[ad_1]

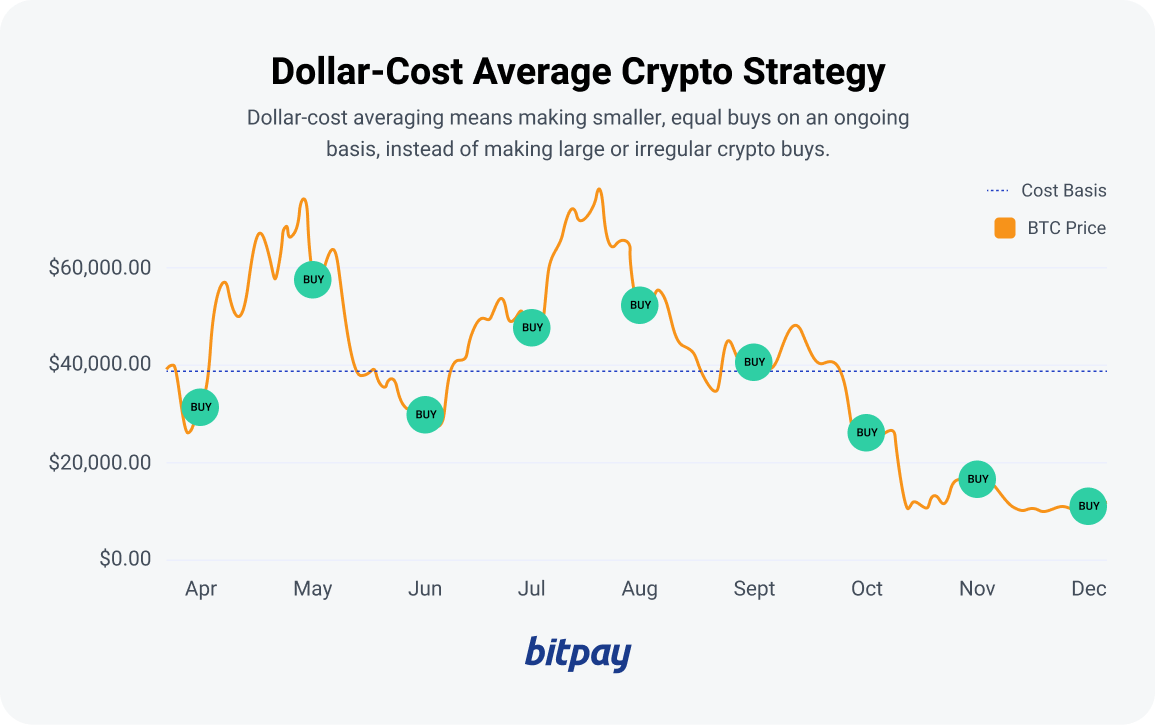

Within the conventional finance world, dollar-cost averaging (DCA) is a time-honored funding technique that includes buying set quantities of inventory at common intervals, whether or not the worth is excessive or low. This technique means that you can scale back your common buy worth on the shares. It’s additionally a great way to take a number of the emotion out of funding selections, and supplies alternatives for larger returns over time. However how does dollar-cost averaging apply to crypto belongings? Let’s have a look.

What’s dollar-cost averaging in crypto?

Greenback-cost averaging (DCA) means making smaller, equal investments on an ongoing foundation, as an alternative of constructing massive or irregular crypto buys. Though cryptocurrency might be significantly extra unstable than shares, dollar-cost averaging with crypto can assist you reap lots of the identical rewards conventional equities merchants get pleasure from via the technique. By recurrently shopping for your favourite cash, you’ll be routinely investing extra over time it doesn’t matter what’s happening within the crypto market. This lets you develop your holdings, and might decrease your general cost-basis throughout dips.

🧠

Fast reminder: The price foundation is the price of an asset if you make your buy. Should you purchase 1 Bitcoin when it equals $50,000, your price foundation is $50,000.

How does dollar-cost averaging with crypto work?

