[ad_1]

The enduring ambiguity of crypto regulation in the USA is poised to witness a defining second. Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) put together to unveil their revamped crypto regulation proposal.

The controversial bipartisan invoice, often called the Lummis-Gillibrand Accountable Monetary Innovation Act, seeks to bridge the regulatory divide that underscores the crypto trade in America.

The Lummis-Gillibrand Act: Regulatory Readability

An escalating dispute between the Securities and Change Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) over the exact nature of cryptocurrencies has left companies in limbo. Each regulators are wielding their respective enforcement powers in opposition to crypto exchanges, Coinbase and Binance.

The Lummis-Gillibrand Act goals to “present for accountable monetary innovation and to digital belongings inside the regulatory perimeter.” It designates most cryptos as commodities beneath the CFTC’s purview, in stark distinction to the SEC’s ongoing enforcement actions.

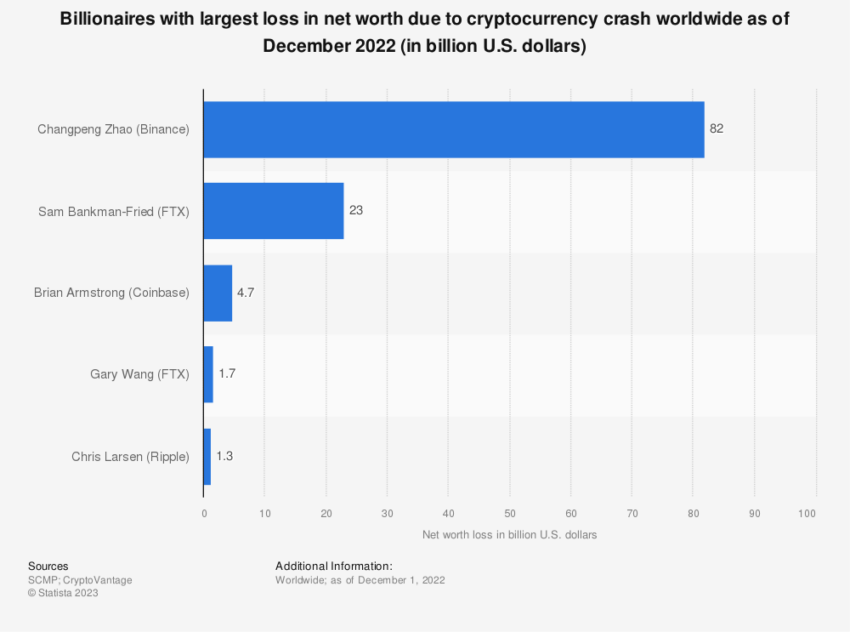

The laws asserts a bid to stop additional turmoil within the crypto sector, which has seen a string of high-profile collapses resulting in substantial investor losses previously two years.

“This laws is probably the most complete proposal thus far that supplies strong client protections and appropriately addresses the present panorama surrounding crypto belongings,” mentioned Senator Lummis.

The proposed act would mandate crypto exchanges to retailer buyer belongings securely in third-party trusts. Subsequently, prohibiting “proprietary buying and selling” or buying and selling with their very own funds on their very own platform.

Crypto Exchanges Should Be Held Accountable

The US crypto regulation invoice might additionally mark a regulatory tightening on “materials associates” of crypto exchanges. This follows allegations that FTX reportedly lent huge sums of buyer funds to its sister firm, Alameda Analysis, previous to a liquidity disaster that triggered its downfall.

“It’s vital to combine digital belongings into current legislation and to harness the effectivity and transparency of this asset class whereas addressing threat… As this trade continues to develop, it’s vital that Congress fastidiously crafts laws that promotes innovation whereas defending the buyer in opposition to dangerous actors,” mentioned Senator Lummis

Moreover, the proposal goals to clamp down on “rehypothecation” of crypto belongings. It successfully proscribes high-risk, but worthwhile crypto providers comparable to staking. It additionally imposes stricter requirements on new tokens earlier than they’re listed on crypto exchanges.

The proposal, set to unveil on Wednesday, July 12, emerges in opposition to a backdrop of serious opposition to SEC Chair Gary Gensler. Significantly within the Republican-dominated Home which has already taken steps to cut back Gensler’s sway.

Whereas the US crypto regulation invoice’s passage in its current state or inside the present Congress seems uncertain, it nonetheless marks a major preliminary stride in direction of cultivating bipartisan laws on this significant topic.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material.

[ad_2]

https://t.me/s/Volna_officials

https://t.me/kazino_s_minimalnym_depozitom/22

В джунглях ставок, где любой сайт норовит зацепить обещаниями простых выигрышей, топ казино рейтинг лучших

превращается той самой картой, что направляет через ловушки подвохов. Игрокам хайроллеров да начинающих, что пресытился из-за ложных посулов, это помощник, чтобы почувствовать подлинную rtp, словно ощущение выигрышной монеты у руке. Минус пустой ерунды, лишь проверенные площадки, где выигрыш не лишь цифра, но конкретная фортуна.Составлено по гугловых трендов, словно паутина, что ловит топовые горячие веяния по сети. Тут отсутствует места для шаблонных приёмов, любой момент как ставка у столе, в котором подвох проявляется сразу. Игроки знают: в России стиль разговора на сарказмом, в котором сарказм маскируется под намёк, помогает избежать обмана.На http://www.don8play.ru/ данный список находится словно раскрытая карта, готовый для раздаче. Загляни, когда хочешь увидеть биение подлинной игры, минуя обмана и неудач. Игрокам кто знает тактильность удачи, он словно иметь карты у руках, а не смотреть в дисплей.

鸳鸯浴、艳舞、按摩、波推、指滑、臀推、毒龙、舌吻、环游、吹箫、六九、口爆、深喉、颜射、制服丝袜 Benchmark results are documented at User Requests.