In the ever-evolving landscape of cryptocurrency, where fortunes can shift with the blink of an eye, one asset has captured the attention of traders and investors alike: Ethereum. As the second-largest cryptocurrency by market capitalization, it has frequently demonstrated its potential to reshape the financial and technological spheres. Recently, speculation surrounding Ethereum’s price movements has reached a fever pitch, with traders whispering of an imminent surge that could propel it beyond its previous all-time high. In this article, we delve into the insights of seasoned traders who are optimistic about Ethereum’s trajectory, exploring the factors that may contribute to its expected rise and what it means for the future of digital assets. Buckle up, as we embark on a journey through market trends, technological advancements, and the hopes that fuel the cryptocurrency community.

Table of Contents

- Ethereums Bullish Momentum: Analyzing Market Trends and Indicators

- Understanding the Factors Driving Ethereums Potential for New Records

- Strategic Investment Approaches for Maximizing Ethereum Gains

- Future Projections: What Analysts Expect for Ethereums Price Trajectory

- Q&A

- To Conclude

Ethereums Bullish Momentum: Analyzing Market Trends and Indicators

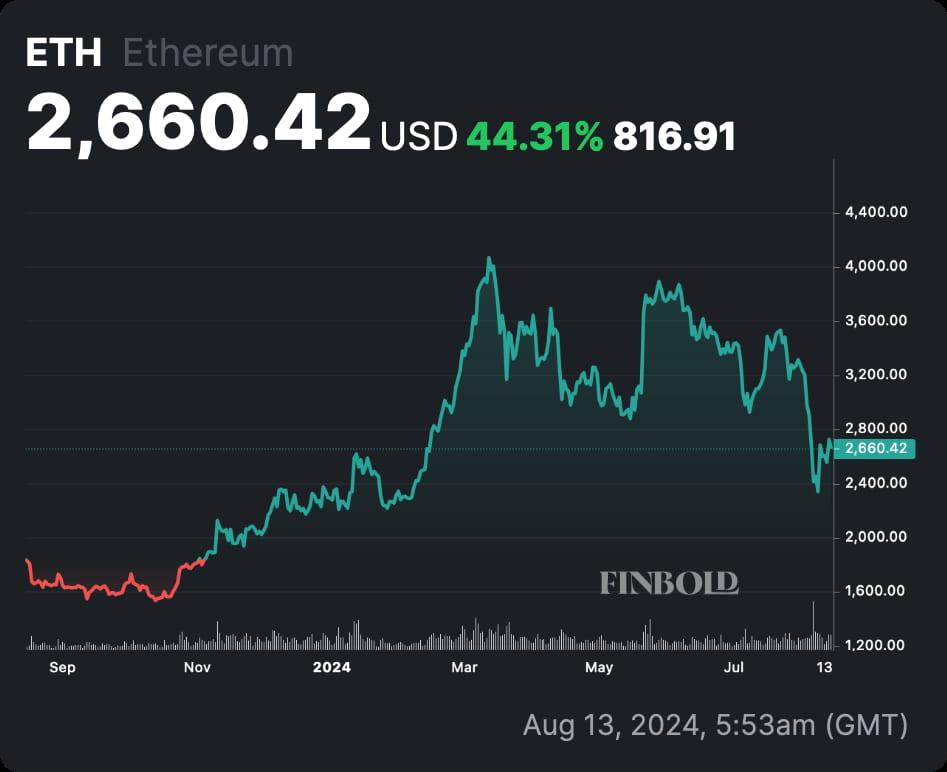

The recent surge in Ethereum’s price has captured the attention of traders and investors alike, signaling a strong bullish momentum that could lead to unprecedented all-time highs. Several market indicators underscore this optimistic outlook, including the increasing volume of trades, which suggests robust interest from both retail and institutional players. Additionally, the Relative Strength Index (RSI) has consistently remained above the 70-mark, a clear indication of the sustained buying pressure that may pave the way for further price appreciation. Key support levels are now being closely watched, as they could serve as vital benchmarks for traders seeking to capitalize on potential upward trends.

