[ad_1]

The {discount} to internet asset worth (NAV) for the $19 billion-plus Grayscale Bitcoin Belief (GBTC) continues to slim within the wake of asset supervisor BlackRock’s software to open a spot bitcoin ETF in america. The {discount} to NAV fell to as little as 26% at one level final week – the trimmest degree since Could 2022 – and at the moment sits at about 27%, in accordance with information from Ycharts. BlackRock’s transfer for a spot bitcoin ETF set off a lot of filings and re-filings for comparable funds from a lot of different business actors, together with from fellow asset administration big Constancy.

Crypto information agency Arkham Intelligence stirred controversy Monday by saying a new service geared toward unmasking the house owners of digital wallets, angering privacy-focused crypto advocates. It seems Arkham has already been leaking its personal prospects’ non-public info, a revelation that additionally appears to have emerged Monday, placing a highlight on the companys personal strategy to person privateness simply because it was rolling out a service meant to unmask crypto pockets house owners on an enormous scale. The problem stems from the best way Arkham arrange its weblink referral program. Customers of Arkham’s pockets monitoring dashboard can invite others onto the platform by sharing their distinctive referral URL. These URLs seem to finish with a meaningless jumble of characters. In actuality, they’re an easy-to-decipher model of the person’s e-mail deal with written in Base64, which is trivial to decode.

Bitcoin (BTC) might rise to $50,000 by the top of this yr and as much as $120,000 by end-2024, Normal Chartered Financial institution mentioned in a analysis report on Monday. The British multinational financial institution in April had put out a $100,000 forecast for the top of 2024, noting at the moment the banking disaster, amongst different components. “We now suppose this estimate is just too conservative, and we due to this fact see upside to our end-2024 goal,” yesterday’s report mentioned, this time pointing to elevated miner profitability as among the many bullish catalysts.

-

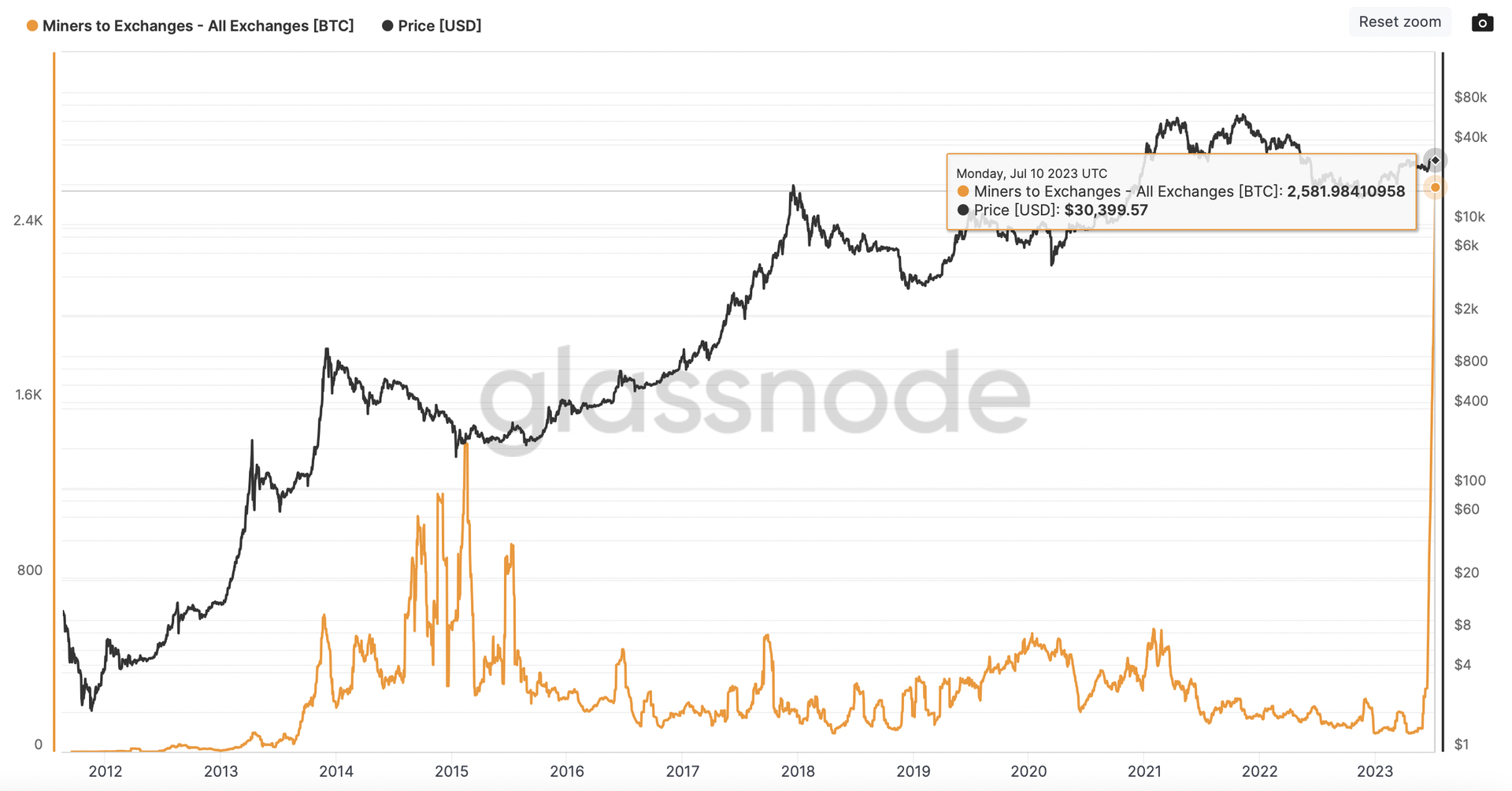

The 30-day easy shifting common of the variety of bitcoin moved from miner wallets to centralized exchanges surged to a file excessive of 2581.98 BTC on Monday.

-

In different phrases, miners have transferred over 77,000 BTC ($2.3 billion) to exchanges previously 30 days, including to promoting strain available in the market.

Disclaimer: This text was written and edited by CoinDesk journalists with the only real objective of informing the reader with correct info. In the event you click on on a hyperlink from Glassnode, CoinDesk could earn a fee. For extra, see our Ethics Coverage .

Edited by Stephen Alpher.

https://www.coindesk.com/markets/2023/07/11/first-mover-americas-gbtc-discount-narrows-to-lowest-since-may-2022/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

[ad_2]