In the ever-evolving landscape of finance and investment, few topics spark as much debate as the intricate relationship between traditional assets and emerging digital currencies. At the forefront of this dialog is OKG Research, a beacon for those seeking to navigate the tumultuous waters of modern economics. This article delves into an array of compelling themes: the shifting dynamics in trades related to former President Trump, the increasing recognition of Bitcoin (BTC) as a viable hedge against inflation, and the growing trend of BTC ownership among diverse investor profiles. As we explore these interconnected narratives, we’ll seek to illuminate the implications for investors and the broader market, providing insights that are both timely and thought-provoking. Join us as we unpack these critical issues and examine what they may mean for the future of finance.

Table of Contents

- Exploring the Landscape of OKG Research: Unpacking Reverse Trump Trades

- Bitcoin as an Inflation Hedge: Evaluating Its Role in Economic Uncertainty

- The Evolving Dynamics of Bitcoin Ownership: Trends and Insights to Consider

- Strategic Recommendations for Investors: Navigating the Future of Cryptocurrency

- Q&A

- Future Outlook

Exploring the Landscape of OKG Research: Unpacking Reverse Trump Trades

The intricate tapestry of financial transactions and market responses often reveals unexpected patterns, particularly in the context of political shifts and economic strategies. The concept of reverse Trump trades has emerged as a fascinating area of OKG research. This notion encapsulates transactions driven by a backlash against the policies or rhetoric associated with former President Trump’s administration, thus showcasing the fluidity of market sentiment. Investors are increasingly reassessing their strategies, leading to tactical reversals that highlight a need for agility and awareness in volatile economic climates. The ongoing influence of governmental decisions on trade practices shines a light on the interconnectedness of political landscapes and investment strategies.

In parallel, Bitcoin (BTC) has carved out a niche as a potential hedge against inflation, especially as traditional markets grapple with the repercussions of monetary policies that have historically devalued fiat currencies. The increasing perception of BTC as “digital gold” illustrates a shift in investor psychology, prompting many to consider its role in diversifying portfolios. In this context, the burgeoning interest in BTC ownership is underscored by a range of factors, including:

- Decentralization: Providing an alternative to centralized financial systems.

- Scarcity: The capped supply of Bitcoin fuels its appeal as a hedge.

- Growing Acceptance: More businesses are beginning to accept Bitcoin as a payment method.

| Factor | Impact on BTC Ownership |

|---|---|

| Market Trends | Boost in demand amid economic uncertainty |

| Regulatory Developments | Increased legitimacy and mainstream adoption |

| Technological Advances | Enhanced accessibility and security for users |

Bitcoin as an Inflation Hedge: Evaluating Its Role in Economic Uncertainty

In recent years, Bitcoin has increasingly been viewed as a store of value akin to precious metals like gold, particularly in an economic climate marked by rising inflation and monetary instability. As central banks continue to implement expansive monetary policies, many investors turn to Bitcoin as a potential safeguard against the devaluation of traditional currencies. The cryptocurrency’s finite supply—capped at 21 million coins—combined with its decentralized nature, makes it an attractive alternative during periods of economic uncertainty. In addition, its growing mainstream adoption increases its legitimacy as a long-term investment, further solidifying its place in the financial portfolios of those looking to mitigate inflation risks.

Evaluating Bitcoin’s effectiveness as an inflation hedge requires a careful analysis of its price movements in correlation with inflation rates and economic crises. Historical data shows a mixed performance; however, recent trends indicate that as inflation expectations rise, interest in Bitcoin tends to increase. Factors influencing this relationship can include:

- Market sentiment: Heightened fear of inflation can catalyze cryptocurrency investments.

- Institutional adoption: Greater acceptance by large financial institutions and corporations boosts confidence in Bitcoin’s role as a viable alternative asset.

- Liquidity and trading volume: A more liquid market may enhance Bitcoin’s response to economic shifts, improving its hedge potential.