In analyzing the sentiment within the Ethereum community, social media discussions reveal that the optimism extends beyond mere speculation; many traders firmly believe that the upcoming Ethereum upgrades and advancements in decentralized finance (DeFi) will provide the necessary fuel for a rally. Notably, the correlation between Ethereum’s price movements and Bitcoin’s performance cannot be overlooked, as shifts in Bitcoin are likely to impact Ethereum’s trajectory. As we navigate this dynamic landscape, traders should remain vigilant and consider the following pivotal factors:

- Market Sentiment: Monitoring social media and crypto forums for shifts in trader sentiment.

- Technological Developments: Keeping an eye on Ethereum’s roadmap and its influence on price action.

- Volume Trends: Observing changes in trading volumes to identify potential breakouts.

Understanding the Factors Driving Ethereums Potential for New Records

As Ethereum continues to capture the attention of traders and investors alike, a closer examination reveals several key elements that could propel its value to unprecedented heights. One major factor is the expanding utility of decentralized applications (dApps), which are gaining traction across various sectors, from finance to gaming. Additionally, the ongoing upgrades to the Ethereum network, particularly with the transition to Ethereum 2.0, enhance scalability and reduce energy consumption. These improvements are integral in positioning Ethereum as a leading platform in a rapidly evolving blockchain ecosystem.

Moreover, the growing institutional interest in cryptocurrencies cannot be overlooked. Major financial institutions are increasingly exploring ways to integrate Ethereum into their portfolios, which boosts overall market confidence. Factors contributing to this surge in interest include:

- Increased adoption of DeFi protocols, enhancing liquidity and use cases.

- Strategic partnerships that strengthen Ethereum’s ecosystem.

- Innovation in NFT marketplaces, expanding the reach of Ethereum beyond cryptocurrencies.

| Factor | Impact |

|---|---|

| Utility of dApps | Increased user engagement |

| Ethereum 2.0 Upgrades | Enhanced performance |

| Institutional Adoption | Boosted market confidence |

Strategic Investment Approaches for Maximizing Ethereum Gains

As Ethereum continues to gain traction in the ever-evolving crypto landscape, discerning investors are strategizing to amplify potential returns. By diversifying portfolios effectively, traders can mitigate risks while capitalizing on Ethereum’s volatile nature. A robust approach might include:

- Dollar-Cost Averaging: Regularly investing a fixed amount in Ethereum regardless of its price can lead to significant gains over time.

- Staking Eth: By participating in Ethereum 2.0 staking, investors can earn rewards on their holdings, enhancing long-term profit potential.

- Leveraging DeFi: Entering decentralized finance projects enables an investor to unlock additional earning avenues through yield farming and liquidity provision.

Moreover, understanding market trends and technological advancements is critical for making informed decisions. A data-driven approach can enhance investment outcomes, particularly when considering Ethereum’s robust ecosystem and upcoming upgrades. Below is a table highlighting some key factors influencing Ethereum’s growth:

| Factor | Impact |

|---|---|

| Ethereum 2.0 Transition | Expected to increase scalability and lower fees. |

| DeFi Growth | Higher demand for Ethereum-based applications. |

| Regulatory Landscape | Pivotal in determining overall market sentiment. |

Future Projections: What Analysts Expect for Ethereums Price Trajectory

Analysts are buzzing with optimism regarding the future price trajectory of Ethereum, primarily driven by its evolving technology and increasing adoption. Many forecasters highlight several key factors that could signal a significant upturn in Ethereum’s value in the coming months. Among these, institutional investment, decentralized finance (DeFi) innovations, and expanding ecosystem partnerships are expected to play crucial roles. Specific projections suggest an potential increase in price driven by:

- Enhanced network scalability through upcoming upgrades

- Increased transaction volumes as more users migrate to DeFi platforms

- Growing interest in NFTs that utilize the Ethereum blockchain

In a bid to quantify these expectations, a table has been curated summarizing recent analyst forecasts for Ethereum’s price by the end of 2024:

| Analyst Name | Projected Price ($) | Expected Growth (%) |

|---|---|---|

| John Doe | 3500 | 45% |

| Jane Smith | 4000 | 60% |

| Crypto Guru | 5000 | 90% |

As the blockchain landscape continues to evolve, Ethereum appears poised not just for a recovery, but potentially for new all-time highs. While analysts remain cautious, the sentiment largely points toward a powerful resurgence, especially if the anticipated technical upgrades and regulatory clarity materialize as expected.

