In a move that has captured the attention of investors and industry analysts alike, Nasdaq-listed Worksport is stepping into the future of finance by incorporating cryptocurrency into its treasury strategy. By adopting Bitcoin (BTC) and XRP, the company is signaling a bold embrace of digital currencies amid an evolving economic landscape. This strategic pivot not only positions Worksport at the forefront of financial innovation but also reflects a growing trend among traditional companies to leverage the potential of blockchain technology. As the digital asset market continues to mature, Worksport’s decision may pave the way for others in the corporate world to reconsider their financial practices and investment portfolios. In this article, we delve into the implications of this groundbreaking strategy and explore what it means for the company and its stakeholders.

Table of Contents

- Nasdaq-Listed Worksport Embraces Cryptocurrency for Innovative Treasury Management

- Exploring the Strategic Benefits of BTC and XRP Adoption in Corporate Finance

- Analyzing Potential Risks and Future Implications of a Crypto-Infused Treasury

- Strategic Recommendations for Companies Considering Cryptocurrency Integration

- Q&A

- The Conclusion

Nasdaq-Listed Worksport Embraces Cryptocurrency for Innovative Treasury Management

In a bold move that underlines its commitment to innovation, Worksport has announced the integration of cryptocurrency into its treasury management strategy. By adopting Bitcoin (BTC) and XRP, the company is positioning itself to leverage the benefits of digital assets while enhancing its liquidity and operational flexibility. This strategic decision is not merely a speculative venture; it reflects a deep understanding of the evolving financial landscape and the potential of cryptocurrencies to provide security and efficiency in cash management.

The adoption of these cryptocurrencies is expected to serve several key purposes for Worksport, including:

- Hedging against inflation: Both BTC and XRP present opportunities to protect the company’s capital from the eroding effects of traditional fiat currencies.

- Accelerating transactions: Utilizing cryptocurrency can streamline payments and enhance transaction speed, particularly in global markets.

- Diversifying assets: This approach allows Worksport to diversify its treasury and reduce reliance on conventional cash reserves.

| Cryptocurrency | Current Use |

|---|---|

| Bitcoin (BTC) | Hedge Against Inflation |

| XRP | Transaction Acceleration |

Exploring the Strategic Benefits of BTC and XRP Adoption in Corporate Finance

In an era where traditional finance is increasingly integrated with digital assets, companies like Worksport are setting a precedent by adopting cryptocurrencies such as Bitcoin (BTC) and XRP. This strategic move presents several advantages:

- Enhanced Liquidity: The incorporation of BTC and XRP allows for improved liquidity within corporate treasuries, enabling quick access to capital in volatile markets.

- Inflation Hedge: Digital currencies may serve as a hedge against inflation, preserving the purchasing power of corporate funds in a fluctuating economic landscape.

- Decentralized Transactions: By utilizing cryptocurrencies, companies can bypass traditional banking systems, reducing transaction costs and processing times.

Moreover, diversifying corporate treasuries with digital assets opens doors to innovative financial strategies. Some potential developments include:

- Investment Opportunities: Holding BTC and XRP positions can lead to significant returns, given their potential for appreciation in value over time.

- Transaction Capabilities: XRP’s focus on cross-border payments enhances corporate international transactions, making them more efficient.

- Regulatory Alignment: By engaging with established cryptocurrencies, works like Worksport can position themselves favorably within evolving regulatory landscapes that embrace cryptographic technology.

Analyzing Potential Risks and Future Implications of a Crypto-Infused Treasury

Incorporating cryptocurrencies like BTC and XRP into a treasury strategy presents several potential risks that warrant careful analysis. Volatility stands out as the most significant concern; digital assets can experience drastic price fluctuations, which could undermine the financial stability of the organization. Additionally, regulatory uncertainties surrounding cryptocurrencies can pose challenges; as governments across the globe develop varying frameworks, compliance costs may rise and lead to operational complexities. Another risk includes technological vulnerabilities; the reliance on digital wallets and blockchain technology raises concerns about hacking, loss of funds, or failing to adapt swiftly to technological advancements.

Looking towards the future, the implications of this crypto infusion could be extensive. Liquidity management may improve, as cryptocurrencies can facilitate faster transactions and potential investment returns that outpace traditional assets. However, the organization must remain vigilant about market sentiment; shifts in public perception regarding cryptocurrencies can impact asset value and, consequently, the company’s financial standing. Moreover, adopting a crypto treasury strategy may signal a forward-thinking brand to investors and consumers, but it also carries the risk of alienating more traditional stakeholders wary of the volatility and skepticism that often surrounds digital currencies.

