In a stunning turn of events that has sent shockwaves through the cryptocurrency market, Bitcoin has plummeted to $62,000 on the Upbit exchange, coinciding with the South Korean government’s announcement of emergency martial law. As fears of economic instability ripple across the nation, investors and enthusiasts alike are grappling with the implications of this drastic measure. This unforeseen crash underscores the fragile nature of digital currencies, where market confidence can be swiftly eroded by geopolitical turmoil. In this article, we delve into the factors behind this precipitous decline, explore the reactions from traders and analysts, and assess the broader implications for the cryptocurrency landscape in an increasingly uncertain world.

Table of Contents

- Impact of Emergency Martial Law on Cryptocurrency Markets

- Analyzing Investor Sentiment Amidst Sudden Price Drops

- Strategies for Navigating Bitcoin Volatility in Turbulent Times

- The Future of Bitcoin Regulation in South Korea and Beyond

- Q&A

- Insights and Conclusions

Impact of Emergency Martial Law on Cryptocurrency Markets

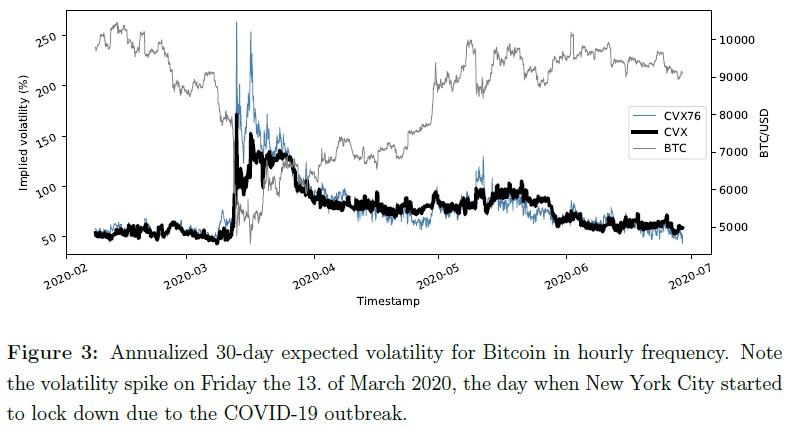

The enactment of emergency martial law in South Korea has sent shockwaves through the cryptocurrency markets, particularly affecting Bitcoin prices. As investors reacted to the sudden change in political climate, fear and uncertainty took hold, leading to significant sell-offs. On platforms like Upbit, Bitcoin plummeted to $62,000, reflecting a broader trend of volatility in digital assets. Market analysts suggest that such drastic measures can create an environment of speculation, prompting traders to either liquidate their assets or bet on a recovery in the long run.

This situation has highlighted several key aspects of how geopolitical events influence cryptocurrency dynamics:

- Regulatory Scrutiny: Emergency measures often lead to increased governmental oversight, which can dampen investor confidence.

- Market Sentiment: The immediate reaction is typically fear-driven, leading to rapid market fluctuations.

- Long-Term Implications: While short-term prices may dive, the long-term outlook can vary if conditions stabilize.

| Event | Impact on Bitcoin | Market Reaction |

|---|---|---|

| Emergency Martial Law | Drop to $62,000 | High volatility, increased sell-offs |

| Investor Sentiment Shift | Potential further decline | Market uncertainty prevalent |