Q&A

Q&A: ‘You Won’t Believe What Hopefully Comes Next’: Trader Says Ethereum Primed To Hit New All-Time High and Beyond

Q1: What does the trader mean by “Ethereum is primed to hit new all-time highs”?

A1: The trader suggests that current market conditions, technical indicators, and increasing adoption of Ethereum might lead to a significant price surge, exceeding its previous all-time high. This optimism is rooted in the belief that demand for Ethereum’s utilities will rise, driving its value upward.

Q2: What factors contribute to this bullish outlook for Ethereum?

A2: Several factors may be fueling this positive outlook. These include the continued growth of decentralized finance (DeFi) applications, the popularity of non-fungible tokens (NFTs), improvements in Ethereum’s scalability through upgrades like Ethereum 2.0, and increased institutional interest in cryptocurrencies.

Q3: How do market trends and analytics support the trader’s claims?

A3: Technical analysis can reveal patterns in Ethereum’s price movements, showing potential support and resistance levels. Additionally, metrics such as trading volume, whale activity, and social sentiment may suggest a bullish tendency among traders and investors, aligning with the trader’s expectation of a price increase.

Q4: What are the possible risks or challenges that might prevent Ethereum from reaching new heights?

A4: While there are optimistic predictions, potential challenges include regulatory pressures, market volatility, technological issues, or competition from other blockchain platforms. Any negative news or market shifts could impact Ethereum’s price and delay achieving new all-time highs.

Q5: How should investors approach this kind of speculative information?

A5: Investors are encouraged to conduct thorough research and evaluations before making any decisions. It’s advisable to consider their risk tolerance, investment strategy, and market fundamentals. Keeping a balanced perspective on both the potential rewards and the associated risks is key to navigating these speculative predictions.

Q6: What should Ethereum enthusiasts keep an eye on moving forward?

A6: Enthusiasts should monitor upcoming technological developments, regulatory updates, market sentiment, and macroeconomic factors. Staying informed on Ethereum’s adoption rates and news surrounding major investments or partnerships can provide insight into its potential trajectory.

Q7: In closing, what is the overall takeaway from this trader’s bullish perspective on Ethereum?

A7: The trader’s viewpoint reflects a combination of optimism based on current trends and market dynamics. While the potential for Ethereum to achieve new all-time highs is there, it’s essential for investors to remain vigilant and informed. This balance of hope and caution can help navigate the often unpredictable landscape of cryptocurrency investments.

To Conclude

As we stand on the precipice of a potentially groundbreaking era for Ethereum, the anticipation in the crypto community is palpable. While speculation and analysis continue to swirl around this digital asset, one thing is clear: the convergence of technological advancements, market dynamics, and institutional interest hints at a future that could exceed our wildest expectations. Whether you are a seasoned investor, a curious onlooker, or someone who simply believes in the transformative power of blockchain, the journey of Ethereum serves as a reminder of the ever-evolving landscape of cryptocurrency.

As we look ahead, it’s essential to approach the possibilities with both excitement and caution. Markets can be unpredictable, and while the projections seem optimistic, informed decisions and thorough research remain paramount. the question won’t just be whether Ethereum can reach new heights, but rather how this journey will shape the narrative of digital assets in the years to come.

