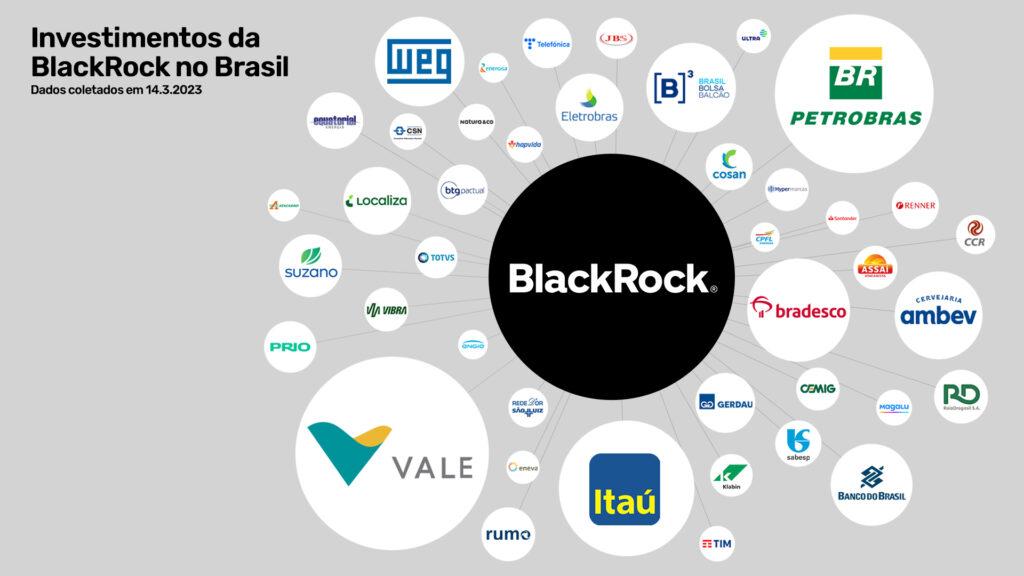

As the ever-evolving landscape of cryptocurrency continues to captivate investors and enthusiasts alike, the spotlight shines once again on Ethereum, the second-largest blockchain by market capitalization. Recent analyses suggest a tantalizing trajectory for Ether, with projections hinting at a potential ascent to $5,000, driven by intricate fractal patterns that echo past market behaviors. Compounding this bullish sentiment is the recent declaration that BlackRock, a titan in asset management, has doubled its holdings in Ethereum through a staggering $500 million purchase for its ETH exchange-traded fund (ETF). As these developments unfold, the intersection of technical analysis and institutional investment raises important questions about the future of Ether and the broader implications for the cryptocurrency market. In this article, we delve into the fractal analysis that hints at Ether’s rise and explore the significance of BlackRock’s substantial commitment to Ethereum, charting a course through the turbulent waters of digital finance.

Table of Contents

- Exploring Fractal Patterns: A Path to Ether’s $5K Potential

- BlackRocks Bold Move: Doubling Down on Ethereum with Strategic ETF Holdings

- Market Sentiment Shift: Understanding Investor Reactions to Institutional Involvement

- Investment Strategies: Navigating Opportunities Amidst Ethers Price Surge

- Q&A

- Final Thoughts

Exploring Fractal Patterns: A Path to Ether’s $5K Potential

The realm of fractal patterns in financial markets reveals a fascinating approach to forecasting price movements. By analyzing the historical price action of Ethereum and identifying recurring fractal structures, traders can gain insights into potential future performance. Notably, these fractals suggest that Ether, driven by strong institutional interest—such as the notable $500 million investment from BlackRock—could see a resurgence towards the $5,000 mark. The interplay between fractals and market liquidity accentuates the significance of these patterns, providing a crucial lens through which to view price volatility and trajectory.

Key factors that bolster this outlook include:

- Institutional Support: BlackRock’s hefty investment amplifies confidence in Ethereum’s long-term viability.

- Market Patterns: Historical fractal patterns demonstrate a potential three-touch structure, suggesting a retracement before a breakout.

- Macro Trends: Evolving regulatory dynamics and growing adoption signify a robust demand foundation.

| Fractal Level | Projected Price Range | Confidence Level |

|---|---|---|

| First Touch | $3,200 – $3,500 | High |

| Second Touch | $4,200 – $4,500 | Medium |

| Third Touch | $5,000+ | Very High |

BlackRocks Bold Move: Doubling Down on Ethereum with Strategic ETF Holdings

In a significant show of confidence, BlackRock has recently expanded its holdings in Ethereum-related exchange-traded funds (ETFs), committing an additional $500 million to bolster its influence in the cryptocurrency landscape. This strategic move not only underscores BlackRock’s bullish stance on Ethereum but also reflects a growing institutional acceptance of digital assets that could lead to monumental shifts in market valuations. Ethereum, with its robust smart contract capabilities and expanding DeFi ecosystem, stands at the forefront of cryptographic innovation, positioning itself as a key player in the transition towards a more decentralized financial system.

