[ad_1]

On Sunday, Bitcoin worth is at the moment buying and selling at $30,325, exhibiting a slight improve in worth.

This upward motion comes as new Lightning Labs instruments allow synthetic intelligence (AI) to facilitate Bitcoin transactions, additional advancing know-how integration and digital currencies.

Moreover, the co-founder of Volatility Shares has introduced the event of a Bitcoin Spot ETF, which has the potential to open new doorways for buyers trying to take part within the cryptocurrency market.

These latest developments elevate questions in regards to the ongoing sell-off and whether or not the market is starting to stabilize.

Lightning Labs’ New Instruments Allow Integration of AI with Bitcoin

A brand new set of developer instruments from Lightning Labs, a outstanding group engaged on the Lightning Community for Bitcoin, has enabled the combination of Bitcoin with AI programmers and Giant Language Fashions (LLMs) like ChatGPT.

In accordance with a latest announcement by Lightning Labs, the Lightning Community will now enable Giant Language Fashions (LLMs) similar to ChatGPT to retailer, obtain, and transmit Bitcoin.

This integration opens up new prospects and expands the use-cases for Bitcoin and AI know-how.

The favored Langchain AI software program library might be made accessible to Bitcoin and the Lightning Community by the L402 commonplace, as said by the programmers at Lightning Labs.

This growth creates a extra open AI infrastructure and additional enhances the potential functions of Bitcoin and AI.

In latest months, synthetic intelligence has gained vital consideration worldwide, surpassing the earlier funding craze centered on cryptocurrencies.

Former BitMex CEO, Arthur Hayes, has even predicted that “AI will select Bitcoin as its native foreign money.”

These optimistic predictions concerning the convergence of Bitcoin and AI might be attributed to the rising costs of Bitcoin, fueling additional curiosity and exploration on this space.

Bitcoin Spot ETF Co-Founding father of Volatility Shares Units Stage for New Funding Alternatives

The surge within the worth of Bitcoin fueled by the applying of an exchange-traded fund (ETF) for spot markets by monetary big BlackRock continues to achieve momentum.

BlackRock’s achievement might signify the start of a brand new part of institutional funding in Bitcoin, attracting extra buyers if different filers are inspired to comply with swimsuit.

Justin Younger, the co-founder, and president of Volatility Shares, expressed in an interview that buyers searching for publicity to Bitcoin are actively trying to find the “best and most regulated means” to spend money on it.

He believes {that a} spot ETF might be the optimum methodology to attain this.

The approval of a regulated spot ETF in Bitcoin, in response to Younger, may assist “dampen” volatility and entice extra buyers who search transparency in monetary devices.

Younger emphasised that the primary benefit of getting a spot ETF and market is the potential for higher stability and lowered unfavorable volatility, addressing considerations raised by the Securities and Alternate Fee (SEC).

These supportive feedback from Younger have contributed to the rise in Bitcoin’s worth.

Bitcoin Value Prediction

Bitcoin is at the moment experiencing a scarcity of volatility, with its buying and selling vary displaying uneven actions.

Taking a broader perspective on the each day timeframe, Bitcoin is consolidating inside a slim vary, with resistance recognized round $31,400 and assist situated roughly at $29,600.

A decisive shut above the $29,600 degree holds the potential to set off a bullish transfer for Bitcoin.

On the flip aspect, if there’s a clear break beneath $29,600, Bitcoin might discover assist round $28,450, and probably even decrease in the direction of $27,450.

By way of upward motion, surpassing the $31,350 degree would set the stage for the following vital goal at round $32,500.

Therefore, it’s endorsed to carefully monitor the $29,600 degree as a pivotal level for at this time’s buying and selling actions.

Prime 15 Cryptocurrencies to Watch in 2023

Preserve your self up to date on the most recent developments in preliminary coin providing (ICO) initiatives and different cryptocurrencies by recurrently exploring our meticulously curated assortment of the highest 15 digittal belongings to observe in 2023.