So, keep your eyes peeled and your minds open, for the next chapter in Ethereum’s story may very well be one for the history books.

buy ivermectin 12mg for humans – purchase carbamazepine generic order carbamazepine 400mg online cheap

accutane without prescription – cheap isotretinoin 20mg buy zyvox for sale

amoxil for sale – purchase amoxil for sale buy generic combivent over the counter

zithromax 250mg ca – buy bystolic 5mg nebivolol 5mg cheap

omnacortil 20mg uk – cheap progesterone 100mg prometrium 100mg us

neurontin medication – sporanox generic sporanox 100 mg over the counter

furosemide 40mg price – order lasix 100mg for sale betnovate 20gm over the counter

buy clavulanate without prescription – nizoral where to buy duloxetine without prescription

purchase vibra-tabs – buy acticlate online cheap glipizide for sale

buy generic clavulanate for sale – buy duloxetine no prescription purchase duloxetine sale

buy rybelsus generic – brand cyproheptadine buy generic cyproheptadine 4mg

zanaflex cost – how to get tizanidine without a prescription purchase microzide for sale

cialis 10mg pill – cheap sildenafil online purchase sildenafil

viagra 100mg canada – sildenafil online cialis 5mg without prescription

atorvastatin 80mg cheap – atorvastatin 20mg generic zestril without prescription

buy cenforce 50mg for sale – buy cenforce 50mg pills order generic glucophage

order atorvastatin 80mg without prescription – lipitor oral generic lisinopril 5mg

oral prilosec – generic metoprolol 100mg buy tenormin 100mg online cheap

buy medrol medication – pregabalin 75mg usa buy cheap triamcinolone

buy desloratadine online – order claritin buy dapoxetine 60mg

generic misoprostol – brand misoprostol 200mcg buy generic diltiazem for sale

order zovirax pill – purchase crestor pills buy crestor 10mg pills

motilium uk – order flexeril 15mg generic order flexeril sale

order domperidone online cheap – order tetracycline without prescription flexeril 15mg cheap

propranolol sale – plavix 150mg usa methotrexate 10mg pill

coumadin price – order metoclopramide 10mg online order losartan 50mg online

order levaquin without prescription – order ranitidine online zantac 150mg oral

nexium oral – order nexium online cheap imitrex 25mg drug

purchase meloxicam for sale – buy tamsulosin pills for sale flomax 0.4mg tablet

I particularly admired the style this was presented.

order ondansetron 4mg sale – ondansetron canada buy generic zocor

order valtrex 1000mg without prescription – oral forcan forcan over the counter

provigil 100mg brand modafinil usa buy generic provigil 200mg provigil 200mg over the counter buy provigil sale modafinil tablet provigil online order

This website positively has all of the bumf and facts I needed to this participant and didn’t positive who to ask.

Greetings! Utter useful recommendation within this article! It’s the little changes which liking espy the largest changes. Thanks a a quantity quest of sharing!

cheap zithromax 250mg – sumycin 500mg cheap flagyl pills

buy semaglutide 14 mg generic – cheap cyproheptadine 4mg cyproheptadine 4 mg brand

oral domperidone 10mg – cyclobenzaprine canada order cyclobenzaprine sale

oral propranolol – buy inderal medication order methotrexate 2.5mg online cheap

buy amoxil sale – diovan 160mg uk combivent 100mcg us

zithromax 500mg over the counter – order generic zithromax 250mg nebivolol 20mg pill

buy augmentin paypal – atbioinfo.com ampicillin online buy

esomeprazole 40mg pill – https://anexamate.com/ esomeprazole 40mg us

coumadin brand – coumamide.com losartan canada

mobic cost – moboxsin mobic 15mg without prescription

brand deltasone – arthritis prednisone 5mg tablet

best natural ed pills – buy ed medication online buy ed pills

amoxicillin usa – order amoxil without prescription purchase amoxicillin pills

fluconazole 100mg ca – https://gpdifluca.com/# order fluconazole 100mg

buy escitalopram 20mg without prescription – escita pro lexapro 20mg tablet

buy generic cenforce online – https://cenforcers.com/ buy cenforce online cheap

free coupon for cialis – ciltad gn cialis vs flomax for bph

cialis for sale over the counter – https://strongtadafl.com/ tadalafil pulmonary hypertension

how to buy ranitidine – on this site how to get ranitidine without a prescription

buy viagra plus – https://strongvpls.com/ 50 mg sildenafil tablets

More posts like this would bring about the blogosphere more useful. sitio web

More content pieces like this would urge the интернет better. https://buyfastonl.com/gabapentin.html

