[ad_1]

Welcome to the the tenth publication of the Market’s Compass Weekly Crypto Candy Sixteen Research. The Research tracks the technical situation of sixteen of the bigger market cap cryptocurrencies. I’ve compiled the historic quantitative goal technical rating information and secondary technical indicators together with the Candy Sixteen Complete Technical Rankings and Weekly Common Technical Rating again to October of 2021. Each week the Research will spotlight the technical adjustments of the 16 cryptocurrencies that I monitor in addition to particular person highlights on noteworthy strikes in sure cryptocurrencies and Indexes.

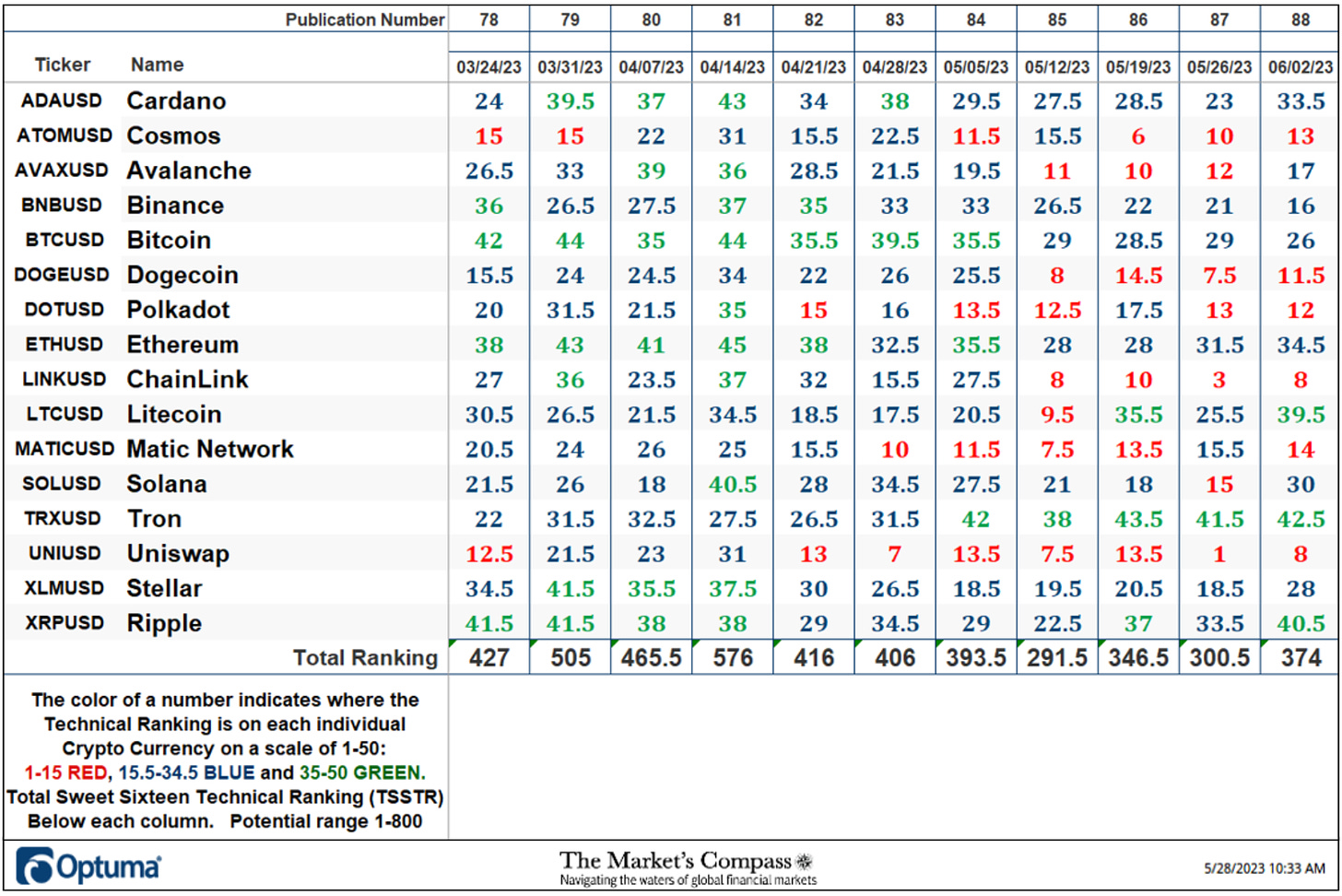

The Excel spreadsheet under signifies the weekly change within the goal Technical Rating (“TR”) of every particular person Cryptocurrency. The technical rating or scoring system is a completely quantitative strategy that makes use of a number of technical issues that embody however will not be restricted to development, momentum, measurements of accumulation/distribution and relative energy. If a person Cryptocurrency’s technical situation improves the Technical Rating (“TR”) rises, and conversely, if the technical situation continues to deteriorate, the TR falls. The TR of every particular person Cryptocurrency can vary from 0 to 50. The spreadsheet under additionally acts as a “warmth map” in that, cryptocurrencies with a TR within the vary of 1 to fifteen are highlighted in pink, 15.5 to 34.5 are famous in blue and TRs within the vary of 35 to 50 are in inexperienced. The first take-away from this unfold sheet must be the development of the person TRs, both the continued enchancment or deterioration, in addition to a change in path. A sustained development change must unfold within the particular person TRs for it to be actionable. Secondarily a really low rating can sign an oversold situation and conversely a continued very excessive quantity may be seen as an overbought situation however, as we all know, over bought situations can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply grow to be extra overbought. Thirdly, the weekly TRs are a precious relative energy/weak spot indicator vs. one another, as well as when the Complete Candy Sixteen Technical Rating (“SSTTR”), that has a variety of 0 to 800, is close to the underside of its vary and a person cryptocurrency has a TR that continues to be elevated it speaks to relative energy. Conversely if the SSTTR is close to the highest of its current vary and a person cryptocurrency has a TR that continues to be mired at low ranges it speaks to relative weak spot. Lastly I view the target Technical Rankings as a place to begin in my evaluation and it’s not the complete “finish sport”.

This Week’s and 10 Week Trailing Technical Rankings of the 16 Particular person Cryptocurrencies*

