As the cryptocurrency market continues to evolve, the spotlight often shifts to the undercurrents that shape its trajectory—one of the most telling indicators is the funding rate for altcoins. Recently, this metric has surged to a nine-month high, sparking discussions among investors and analysts alike. While some view this surge as a bullish sign that might herald the long-anticipated altseason, others caution it could be a red flag, suggesting unsustainable speculation. In the world of digital currencies, where sentiment can shift in the blink of an eye, understanding the implications of these funding rates is essential. Join us as we delve into the dynamics of altcoin funding, exploring the potential signals it sends for the future of alternative cryptocurrencies in an ever-fluctuating market.

Table of Contents

- Altcoin Funding Rates Surge Indicating Market Sentiment Shift

- Analyzing the Implications of High Funding Rates on Altcoins

- Key Indicators to Watch in the Lead-Up to Potential Altseason

- Strategic Approaches for Investors Amid Rising Funding Dynamics

- Q&A

- In Conclusion

Altcoin Funding Rates Surge Indicating Market Sentiment Shift

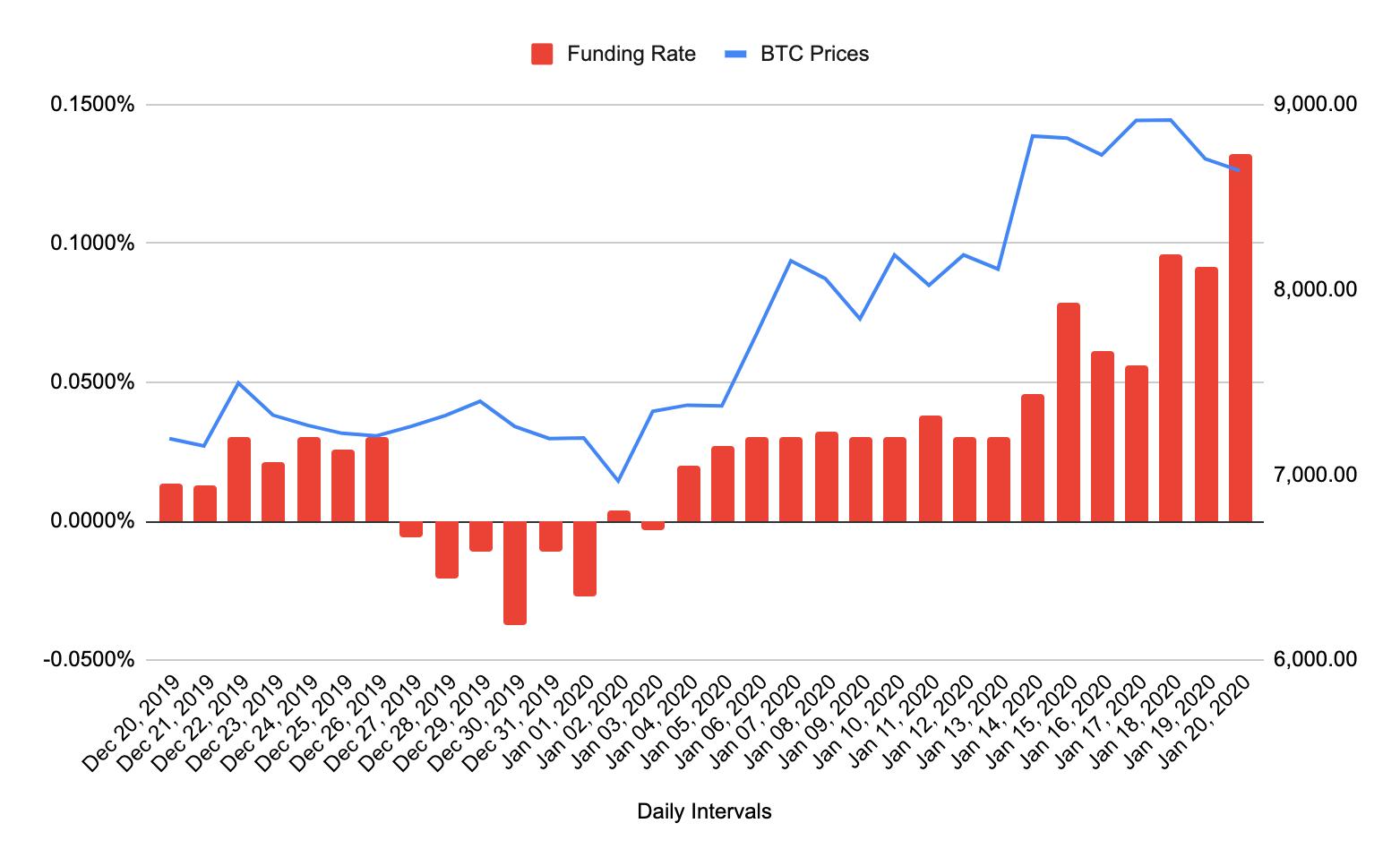

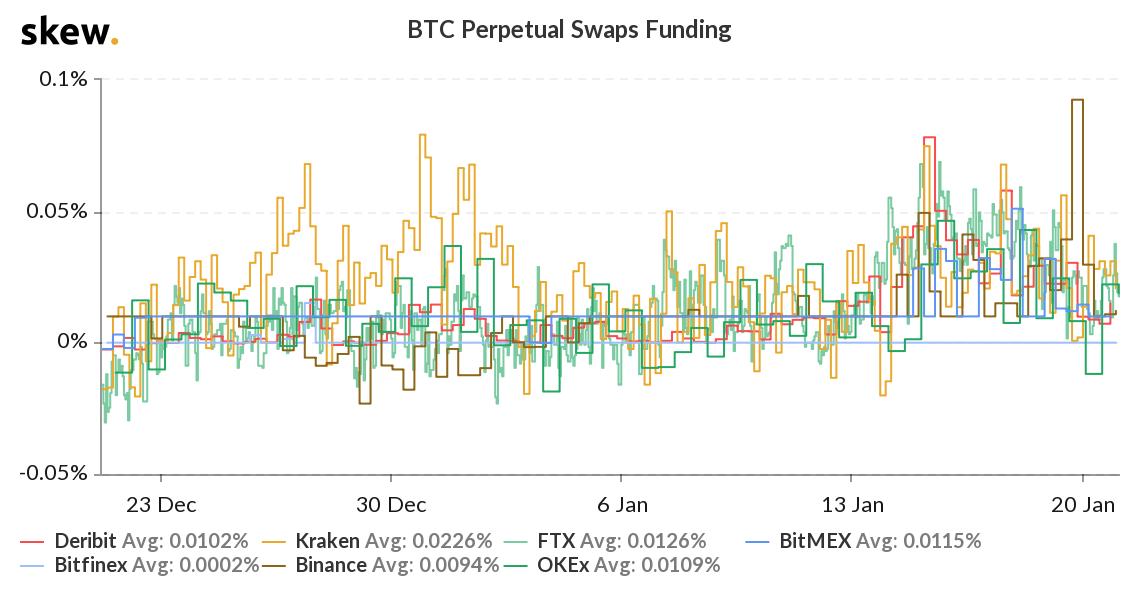

Recent data reveal a significant uptick in altcoin funding rates, reaching levels not seen for nine months. This surge is often viewed as a potential harbinger of renewed investment and interest in altcoins, possibly signaling the dawn of another altseason. Investors are keenly watching this trend, as high funding rates can indicate increased borrowing costs to go long on these digital assets, a scenario typically aligned with bullish sentiment in the market. The question remains: are traders diving in with strong confidence, or is there an underlying risk that could disrupt this optimistic outlook?

Market analysts are exploring the implications of these funding rates as they assess the broader cryptocurrency landscape. A few critical points of consideration include:

- Increase in retail participation: More investors are likely looking towards altcoins, diversifying beyond Bitcoin.

- Institutional interest: Higher funding rates might attract institutional players, driving more capital into the altcoin market.

- Volatility ahead: Historical trends show that elevated funding rates can lead to market corrections.

Analyzing the recent funding data further, the following table encapsulates altcoin funding rates alongside their relative market performances:

| Altcoin | Funding Rate (%) | Price Change (7D) |

|---|---|---|

| Ethereum | 0.12 | +8.5% |

| Cardano | 0.10 | +5.3% |

| Solana | 0.15 | +12.1% |

Analyzing the Implications of High Funding Rates on Altcoins

The recent surge in funding rates for altcoins, now reaching a 9-month high, has sparked debate among traders and investors. High funding rates often signify a robust bullish sentiment in the market, where long positions are paying short positions to maintain their leverage. However, while this can indicate strong demand, it might also serve as a cautionary sign, potentially hinting at over-leverage and market saturation. Investors must scrutinize whether this rise is sustainable or a precursor to corrections that might force liquidations among overly leveraged positions.