Let’s say you’ve gotten $50,000 you’d prefer to spend money on cryptocurrency. If the worth of Bitcoin was at present $50,000 and also you made a lump sump funding proper now, you’d have one Bitcoin at a price foundation of $50,000. Nevertheless, when you unfold that $50,000 throughout 5 equal $10,000 buys at a price of $50,000/BTC, $45,000/BTC, $25,000/BTC, $25,000/BTC and $55,000/BTC then your common price foundation could be $40,000, and also you’d have 1.4 Bitcoin. When Bitcoin’s worth goes again up, your positive aspects will likely be magnified since you lowered the typical price to amass your holdings. With dollar-cost averaging crypto you’ll be buying extra Bitcoin even throughout ups and downs.

How you can DCA crypto

Are you able to attempt dollar-cost averaging with crypto? Whereas the general concept of standard buys stays true, there are a couple of different issues to contemplate earlier than leaping in. Here is tips on how to DCA crypto like a professional:

- Select the belongings you may be shopping for

- Determine how usually you may make your buys

- Set a tough sum of money you may be investing

- Select a reliable supplier/trade you may use to make investments

- Choose a safe, handy place the place you may retailer and handle your funding

Determine on the token/cryptocurrency you’ll be shopping for

Should you’re seeking to begin dollar-cost averaging on future purchases of cryptocurrencies you already personal, you possible already know what cash you’ll be focusing on. Should you’re new to crypto, it’s smart to conduct thorough due diligence on any token you’re occupied with buying, particularly earlier than attempting your hand at dollar-cost averaging.

How usually will you make investments?

Many exchanges provide the choice to make computerized purchases month-to-month, weekly and even day by day in some instances. Day by day or weekly recurring purchases don’t make as a lot sense for slower-moving belongings like conventional securities, however crypto’s volatility means you’ll be able to feasibly make the most of a DCA technique with larger frequency than you’ll when shopping for inventory. As all the time, make certain the cash you earmark for investing is just not wanted to maintain a roof over your head or pay your payments (except you’re paying payments with crypto).

How a lot will you make investments?

All investing includes danger, however given the crypto market’s potential for excessive volatility, it is best to solely make investments cash you’ll be able to afford to lose. Dig into your month-to-month price range to find out how a lot in discretionary revenue you need to decide to investing and keep away from exceeding that determine.

The place will you make your buys?

A number of buying and selling exchanges provide recurring buys which might be handy. Nevertheless, comfort comes at a price. Exchanges gained’t all the time have one of the best charges and might add pricey charges on high of every purchase. Often examine charges to see the place you’ll be able to get one of the best worth. BitPay gives crypto buys with no hidden charges and exhibits a number of gives to be sure you get one of the best fee.

The place will you retailer your funding?

Deciding the place you’ll hold your crypto holdings secure and sound is a private choice. There are many several types of crypto wallets. Should you’re utilizing a custodial crypto pockets, make certain it’s acquired a strong status and a longtime safety monitor document. For extra superior customers who’re selecting to self-custody, there are a lot of crypto wallets to select from, together with the BitPay Pockets. Not solely does the BitPay Pockets provide market-leading safety features like self-custody, biometric safety, multisig and key encryption to maintain your funds secure, it additionally opens the door to a various ecosystem of BitPay services and products that can assist you get extra utility out of your holdings. Purchase and swap the preferred cash with BitPay to help in your DCA crypto technique.