This thoughtfully compiled record has been crafted by business consultants from Business Discuss and Cryptonews, guaranteeing skilled suggestions and precious insights.

Keep forward of the competitors and uncover the potential of those cryptocurrencies as you navigate the dynamic panorama of digital belongings.

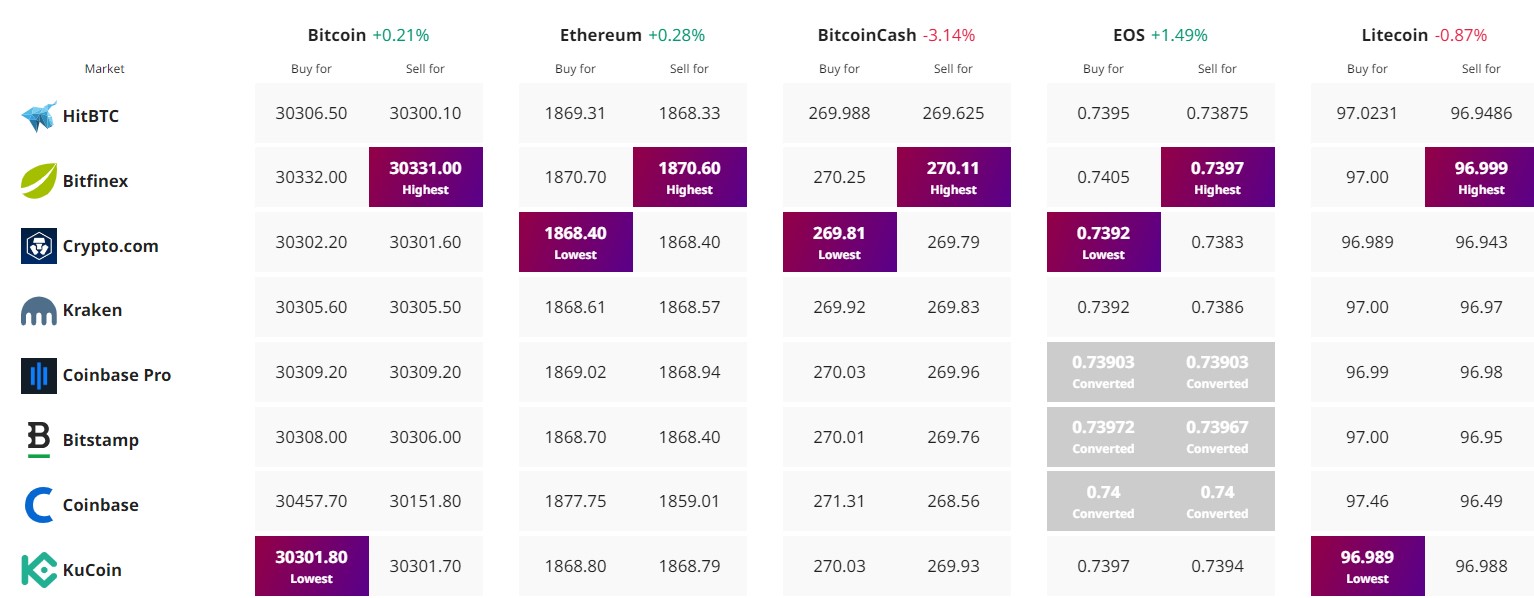

Discover The Greatest Value to Purchase/Promote Cryptocurrency

Disclaimer: Cryptocurrency initiatives endorsed on this article should not the monetary recommendation of the publishing creator or publication – cryptocurrencies are extremely unstable investments with appreciable danger, all the time do your personal analysis.

[ad_2]

I’m extremely inspired together with your writing abilities and also with the format on your blog. Is this a paid subject matter or did you modify it yourself? Either way stay up the excellent quality writing, it’s uncommon to see a great weblog like this one nowadays!

https://t.me/s/iGaming_live/4866