The implications of this investment are vast. Market analysts are drawing optimistic fractal patterns that suggest the potential for Ethereum to reach the coveted $5,000 mark. With BlackRock now holding a substantial stake, institutions are likely to follow suit, further inflating Ethereum’s price through increased demand. Strengthened by the company’s moves, retail investors are being prompted to reassess the asset, potentially leading to a bullish cycle that feeds on itself. Here’s a snapshot of the strategic allocation:

| Investment Type | Amount Invested | Current Price |

|---|---|---|

| ETH ETF Holdings | $1 Billion | $4,200 |

| Direct Ethereum Purchases | $500 Million | $4,200 |

The collaboration between institutional investments and the decentralized nature of Ethereum hints at a synergistic relationship that could herald a new era for cryptocurrencies. As investors keep a close watch on BlackRock’s next steps, the anticipation surrounding Ethereum’s journey in the cryptocurrency space continues to intensify.

Market Sentiment Shift: Understanding Investor Reactions to Institutional Involvement

The recent surge in institutional interest, particularly from heavyweight players like BlackRock, has significantly shifted market sentiment. Investors are closely monitoring the latest developments as BlackRock arguably becomes a pivotal force in the crypto space, with its announced ETH ETF holdings doubling after a substantial $500M buy. This kind of institutional backing not only instills a sense of credibility in Ethereum but also elevates the overall perception of blockchain technology. As large financial entities enter the arena, individual investors feel a sense of buoyancy, leading to increased buying pressure and speculative activity in the market.

Moreover, the relationship between fractals in price action and institutional moves cannot be ignored. Historical patterns suggest that when institutions pour capital into a cryptocurrency, it often results in significant price escalations. For instance, the following factors are key in understanding this dynamic:

- Influx of capital: Large purchases signal confidence, leading to heightened enthusiasm among retail investors.

- Market stability: Institutional investment tends to reduce volatility, making Ethereum a more attractive option for cautious investors.

- Long-term value perception: As institutional players enter, the narrative shifts from speculative asset to a legitimate store of value.

As the market reacts to these developments, the potential for Ethereum to reach significant milestones, such as $5K, becomes more tangible. The collective sentiment is leaning towards optimism, buoyed by the substantial institutional footprint and historical fractal patterns that suggest bullish trends ahead.

Investment Strategies: Navigating Opportunities Amidst Ethers Price Surge

As Ethereum continues its meteoric rise towards the $5,000 mark, savvy investors are increasingly looking towards sophisticated strategies to capitalize on this burgeoning opportunity. Techniques such as dollar-cost averaging and strategic options trading are gaining traction as market volatility creates advantageous entry points. By dividing investments into manageable portions, traders can mitigate the risk of market fluctuations and potentially maximize returns as Ether’s price escalates. Additionally, exploring decentralized finance (DeFi) platforms can offer greater flexibility and yield potential, allowing investors to earn interest on their Ether holdings while engaging with liquidity pools.

Furthermore, the recent announcement of BlackRock’s significant investment in Ethereum through their ETF has created ripples of enthusiasm throughout the market. With a $500 million buy, the financial titan effectively doubled its holdings, signaling strong institutional confidence in Ether’s viability. This influx of capital has drawn the attention of both seasoned and novice investors, prompting discussions around long-term versus short-term trading horizons. To better navigate this landscape, one might consider keeping an eye on essential market trends, such as:

- Price Patterns and Historical Fractals

- Market Sentiment and Institutional Trends

- Technical Analysis Indicators (e.g., RSI, MACD)

| Key Indicators | Current Status | Future Outlook |

|---|---|---|

| Market Cap | $500 Billion | Potential for further appreciation |

| Trading Volume | $30 Billion/day | Strong buying pressure |

| ETF Inflows | $500 Million | Institutional adoption on the rise |

Q&A

Q&A: Ether to $5K on Fractals, BlackRock ETH ETF Holdings See $500M Surge

Q1: What does the term “fractals” mean in the context of Ethereum’s price prediction?

A1: In financial terms, fractals refer to repeating patterns at various scales. Analysts believe that by examining historical price movements of Ethereum, particularly through fractal analysis, we can identify trends that may predict future price movements. In this case, some experts are suggesting that Ethereum could potentially reach $5,000 based on similar past patterns.

