In the ever-evolving landscape of cryptocurrency, few assets have sparked as much fervor and speculation as Bitcoin. As financial markets navigate an intricate web of challenges and opportunities, the enigmatic cryptocurrency finds itself in the spotlight once again. With whispers of six-figure price predictions resurfacing, the demand for Bitcoin to reclaim the coveted $95,000 level is reigniting discussions among investors, analysts, and enthusiasts alike. As we delve into this intriguing narrative, we explore the factors fueling these bold projections and the implications they hold for the future of digital currency. In a world where fortunes can change at the speed of a blockchain transaction, the journey to six figures promises to be as compelling as the asset itself.

Table of Contents

- Bitcoin Price Analysis Shifts Towards Six-Figure Predictions

- Market Sentiment and Influencers Driving the $95K Target

- Navigating Volatility Strategies for Potential Bitcoin Investors

- Future Trends and Indicators to Watch in the BTC Landscape

- Q&A

- Future Outlook

Bitcoin Price Analysis Shifts Towards Six-Figure Predictions

As market sentiment begins to shift, analysts are once again turning their eyes toward ambitious price targets for Bitcoin, particularly in the six-figure range. Recent trends indicate a pressing need for Bitcoin to secure a robust position above the $95,000 mark to incentivize momentum that could lead to this lofty valuation. Many traders are closely monitoring key resistance levels, as well as which institutional forces and technological advancements might play pivotal roles in this bullish resurgence. With discussions on regulatory clarity and mainstream adoption heating up, the stage is arguably set for a significant breakout.

The crypto community is buzzing with expectations, debating whether Bitcoin can flip previous resistance into support in its quest for higher altitudes. Several factors underpin these forecasts, including the tightening supply caused by halving events and the increasing institutional interest. To better understand the current landscape, consider the following vital indicators:

- Market Sentiment: Growing confidence among investors.

- Supply Dynamics: Limited Bitcoin availability bolstering price.

- Institutional Involvement: Higher investment from traditional finance.

In light of these dynamics, an analysis of previous market cycles suggests that reclaiming $95K could act as a crucial catalyst. Below is a table summarizing past and projected price movements that hint at the bullish potential of Bitcoin:

| Period | Price Movement | Key Events |

|---|---|---|

| 2017 | $2K – $20K | First major retail adoption |

| 2020 | $3K – $64K | Institutional buy-in and PayPal integration |

| 2023 (Projected) | $20K – $100K+ | Broader DeFi adoption and ETF approvals |

Market Sentiment and Influencers Driving the $95K Target

The recent surge in Bitcoin’s valuation has ignited a renewed sense of optimism among investors, with many industry influencers echoing the potential for a significant price surge. Analysts and prominent crypto figures are pointing towards favorable market dynamics including increased institutional adoption and a macroeconomic environment ripe for speculative assets. The bullish sentiment is further fueled by predictions and forecasts circulating across digital platforms, suggesting that Bitcoin could reclaim the significant threshold of $95,000. This figure has become a psychological benchmark as the community rallies around the belief that once it is reached, it could trigger a cascade of buying activity.

Key influencers are leveraging social media and financial news outlets to amplify this sentiment, noting several critical factors that could drive Bitcoin towards this target:

- Institutional Investment: Major companies beginning to allocate portions of their portfolio to Bitcoin.

- Limited Supply: The halving event scheduled for next year, which historically has led to price hikes.

- Technological Advances: Innovations like the Lightning Network enhance transaction efficiency and acceptance.

Moreover, analyzing trends from past market cycles reveals that significant price calls often solidify when key influencers align on their predictions. These patterns support the notion that the current environment might just be the catalyst needed for Bitcoin to approach and potentially exceed the $95,000 mark, making it a focal point for both veteran traders and newcomers alike.

Navigating Volatility Strategies for Potential Bitcoin Investors

As Bitcoin continues to demonstrate its dramatic price swings, understanding volatility strategies becomes crucial for potential investors. With whispers of a $95,000 target making waves, navigating these unpredictable waters requires insight and a solid plan. Here are some strategies to consider:

- Dollar-Cost Averaging: Instead of investing a lump sum, consider spreading your investment over time to mitigate the impact of market fluctuations.

- Setting Stop-Loss Orders: Protect your capital by setting predefined levels at which your investment will automatically sell, limiting potential losses.

- Utilizing Options: Explore options trading to hedge your bets, allowing you to potentially profit regardless of market direction.

- Staying Informed: Regularly update your knowledge of market trends and Bitcoin developments to adapt your strategy in real-time.