Kick off your DCA technique with BitPay

DCA vs. lump-sum investing

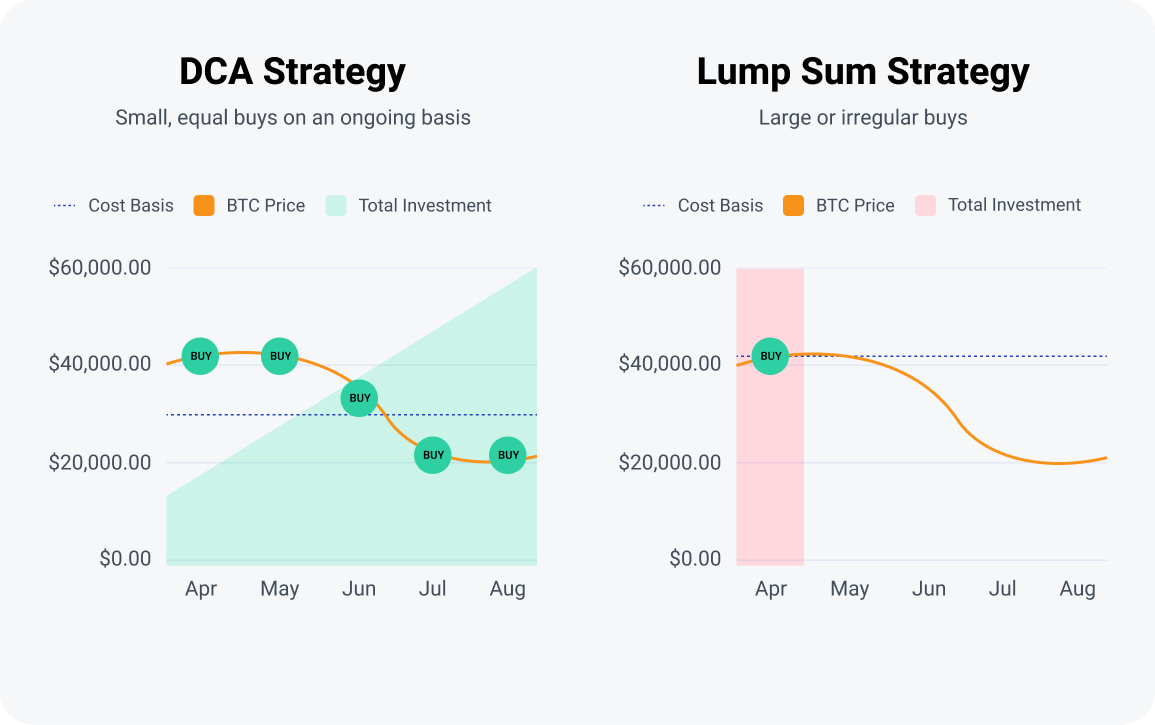

Everytime you put a single lump-sum of cash into an funding, the worth of your holdings is pegged completely to the ups and downs of its share worth (or coin worth, within the case of cryptocurrency).. By using a dollar-cost averaging technique, nevertheless, you’ll be able to flatten out a number of the worth volatility over time by making further purchases throughout market downturns. As of 2022, we’re within the midst of one other crypto winter which suggests asset costs are depressed. Greenback-cost averaging technique might be particularly profitable throughout these market situations.

Potential drawbacks of DCA crypto investing

After all, there are not any fully foolproof funding methods, and dollar-cost averaging crypto can carry some disadvantages and dangers. Mechanically buying crypto at set intervals means you would spend extra money for smaller quantities of crypto if the market goes up sharply. This has the alternative supposed impact of DCA, and might truly increase your cost-basis if quite a few recurring purchases happen after a serious upswing. Some merchants favor lump-sum investing throughout market downturns hoping for greater positive aspects, however truly reaching these positive aspects requires efficiently timing the market, which may be very onerous to do if you’re competing towards automated and/or institutional merchants.

Is a DCA crypto technique proper for me?

Utilizing a dollar-cost common in crypto is a constant, easy strategy to construct your portfolio, notably for rookies or those that don’t need to continuously be in entrance of a display screen. Should you’d like to speculate extra in crypto, however end up in “evaluation paralysis”, leveraging DCA ways can assist instantly relieve your anxiousness and construct a steady portfolio extra time.

FAQs about DCA methods in crypto

How can greenback price averaging defend your investments?

By making recurring purchases over time in a set quantity, you’re successfully eradicating all emotion from the investing equation. It may be tempting to yank a lump-sum funding out of the market throughout a downturn, even when you ebook a loss because of this. However this might price you huge time positive aspects if the crypto you bought comes unexpectedly roaring again to life after you’ve offered all of your holdings.

How do you calculate the dollar-cost common?

Should you’re not a math whiz, don’t fret. There are numerous helpful DCA calculators on the market that allow you to merely plug in some numbers to determine how numerous purchases will have an effect on your cost-basis, together with this one from Omni. Technically it’s designed for calculating DCA on inventory purchases, however it could actually simply as simply be used for crypto dollar-cost averaging as effectively.

How lengthy do you have to use a greenback price common technique?

This is determined by elements like your investing horizon and monetary targets. Ideally a dollar-cost averaging technique is one thing you’ll be able to set and overlook, with out having to continuously monitor your portfolio. However true dollar-cost averaging usually occurs over a prolonged time frame, usually not less than 6-12 months. In spite of everything, you’ll be able to’t actually common one thing out with only some knowledge factors.

How usually do you have to use a dollar-cost common crypto technique?

