[ad_1]

Regardless of the volatility Bitcoin skilled in 2023, the prolonged sideways motion between February and July has proved to be fertile floor for accumulation. Onchain evaluation confirmed that short-term holders (STHs) and long-term holders (LTHs) had steadily gathered all through the previous quarter, indicating a robust perception within the asset’s long-term worth.

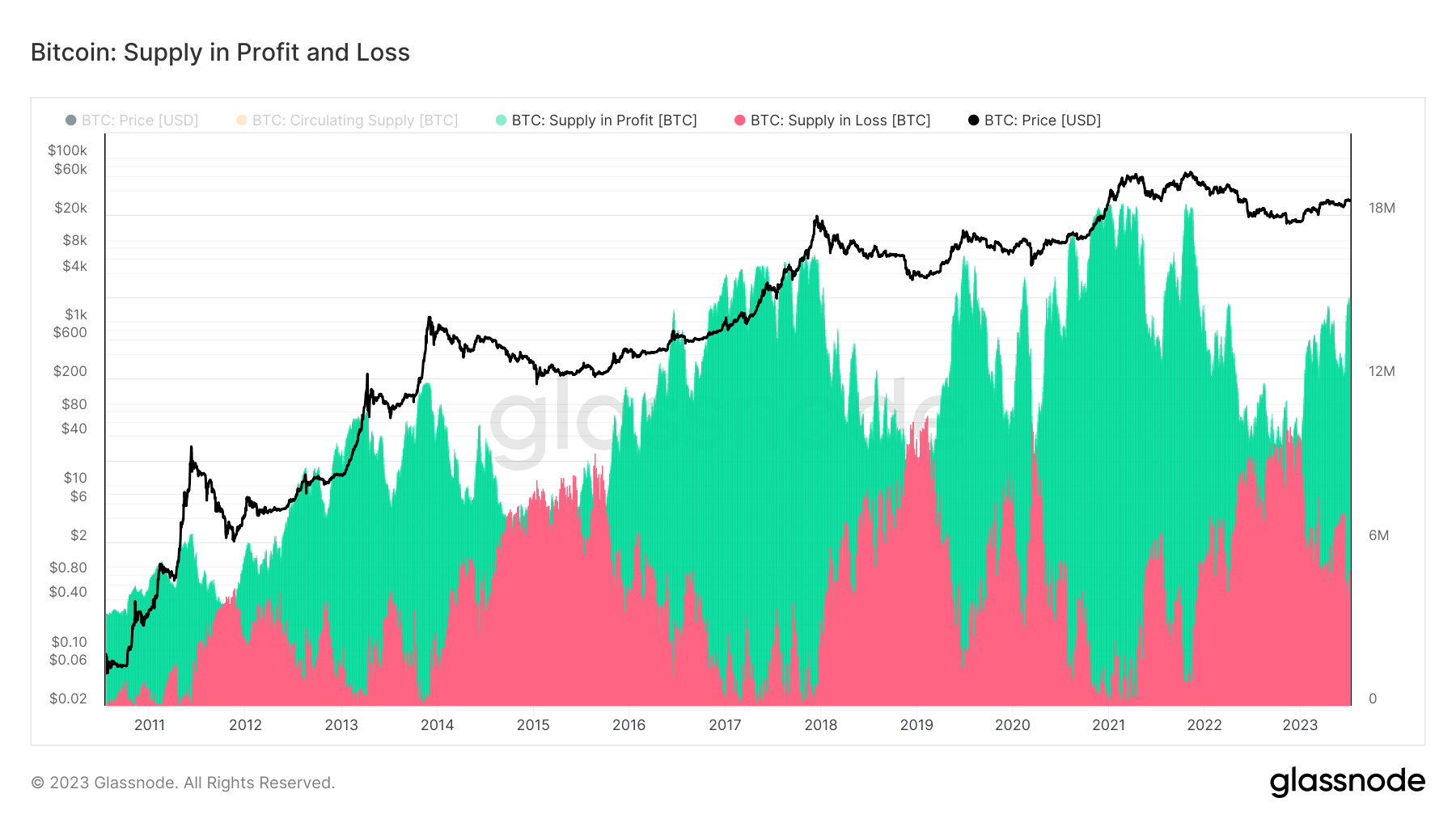

Measuring Bitcoin’s provide in revenue and loss is a necessary a part of analyzing the market. These metrics present invaluable insights into market sentiment and investor conduct — a better provide in revenue signifies that traders are holding onto their belongings, anticipating additional value appreciation. Conversely, a better provide in loss might sign potential sell-offs.