Employing a diversified approach can also enhance your resilience against Bitcoin’s volatility. Consider allocating your investment across various crypto assets rather than concentrating solely on Bitcoin. Here’s a simple comparison table to illustrate this diversified approach:

| Asset Type | Allocation (%) | Potential Risk |

|---|---|---|

| Bitcoin | 50% | High |

| Ethereum | 25% | Medium |

| Altcoins | 15% | High |

| Stablecoins | 10% | Low |

Future Trends and Indicators to Watch in the BTC Landscape

The Bitcoin market is set to evolve with several emerging trends that could significantly influence the cryptocurrency’s trajectory in the coming months. As the community grapples with the possibility of a six-figure BTC price, a few key indicators are proving to be pivotal. These include:

- Regulatory Developments: Regulatory clarity across major economies can enhance institutional adoption, leading to potentially increased demand for Bitcoin.

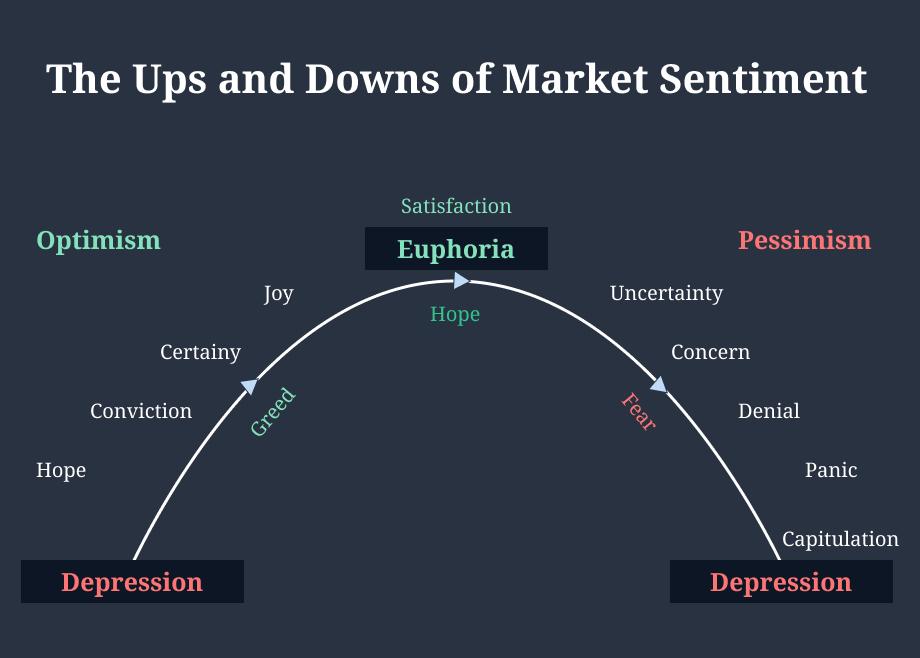

- Market Sentiment Analysis: Social media activity and sentiment analysis tools can provide real-time insights into market psychology, offering traders a glimpse into potential price movements.

- Technological Advancements: Innovations such as the Lightning Network are enhancing transaction speed and reducing fees, which can revitalize Bitcoin’s utility and attractiveness.

Another important factor to monitor is the impact of macroeconomic trends on Bitcoin’s positioning as a digital gold. Whether it’s inflation rates, changes in interest rates, or geopolitical tensions, these elements could create a conducive environment for a price reawakening. Observing the correlation between Bitcoin and traditional markets will be crucial. A consolidated view might result from analyzing:

| Indicator | Potential Impact |

|---|---|

| Inflation Rates | Increased investment in BTC as a hedge. |

| Institutional Adoption | Significant price surges due to demand. |

| Technological Integration | Enhanced usability and adoption rates. |

Q&A

Q&A: Bitcoin Demands $95K Reclaim as Six-Figure BTC Price Calls Return

Q1: What recent developments have triggered the renewed confidence in Bitcoin’s price reaching $95K?

A1: Recent market trends, combined with increasing institutional interest and a stronger financial ecosystem, have led analysts to conclude that Bitcoin has the potential to reclaim the $95K price point. Factors such as higher adoption rates, inflation hedging, and regulatory clarity are contributing to this optimistic outlook.

Q2: Why is the $95K marker significant for Bitcoin?

A2: The $95K level holds psychological significance for traders and investors, representing a historical peak that many believe could serve as a springboard for further price increases. Crossing this threshold could instill confidence across the market, potentially drawing in more investors and triggering a positive feedback loop.

Q3: Are there any prominent figures in the cryptocurrency space advocating for this six-figure price prediction?

A3: Yes, several influential analysts and crypto enthusiasts have begun to publicly support the notion of Bitcoin hitting six-figure prices again. These voices include well-known market analysts, institutional investors, and thought leaders who base their predictions on technical analysis and macroeconomic trends.