To further understand the implications, consider the following dynamics:

- Investor Sentiment: The growing enthusiasm could attract more participants to the market, but it also raises the stakes for a correction.

- Market Volatility: Higher funding rates may lead to increased volatility, as rapid shifts in sentiment can trigger cascade liquidations.

- Comparative Analysis: Observing historical funding rate trends can provide insights into potential price action, considering various altcoins respond differently.

| Funding Rate | Implication |

|---|---|

| High | Potential Bullish Momentum |

| Moderate | Stability but Caution |

| Low | Bearish Trend Likely |

Key Indicators to Watch in the Lead-Up to Potential Altseason

As altcoin funding rates reach a remarkable nine-month high, traders should keep a vigilant eye on several key indicators that could signal the onset of altseason. First and foremost, monitor the altcoin liquidity levels. Improved liquidity often indicates greater investor confidence and can lead to more substantial price movements. Additionally, watch for any significant spikes in trading volumes across various exchanges; increased interest in altcoins could hint at shifting sentiment from Bitcoin dominance to a diversified portfolio. Lastly, observe the overall market sentiment, often reflected in social media trends and sentiment analysis platforms, which can be precursors to broader market rallies.

In tandem with these considerations, paying attention to price correlations between altcoins and Bitcoin is crucial. Historically, a decoupling of altcoin performance from Bitcoin’s price action has been an encouraging sign for altseason. Analyze the relative performance of top altcoins, benchmarking them against Bitcoin to discern any emerging trends. Moreover, keep an eye on institutional investments in altcoins; a rise in institutional interest and capital inflows can support bullish momentum for altcoins and pave the way for potential gains. Lastly, consider the impact of regulatory developments, as new policies can either hinder or accelerate altcoin growth, affecting investor sentiment and market dynamics.

Strategic Approaches for Investors Amid Rising Funding Dynamics

In the current landscape characterized by rising funding dynamics, investors must adopt strategic approaches to navigate the shifting tides of altcoin investments. Understanding market trends and aligning with the prevailing sentiment is crucial. As altcoin funding rates surge to a 9-month high, investors should assess whether this signals an impending altseason or if it is merely a precursor to market volatility. Evaluating key indicators such as trading volumes, market cap fluctuations, and sentiment analysis can provide insights into potential strategies. A proactive stance involves diversifying portfolios to mitigate risks associated with sudden market corrections, while remaining open to the opportunities presented by emerging altcoins poised for growth.

Another avenue investors might explore is the timing of entries and exits in relation to historical funding rate patterns. Tracking these funding dynamics allows investors to strategically position themselves, optimizing their returns while minimizing exposure to risks. Consider using a data-driven approach to evaluate the following factors:

- Core market indicators: Examine historical price movements juxtaposed with funding rates.

- Stakeholder sentiment: Gauge the market mood through social media and news sources.

- Regulatory developments: Monitor evolving regulations that may impact altcoin valuations.

In light of these strategies, below is a simple table highlighting key altcoins of interest along with their corresponding funding rates, aiding in quick decision-making:

| Altcoin | Funding Rate | Market Cap |

|---|---|---|

| Ethereum | 2.5% | $220B |

| Cardano | 1.8% | $76B |

| Solana | 3.0% | $45B |

Q&A

Q&A: Exploring Altcoin Funding Rates and Their Implications for the Market

Q: What are altcoin funding rates, and why are they important?

A: Altcoin funding rates represent the cost of holding long or short positions in altcoins on exchanges. They are important because they indicate market sentiment—positive funding rates suggest a bullish bias, while negative rates signal bearish sentiment. High funding rates, like the recent 9-month peak, can suggest increased trading activity and speculation, making them a key indicator for traders gauging potential market movements.

Q: Why have altcoin funding rates reached a 9-month high recently?

A: The surge in funding rates can be attributed to a combination of factors, including increased demand for altcoins, a general bullish sentiment in the broader cryptocurrency market, and significant price movements in leading altcoins. Traders are becoming more optimistic, leading to heightened trading volume and a willingness to take on leveraged positions, which drives up funding rates.

Q: Is the high funding rate a bullish sign for an altseason?