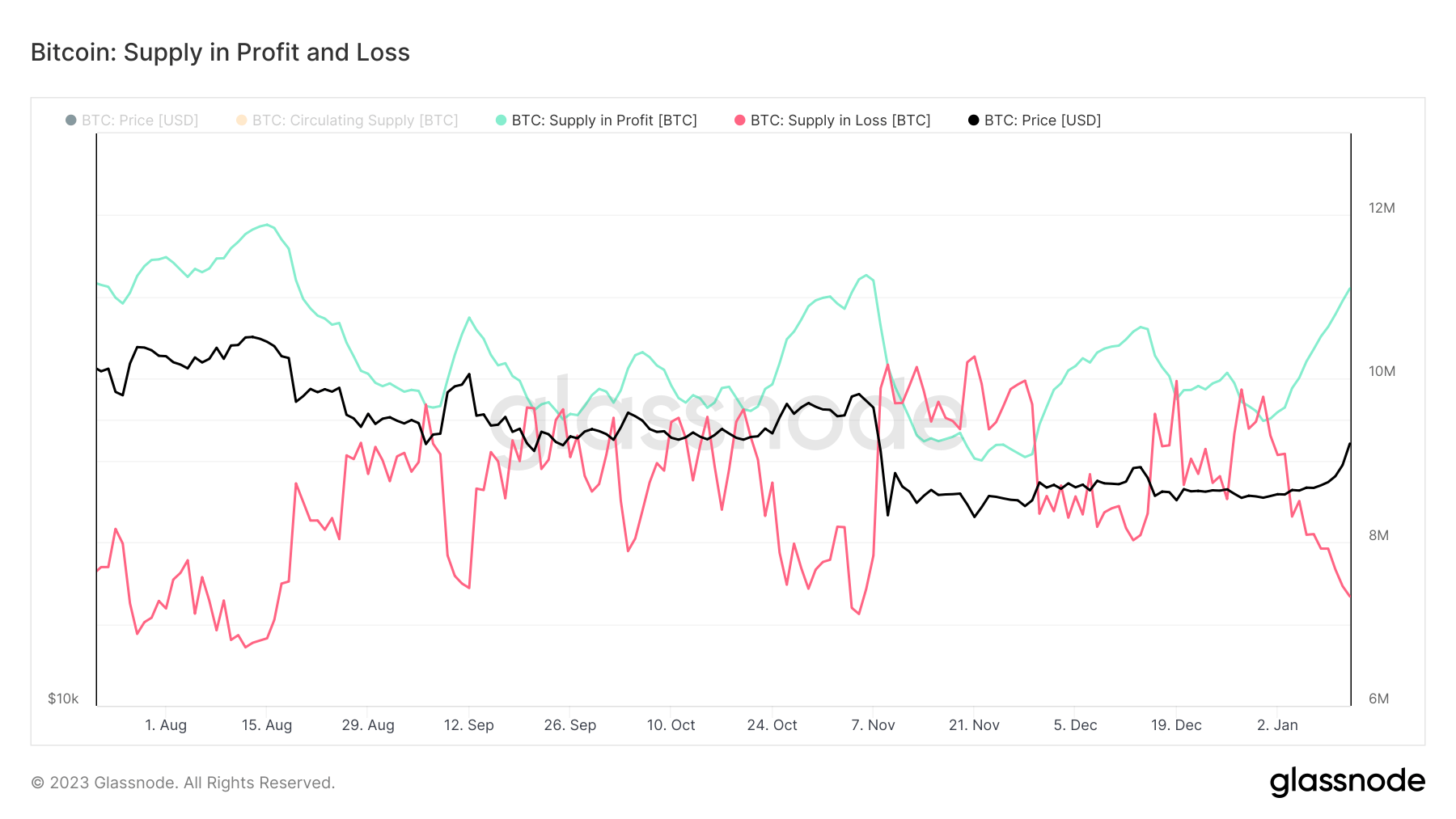

Between September and December 2022, throughout a interval of serious value volatility, the provides in revenue and loss converged a number of instances, reflecting the market’s uncertainty.

