[ad_1]

The Chinese language yuan has surpassed the US greenback in China’s cross-border funds for the primary time in historical past, in line with banking big Goldman Sachs.

The yuan’s share of cross-border settlements surpassed the greenback and hit an all-time excessive in March, says Goldman, citing knowledge from China’s State Administration of Overseas Alternate (SAFE).

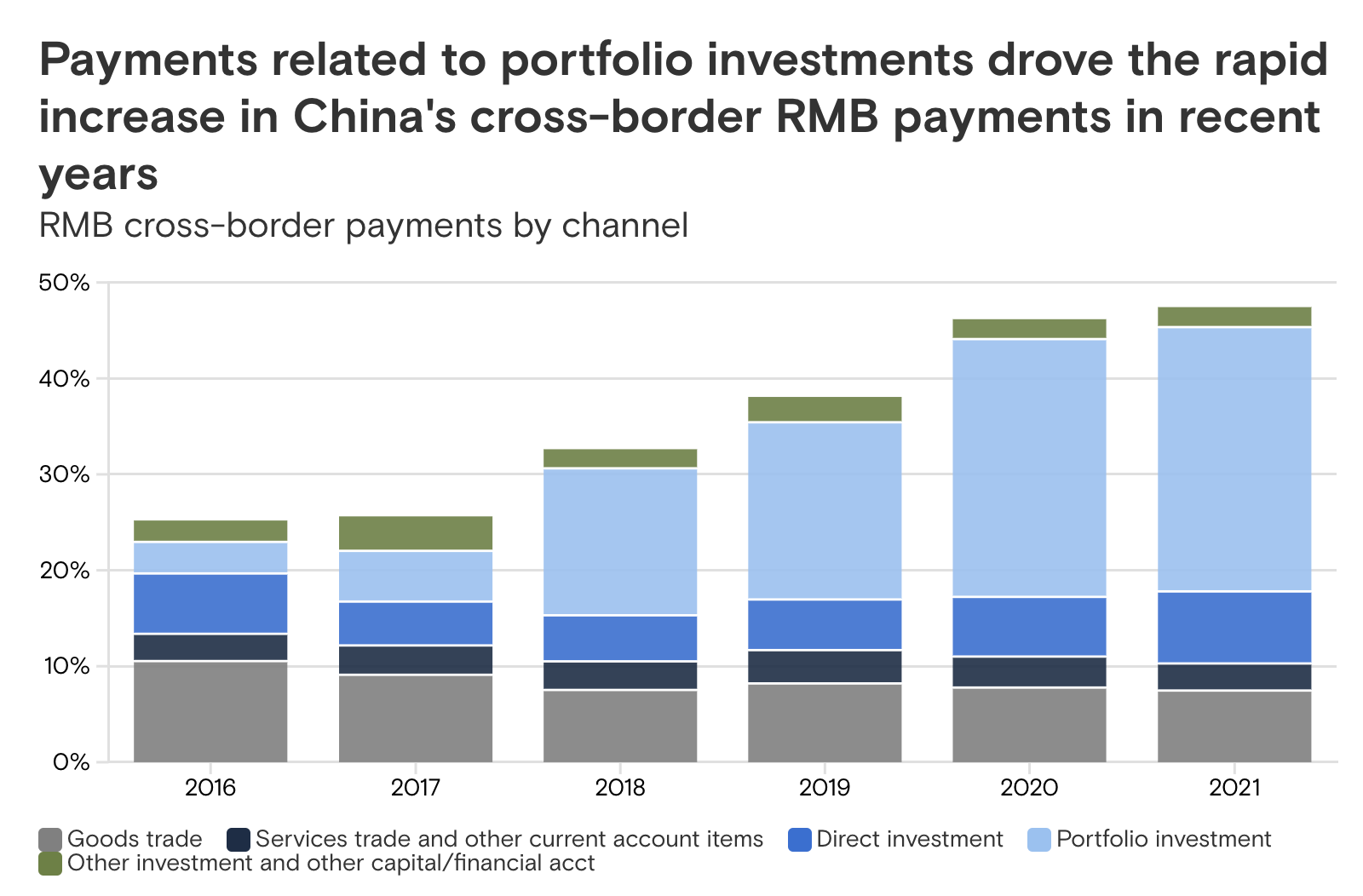

The large uptick was principally fulled by foreigners buying and selling renminbi property, in line with the financial institution.

Goldman says that China has gained market share and made vital progress in functioning as a medium of change in world markets. Nonetheless, the yuan remains to be not really competing with the greenback in some ways.

“However progress seems gradual in different respects. Whereas China is turning into more and more vital in world items, companies, and monetary markets, the world’s second-largest financial system nonetheless has capital controls in place and the renminbi shouldn’t be totally freely tradable, which might restrict its progress with regards to being a ‘retailer of worth’ and ‘unit of account.’

The U.S. greenback remains to be the dominant forex in worldwide funds, accounting for 43% in Might, in line with SWIFT. Some 32% of worldwide funds have been in euros, 7% in British kilos, and three.2% in Japanese yen.”

The financial institution’s analysis means that funds linked to portfolio investments, like China’s home inventory and bond market have helped drive the usage of the yuan.

Yuan-based buying and selling is beginning to decide up in Hong Kong, which the financial institution refers to as an “offshore heart for renminbi.”

“On the subject of retailer of worth, China’s forex remains to be little used. In worldwide bond markets, debt securities denominated in renminbi have been solely round 0.7%, in line with Financial institution for Worldwide Settlements knowledge, as compared with 0.4% 10 years in the past, Wei writes. Reserves denominated in China’s forex accounted for round 3% of world reserves, larger than the 1% in 2016 however nonetheless low in absolute ranges.

On the identical time, a variety of renminbi-denominated property can be found in Hong Kong, the offshore heart for renminbi, for world buyers: these embrace bonds, funding funds, commodity-linked merchandise, ETFs, actual property funding trusts, equities, and insurance coverage merchandise.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses you might incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney

[ad_2]

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I’m extremely impressed together with your writing skills as neatly as with the layout in your weblog. Is this a paid theme or did you modify it yourself? Anyway keep up the excellent high quality writing, it is rare to see a nice blog like this one nowadays!

https://t.me/s/Martin_casino_officials

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.