Q4: What challenges might Bitcoin face on its journey to reclaim $95K?

A4: Bitcoin’s journey to higher price points is not without challenges. Potential hurdles include regulatory changes, market volatility, competition from other cryptocurrencies, and macroeconomic factors such as inflation and interest rate fluctuations. Additionally, market sentiment can shift rapidly, impacting investor behavior.

Q5: How does the broader economic climate affect Bitcoin’s price movements?

A5: Bitcoin often reacts to broader economic conditions. Factors like inflation rates, currency devaluation, and geopolitical events can influence investor interest in Bitcoin as a digital asset. During times of economic uncertainty, many view Bitcoin as a store of value, which can drive up demand and, subsequently, its price.

Q6: What indicators should investors watch for to gauge Bitcoin’s potential price movements?

A6: Investors may want to monitor several key indicators, including trading volume, on-chain metrics like active addresses and transaction counts, and macroeconomic indicators such as inflation rates and monetary policy. Technical analysis tools, such as support and resistance levels, also play a crucial role in predicting price movements.

Q7: Are there historical precedents for rapid price increases in Bitcoin?

A7: Yes, Bitcoin has witnessed dramatic price surges in the past, such as the notable rises in late 2017 and late 2020. Each rally was fueled by various market dynamics, including increased media coverage, institutional adoption, and larger economic trends—suggesting that previous patterns could repeat under favorable conditions.

Q8: How should investors approach the potential for Bitcoin reaching the $95K mark?

A8: Investors should approach the situation with a balanced perspective. While optimism can be beneficial, it’s important to conduct thorough research, understand risk management practices, and diversify investments. Setting realistic expectations and preparing for potential volatility can help navigate this unpredictable market.

Q9: What’s the future outlook for Bitcoin beyond the $95K price point?

A9: If Bitcoin successfully reclaims and stabilizes above the $95K mark, the outlook could be bullish, with discussions around even higher prices entering the conversation. However, the cryptocurrency market remains unpredictable, and future performance will depend on a confluence of factors, including market sentiment, technological advancements, and regulatory developments.

Future Outlook

As we conclude our exploration into Bitcoin’s current trajectory and the renewed calls for a $95K reclaim, it’s evident that the dynamics of the cryptocurrency market continue to evolve. The recent surge in optimism, driven by a confluence of factors from regulatory developments to institutional interest, underscores the unpredictable nature of this digital asset. While predictions for a six-figure Bitcoin price may stir excitement among investors, it’s essential to approach such projections with a level of caution.

As the market fluctuates, staying informed and adapting to the shifting waves of sentiment will be key for both seasoned traders and newcomers alike. Whether Bitcoin manages to break through the $95,000 barrier or settles into a different rhythm, one truth remains: the world of cryptocurrency is never short of surprises. As we look to the future, only time will reveal where this decentralized journey will lead us next. Until then, keep your analytical lens focused and prepare for whatever twists and turns lie ahead on the Bitcoin rollercoaster.

side effects of ivermectin – ivermectin 3 mg stromectol tegretol 200mg price

buy isotretinoin 10mg pill – purchase isotretinoin pills buy zyvox 600mg generic

order amoxil for sale – buy valsartan tablets ipratropium 100 mcg cheap

order azithromycin 500mg generic – buy tindamax 300mg generic buy bystolic generic

buy prednisolone 5mg generic – prednisolone where to buy order prometrium 200mg without prescription

neurontin 100mg usa – order neurontin order itraconazole without prescription

order lasix 40mg sale – betnovate canada3 betamethasone 20gm ca

order augmentin 625mg generic – order generic nizoral buy generic duloxetine for sale

order acticlate for sale – buy ventolin 2mg pills buy glucotrol pills

augmentin medication – buy nizoral generic buy cymbalta no prescription

rybelsus 14mg pills – order periactin generic cyproheptadine buy online

purchase tizanidine online – buy hydroxychloroquine 400mg generic buy microzide sale

tadalafil 5mg over the counter – buy tadalafil 20mg pills viagra pharmacy

order sildenafil 50mg generic – tadalafil 40mg without prescription buy tadalafil 40mg pills

atorvastatin 20mg ca – buy generic atorvastatin 10mg generic lisinopril 2.5mg

order generic cenforce – cenforce 100mg brand buy glycomet without prescription

prilosec without prescription – buy metoprolol generic tenormin 50mg cheap

methylprednisolone 16 mg tablets – buy generic lyrica 150mg aristocort for sale online

where can i buy desloratadine – brand desloratadine 5mg priligy pill

buy cytotec 200mcg sale – misoprostol 200mcg oral purchase diltiazem generic

order zovirax generic – purchase zovirax pill crestor 10mg tablet

order motilium 10mg generic – purchase flexeril pill flexeril brand

order domperidone for sale – buy generic cyclobenzaprine for sale cyclobenzaprine order online