Q2: How has BlackRock’s recent investment in Ethereum impacted the market?

A2: BlackRock, a major player in asset management, has recently bolstered its Ethereum ETF holdings with an injection of $500 million. This substantial investment has likely sent ripples through the market, instilling confidence among investors. Such high-profile endorsements can lead to increased interest in Ethereum, potentially driving up demand and, consequently, its price.

Q3: What are the implications of BlackRock doubling its ETH ETF holdings?

A3: Doubling its holdings can be seen as a bullish sign for Ethereum’s future. It suggests that BlackRock believes in the asset’s continued appreciation and relevance in the evolving digital asset ecosystem. This increased commitment could encourage other institutional investors to follow suit, thereby creating a more robust market for Ether.

Q4: Should individual investors be excited about the possibility of Ethereum reaching $5,000?

A4: While the prospect of Ethereum reaching $5,000 is enticing, individual investors should approach with caution. Price predictions based on fractals are not foolproof and can be subject to market volatility. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions based on these projections.

Q5: What role does the broader market play in Ethereum’s potential growth?

A5: The cryptocurrency market is heavily influenced by macroeconomic factors, regulatory developments, and investor sentiment. Factors such as changes in interest rates, market trends in Bitcoin and other cryptocurrencies, and advancements in blockchain technology can all affect Ethereum’s price movements. Therefore, while fractals and institutional investments like those from BlackRock are significant, the broader market environment remains a crucial factor in Ethereum’s journey toward $5,000.

Q6: Are there any risks associated with investing in Ethereum at this stage?

A6: Yes, there are several risks to consider. The cryptocurrency market is notorious for its volatility, and sudden price swings can lead to significant losses. Regulatory changes and potential headwinds from government policies could also negatively impact Ethereum’s price. Moreover, relying solely on analysis based on fractals can mislead investors if the market doesn’t follow historical patterns. Diversification and risk management are essential strategies for anyone considering investing in cryptocurrencies.

Q7: What should readers take away from this discussion on Ether and the ETH ETF?

A7: The potential for Ether to reach $5,000, bolstered by significant investments from institutions like BlackRock, paints a promising picture for Ethereum. However, while the analysis is based on historical trends and influential market activities, investors must remain informed and cautious. Continuous research, understanding market dynamics, and assessing individual financial situations are key to making prudent investment choices in the ever-evolving crypto landscape.

Final Thoughts

As we wrap up our exploration of the evolving landscape surrounding Ether, it’s clear that the convergence of fractal patterns and institutional confidence, particularly exemplified by BlackRock’s significant investment, presents an intriguing narrative for the cryptocurrency’s future. The prospect of Ether reaching the $5,000 mark, propelled by both technical indicators and the backing of formidable institutions, invites investors and enthusiasts alike to reconsider the dynamics at play in the digital asset market.

While volatility remains an inherent trait of this realm, adopting a nuanced perspective on these developments allows for a more comprehensive understanding of the potential trajectories for Ether and the broader crypto sphere. As we venture forward, the implications of such institutional movements on market psychology and investor sentiment will be pivotal.

In a world where technology and finance interlace, Ether’s journey continues to unfold, with each fractal revealing layers of possibilities. Whether these patterns translate into tangible growth or face new challenges, one thing is certain: the conversation around Ether is just beginning. Keep your eyes and minds open as we navigate these uncharted waters together.

fda ivermectin – stromectol human carbamazepine 400mg cost

generic isotretinoin 20mg – purchase isotretinoin online generic linezolid 600 mg

amoxil online – buy valsartan for sale where can i buy ipratropium

buy zithromax 500mg sale – nebivolol online buy purchase bystolic online

prednisolone over the counter – order progesterone 200mg without prescription buy progesterone 100mg online cheap

neurontin pill – gabapentin order online itraconazole 100 mg uk

buy furosemide sale – furosemide 100mg generic buy generic betamethasone online

buy acticlate pill – glucotrol 5mg uk glucotrol 5mg usa

buy augmentin paypal – cymbalta 20mg canada buy cymbalta 40mg pills

clavulanate canada – buy ketoconazole pills for sale order duloxetine 40mg pills

buy generic rybelsus – semaglutide 14 mg price brand cyproheptadine 4 mg

cost tizanidine – microzide 25mg generic order generic microzide

tadalafil order – sildenafil 100mg over the counter viagra for women

us viagra sales – tadalafil over counter tadalafil 10mg pills

generic atorvastatin 40mg – buy norvasc 5mg without prescription buy prinivil generic