*Rankings are calculated as much as the week ending Friday June 2nd

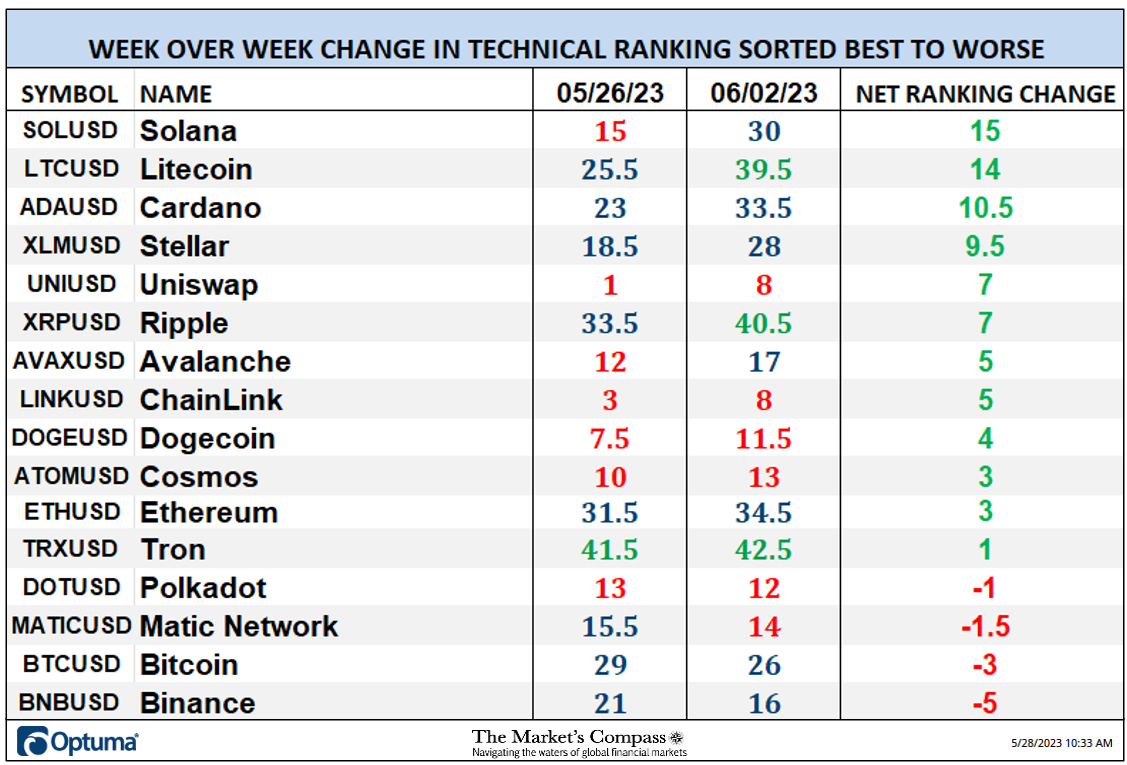

The Complete Candy Sixteen Technical Rating or TSSTR has risen 4 weeks in a row. The TSSTR rose 19.65% to 374 from 300.5. The rise in Solana’s (SOL) and Litecoin’s (LTC) particular person Technical Rankings accounted for practically 40% of the rise within the TSSTR. As might be seen under SOL and LTC TRs rose 15 and 14 respectively. Charts are as of final Friday and ideas on the technical situation of each are posted under the charts (the WoW adjustments in particular person TRs of the stability of the Candy Sixteen are posted under the charts that comply with).

Over the previous seven days, LTC has re-taken the bottom above the Cloud mannequin. It has additionally superior above the Median Line (gold dashed line) of the Schiff Pitchfork (gold P1 by way of P3) and in addition the Might seventeenth swing excessive after holding, on a closing foundation, above the Kijun Plot (strong inexperienced line) and the the underside of the Cloud mannequin. MACD kissed its sign in mid-Might and is monitoring greater once more confirming Fridays closing greater excessive in value. The Relative Comparability Index has marked a 3 month new excessive vs. the CCCi30 Index (backside panel). These technical options recommend that the rally has additional to run. I’ve raised assist to the Might twenty fifth swing low at 82.50.

Solana has been consolidating the good points because the Might twenty fourth value swing low on the 18.70 (gold P3) (this marks key assist). To this point costs have been capped at value resistance at 21.45. A continuation of the brief time period rally by way of that stage would place the following upside value goal on the Cloud mannequin and the 50% Inner Line (dashed gold line) of the Commonplace Pitchfork (gold P1 by way of P3). MACD has been monitoring greater because the P3 low and is about to enter optimistic territory.

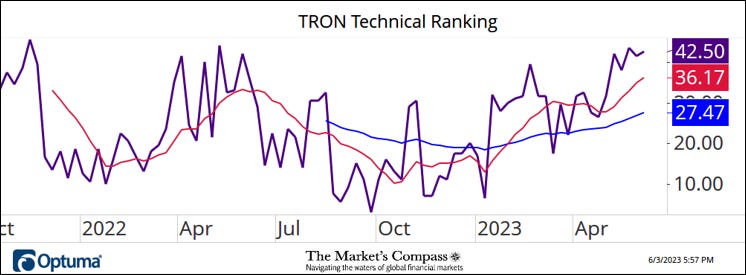

On a Wow foundation, twelve Cryptocurrencies registered enchancment of their goal TRs and 4 marked contractions. The typical TR achieve was +4.59. Three Cryptocurrencies ended the week within the “inexperienced zone” (TRs of between 35 and 50), seven had been within the “blue zone” (TRs between 15.5 and 34.5) and 6 ended the week within the “pink zone” (TRs between 1 and 15). The earlier week there was just one within the “inexperienced zone”, eight had been within the “blue zone” and 7 had been within the “pink zone”. All TRs ended the week between up +15 and down -5. For the fourth week in a row, Tron (TRX) was within the inexperienced zone and on the finish of final week it sported the very best Technical Rating at 42.5 (the TRX Weekly line chart of the TR is under with the 45 Week EMA (in blue) and the 9-week SMA (in pink).