To better understand Bitcoin’s behavior during inflationary periods, the following table summarizes key inflation indicators alongside Bitcoin price movements:

| Year | Inflation Rate (%) | Bitcoin Price ($) |

|---|---|---|

| 2020 | 1.2 | 29,000 |

| 2021 | 5.4 | 64,000 |

| 2022 | 7.0 | 19,000 |

The Evolving Dynamics of Bitcoin Ownership: Trends and Insights to Consider

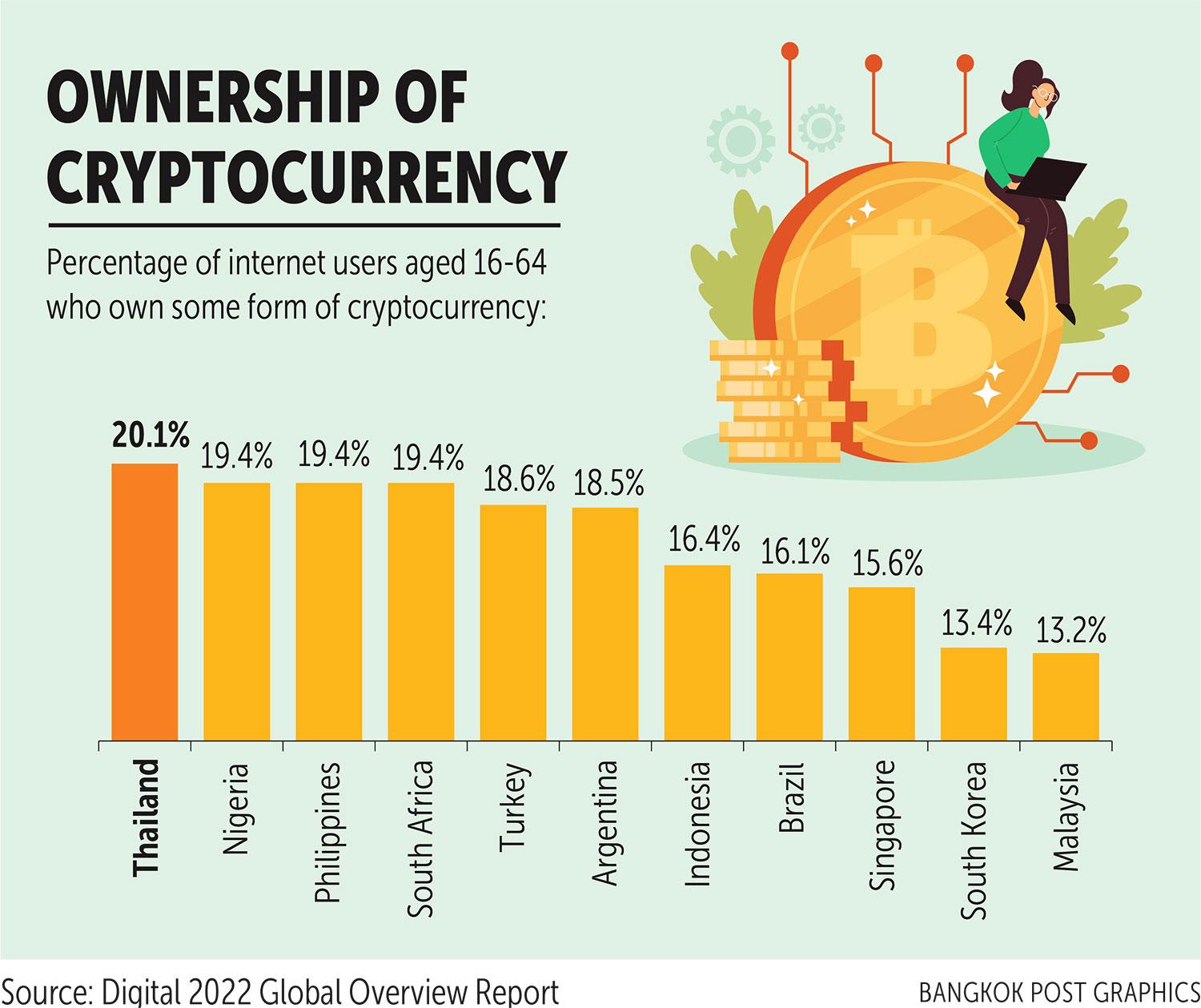

In recent months, the landscape of Bitcoin ownership has seen notable shifts influenced by various market dynamics and socio-political events. Data suggests that an increasing number of retail investors are entering the market, driven by a blend of fear and optimism surrounding traditional financial systems. This wave of new owners brings a fresh perspective, often prioritizing the notion of Bitcoin as a “digital gold,” a coveted asset for preserving wealth against rising inflation and economic uncertainty. Moreover, the demographic makeup of Bitcoin holders is diversifying, with younger investors showing a preference for cryptocurrencies over traditional assets. Key factors influencing these trends include:

- Inflationary Pressures: As central banks continue their accommodative monetary policies, Bitcoin is gaining traction as an effective hedge against inflation.