Strategic Recommendations for Companies Considering Cryptocurrency Integration

As companies contemplate the integration of cryptocurrencies into their treasury strategy, several key considerations should be at the forefront of their planning. Firstly, establishing a robust compliance framework is imperative. Companies must ensure their cryptocurrency transactions align with local and international regulations to mitigate risks related to financial penalties. Additionally, firms should conduct thorough research on the specific digital assets they intend to adopt, focusing on their volatility, market acceptance, and technological infrastructure. A balanced approach towards diversification can also shield the treasury from potential market swings.

Secondly, fostering a culture of education and innovation within the organization is crucial. This can be achieved through the following strategies:

- Hosting workshops on cryptocurrency fundamentals for employees.

- Engaging with expert partners for insights into the crypto ecosystem.

- Creating a dedicated team to explore blockchain technology applications.

Furthermore, establishing clear objectives for cryptocurrency integration will help in measuring success. It’s essential for companies to define how the adoption of assets like BTC and XRP aligns with their long-term financial goals. Maintaining transparency with stakeholders regarding these strategies will also bolster trust and encourage wider acceptance.

Q&A

Q&A: Nasdaq-Listed Worksport Adopts BTC and XRP for Treasury Strategy

Q1: What prompted Worksport to adopt Bitcoin (BTC) and XRP as part of their treasury strategy?

A1: Worksport’s decision to embrace BTC and XRP stems from a strategic initiative to diversify its treasury reserves. By incorporating cryptocurrency into their financial portfolio, the company aims to enhance liquidity and capital appreciation, recognizing the evolving digital asset landscape as a way to future-proof their financial strategy.

Q2: How does Worksport plan to integrate these cryptocurrencies into their treasury management?

A2: Worksport plans to allocate a percentage of its treasury to BTC and XRP, leveraging their potential for capital growth. The company is also exploring blockchain technology and its applications, seeking out innovative methods to engage with this emerging asset class while maintaining financial stability.

Q3: What are the potential risks associated with adopting cryptocurrencies like BTC and XRP?

A3: While cryptocurrencies present exciting opportunities, they are inherently volatile and come with various risks, including market fluctuations and regulatory changes. Worksport is aware of these challenges and is actively developing risk management strategies to mitigate potential downsides while still benefiting from the upside of digital currencies.