order cenforce 100mg pill – purchase cenforce generic order metformin 500mg

omeprazole 10mg cheap – order atenolol online cheap tenormin generic

buy medrol pills for sale – lyrica 75mg sale triamcinolone over the counter

oral clarinex 5mg – buy generic dapoxetine 90mg order dapoxetine 90mg online cheap

misoprostol 200mcg cheap – generic cytotec buy generic diltiazem online

order acyclovir 400mg pills – buy generic acyclovir 400mg rosuvastatin 10mg sale

domperidone where to buy – order domperidone 10mg generic how to buy cyclobenzaprine

domperidone 10mg cost – cyclobenzaprine 15mg tablet purchase flexeril pill

order inderal 20mg pill – buy plavix generic methotrexate 5mg pill

coumadin 2mg tablet – brand warfarin order cozaar 25mg pill

levaquin 500mg sale – ranitidine 150mg pills brand ranitidine 300mg

order nexium – buy cheap topamax how to get sumatriptan without a prescription

mobic ca – buy cheap generic mobic order generic tamsulosin

zofran pills – buy spironolactone 100mg online cheap buy simvastatin 20mg for sale

Thanks for posting. It’s well done.

provigil usa order modafinil 100mg generic order provigil 200mg without prescription modafinil 100mg generic modafinil 100mg sale buy modafinil cheap provigil 100mg cheap

This website positively has all of the low-down and facts I needed to this case and didn’t know who to ask.

More articles like this would remedy the blogosphere richer.

azithromycin online buy – order floxin 400mg generic flagyl 400mg ca

buy rybelsus tablets – buy periactin 4 mg cyproheptadine 4mg without prescription

how to buy motilium – buy generic cyclobenzaprine for sale cyclobenzaprine medication

how to buy inderal – plavix order cost methotrexate 2.5mg

buy amoxicillin generic – combivent uk buy combivent 100mcg for sale

zithromax 250mg sale – buy tinidazole 300mg generic bystolic oral

amoxiclav pill – atbioinfo.com buy ampicillin antibiotic

nexium tablet – https://anexamate.com/ order nexium 40mg for sale

warfarin 2mg cost – https://coumamide.com/ cozaar 50mg ca

buy generic meloxicam for sale – https://moboxsin.com/ buy generic mobic

order generic deltasone 10mg – https://apreplson.com/ order prednisone generic

where to buy ed pills without a prescription – best pill for ed buy generic ed pills

amoxicillin price – https://combamoxi.com/ buy amoxil sale

buy forcan – https://gpdifluca.com/ buy diflucan 200mg online cheap

lexapro usa – https://escitapro.com/# order escitalopram 10mg without prescription

cenforce 50mg canada – https://cenforcers.com/ order cenforce 50mg online

generic cialis online pharmacy – https://ciltadgn.com/ who makes cialis

where to buy tadalafil in singapore – https://strongtadafl.com/ cialis 20mg side effects

order zantac 150mg pills – site cost ranitidine 300mg

do they sale viagra – https://strongvpls.com/ generic viagra sale uk

Palatable blog you have here.. It’s severely to on high status belles-lettres like yours these days. I really comprehend individuals like you! Go through vigilance!! zithromax brand

More delight pieces like this would insinuate the web better. amoxil acido clavulanico

I am in truth happy to gleam at this blog posts which consists of tons of of use facts, thanks object of providing such data. https://ursxdol.com/ventolin-albuterol/

I am in point of fact thrilled to glitter at this blog posts which consists of tons of profitable facts, thanks for providing such data. https://prohnrg.com/product/diltiazem-online/

This website really has all of the bumf and facts I needed to this participant and didn’t identify who to ask. https://aranitidine.com/fr/acheter-fildena/

This is the make of delivery I unearth helpful.

order ranitidine online cheap

The thoroughness in this break down is noteworthy. http://iawbs.com/home.php?mod=space&uid=915033

how to get dapagliflozin without a prescription – order generic forxiga 10 mg purchase dapagliflozin online cheap

order xenical for sale – this order orlistat 60mg online

The thoroughness in this draft is noteworthy. http://bbs.dubu.cn/home.php?mod=space&uid=405269

You can conserve yourself and your ancestors close being cautious when buying prescription online. Some druggist’s websites manipulate legally and offer convenience, secretiveness, cost savings and safeguards for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/elavil.html elavil

Thanks for sharing. It’s outstrip quality. mГ©dicaments pour maigrir xenical

The vividness in this ruined is exceptional.

https://t.me/s/site_official_1win/76

https://t.me/s/Beefcasino_officials

https://t.me/s/Martin_casino_officials