A: A high funding rate can indeed be interpreted as a bullish signal for an altseason, as it often indicates strong demand from traders looking to capitalize on potential price increases. This exuberance may propel altcoins to outperform Bitcoin and Ethereum, reflecting a lively altcoin market. However, historical trends suggest that extreme funding rates can lead to corrections as market positions become overcrowded.

Q: Could a high funding rate be a red flag for investors?

A: Absolutely, a high funding rate could also act as a red flag. While it indicates bullish sentiment, over-leveraged positions might create vulnerabilities. If many traders are caught on the long side when a correction occurs, the unwinding of these positions can lead to sharp price declines. This pattern is commonly observed in hyper-volatile markets like cryptocurrency, where sudden shifts can provoke panic selling.

Q: What should investors keep an eye on moving forward?

A: Investors should closely monitor both the funding rates and overall market conditions. Specifically, they should watch for divergence between funding rates and price movements—if prices don’t follow the bullish sentiment suggested by high funding rates, it might raise concerns. Additionally, keeping an eye on market news, regulatory developments, and global economic factors can provide context to the funding rates’ implications.

Q: should investors be excited or cautious about the current altcoin funding rates?

A: The elevated altcoin funding rates present a dual narrative—there’s potential for exciting price movements and profit opportunities, reflective of market enthusiasm. However, the risks of market volatility and potential corrections loom large. A balanced approach, involving both optimism and caution, is key for navigating these turbulent waters. Always consider your risk tolerance and stay informed before making investment decisions.

In Conclusion

As we navigate the intricate tapestry of the cryptocurrency landscape, the recent surge in altcoin funding rates to a nine-month high introduces a compelling narrative that underscores both opportunity and caution. On one hand, this uptick may signal the dawn of an exhilarating altseason, enticing investors with the allure of potential gains. On the other, the heightened rates could serve as a warning bell, suggesting an overheated market ripe for volatility.

As you weigh the implications of these trends, remember to approach the market with a balanced perspective. Essential to this journey is ongoing research and a willingness to adapt to the ever-shifting currents of the crypto ecosystem. Whether you find yourself drawn to the promise of altcoins or remain vigilant amidst the unease they might inspire, one thing is clear: the saga of cryptocurrency continues to evolve, offering a wealth of narratives to explore in the chapters ahead. Stay informed, stay curious, and let the market’s story unfold.

ivermectin 6mg otc – ivermectin 6 mg without a doctor prescription carbamazepine 200mg tablet

buy isotretinoin 40mg without prescription – buy linezolid generic order zyvox 600mg without prescription

where to buy amoxil without a prescription – where can i buy amoxicillin ipratropium 100 mcg uk

buy azithromycin no prescription – zithromax 250mg cost buy nebivolol 5mg generic

omnacortil 5mg pills – buy cheap azipro prometrium 200mg brand

buy furosemide 40mg sale – where to buy betnovate without a prescription3 betnovate 20gm us

acticlate medication – purchase monodox online cheap buy generic glipizide

order augmentin 625mg sale – buy clavulanate pills cymbalta 20mg pill

order augmentin online cheap – order cymbalta 40mg sale buy cymbalta 20mg without prescription

order rybelsus 14mg pill – periactin 4 mg us cyproheptadine ca

tizanidine 2mg sale – buy plaquenil no prescription buy microzide generic

viagra overnight delivery – tadalafil 10mg ca cialis coupon walmart

buy tadalafil 40mg pill – sildenafil for sale online purchase viagra pill

cost cenforce – aralen 250mg canada order glucophage 500mg

buy generic atorvastatin 10mg – lipitor over the counter prinivil drug

omeprazole 10mg uk – prilosec 10mg without prescription atenolol 50mg price

order medrol sale – buy methylprednisolone generic buy triamcinolone 10mg generic

buy desloratadine 5mg pills – desloratadine 5mg pill order priligy 90mg pill

cytotec 200mcg usa – cytotec 200mcg cheap diltiazem medication

acyclovir 800mg for sale – order rosuvastatin 20mg sale order rosuvastatin 10mg sale

buy generic domperidone – order generic motilium 10mg cyclobenzaprine 15mg without prescription

buy generic domperidone for sale – sumycin order online flexeril pills

purchase inderal online – order inderal 10mg buy generic methotrexate 5mg

purchase coumadin pill – buy hyzaar without prescription brand losartan 50mg

buy nexium 20mg without prescription – nexium 40mg uk order imitrex 50mg online cheap

order levaquin 500mg – order avodart 0.5mg online ranitidine 300mg brand

order mobic 7.5mg pill – meloxicam pill buy flomax paypal

buy zofran 4mg generic – buy ondansetron for sale zocor 10mg tablet

order valacyclovir 1000mg without prescription – order valtrex 1000mg online cheap purchase fluconazole for sale

Such a valuable bit of content.

order provigil pill modafinil 100mg brand order modafinil 100mg online cheap purchase modafinil generic modafinil sale purchase modafinil pill order provigil 100mg pills

More articles like this would frame the blogosphere richer.