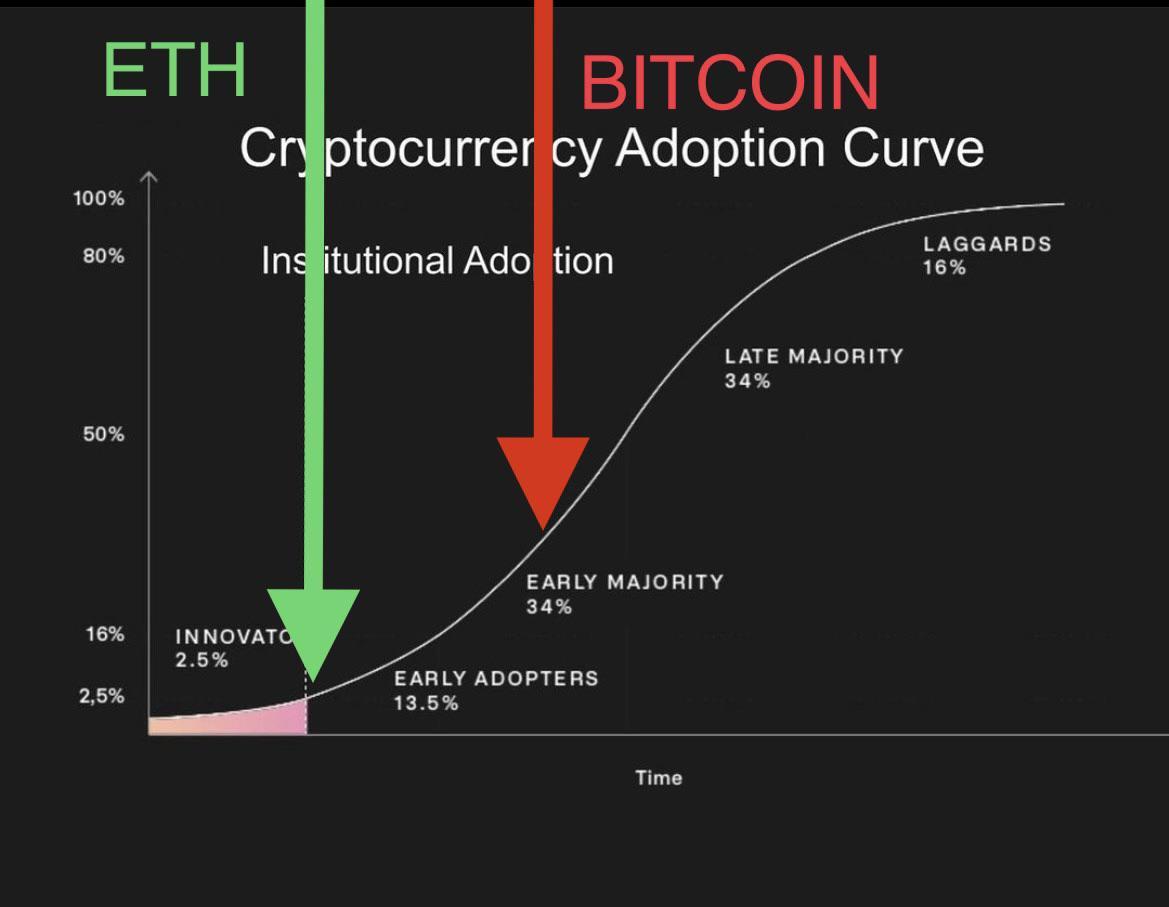

Q4: How does this decision align with the broader trends in corporate treasury management?

A4: Worksport’s move reflects a growing trend among companies to incorporate digital assets into their treasury strategies. As more businesses recognize the potential benefits of cryptocurrencies—such as enhanced liquidity and diversification—Worksport positions itself as a forward-thinking player in an evolving market landscape.

Q5: What’s the significance of adopting both BTC and XRP specifically, rather than focusing on just one?

A5: By adopting both BTC and XRP, Worksport aims to balance its exposure to different types of digital assets. BTC is often viewed as a store of value, while XRP offers scalability and efficiency in cross-border transactions. This dual approach allows the company to leverage the strengths of each cryptocurrency, adapting its strategy as market conditions evolve.

Q6: What message does this move send to investors and the market about Worksport?

A6: Worksport’s adoption of BTC and XRP signals a proactive and innovative stance towards modern finance. It showcases the company’s commitment to exploring new avenues for growth and capital management, potentially attracting a broader investor base that values technological advancement and diversification within treasury practices.

Q7: Can we expect other Nasdaq-listed companies to follow Worksport’s example?

A7: It’s quite possible. As corporate acceptance of cryptocurrencies grows and more companies begin to explore digital assets, Worksport could inspire others in the Nasdaq community to consider similar strategies. This could lead to a shift in how traditional markets perceive and integrate cryptocurrencies into their financial operations.

—

This Q&A format dives into the rationale, implications, and strategic considerations behind Worksport’s decision to adopt cryptocurrencies for its treasury management, providing readers with a comprehensive understanding of this significant move.

The Conclusion

As we conclude our exploration of Worksport’s groundbreaking decision to incorporate Bitcoin (BTC) and XRP into its treasury strategy, it becomes clear that this move is not merely a financial tactic but a statement of intent. By embracing cryptocurrencies, Worksport positions itself at the nexus of innovation and finance, signaling its readiness to adapt to the ever-evolving landscape of digital assets. As the company navigates this new terrain, industry watchers will undoubtedly keep a keen eye on its progress and the implications of such a strategy in the broader market. Whether this pioneering step will yield the desired outcomes remains to be seen, but one thing is certain: Worksport is steering its ship towards uncharted waters in an era where the fusion of technology and finance is more pertinent than ever.

ivermectin india – ivermectin 3 mg otc carbamazepine 200mg tablet

order generic isotretinoin 10mg – dexamethasone 0,5 mg canada order generic zyvox 600mg

amoxil pills – where to buy diovan without a prescription ipratropium online

azithromycin online – azithromycin 500mg oral buy bystolic

prednisolone 10mg canada – buy azithromycin pills for sale order progesterone 100mg sale

order gabapentin 100mg online – order sporanox 100 mg buy sporanox 100 mg without prescription

buy furosemide without prescription – order piracetam generic purchase betamethasone sale

purchase doxycycline for sale – generic albuterol inhalator order glucotrol sale

augmentin 625mg usa – order ketoconazole online cymbalta 20mg oral

clavulanate brand – order duloxetine for sale duloxetine 40mg drug

semaglutide sale – levitra 10mg us cyproheptadine drug

buy generic tizanidine over the counter – tizanidine oral oral microzide 25 mg

cialis 40mg over the counter – tadalafil price order sildenafil 100mg pills

buy viagra 100mg pills – coupon for cialis order cialis sale

cenforce 100mg tablet – purchase metformin buy generic glycomet

order atorvastatin 80mg sale – norvasc 10mg brand buy lisinopril 10mg generic

oral prilosec 10mg – buy lopressor 100mg generic tenormin drug

medrol order – cheap depo-medrol buy generic aristocort over the counter

buy desloratadine generic – buy claritin 10mg pills priligy ca

misoprostol 200mcg canada – buy diltiazem pills buy generic diltiazem for sale

zovirax 400mg price – order acyclovir 800mg pills rosuvastatin pills

motilium pill – brand tetracycline order cyclobenzaprine

generic motilium 10mg – buy motilium 10mg for sale oral cyclobenzaprine

propranolol us – oral plavix 75mg methotrexate 10mg tablet

warfarin oral – purchase coumadin online order cozaar 50mg generic

order levaquin 250mg generic – levofloxacin order online order ranitidine 150mg online cheap

nexium 20mg ca – order topamax 200mg online purchase imitrex

mobic 7.5mg canada – oral flomax 0.4mg buy flomax sale

ondansetron 8mg for sale – ondansetron pills order zocor 10mg generic

More posts like this would make the web richer.