Analyzing Investor Sentiment Amidst Sudden Price Drops

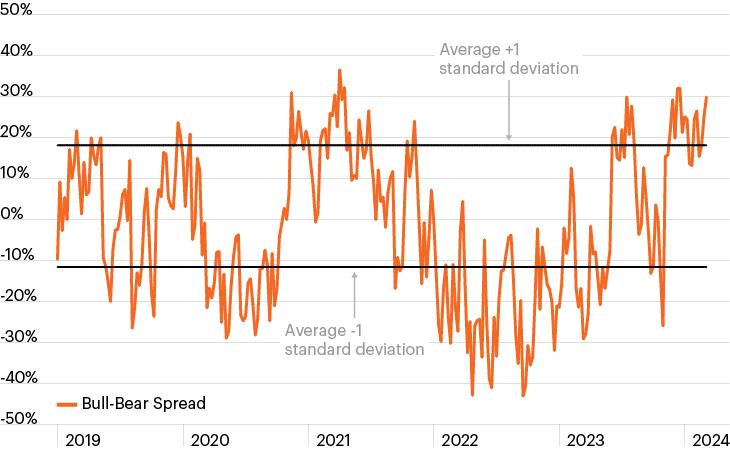

The recent plunge of Bitcoin to $62,000 on Upbit, triggered by South Korea’s declaration of emergency martial law, has sent ripples through the cryptocurrency markets, compelling investors to reassess their strategies. Investor sentiment often sways dramatically during periods of unexpected market turmoil, as panic selling can lead to a cascade of further declines. This volatile reaction is exacerbated by social media chatter and the rapid dissemination of news, which can influence decisions in real-time. Market analysts have noted a trend towards increased bearish sentiment, as many traders fear prolonged instability and potential cascading effects on the broader market.

In light of these developments, some investors are choosing to adopt a more cautious approach, while others are seizing the opportunity to invest at what they perceive as a discounted price. Key indicators are currently being scrutinized to gauge sentiment, including:

- Trading Volume: Increased volume often suggests heightened investor activity and can indicate a shift towards either fear or opportunistic buying.

- Social Media Mentions: The frequency of discussions and sentiment on platforms like Twitter can reveal prevailing market attitudes.

- Fear & Greed Index: A useful tool for assessing the emotional state of investors, reflecting whether the market is skewed towards fear or greed.

| Indicator | Current Status | Investor Reaction |

|---|---|---|

| Trading Volume | High | Panic Selling |

| Social Media Sentiment | Negative | Increased Caution |

| Fear & Greed Index | Fear | Consider Selling |

As the situation evolves, understanding the nuances of investor psychology during critical price movements becomes essential for navigating these turbulent waters. While some see this as an opportunity to capitalize on lower prices, others may err on the side of caution, resulting in a market that is reacting more to sentiment than to fundamentals. It remains vital for participants in the crypto space to stay informed and to be mindful of the emotional factors that often drive market behavior.

Strategies for Navigating Bitcoin Volatility in Turbulent Times

The recent crash of Bitcoin to $62,000 on Upbit amid South Korea’s emergency martial law highlights the importance of having a solid strategy to manage the inherent volatility of cryptocurrencies. Investors can consider adopting a diversified portfolio approach, which helps mitigate risk by spreading investments across various assets. Additionally, setting up stop-loss orders ensures that investors can automatically exit a position when the price reaches a certain point, preventing further losses during sharp downturns. It’s also prudent to keep a portion of assets in stablecoins, which provide a temporary haven from market fluctuations.

Another effective strategy involves maintaining a long-term perspective. Many seasoned investors focus on the fundamentals of Bitcoin and other cryptocurrencies rather than moment-to-moment price changes. During turbulent times, market sentiment can significantly influence prices; therefore, it’s crucial to remain informed about global events that could impact cryptocurrency valuations. Engaging with real-time data analytics tools can further empower investors by giving them insights on market trends and price movements. Lastly, joining crypto communities and forums can offer invaluable support, insights, and strategies from fellow traders navigating the same turbulent waters.

The Future of Bitcoin Regulation in South Korea and Beyond

The recent implementation of emergency martial law in South Korea has sent shockwaves through the cryptocurrency markets, leading to a dramatic fall in Bitcoin’s value. As regulatory bodies react to intense public scrutiny and concerns surrounding economic stability, the future landscape for cryptocurrencies such as Bitcoin remains uncertain. Key players within the South Korean government are contemplating various approaches to regulation that could either foster innovation or stifle growth. The rising trend towards transparency, consumer protection, and anti-money laundering measures are at the forefront of these discussions, signaling a shift towards more structured governance of digital assets.

Internationally, South Korea’s actions may set a precedent influencing regulatory measures in other markets, making it essential to monitor global responses. The evolution of Bitcoin regulation will likely encompass various factors such as market behavior, technological advancements, and public sentiment. Analysts predict a potential framework that could feature:

- Collaboration with Financial Institutions: Encouraging partnerships between crypto exchanges and banks to ensure security and legitimacy.

- Enhanced Compliance Regulations: Stricter measures for exchanges to comply with tax laws and consumer protection standards.