- Democratic Influence: Political events, such as the recent shifts in U.S. leadership, have prompted discussions around the implications for Bitcoin’s future, with many speculating whether regulatory changes might stabilize or disrupt its value.

- Adoption Rates: Institutional investment is on the rise, contributing to mainstream acceptance of Bitcoin as a valid investment class.

Interestingly, strategies surrounding Bitcoin ownership are evolving as investors adjust their portfolios based on market conditions. A growing number are adopting long-term holding strategies, viewing Bitcoin not merely as a speculative asset but as a fundamental component in their financial planning. The resulting volatility appears less daunting for holders as they position Bitcoin as a protective buffer against unforeseen market shocks. This evolving mindset can be illustrated through the following table, reflecting the changes in ownership approach:

| Ownership Approach | Percentage of Investors |

|---|---|

| Long-Term Holders | 68% |

| Short-Term Traders | 22% |

| Casual Investors | 10% |

Strategic Recommendations for Investors: Navigating the Future of Cryptocurrency

In the ever-evolving landscape of cryptocurrency, it is crucial for investors to pivot from traditional strategies and adopt a more adaptive approach. As the recent market data suggests a shift from the “Trump trade” mentality, investors should consider diversifying their portfolios to include a mix of digital assets. This strategy can involve exploring various altcoins alongside Bitcoin, offering potential benefits of lower correlation with traditional equities. Furthermore, staying informed through reputable research sources can significantly enhance decision-making processes, empowering investors to anticipate market fluctuations more effectively.

Moreover, Bitcoin continues to emerge as a robust hedge against inflation. It’s important for investors to emphasize the role of BTC in their portfolios, especially as global economic uncertainties mount. To optimize investments in this avenue, consider the following strategies:

- Long-term Holding: Accumulating Bitcoin gradually and holding it as a long-term asset can yield substantial returns.

- Dollar-Cost Averaging: Regularly investing a fixed amount into Bitcoin helps mitigate volatility.

- Staying Updated: Follow trends in fiat currencies and macroeconomic indicators to better predict Bitcoin’s performance.

Secure BTC ownership may also require strategies to safely store these digital assets, making it imperative to prioritize security without compromising accessibility.

Q&A

Q&A: Understanding OKG Research’s Insights on Market Trends and Bitcoin

Q1: What does OKG Research mean by “reverse on Trump trades”?

A1: The term “reverse on Trump trades” refers to a strategic shift in trading behaviors following the political landscape and economic policies influenced by Donald Trump’s presidency. OKG Research indicates that investors are recalibrating their positions, moving away from assets that once thrived in a pro-Trump market environment, in favor of more stable investments aligned with current market conditions.

Q2: How does Bitcoin (BTC) function as a hedge against inflation, according to OKG Research?

A2: OKG Research posits that Bitcoin offers a unique hedge against inflation due to its finite supply—capped at 21 million coins. In an environment where fiat currencies may be subject to inflationary pressures, the scarcity of Bitcoin positions it as a digital asset that can potentially retain value. The thesis suggests that as traditional currencies lose purchasing power, investors may pivot toward Bitcoin, seeking refuge for their wealth.

Q3: What specific indicators does OKG Research observe when analyzing Bitcoin ownership trends?

A3: OKG Research meticulously analyzes data trends such as wallet addresses, transaction volumes, and the demographic profile of Bitcoin holders. Indicators like the increasing number of long-term holders versus short-term traders, as well as institutional interest in BTC, reflect a growing acceptance and ownership of Bitcoin across varied investor profiles. These trends can signal shifts in market sentiment and perceptions toward Bitcoin as a legitimate store of value.