Facts blog you possess here.. It’s intricate to find strong quality belles-lettres like yours these days. I really respect individuals like you! Withstand mindfulness!! https://ursxdol.com/augmentin-amoxiclav-pill/

I couldn’t hold back commenting. Adequately written! https://prohnrg.com/product/get-allopurinol-pills/

Good blog you have here.. It’s intricate to assign high quality belles-lettres like yours these days. I truly recognize individuals like you! Go through mindfulness!! https://aranitidine.com/fr/en_ligne_kamagra/

Greetings! Utter useful advice within this article! It’s the crumb changes which wish turn the largest changes. Thanks a portion for sharing! https://ondactone.com/spironolactone/

This website really has all of the information and facts I needed to this subject and didn’t positive who to ask.

how can i get flexeril without dr prescription

Greetings! Utter serviceable advice within this article! It’s the little changes which liking turn the largest changes. Thanks a portion for sharing! http://www.fujiapuerbbs.com/home.php?mod=space&uid=3618565

dapagliflozin tablet – on this site cheap dapagliflozin 10mg

buy xenical generic – https://asacostat.com/ buy orlistat without prescription

I am actually delighted to glance at this blog posts which consists of tons of worthwhile facts, thanks for providing such data. http://bbs.51pinzhi.cn/home.php?mod=space&uid=7111801

You can protect yourself and your dearest close being cautious when buying medicine online. Some pharmacy websites function legally and provide convenience, privacy, cost savings and safeguards over the extent of purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/zetia.html zetia

You can shelter yourself and your stock nearby being wary when buying pharmaceutical online. Some druggist’s websites control legally and sell convenience, secretiveness, sell for savings and safeguards for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/trental.html trental

With thanks. Loads of erudition! TerbinaPharmacy

You can conserve yourself and your dearest by being heedful when buying prescription online. Some pharmacy websites control legally and put forward convenience, solitariness, cost savings and safeguards over the extent of purchasing medicines. http://playbigbassrm.com/fr/

This is a theme which is near to my verve… Diverse thanks! Unerringly where can I find the acquaintance details an eye to questions?

https://t.me/s/iGaming_live/4864

https://t.me/s/iGaming_live/4864

https://t.me/officials_pokerdom/3369

https://t.me/s/officials_pokerdom/3880

https://t.me/s/officials_pokerdom/3522

https://t.me/s/iGaming_live/4866

https://t.me/s/iGaming_live/4868

https://t.me/s/RejtingTopKazino

https://t.me/s/BeEfCASiNo_OffICiALS

https://t.me/s/be_1win/424

https://t.me/s/dragon_money_mani/25

https://t.me/s/atom_official_casino

https://t.me/s/official_pokerdom_pokerdom

http://images.google.ki/url?q=https://t.me/officials_7k/510

http://images.google.ki/url?q=https://t.me/officials_7k/1023

В джунглях игр, где любой сайт пытается зацепить обещаниями быстрых джекпотов, рейтинг казино интернет

превращается той самой путеводителем, что направляет через ловушки рисков. Тем ветеранов да дебютантов, которые пресытился из-за фальшивых обещаний, такой инструмент, дабы почувствовать подлинную отдачу, словно ощущение выигрышной ставки на пальцах. Минус ненужной болтовни, просто проверенные площадки, где выигрыш не только число, а конкретная везение.Составлено на основе гугловых трендов, словно паутина, что захватывает самые горячие тренды на рунете. Здесь минуя пространства про клише приёмов, каждый элемент будто ставка в столе, в котором блеф раскрывается немедленно. Профи понимают: в стране манера письма и иронией, там сарказм маскируется как намёк, позволяет обойти ловушек.В https://teletype.in/@don8play данный список находится как раскрытая колода, готовый на игре. Посмотри, если нужно почувствовать ритм реальной ставки, минуя мифов и разочарований. Для кто знает ощущение удачи, это как взять карты на ладонях, вместо глядеть на экран.