- Dynamic Regulatory Updating: Adapting regulations swiftly in response to market changes and technological innovations.

| Regulatory Area | Expected Changes | Potential Impact |

|---|---|---|

| Market Transparency | Mandatory reporting and auditing | Increased investor confidence |

| Consumer Protection | Clear guidelines for exchanges | Reduction in fraud incidents |

| Global Cooperation | Information sharing with international bodies | Stronger regulatory framework |

Q&A

Q&A on Bitcoin Crash Following South Korea’s Martial Law

Q1: What happened to Bitcoin on Upbit recently?

A1: Bitcoin experienced a significant plunge, dropping to $62,000 on the Upbit exchange amidst rising tensions in South Korea after the government enacted emergency martial law. This sudden move led to substantial market reactions and panic among traders.

Q2: What are the potential causes behind this sharp decline in Bitcoin’s price?

A2: The crash can be attributed to various factors, primarily the geopolitical unrest caused by the implementation of martial law. The uncertainty surrounding regulatory environments often triggers volatility in cryptocurrency markets, and traders may have reacted swiftly to the news, leading to a mass sell-off.

Q3: How is the South Korean government’s decision to impose martial law affecting its cryptocurrency market?

A3: The South Korean government’s announcement has created a climate of fear and uncertainty, resulting in decreased investor confidence. Many traders, wary of potential crackdowns or regulatory changes, have opted to liquidate their holdings, exacerbating the downward pressure on Bitcoin’s price.

Q4: What’s the general sentiment among investors regarding cryptocurrencies at this time?

A4: Investors are currently in a state of caution. The volatility in the market is prompting many to reassess their positions. While some view this as a temporary setback and an opportunity to buy at lower prices, others are hesitant to invest further until there’s more clarity about the situation in South Korea.

Q5: Is this crash reflective of the overall cryptocurrency market or is it an isolated incident?

A5: While the crash of Bitcoin on Upbit is particularly pronounced due to local news, it does reflect larger sentiments within the global cryptocurrency market. In times of geopolitical instability, cryptocurrencies often experience cascading effects, and traders worldwide are monitoring these developments closely.

Q6: What steps can investors take in response to this situation?

A6: Investors are encouraged to stay informed and consider their risk tolerance. Some might choose to diversify their portfolios to mitigate potential losses, while others may utilize stop-loss orders if they wish to limit their exposure. Researching the broader implications of South Korea’s martial law on crypto markets can also inform better decision-making.

Q7: What should we look for in the coming days regarding Bitcoin’s recovery?

A7: Monitoring the news from South Korea will be crucial. Any announcements regarding the duration or extent of the martial law could significantly influence market sentiment. Additionally, observing trading volumes and any shifts in investor behavior can provide insights into the potential for recovery or further decline in Bitcoin’s price.

Q8: Is there a possibility that this event could lead to more regulatory scrutiny in other countries?

A8: It’s certainly a possibility. Major events in significant markets often prompt regulators in other countries to reassess their stance on cryptocurrency. However, each country’s response will depend on its unique economic circumstances and regulatory framework, making a uniform reaction unlikely.

—

the unfolding situation in South Korea serves as a reminder of the inherent volatility in the cryptocurrency market. As we navigate these turbulent waters, remaining informed and adaptable remains key for investors and enthusiasts alike.

Insights and Conclusions

As the dust settles from the seismic fluctuations in Bitcoin’s value, the implications of South Korea’s emergency martial law resonate far beyond the screens of traders and investors. The rapid descent to $62,000 on Upbit encapsulates the unpredictable nature of cryptocurrency markets, often influenced by geopolitical events and government interventions. While the digital finance landscape demonstrates resilience, such extreme volatility serves as a stark reminder of the risks inherent in this relatively nascent asset class. As we navigate these tumultuous waters, both seasoned investors and curious newcomers must remain vigilant, informed, and adaptable. The question now looms: how will the market respond in the aftermath of this unprecedented event? Only time will tell if this is a fleeting dip or a pivotal moment in Bitcoin’s journey. As always, staying abreast of developments will be crucial for anyone seeking to understand the evolving narrative of cryptocurrencies in an ever-changing world.

https://t.me/s/iGaming_live/4866

https://t.me/s/Legzo_officials

https://t.me/dragon_money_mani/39

https://t.me/dragon_money_mani/39

https://t.me/s/be_1win/825

https://t.me/s/ezcash_officials