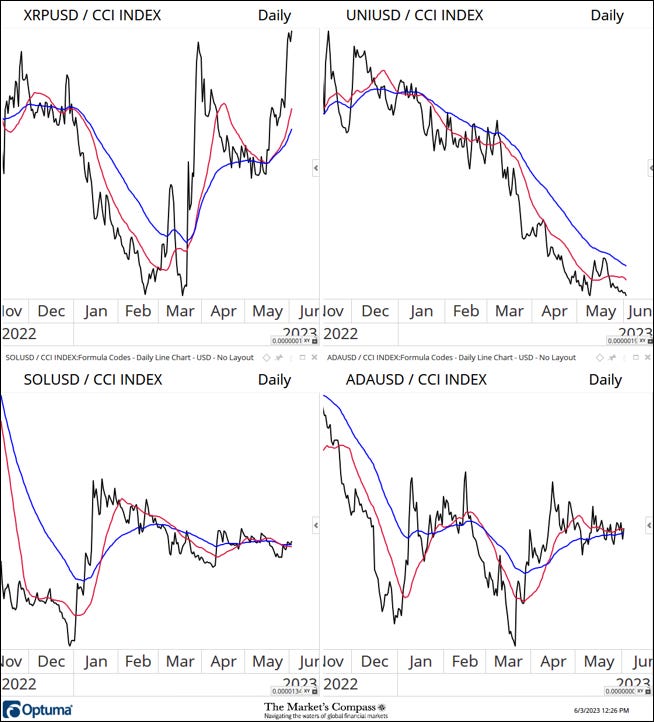

Measurements of Relative Energy and Weak point within the Candy Sixteen vs. The CCi30 Index*.

*The CCi30 Index is a registered trademark and was created and is maintained by an impartial staff of mathematicians, quants and fund managers lead by Igor Rivin. It’s is a rules-based index designed to objectively measure the general progress, each day and long-term motion of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding secure cash (extra particulars may be discovered at CCi30.com).

“What’s in Your Pockets?”

I hope its been Ethereum (ETH), Ripple (XRP) or Tron (TRX) and never Polkadot (DOT or Avalanche (AVAX).

