In the ever-evolving landscape of financial markets, where the digital and traditional realms entwine, an intriguing narrative unfolds. Amidst the ebb and flow of cryptocurrencies and stock valuations, analyst Jason Pizzino proposes a striking perspective: the specter of an ‘everything bubble’ still has room to expand. As investors grapple with uncertainty, Pizzino’s insights invite us to explore the dynamics connecting crypto assets and stock performance, challenging conventional wisdom and prompting a deeper inquiry into the sustainability of market exuberance. In this article, we delve into the nuances of Pizzino’s analysis, examining the implications for investors navigating this complex terrain brimming with both opportunities and risks.

Table of Contents

- The Resilience of Crypto Amid Market Whispers

- Understanding the Stock Market Dynamics in an Expanding Bubble

- Jason Pizzinos Insights on Investment Strategies for Current Conditions

- Navigating the Future: Recommendations for Diverse Portfolio Growth

- Q&A

- In Retrospect

The Resilience of Crypto Amid Market Whispers

The world of cryptocurrency has faced its share of skepticism, yet it demonstrates remarkable resilience as market conditions fluctuate. Despite whispers of impending downturns and the looming specter of an ‘everything bubble’, cryptocurrencies continue to attract both institutional and retail investors. Analyst Jason Pizzino posits that this endurance is indicative of a larger trend, suggesting that the interconnectedness of crypto with traditional markets is becoming more pronounced. As investors scrutinize their portfolios, cryptocurrencies stand as a beacon of innovation and potential, offering opportunities for diversification even amidst uncertainty.

Key factors contributing to this tenacity include:

- Decentralization: The fundamental aspect of crypto technologies, allowing for autonomy from centralized financial systems.

- Institutional Interest: Increased participation from hedge funds and corporations signals faith in long-term viability.

- Technological Advancements: Ongoing development in blockchain technology and decentralized finance (DeFi) reinforces the case for digital assets.

Moreover, the evolving regulatory landscape may ultimately benefit the cryptocurrency sector, as clearer guidelines provide legitimacy and facilitate broader adoption. It’s crucial for investors to remain informed about these trends, as they could reveal opportunities even in a landscape characterized by doubt and volatility.

Understanding the Stock Market Dynamics in an Expanding Bubble

In the evolving landscape of financial markets, understanding the intricacies of the stock market is crucial, especially when it appears to be operating within an expanding bubble. Analysts like Jason Pizzino suggest that this environment is characterized by heightened investor sentiment, driven by speculative interests. Below are key factors contributing to the current dynamics:

- Liquidity Infusion: Central banks have injected vast amounts of liquidity into the financial system, which often leads to inflated asset prices.

- Retail Investor Participation: A surge in retail investors, emboldened by information readily accessible through digital platforms, contributes significantly to market volatility.

- Sustained Momentum: Investors are often influenced by previous performance trends, resulting in a self-reinforcing cycle of buying.

Understanding these dynamics is essential for navigating the risks and opportunities within the stock market. Pizzino points out that while caution is warranted, there remains potential for further growth. Consider the following comparative analysis of recent market trends:

| Market Indicators | Current Trend | Potential Outlook |

|---|---|---|

| Stock Valuations | High | Possible Further Upswing |

| Investor Sentiment | Optimistic | Sustained Enthusiasm |

| Interest Rates | Low | Buoyant Borrowing Conditions |

Jason Pizzinos Insights on Investment Strategies for Current Conditions

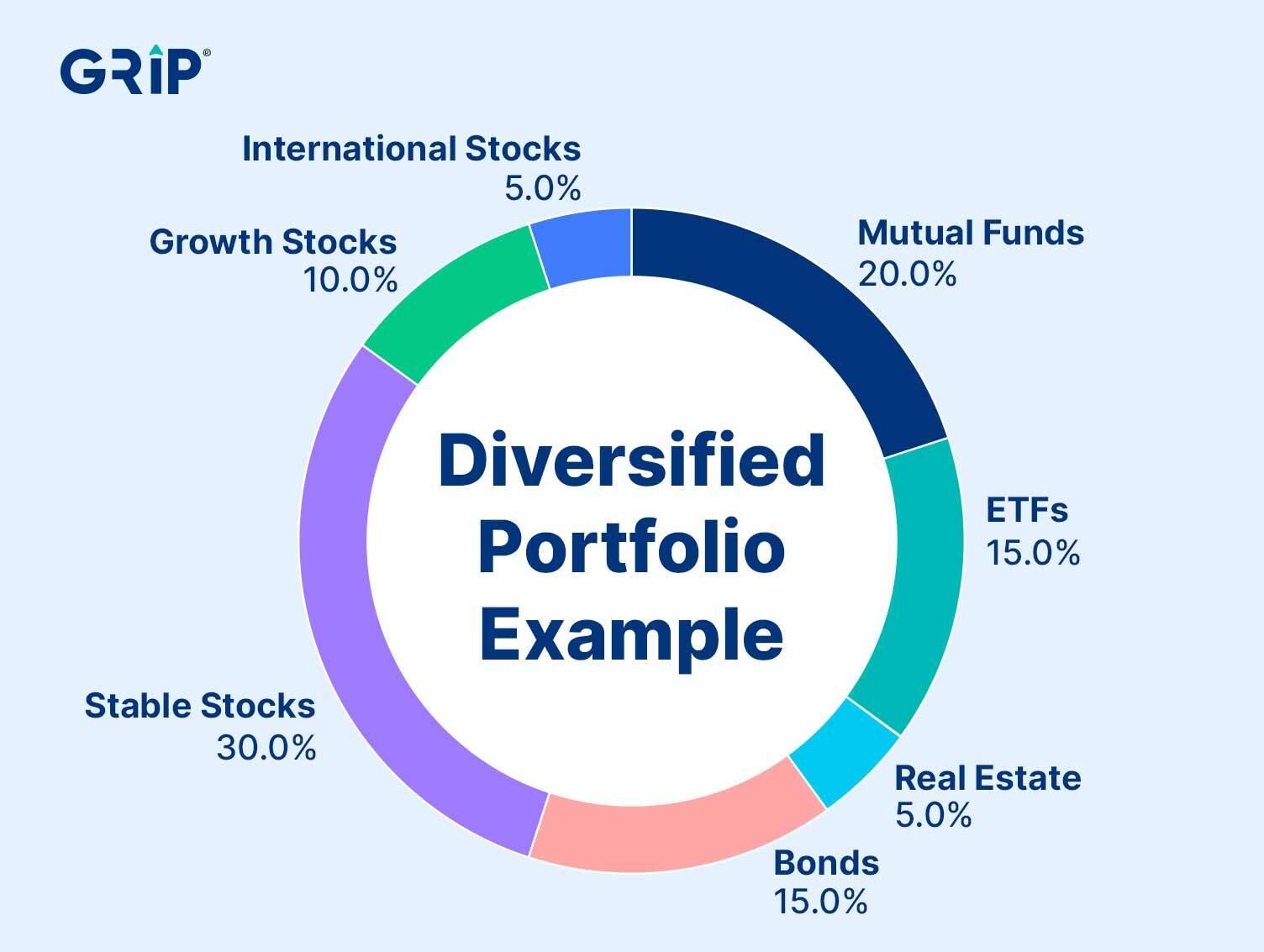

In the ever-evolving landscape of investing, Jason Pizzino emphasizes the importance of adaptability and informed decision-making. His analysis suggests that crypto and stocks are not only surviving but are also poised for potential growth, even amid discussions surrounding an “everything bubble.” Key insights into his strategic approach highlight the need to maintain a diversified portfolio. Investors should consider the following strategies:

- Risk Management: Always assess your risk tolerance before diving into new investments.

- Market Trends: Stay updated with market movements to identify emerging opportunities.

- Diversification: Spread investments across various asset classes to mitigate risks.

Pizzino also points to the interconnection of various markets as a critical factor that could drive future performance. He believes that while some sectors may experience pullbacks, others will thrive, suggesting a cyclical behavior where equities and digital assets might still see upward momentum. To illustrate this idea, the following table outlines potential sectors of opportunity and their expected performance:

| Sector | Potential Growth | Risk Level |

|---|---|---|

| Emerging Tech | High | Medium |

| Blockchain | Very High | High |

| Healthcare | Moderate | Low |

Navigating the Future: Recommendations for Diverse Portfolio Growth

To effectively navigate the evolving landscape of investments, it’s crucial to adopt a strategy that emphasizes diversification across various asset classes. This approach not only reduces risk but also positions investors to capitalize on potential growth opportunities. Consider incorporating the following elements into your portfolio:

- Cryptocurrency: With continued interest and adoption, diversifying into established cryptocurrencies can yield significant returns.

- Technology Stocks: Sector-centric investments, particularly in growth-driven tech companies, can enhance your portfolio’s performance.

- Alternative Assets: Exploring real estate, commodities, and even collectibles can provide a hedge against traditional market volatility.