Greenback-cost averaging doesn’t should be the whole lot of your crypto investing technique. Some traders could use DCA for a portion of their holdings even when the majority of their purchases are made in lump sums.

Is lump-sum investing higher than greenback price averaging for crypto?

There are advantages and disadvantages to each methods. Lump-sum investing provides you an opportunity to earn outsize income when an organization’s share worth rebounds sharply after a dip, however figuring out the market’s backside or predicting the place a inventory will likely be in a couple of months or years is nearly unattainable to find out. That goes double for crypto investing, the place costs usually are not solely extra unstable than shares, however might be impacted by a variety of exterior, unpredictable elements. Your danger tolerance in addition to your dedication to your long-term funding plan will decide which methodology is best for you.

Observe: All data on this article is for academic functions solely, and should not be interpreted as funding recommendation. BitPay is just not chargeable for any errors, omissions or inaccuracies. The opinions expressed are solely these of the creator, and don’t replicate views of BitPay or its administration. For funding or monetary steerage, an expert must be consulted.

[ad_2]

generic stromectol online – buy atacand paypal carbamazepine over the counter

purchase isotretinoin pill – absorica pills buy zyvox 600mg pills

amoxicillin pills – how to buy diovan combivent for sale online

order zithromax 500mg – where can i buy zithromax order bystolic 20mg generic

cheap prednisolone without prescription – buy azithromycin 250mg pills buy progesterone 200mg pills

purchase neurontin without prescription – neurontin 100mg oral purchase itraconazole sale

lasix 40mg tablet – buy generic betnovate over the counter3 buy generic betnovate 20gm

order doxycycline sale – vibra-tabs ca glucotrol 5mg canada

augmentin 375mg cheap – ketoconazole 200mg without prescription purchase duloxetine online cheap

augmentin cheap – buy cymbalta 20mg generic purchase cymbalta without prescription

buy semaglutide online cheap – periactin drug periactin medication

tizanidine 2mg canada – hydrochlorothiazide cost microzide 25 mg oral

order cialis 5mg pill – order sildenafil 50mg online viagra 50mg usa

sildenafil pills 50mg – tadalafil sale buy tadalafil pill

order cenforce pills – order chloroquine 250mg online cheap glucophage without prescription

buy lipitor sale – lipitor ca zestril 10mg drug

buy prilosec sale – omeprazole 20mg canada tenormin drug

order depo-medrol online – medrol 8 mg for sale buy triamcinolone 10mg online cheap

buy clarinex 5mg generic – buy desloratadine without prescription order priligy 90mg pills

buy cytotec – diltiazem drug diltiazem 180mg us

acyclovir 800mg brand – rosuvastatin 20mg us purchase crestor sale

buy domperidone – tetracycline 250mg uk cyclobenzaprine 15mg cost

motilium canada – sumycin 500mg pill cyclobenzaprine generic

order inderal 20mg sale – buy cheap methotrexate buy generic methotrexate over the counter

I am really inspired with your writing skills and also with the structure to your blog. Is this a paid topic or did you modify it yourself? Either way stay up the nice quality writing, it is uncommon to peer a great blog like this one these days!

medex order – oral losartan 25mg purchase cozaar generic

buy cheap levofloxacin – order levaquin 250mg online cheap ranitidine 150mg canada

oral esomeprazole 40mg – order topamax 200mg generic sumatriptan without prescription

buy meloxicam online cheap – how to buy flomax order tamsulosin 0.4mg pills

ondansetron over the counter – simvastatin 20mg without prescription purchase zocor without prescription

buy valacyclovir pills for sale – diflucan pills buy forcan paypal

This is the kind of content I look for.

provigil 100mg uk buy generic modafinil buy provigil generic provigil oral order modafinil 200mg without prescription order provigil 200mg for sale provigil where to buy

I am in fact delighted to glance at this blog posts which consists of tons of useful facts, thanks representing providing such data.