This is the gentle of writing I positively appreciate.

zithromax 250mg canada – flagyl 200mg without prescription brand metronidazole

buy generic rybelsus – semaglutide where to buy buy periactin 4 mg for sale

motilium cheap – flexeril buy online flexeril 15mg ca

inderal oral – buy generic clopidogrel 150mg methotrexate 10mg pills

amoxil cost – buy generic amoxil over the counter cheap combivent 100mcg

buy zithromax 250mg generic – buy zithromax 500mg buy generic bystolic 20mg

buy clavulanate – atbio info brand ampicillin

order generic nexium 20mg – https://anexamate.com/ order generic esomeprazole 20mg

coumadin cheap – https://coumamide.com/ order losartan 25mg

buy meloxicam 7.5mg for sale – https://moboxsin.com/ order mobic online cheap

deltasone 40mg tablet – corticosteroid deltasone 10mg for sale

ed pills comparison – https://fastedtotake.com/ buy ed pill

purchase amoxil pill – buy amoxil tablets cheap amoxil generic

order diflucan 200mg for sale – how to buy diflucan fluconazole pills

oral lexapro – order escitalopram 20mg generic buy lexapro 20mg pill

buy generic cenforce 100mg – buy generic cenforce cenforce 100mg oral

do you need a prescription for cialis – https://strongtadafl.com/ achats produit tadalafil pour femme en ligne

buy zantac 150mg pill – https://aranitidine.com/ buy zantac 150mg online

order viagra online fast delivery – https://strongvpls.com/ sildenafil 100 mg ebay

This is the kind of topic I enjoy reading. https://buyfastonl.com/gabapentin.html

Palatable blog you have here.. It’s hard to find elevated status article like yours these days. I truly respect individuals like you! Take mindfulness!! lasix sin receta

I couldn’t turn down commenting. Adequately written! https://ursxdol.com/get-metformin-pills/

Thanks on putting this up. It’s okay done. web

More articles like this would remedy the blogosphere richer. https://aranitidine.com/fr/viagra-professional-100-mg/

Thanks towards putting this up. It’s well done. https://ondactone.com/spironolactone/

This is a keynote which is near to my heart… Many thanks! Quite where can I find the acquaintance details in the course of questions?

https://doxycyclinege.com/pro/sumatriptan/

This is the type of post I unearth helpful. https://experthax.com/forum/member.php?action=profile&uid=124581

dapagliflozin canada – order forxiga generic where can i buy dapagliflozin

buy orlistat online – https://asacostat.com/ buy xenical 60mg pills

More posts like this would add up to the online time more useful. https://lzdsxxb.com/home.php?mod=space&uid=5112172

Этот информативный материал предлагает содержательную информацию по множеству задач и вопросов. Мы призываем вас исследовать различные идеи и факты, обобщая их для более глубокого понимания. Наша цель — сделать обучение доступным и увлекательным.

Исследовать вопрос подробнее – https://quick-vyvod-iz-zapoya-1.ru/

You can protect yourself and your dearest by being alert when buying medicine online. Some druggist’s websites control legally and provide convenience, reclusion, cost savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/risperdal.html risperdal

Thanks an eye to sharing. It’s acme quality. TerbinaPharmacy

Palatable blog you be undergoing here.. It’s obdurate to find high calibre writing like yours these days. I really respect individuals like you! Rent care!!

https://t.me/officials_pokerdom/3124

https://t.me/s/officials_pokerdom/3892

https://t.me/s/Martin_casino_officials

https://t.me/dragon_money_mani/39

https://t.me/s/dragon_money_mani/13

online blackjack olga

best online casino texas

best casino near san diego ca

mgmbetting https://betmgm-play.com/ betmgm llc

Awaken to the possibilities of overnight riches and fun. In crown coins casino official website, scratch cards add instant gratification. Dive in and scratch your way to success!