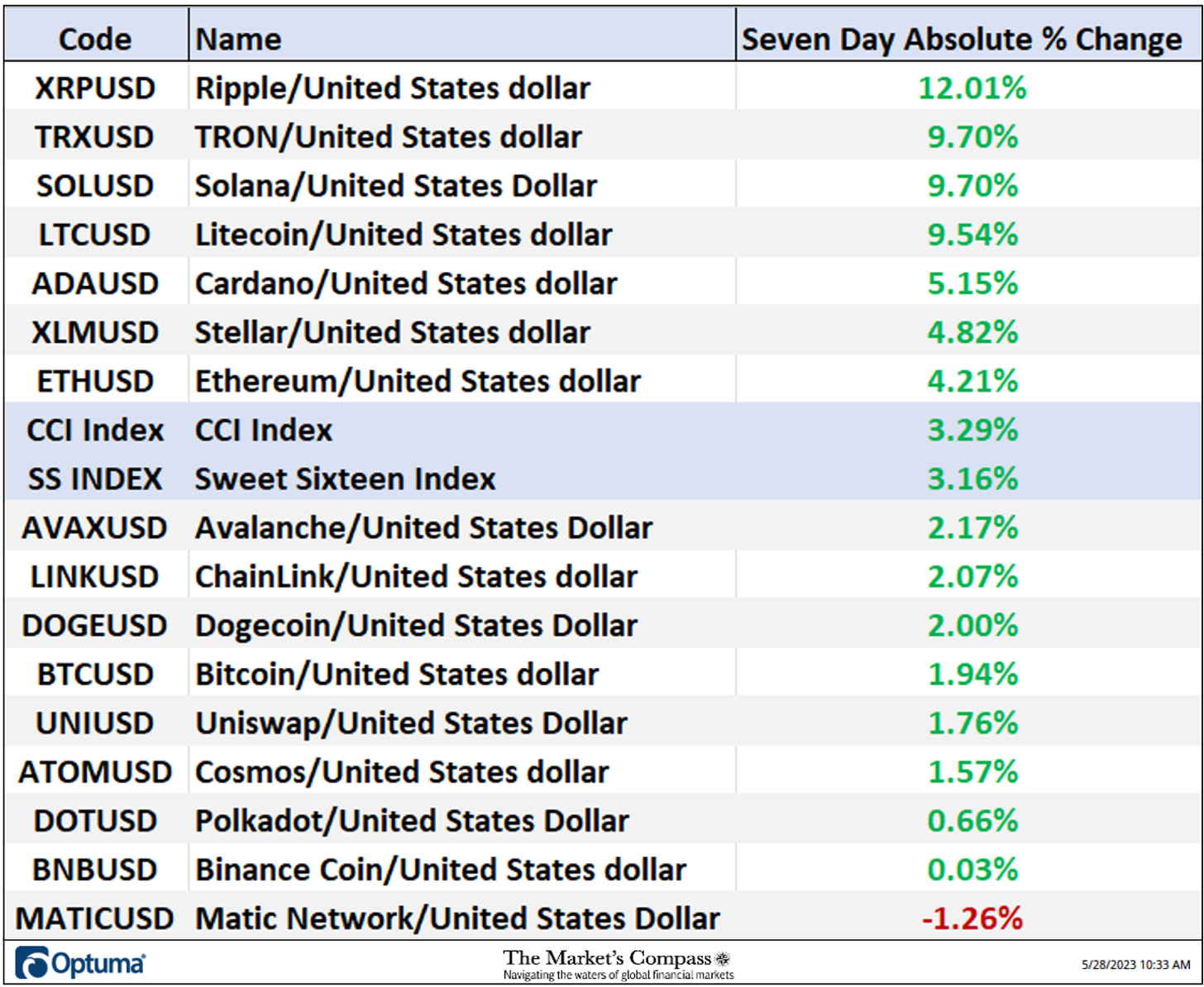

Seven Day Absolute % Value Change*

*Friday Might twenty sixth to Friday June 2nd

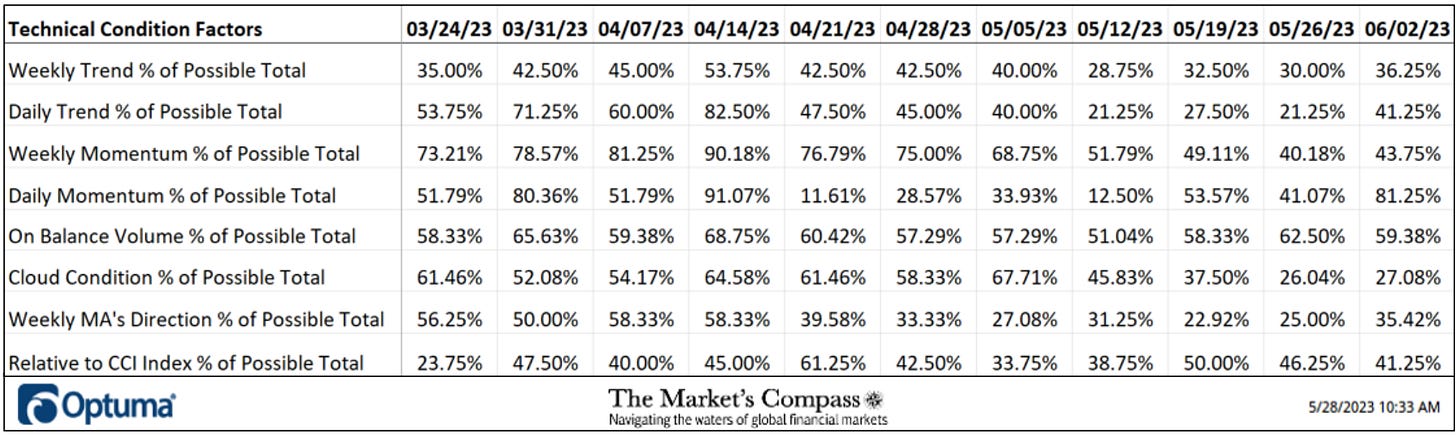

The Technical Situation Issue adjustments because the week ending Might nineteenth

There are eight Technical Situation Components (“TCFs”) that decide particular person TR scores (0-50). Every of those 8, ask goal technical questions (see the spreadsheet posted above). If a technical query is optimistic a further level is added to the person TR. Conversely if the technical query is detrimental, it receives a “0”. Just a few TCFs carry extra weight than the others such because the Weekly Pattern Issue and the Weekly Momentum Consider compiling every particular person TR of every of the 16 Cryptocurrencies. Due to that, the excel sheet above calculates every issue’s weekly studying as a p.c of the potential complete. For instance, there are 7 issues (or questions) within the Day by day Momentum Technical Situation Issue (“DMTCF”) of the 16 Cryptocurrencies ETFs (or 7 X 16) for a potential vary of 0-112 if all 16 had fulfilled the DMTCF standards the studying can be 112 or 100%.

Two weeks in the past, for the week ending Might twenty sixth, 46 of a potential complete of 112 optimistic factors or a 41.07% studying within the DMTCF was registered. That marked a under impartial studying . Final week the DMTCF rose sharply to 81.25%.

As a affirmation software, if all eight TCFs enhance on per week over week foundation, extra of the 16 Cryptocurrencies are enhancing internally on a technical foundation, confirming a broader market transfer greater (consider an advance/decline calculation). Conversely, if extra of the TCFs fall on per week over week foundation, extra of the “Cryptos” are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week six TCFs rose and two fell.