buy propranolol online cheap – buy generic clopidogrel methotrexate 10mg drug

order coumadin for sale – order reglan hyzaar over the counter

levaquin 250mg sale – buy avodart no prescription ranitidine buy online

buy esomeprazole – purchase imitrex sale cheap sumatriptan

meloxicam 15mg for sale – buy mobic pills tamsulosin usa

ondansetron 4mg brand – ondansetron price order simvastatin 10mg pills

valacyclovir for sale – buy generic valacyclovir 1000mg purchase diflucan for sale

where can i buy modafinil provigil pill where to buy modafinil without a prescription provigil 200mg canada buy provigil for sale buy modafinil 200mg pills buy provigil paypal

This is the type of delivery I turn up helpful.

More content pieces like this would urge the интернет better.

azithromycin brand – ofloxacin 200mg drug metronidazole over the counter

semaglutide 14mg usa – buy cyproheptadine 4mg generic cheap periactin 4mg

where to buy domperidone without a prescription – buy sumycin for sale buy cyclobenzaprine 15mg generic

buy propranolol for sale – buy clopidogrel 150mg online buy methotrexate 5mg sale

buy amoxil tablets – buy amoxil online ipratropium over the counter

zithromax 250mg pill – order tindamax 500mg pill order nebivolol 5mg generic

order amoxiclav pill – https://atbioinfo.com/ buy acillin cheap

buy nexium pills for sale – nexiumtous cost esomeprazole 20mg

coumadin 5mg oral – blood thinner losartan 25mg brand

buy meloxicam 15mg online – https://moboxsin.com/ order meloxicam 7.5mg

buy deltasone 10mg generic – aprep lson prednisone pills

best otc ed pills – fast ed to take cheap ed drugs

buy amoxicillin sale – https://combamoxi.com/ purchase amoxicillin pill

order fluconazole 100mg sale – https://gpdifluca.com/ buy generic fluconazole over the counter

order cenforce 100mg pill – cenforcers.com buy cheap generic cenforce

cialis 50mg – on this site buy cialis online in austalia

oral ranitidine – click buy ranitidine 300mg online cheap

para que sirve las tabletas cialis tadalafil de 5mg – https://strongtadafl.com/# can you drink wine or liquor if you took in tadalafil

I couldn’t turn down commenting. Well written! https://gnolvade.com/es/prednisona/

viagra sale durban – strongvpls sildenafil citrate tablets 50mg

The detail in this content is commendable.

Thanks towards putting this up. It’s understandably done. https://buyfastonl.com/

This is the big-hearted of criticism I truly appreciate. ursxdol.com

I’ll certainly bring to be familiar with more. https://prohnrg.com/product/diltiazem-online/

Such a beneficial read.

You’ve clearly put in effort.

This is the tolerant of advise I turn up helpful. viagra professional homme sans prescription

I gained useful knowledge from this.

I’ll gladly recommend this.

More content pieces like this would make the online space a better place.

I’ll certainly return to read more.

I genuinely valued the way this was written.

The clarity in this piece is praiseworthy.

You’ve clearly put in effort.

I discovered useful points from this.

I absolutely appreciated the way this was written.

Such a informative resource.

I gained useful knowledge from this.

This is the kind of advise I find helpful. https://ondactone.com/spironolactone/

I’ll definitely bookmark this page.

You’ve clearly researched well.

More posts like this would add up to the online time more useful.

https://doxycyclinege.com/pro/spironolactone/

This is the amicable of glad I have reading. http://web.symbol.rs/forum/member.php?action=profile&uid=1171353

generic forxiga – https://janozin.com/# forxiga 10 mg usa

purchase orlistat without prescription – site buy cheap generic orlistat

This is the kind of serenity I get high on reading. http://pokemonforever.com/User-Mfehqj

You can shelter yourself and your stock by being wary when buying prescription online. Some pharmaceutics websites manipulate legally and sell convenience, reclusion, sell for savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/elavil.html elavil

I’ll certainly carry back to be familiar with more. TerbinaPharmacy

You can shelter yourself and your stock by way of being alert when buying panacea online. Some pharmaceutics websites operate legally and offer convenience, privacy, sell for savings and safeguards for purchasing medicines. http://playbigbassrm.com/

More posts like this would prosper the blogosphere more useful.

https://t.me/s/iGaming_live/4864

https://t.me/s/be_1win/985

https://t.me/s/pov_1win

**mitolyn official**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.

online casino with sportsbook

free slots with bonus no download for mobile

online roulette number prediction software development