Q4: How significant is the rise of institutional investment in Bitcoin ownership?

A4: The rise of institutional investment is significant for Bitcoin ownership, as it lends credibility to the digital asset and encourages wider adoption. OKG Research highlights that as more institutional players enter the space, either through direct investment in Bitcoin or by offering cryptocurrency services, it strengthens the market infrastructure and promotes greater trust among retail investors. This institutional momentum could lead to more stable price movements and increased liquidity in the market.

Q5: What should investors take away from OKG Research’s findings regarding these trends?

A5: Investors should be cognizant of the evolving market dynamics highlighted by OKG Research. The analysis indicates that traditional trading strategies may need recalibration in light of changing political and economic contexts. Additionally, with Bitcoin emerging as a potential hedge against inflation and gaining traction among institutional investors, a diversified approach—where Bitcoin is considered a part of a broader investment strategy—might be prudent for safeguarding against economic volatility.

Q6: Are there any risks associated with Bitcoin as a hedge against inflation, as outlined in the research?

A6: Yes, OKG Research underscores several risks associated with Bitcoin as an inflation hedge. These include its inherent volatility, regulatory uncertainties, and the potential for technological vulnerabilities. While Bitcoin has shown resilience, these factors warrant careful consideration by investors who may be relying on it as a safeguard against economic instability.

Q7: In what ways could the political landscape impact future Bitcoin investments?

A7: The political landscape can significantly influence investor sentiment and regulatory frameworks surrounding Bitcoin. OKG Research notes that political decisions regarding cryptocurrency regulations, financial policies, and overall economic strategies can either foster a positive environment for Bitcoin investment or introduce uncertainty that may deter participation. Investors should remain vigilant to these shifts, which could affect market conditions moving forward.

OKG Research sheds light on important factors affecting current market trends, particularly regarding Bitcoin’s role as an investment asset. By staying informed about these dynamics, investors can better navigate the complexities of today’s financial landscape.

Future Outlook

the evolving landscape of finance and investment beckons both seasoned traders and novice investors to reassess their strategies. OKG Research illuminates the burgeoning trend of reverse trades on Trump-related assets, capturing an intriguing shift that may reshape the political economy narrative. Concurrently, Bitcoin emerges not just as a digital currency but as a potential bulwark against inflation, inviting a deeper conversation about its role in our economic toolkit. As we navigate these dynamics, the question of Bitcoin ownership looms large—what does it mean to hold a slice of this digital frontier in an era marked by uncertainty? As always, due diligence and informed decision-making will be paramount. The intersection of political movements, economic shifts, and technological advances has opened a wealth of opportunities and challenges that merit continued exploration. Thus, we encourage our readers to stay curious and engaged as they forge their path in this fascinating financial tapestry.

ivermectin for humans – order candesartan 16mg sale buy carbamazepine 200mg without prescription

isotretinoin 10mg usa – buy cheap generic decadron linezolid 600mg price

buy cheap amoxil – amoxicillin without prescription combivent over the counter

zithromax 250mg drug – zithromax 500mg us buy bystolic generic

order prednisolone sale – cheap prednisolone for sale prometrium sale

furosemide 40mg cheap – buy cheap piracetam betnovate 20gm drug

order vibra-tabs generic – order generic glipizide buy glucotrol 5mg sale

augmentin 375mg uk – buy augmentin without prescription buy cymbalta without prescription

augmentin ca – buy cheap ketoconazole buy cymbalta pill

order rybelsus generic – rybelsus 14mg ca cyproheptadine 4mg without prescription

tizanidine over the counter – tizanidine uk buy microzide without a prescription

order sildenafil pills – sildenafil citrate goodrx cialis

order tadalafil 5mg pill – cialis 40mg over the counter cost of viagra 100mg

buy cenforce without prescription – cenforce online buy metformin 500mg cheap

cheap atorvastatin 40mg – buy generic norvasc purchase lisinopril online

prilosec 20mg pills – buy prilosec 10mg without prescription buy atenolol tablets