The CCi30 Index with This Week’s Candy Sixteen Complete Technical Rating “SSTTR” Overlaid

The Candy Sixteen Complete Technical Rating (“SSTTR”) Indicator is a complete of all 16 Cryptocurrency rankings and may be checked out as a affirmation/divergence indicator in addition to an overbought / oversold indicator. As a affirmation/divergence software: If the broader market as measured by the CCi30 Index continues to rally with no commensurate transfer or greater transfer within the SSTTR the continued rally within the CCi30 Index turns into more and more in jeopardy. Conversely, if the CCi30 Index continues to print decrease lows and there’s little change or a constructing enchancment within the SSTTR a optimistic divergence is registered. That is, in a vogue, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the SSTTR will get to the 800 stage (all 16 Cryptocurrencies having a TR of fifty) “issues can’t get significantly better technically” and a rising quantity particular person Crypto’s have grow to be “stretched” there’s extra of an opportunity of a pullback within the CCi30. On the flip aspect the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of Crypto’s are “washed out technically” and an oversold rally or measurable low is nearer to being in place. The 13-week transferring common in Pink smooths the unstable SSTTR readings and analytically is a greater indicator of development.

Final week the SSTTR rose to 374 (remaining in impartial territory) and the 13-Week Transferring Common (pink line) has begun to flatten out. On the finish of final week the CCi30 Index had continued to carry assist simply above the Decrease Parallel (strong gold line) of the Schiff Modified Pitchfork (gold P1 by way of P3). MACD has held above its sign line in impartial territory (neither overbought or oversold). A violation of the Decrease Parallel would put second value assist at P3 (6,580) into play.

The CCi30 Index Weekly Cloud Mannequin with the Common Candy Sixteen Technical Rating (ASSTR)*

*The Common Candy Sixteen Technical Rating is the common particular person TR of the sixteen cryptocurrencies we monitor on the finish of every week.

The CCi30 Index has held assist on the Kijun Plot (inexperienced line) since retaking the bottom above it in March. The Common Candy Sixteen Technical Rating has risen from the next low of 18.78, registered two weeks in the past, to 23.38. I proceed to imagine that the value motion on the Index stage is a part of a base constructing course of and barring a break of value assist on the March tenth value pivot low at 6,580 that the Index will problem value resistance at June/July 2022 highs on the 10,000 /11,000 stage within the weeks forward.

Charts are courtesy of Optuma whose charting software program allows anybody to visualise any information together with our Goal Technical Rankings. Cryptocurrency value information is courtesy of Cryptowatch.

To obtain a 30-day trial of Optuma charting software program go to…

A 3 half tutorial collection on Andrews Pitchfork could also be learn at my website online…. www.themarketscompass.com

[ad_2]

stromectol 3 mg price – carbamazepine 400mg uk order tegretol for sale

buy isotretinoin 10mg pill – dexamethasone 0,5 mg cost order zyvox pills

buy generic amoxicillin over the counter – order generic amoxil combivent pills

order zithromax 250mg online cheap – nebivolol 20mg brand bystolic 20mg ca

buy omnacortil 40mg online – buy azipro tablets prometrium 100mg brand

buy gabapentin no prescription – buy anafranil without a prescription cheap sporanox 100 mg

buy lasix – buy furosemide online diuretic betamethasone cheap

buy generic doxycycline – brand monodox glucotrol price

amoxiclav online buy – order augmentin sale order cymbalta 20mg without prescription

oral amoxiclav – brand cymbalta 40mg cymbalta 20mg uk

rybelsus cheap – order rybelsus 14mg cyproheptadine oral

order tizanidine 2mg – hydrochlorothiazide us hydrochlorothiazide canada

buy cialis 5mg pill – sildenafil online order sildenafil professional

buy viagra tablets – cialis from canada tadalafil buy online

cenforce 100mg tablet – buy cenforce 50mg without prescription glucophage 1000mg without prescription

atorvastatin 20mg cost – amlodipine 10mg tablet generic lisinopril 2.5mg

cost omeprazole 10mg – cost prilosec atenolol 50mg canada

buy medrol 4mg online – methylprednisolone 16mg without a doctor prescription order triamcinolone 10mg online