I’ll certainly bring to skim more.

order generic azithromycin 250mg – ciplox 500 mg generic metronidazole online order

order rybelsus 14mg online cheap – cyproheptadine 4mg uk buy cyproheptadine 4 mg without prescription

motilium over the counter – buy generic sumycin over the counter cyclobenzaprine cheap

inderal 20mg pill – buy propranolol for sale methotrexate cost

amoxil pills – buy cheap generic valsartan order ipratropium 100 mcg pills

zithromax 250mg pills – order bystolic 20mg online purchase bystolic pills

brand augmentin 625mg – atbio info ampicillin antibiotic online

nexium order online – nexium to us order nexium generic

buy coumadin 5mg without prescription – https://coumamide.com/ brand cozaar 25mg

buy mobic without prescription – tenderness where to buy mobic without a prescription

order prednisone 10mg – aprep lson cheap deltasone 20mg

best ed medication – https://fastedtotake.com/ ed pills that work quickly

cheap amoxil online – buy amoxil paypal purchase amoxil online cheap

diflucan 200mg us – flucoan buy generic diflucan for sale

lexapro oral – escita pro purchase lexapro sale

order generic cenforce 50mg – https://cenforcers.com/ cenforce 100mg canada

cialis a domicilio new jersey – https://ciltadgn.com/# generic cialis super active tadalafil 20mg

cialis canada over the counter – https://strongtadafl.com/# cialis where to buy in las vegas nv

buy ranitidine 300mg online cheap – site purchase ranitidine for sale

viagra prices – sildenafil 50 mg cost buy viagra discount

Thanks on sharing. It’s acme quality. https://buyfastonl.com/furosemide.html

I found new insight from this.

This is the kind of serenity I have reading. online

I am actually delighted to glitter at this blog posts which consists of tons of profitable facts, thanks object of providing such data. https://ursxdol.com/furosemide-diuretic/

The thoroughness in this section is noteworthy. https://prohnrg.com/product/omeprazole-20-mg/

This is the kind of content I truly appreciate.

Proof blog you procure here.. It’s intricate to espy elevated calibre belles-lettres like yours these days. I justifiably appreciate individuals like you! Rent mindfulness!! lasix famille

I took away a great deal from this.

I really enjoyed the style this was presented.

I found new insight from this.

Thanks for putting this up. It’s a solid effort.

Such a useful read.

I absolutely appreciated the style this was presented.

This is the kind of content I value most.

Such a beneficial bit of content.

More articles like this would make the internet a better place.

Such a valuable insight.

I’ll surely be back for more.

I genuinely liked the way this was presented.

This is the kind of writing I value most.

Greetings! Very useful advice within this article! It’s the petty changes which choice espy the largest changes. Thanks a a quantity for sharing! https://ondactone.com/product/domperidone/

I truly enjoyed the approach this was written.

More blogs like this would make the web a better place.

I discovered useful points from this.

More articles like this would frame the blogosphere richer.

buy generic metoclopramide 20mg

More articles like this would remedy the blogosphere richer. https://lzdsxxb.com/home.php?mod=space&uid=5057518

order dapagliflozin 10 mg without prescription – https://janozin.com/ purchase forxiga without prescription

how to get orlistat without a prescription – xenical cost buy orlistat 120mg generic

I couldn’t turn down commenting. Well written! http://fulloyuntr.10tl.net/member.php?action=profile&uid=3213

You can keep yourself and your family close being alert when buying panacea online. Some pharmacopoeia websites control legally and offer convenience, solitariness, bring in savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/doxazosin.html doxazosin

This is the big-hearted of criticism I positively appreciate. on this site

This is the type of advise I unearth helpful.

https://t.me/s/Volna_officials

В джунглях игр, где любой сайт стремится привлечь гарантиями быстрых выигрышей, рейтинг российских интернет казино

является как раз той путеводителем, что проводит сквозь заросли подвохов. Для профи плюс новичков, которые пресытился от пустых заверений, это инструмент, чтоб почувствовать настоящую выплату, как тяжесть выигрышной фишки в руке. Обходя пустой воды, лишь надёжные клубы, там отдача не лишь показатель, а ощутимая фортуна.Собрано из поисковых трендов, как ловушка, которая ловит топовые актуальные тренды в рунете. Тут нет места про клише трюков, любой элемент будто ход у игре, где подвох раскрывается немедленно. Хайроллеры понимают: по России стиль письма с подтекстом, где юмор скрывается как рекомендацию, даёт обойти ловушек.В https://www.don8play.ru такой список ждёт словно готовая колода, готовый на старту. Загляни, когда нужно увидеть ритм подлинной азарта, минуя мифов да провалов. Игрокам тех любит тактильность удачи, такое как держать ставку в пальцах, а не смотреть на дисплей.