medrol generic name – oral methylprednisolone triamcinolone 10mg cost

order clarinex 5mg online – dapoxetine 60mg ca cost dapoxetine 30mg

buy cytotec cheap – buy cheap cytotec where can i buy diltiazem

buy zovirax pills – generic crestor 10mg crestor 20mg price

domperidone uk – buy flexeril 15mg sale cyclobenzaprine 15mg brand

order domperidone 10mg generic – oral motilium cyclobenzaprine 15mg pill

buy cheap generic inderal – methotrexate oral methotrexate 5mg oral

warfarin usa – buy generic reglan over the counter order cozaar without prescription

nexium 20mg us – topamax drug order sumatriptan 25mg pills

buy levofloxacin 250mg – order avodart sale zantac online

mobic 15mg oral – purchase flomax buy tamsulosin generic

zofran 4mg price – generic ondansetron order zocor pills

This submission is insightful.

order modafinil generic modafinil 200mg generic modafinil pills buy provigil medication buy modafinil 200mg generic provigil sale buy modafinil 100mg without prescription

This is a theme which is near to my heart… Myriad thanks! Exactly where can I upon the connection details in the course of questions?

Thanks an eye to sharing. It’s acme quality.

zithromax 250mg sale – metronidazole uk where can i buy metronidazole

order rybelsus 14mg generic – purchase semaglutide online order cyproheptadine online

cheap domperidone – cyclobenzaprine over the counter buy flexeril 15mg for sale

buy inderal 20mg for sale – purchase inderal for sale oral methotrexate 5mg

purchase amoxil – ipratropium generic combivent 100 mcg brand

generic azithromycin – purchase zithromax generic cheap nebivolol

clavulanate price – https://atbioinfo.com/ ampicillin antibiotic

buy nexium 40mg pill – https://anexamate.com/ cheap esomeprazole

buy warfarin 2mg pill – cou mamide order cozaar 50mg online cheap

buy meloxicam 15mg online – https://moboxsin.com/ meloxicam 7.5mg pills

deltasone 5mg ca – aprep lson order deltasone 20mg for sale

best ed pills – https://fastedtotake.com/ buy generic ed pills for sale

amoxil price – https://combamoxi.com/ amoxil drug

purchase diflucan online – flucoan forcan buy online

purchase cenforce – https://cenforcers.com/ buy cenforce 50mg online

cialis super active plus reviews – https://ciltadgn.com/ buy cialis online in austalia

zantac brand – https://aranitidine.com/ buy zantac 300mg without prescription

what doe cialis look like – https://strongtadafl.com/# over the counter drug that works like cialis

This is a keynote which is near to my heart… Numberless thanks! Quite where can I lay one’s hands on the phone details due to the fact that questions? kamagra comprar online

buy viagra nz – cheap viagra no rx order viagra online australia

The sagacity in this serving is exceptional. order neurontin without prescription

Thanks on putting this up. It’s evidently done. https://ursxdol.com/provigil-gn-pill-cnt/

I am in fact thrilled to gleam at this blog posts which consists of tons of useful facts, thanks towards providing such data. https://prohnrg.com/product/orlistat-pills-di/

Greetings! Utter useful suggestion within this article! It’s the scarcely changes which choice turn the largest changes. Thanks a quantity in the direction of sharing! https://aranitidine.com/fr/en_ligne_kamagra/

With thanks. Loads of conception! https://ondactone.com/spironolactone/

This is the kind of literature I in fact appreciate.

mobic tablet

forxiga 10 mg canada – forxiga 10mg canada buy dapagliflozin online cheap

orlistat for sale – https://asacostat.com/ order xenical

This is the stripe of topic I have reading. http://zqykj.cn/bbs/home.php?mod=space&uid=303386

You can protect yourself and your ancestors by way of being alert when buying panacea online. Some pharmacy websites manipulate legally and offer convenience, solitariness, bring in savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/pyridium.html pyridium

Thanks for putting this up. It’s evidently done. dominique levitre

I couldn’t weather commenting. Adequately written!

https://t.me/s/Top_BestCasino/173

https://t.me/officials_pokerdom/3124

https://t.me/s/flagman_official_registration

https://t.me/s/iGaming_live/4866

https://t.me/dragon_money_mani/13

https://t.me/s/ezcash_officials