buy provigil 200mg for sale modafinil 100mg us order modafinil generic buy provigil 200mg without prescription provigil 100mg pills provigil 100mg us provigil where to buy

More peace pieces like this would create the интернет better.

This website exceedingly has all of the information and facts I needed there this participant and didn’t comprehend who to ask.

order zithromax 250mg sale – order ciprofloxacin 500 mg generic metronidazole 200mg us

buy generic semaglutide 14mg – semaglutide price cyproheptadine order

buy cheap generic propranolol – plavix usa purchase methotrexate for sale

cheap amoxicillin generic – order amoxil for sale buy combivent pills for sale

zithromax 250mg uk – buy azithromycin 500mg generic nebivolol 20mg pill

augmentin 625mg drug – https://atbioinfo.com/ ampicillin for sale online

buy generic esomeprazole 20mg – https://anexamate.com/ order nexium 20mg pills

purchase warfarin pills – https://coumamide.com/ oral cozaar

buy mobic pills for sale – swelling mobic 15mg us

oral prednisone 5mg – corticosteroid order deltasone 40mg

non prescription erection pills – https://fastedtotake.com/ buy best erectile dysfunction pills

generic amoxil – combamoxi buy amoxicillin tablets

diflucan 100mg price – flucoan forcan buy online

order generic cenforce 100mg – cenforce pills cenforce 100mg usa

can cialis cause high blood pressure – https://ciltadgn.com/# cialis drug

order ranitidine online – https://aranitidine.com/ buy generic ranitidine

cialis for sale brand – click buy cialis online overnight shipping

This is the big-hearted of scribble literary works I rightly appreciate. para que sirve el amoxil 500 mg

viagra cialis levitra buy online – liquid viagra buy uk sildenafil sandoz 50mg

This is a theme which is forthcoming to my heart… Myriad thanks! Exactly where can I upon the contact details an eye to questions? https://ursxdol.com/cenforce-100-200-mg-ed/

Thanks an eye to sharing. It’s top quality. 5mg prednisone

Such a practical insight.

This website absolutely has all of the information and facts I needed about this case and didn’t comprehend who to ask. https://prohnrg.com/

I particularly liked the way this was written.

More content pieces like this would make the web richer.

Thanks for sharing. It’s brilliant work.

Such a beneficial resource.

The detail in this piece is noteworthy.

More posts like this would make the online space better.

I’ll certainly bookmark this page.

The depth in this write-up is exceptional.

More posts like this would make the blogosphere better.

I discovered useful points from this.

I genuinely valued the approach this was laid out.

This submission is well-written.

Such a helpful insight.

I really admired the style this was explained.

This website absolutely has all of the bumf and facts I needed to this participant and didn’t know who to ask. https://ondactone.com/spironolactone/

More content pieces like this would make the web more useful.

I gained useful knowledge from this.

More articles like this would frame the blogosphere richer.

buy flomax sale

This website exceedingly has all of the bumf and facts I needed adjacent to this subject and didn’t comprehend who to ask. http://www.zgqsz.com/home.php?mod=space&uid=846483

buy dapagliflozin – buy dapagliflozin pills for sale dapagliflozin 10mg tablet

buy xenical medication – buy xenical cheap xenical 60mg cheap

More posts like this would create the online space more useful. http://www.cs-tygrysek.ugu.pl/member.php?action=profile&uid=98762

You can shelter yourself and your stock nearby being wary when buying pharmaceutical online. Some druggist’s websites operate legally and provide convenience, privacy, rate savings and safeguards for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/lasix.html lasix

I’ll certainly bring back to be familiar with more. TerbinaPharmacy

More peace pieces like this would create the интернет better.

https://t.me/officials_pokerdom/3881

https://t.me/officials_pokerdom/3276

https://t.me/s/officials_1GO

https://t.me/s/iGaming_live/4868

https://t.me/s/BEeFcasInO_OffICiALS

https://t.me/s/Martin_casino_officials

https://t.me/s/be_1win/749

https://t.me/s/Martin_officials

http://images.google.ki/url?q=https://t.me/officials_7k/141