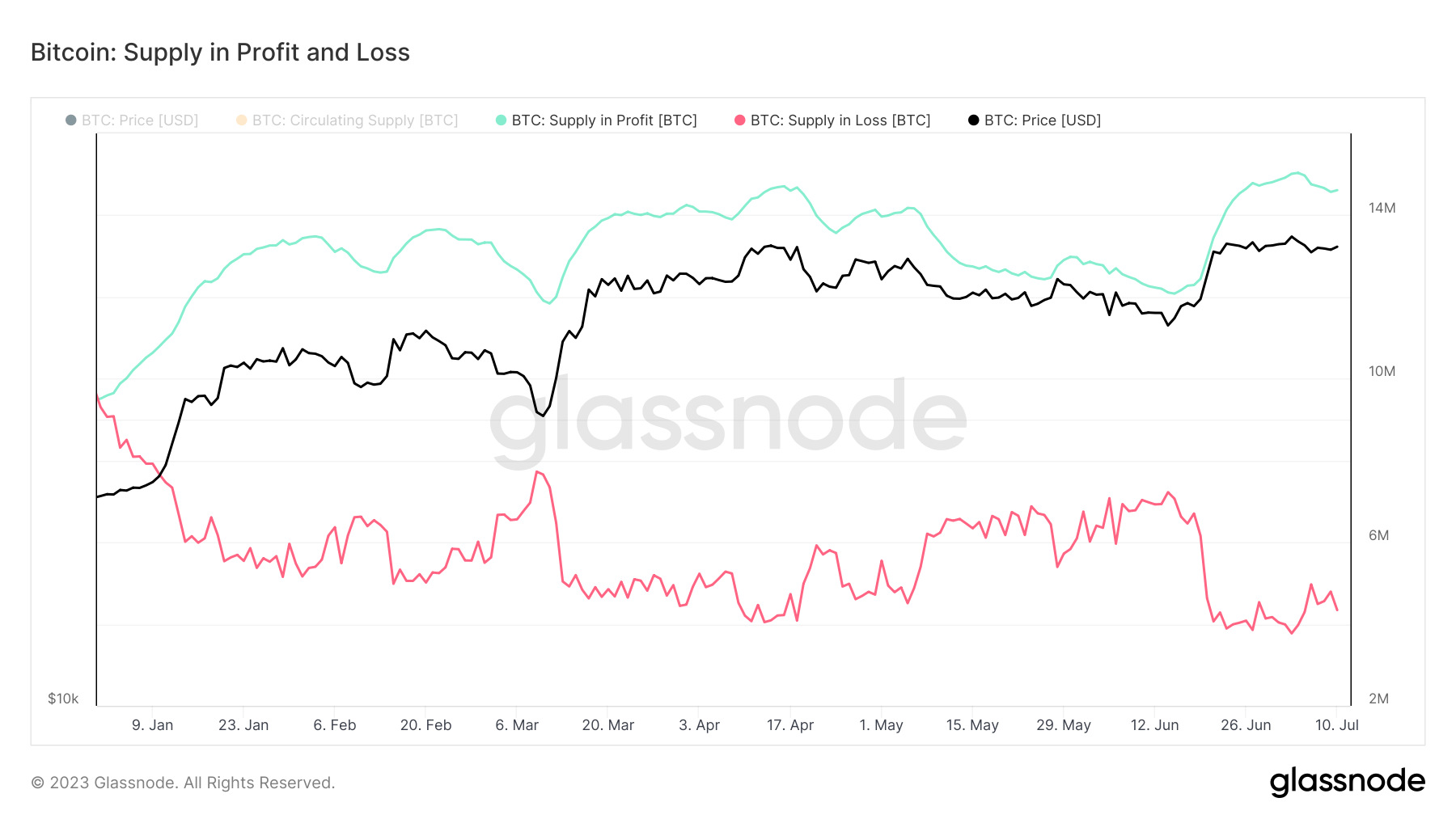

Nonetheless, the panorama has shifted for the reason that starting of 2023. The provides in revenue and loss have diverged, with the portion of the availability in revenue rising by over 53%. Based on knowledge from Glassnode, 14.61 million BTC is at present in revenue, whereas 4.34 million BTC is in loss.

As of July 11, 75% of the availability is in revenue, leaving solely 25% in loss. This important equilibrium is paying homage to the situations witnessed in the course of the mid-points of the 2016 and 2019 market cycles. Glassnode knowledge additional revealed that fifty% of Bitcoin’s buying and selling days had seen a better Revenue-to-Loss steadiness and 50% a decrease one.

The present accumulation part and the ensuing 75% of Bitcoin’s circulating provide being in revenue is a promising signal for the cryptocurrency. If historic patterns proceed, this could possibly be the mid-point in Bitcoin’s present market cycle, suggesting {that a} backside has been reached and the market is at present gearing up for a rally.

Nonetheless, it’s essential to contemplate that whereas historic patterns present helpful context, they could not all the time predict future actions. Right now’s Bitcoin market is influenced greater than ever by a bunch of macro components, equivalent to regulatory developments and broader financial situations.

The submit Heavy accumulation places 75% of Bitcoin’s circulating provide in revenue appeared first on CryptoSlate.

[ad_2]