- ESG Investments: Focusing on environmental, social, and governance metrics may align your investments with sustainable growth trends.

As you formulate your investment strategy, it’s essential to keep an eye on key market indicators that could influence your decisions. Below is a summary of some potential factors:

| Market Indicator | Importance |

|---|---|

| Interest Rates | Higher rates can impact stocks and crypto valuations. |

| Inflation Rates | Persistent inflation can drive the demand for alternative assets. |

| Regulatory Changes | New regulations in the crypto space can create volatility. |

Q&A

Q&A: Insights from Analyst Jason Pizzino on Crypto, Stocks, and the “Everything Bubble”

Q1: Who is Jason Pizzino, and what is his perspective on the current investment landscape?

A: Jason Pizzino is a financial analyst and content creator known for his insights on cryptocurrency and traditional markets. According to him, the current investment landscape reflects an “everything bubble,” which encompasses not only stocks and cryptocurrencies but also a range of assets inflated by excessive liquidity. Pizzino believes that despite growing awareness of market risks, there remains significant room for growth.

Q2: What does Pizzino mean by the “everything bubble”?

A: The “everything bubble” refers to a broad market condition where asset prices across various sectors are significantly elevated due to factors such as low interest rates, expansive monetary policies, and investor euphoria. Pizzino argues that this phenomenon is not confined to one asset class—equities, cryptocurrencies, real estate, and more are all intertwined in this inflated environment.

Q3: According to Pizzino, how do cryptocurrencies fit into this complex picture?

A: Pizzino sees cryptocurrencies as both a risky asset and a potential hedge against traditional financial systems. He believes that while the crypto market has experienced its share of volatility, factors such as increased adoption, institutional investment, and innovative technology could propel its growth further. He advises investors to remain vigilant but optimistic, emphasizing that opportunities still exist even within perceived bubbles.

Q4: Why does Pizzino believe the “everything bubble” has room to run?

A: Pizzino argues that the underlying conditions driving the inflation of asset prices—such as continuous monetary stimulus, global liquidity, and investor sentiment—are still very much in play. He notes that historical precedents often show that bubbles can expand further before they ultimately burst. As such, he suggests that investors exercise patience and maintain an active strategy to navigate these dynamics effectively.

Q5: What should investors take into consideration according to Jason Pizzino?

A: Pizzino advises that investors should focus on education and diversification, recognizing the inherent risks involved in chasing inflated asset prices. He emphasizes the importance of conducting thorough research, understanding market fundamentals, and being wary of the psychological traps that accompany euphoric markets. Positioning oneself defensively while also seizing opportunities could be a balanced approach during uncertain times.

Q6: what is Pizzino’s main message to investors?

A: Pizzino’s main message centers on the idea that while the “everything bubble” presents significant risks, it also offers unique possibilities for growth. He encourages investors to be proactive, remain informed, and adapt their strategies as they navigate this unpredictable landscape, ensuring they can capitalize on potential gains while safeguarding their investments against unforeseen downturns.

In Retrospect

As the financial landscape continues to evolve, the insights of analysts like Jason Pizzino become increasingly invaluable. His perspective on the interplay between cryptocurrencies, stocks, and the so-called “everything bubble” offers a compelling framework for understanding today’s market dynamics. While caution is warranted, Pizzino’s analysis suggests that opportunities still abound for both seasoned investors and newcomers alike. As we navigate this intricate web of asset classes, it’s crucial to remain informed and adaptable. Whether you’re drawn to the allure of crypto or the stability of traditional stocks, staying attuned to market signals can help chart a path through the complexities ahead. The journey unfolds, and with it, the potential for growth in a world where uncertainty seems to reign. As we close this discussion, it’s worth remembering that every bubble eventually finds a way to manifest itself—perhaps the next chapter in this story is yet to be written.

https://t.me/s/officials_pokerdom/3395

https://t.me/s/officials_pokerdom/3274

https://t.me/officials_pokerdom/3110

https://t.me/s/iGaming_live/4867

https://t.me/s/BeeFcasInO_OffICiAlS

https://t.me/s/be_1win/831

https://t.me/s/official_pokerdom_pokerdom

https://t.me/s/ef_beef

No long roads.

No overexplaining.

Only what matters, when it matters.

Fresh signals.

Clear mechanics.

Moments that feel right — not forced.

This is where rhythm meets timing,

and timing quietly turns into advantage.

You scroll — you get it.

You stay — you feel it.

https://t.me/s/portable_1WIN

Slide in.

Catch the flow.

Stay where momentum lives.