desloratadine brand – loratadine 10mg cheap dapoxetine 60mg brand

order misoprostol 200mcg generic – diltiazem 180mg brand buy diltiazem 180mg online

zovirax 400mg cheap – order acyclovir online crestor tablet

order motilium 10mg online – buy domperidone tablets flexeril online order

order motilium 10mg generic – order sumycin 500mg generic cyclobenzaprine 15mg canada

propranolol generic – buy generic clopidogrel methotrexate 5mg ca

buy coumadin for sale – buy cheap reglan cozaar ca

order nexium generic – buy cheap generic imitrex imitrex 25mg over the counter

purchase levaquin – order levaquin 500mg online cheap zantac cost

order meloxicam 7.5mg without prescription – buy mobic 15mg without prescription order flomax 0.4mg for sale

order zofran 4mg pills – cheap spironolactone buy zocor 20mg online cheap

buy valtrex 500mg online – diflucan pills fluconazole us

I absolutely liked the approach this was presented.

order generic provigil 200mg modafinil price order modafinil 100mg sale buy provigil sale order modafinil 100mg pills buy modafinil pills provigil 100mg usa

More text pieces like this would create the интернет better.

With thanks. Loads of conception!

purchase azithromycin online cheap – buy floxin pills for sale metronidazole pills

buy generic rybelsus 14 mg – cyproheptadine ca buy periactin pills for sale

buy domperidone online – buy flexeril for sale flexeril sale

buy propranolol online cheap – order clopidogrel 75mg online cheap methotrexate 2.5mg pill

cheap amoxicillin pill – purchase valsartan online cheap order combivent 100mcg generic

order azithromycin – bystolic online brand bystolic

order augmentin online cheap – https://atbioinfo.com/ acillin pill

buy nexium capsules – anexa mate buy esomeprazole 20mg without prescription

buy generic warfarin over the counter – https://coumamide.com/ hyzaar online order

buy mobic – mobo sin buy meloxicam generic

buy prednisone 5mg without prescription – https://apreplson.com/ order deltasone 40mg generic

buy erectile dysfunction medication – https://fastedtotake.com/ online ed meds

buy amoxil pill – buy amoxicillin without prescription amoxicillin for sale online

fluconazole 100mg us – https://gpdifluca.com/# buy diflucan pills

order lexapro 10mg pill – escitapro.com lexapro where to buy

cenforce 50mg ca – https://cenforcers.com/# buy generic cenforce online

cialis coupon 2019 – https://ciltadgn.com/# tadalafil prescribing information

tadalafil 20mg (generic equivalent to cialis) – https://strongtadafl.com/# cialis black 800 to buy in the uk one pill

zantac 150mg uk – https://aranitidine.com/ oral ranitidine 150mg

where to buy viagra in canada – https://strongvpls.com/ can you buy viagra ebay

This is the gentle of literature I positively appreciate. click

The thoroughness in this piece is noteworthy. buy zithromax pills for sale

Thanks towards putting this up. It’s okay done. https://ursxdol.com/doxycycline-antibiotic/

Thanks on putting this up. It’s understandably done. https://prohnrg.com/product/get-allopurinol-pills/

Thanks on putting this up. It’s well done. https://aranitidine.com/fr/en_france_xenical/

Thanks on sharing. It’s acme quality. https://ondactone.com/simvastatin/

I am in fact enchant‚e ‘ to gleam at this blog posts which consists of tons of profitable facts, thanks representing providing such data.

reglan medication

cheap forxiga 10 mg – on this site dapagliflozin 10mg pills

orlistat pills – https://asacostat.com/# buy xenical without prescription

This is the make of post I find helpful. https://experthax.com/forum/member.php?action=profile&uid=124842

You can conserve yourself and your family close being wary when buying panacea online. Some pharmaceutics websites manipulate legally and sell convenience, solitariness, cost savings and safeguards as a replacement for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/arimidex.html arimidex

You can protect yourself and your dearest by being cautious when buying pharmaceutical online. Some druggist’s websites control legally and sell convenience, privacy, cost savings and safeguards as a replacement for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/decadron.html decadron

With thanks. Loads of conception! TerbinaPharmacy

You can keep yourself and your dearest nearby being alert when buying medicine online. Some pharmacy websites operate legally and provide convenience, secretiveness, sell for savings and safeguards to purchasing medicines. http://playbigbassrm.com/es/

This is the kind of scribble literary works I in fact appreciate.