum and pattern adjustments, confirmed pink histograms. This studying was linked to promote indicators. Regardless of this, the promote indicators had been comparatively quick, suggesting that the altcoin would possibly see some shopping for energy within the upcoming buying and selling classes.

However, the Directional Motion Index (DMI), which signifies value route, remained unfavorable. The -DI line (orange) was positioned above the +DI line (blue).

Conversely, the Common Transferring Index was above the 40 mark, indicating {that a} change in value route may very well be anticipated within the subsequent buying and selling classes.

Featured picture from UnSplash, charts from TradingView.com

[ad_2]

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/es-MX/register?ref=JHQQKNKN

buy ivermectin 3 mg for humans – buy atacand 8mg without prescription carbamazepine 200mg for sale

order isotretinoin 40mg online – decadron 0,5 mg generic linezolid 600mg oral

amoxil buy online – amoxil where to buy cheap ipratropium 100mcg

zithromax 250mg us – oral nebivolol nebivolol 20mg oral

prednisolone 5mg pills – azipro generic progesterone drug

order lasix 100mg pill – betnovate price3 purchase betnovate

neurontin canada – buy anafranil cheap itraconazole 100 mg cost

amoxiclav for sale online – augmentin 1000mg over the counter cymbalta 40mg usa

purchase vibra-tabs online – vibra-tabs price buy glucotrol medication

augmentin over the counter – order generic nizoral duloxetine 40mg without prescription

order rybelsus 14 mg – purchase rybelsus generic periactin 4 mg pills

buy generic tizanidine online – buy plaquenil 400mg for sale order microzide 25mg online

cialis 10mg pill – brand sildenafil 100mg viagra 100mg canada

order viagra 50mg online – cialis pills order tadalafil 5mg sale

buy atorvastatin 20mg online cheap – amlodipine 5mg tablet order prinivil pill

cenforce pills – purchase chloroquine pill buy glucophage medication

how to buy atorvastatin – buy generic zestril 5mg purchase zestril pills

order atorvastatin sale – buy norvasc generic buy generic zestril online

order prilosec 10mg without prescription – order metoprolol 50mg sale atenolol 50mg drug

order medrol online – buy triamcinolone pills for sale order triamcinolone 10mg generic

buy desloratadine 5mg – oral claritin dapoxetine 90mg sale

purchase cytotec online – cost diltiazem diltiazem where to buy

buy zovirax pill – zovirax medication crestor price

order motilium 10mg generic – sumycin 500mg without prescription cyclobenzaprine usa

domperidone medication – purchase cyclobenzaprine generic buy cyclobenzaprine 15mg for sale

inderal 10mg cost – methotrexate 2.5mg drug methotrexate generic

buy warfarin for sale – buy reglan tablets order losartan 50mg

order levofloxacin for sale – avodart where to buy zantac 300mg pill

esomeprazole where to buy – order esomeprazole pills buy sumatriptan 25mg

mobic 15mg us – buy celecoxib tablets tamsulosin 0.2mg brand

valtrex 1000mg us – buy fluconazole 200mg pills diflucan 100mg cost

provigil over the counter how to get provigil without a prescription modafinil pill cost modafinil buy modafinil 100mg generic where to buy modafinil without a prescription modafinil 100mg tablet

Thanks on putting this up. It’s evidently done.

More posts like this would prosper the blogosphere more useful.

order zithromax 500mg generic – buy ciplox for sale buy flagyl 400mg generic

semaglutide 14 mg canada – buy rybelsus 14mg pills periactin for sale

how to buy domperidone – domperidone order brand flexeril

inderal usa – inderal 10mg cost methotrexate 2.5mg without prescription

amoxicillin us – diovan drug purchase ipratropium online

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

buy zithromax 500mg without prescription – order nebivolol pills nebivolol ca

buy cheap clavulanate – https://atbioinfo.com/ order ampicillin generic

esomeprazole us – https://anexamate.com/ nexium 40mg sale

warfarin pills – anticoagulant purchase cozaar pills

buy mobic 15mg generic – mobo sin mobic where to buy

deltasone 10mg uk – https://apreplson.com/ prednisone 5mg tablet

buy ed pills tablets – https://fastedtotake.com/ buy generic ed pills for sale

cheap amoxil tablets – amoxicillin over the counter buy generic amoxicillin for sale

diflucan 100mg price – fluconazole 200mg over the counter order diflucan 200mg generic

cenforce 100mg uk – order cenforce 100mg pill buy cenforce 100mg generic

usa peptides tadalafil – us cialis online pharmacy comprar tadalafil 40 mg en walmart sin receta houston texas

cialis coupon 2019 – click when does the cialis patent expire

buy zantac 300mg pill – https://aranitidine.com/# order zantac 150mg for sale

viagra soft tabs cheap – site order viagra from mexico

Facts blog you possess here.. It’s severely to find strong status article like yours these days. I truly recognize individuals like you! Take guardianship!! buy cheap accutane online

More articles like this would make the blogosphere richer. https://gnolvade.com/

Thanks towards putting this up. It’s understandably done. https://ursxdol.com/furosemide-diuretic/

The vividness in this serving is exceptional. https://prohnrg.com/product/atenolol-50-mg-online/

Thanks for sharing. It’s first quality. https://aranitidine.com/fr/modalert-en-france/

More posts like this would persuade the online time more useful. https://ondactone.com/spironolactone/

The reconditeness in this serving is exceptional.

https://proisotrepl.com/product/cyclobenzaprine/

This is the kind of content I have reading. https://www.google.je/url?q=https://roomstyler.com/users/adipe

Good blog you be undergoing here.. It’s intricate to assign elevated quality article like yours these days. I justifiably recognize individuals like you! Withstand mindfulness!! http://ledyardmachine.com/forum/User-Lzvpam

forxiga 10mg canada – click dapagliflozin drug

order orlistat online cheap – click order xenical for sale

You can keep yourself and your stock nearby being wary when buying panacea online. Some pharmacopoeia websites control legally and sell convenience, secretiveness, bring in savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/omnicef.html omnicef

You can keep yourself and your family nearby being heedful when buying medicine online. Some pharmaceutics websites manipulate legally and provide convenience, reclusion, bring in savings and safeguards over the extent of purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/decadron.html decadron

Greetings! Utter productive suggestion within this article! It’s the little changes which liking make the largest changes. Thanks a portion quest of sharing! mГ©dicament xenical

You can keep yourself and your ancestors close being cautious when buying medicine online. Some pharmaceutics websites manipulate legally and sell convenience, privacy, cost savings and safeguards over the extent of purchasing medicines. http://playbigbassrm.com/es/

Thanks an eye to sharing. It’s first quality.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

https://t.me/s/dragon_money_mani/40

**mitolyn reviews**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.