[ad_1]

The value of Chainlink (LINK) demonstrates constructive long-term bias because it efficiently averted a breakdown from a major horizontal help space. It’s trying to verify that very same space as a help stage.

Though the long-term outlook stays bullish, short-term readings recommend that the value has initiated a retracement. However, there may be potential for the LINK worth to renew its upward motion and attain new highs after establishing the next low.

Chainlink Worth Reclaims Crucial Lengthy-Time period Stage

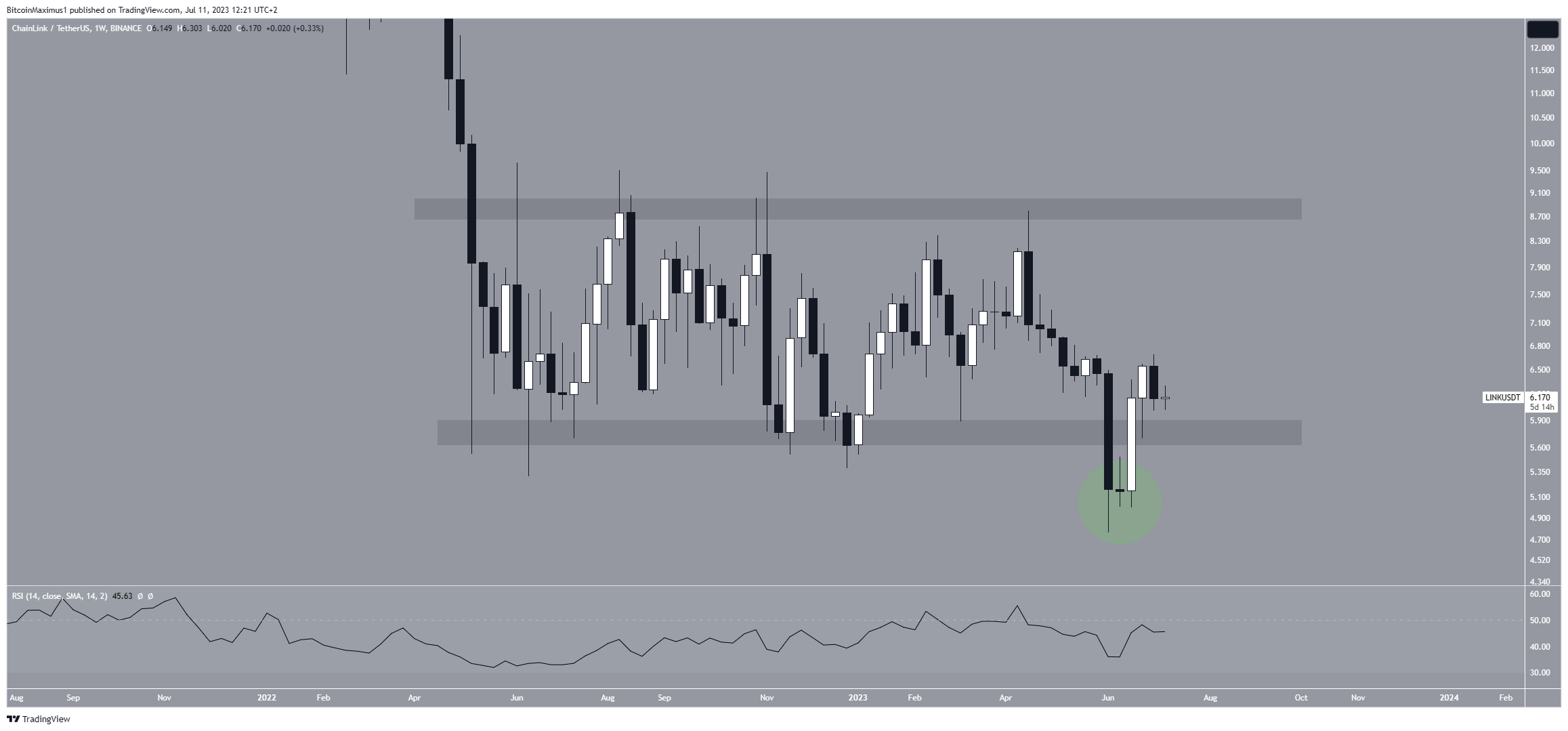

In keeping with the weekly evaluation, the worth of LINK has been buying and selling barely above the $5.80 help stage since April 2022. Throughout this time, it encountered resistance at $8.90. Nonetheless, in early June 2023, the value dropped beneath $5.80, initially indicating a breakdown from the long-term help. However, the value subsequently rebounded and has since risen, reclaiming the $5.80 space.

Due to this fact, what beforehand appeared like a breakdown is taken into account a deviation (inexperienced circle). That is thought-about a bullish signal, typically adopted by a notable upward motion.

Though the value has recovered, the weekly RSI (Relative Energy Index) exhibits a impartial studying. RSI is a momentum indicator utilized by merchants to evaluate whether or not a market is overbought or oversold and to find out whether or not to purchase or promote an asset. Readings above 50 and an upward development recommend that bulls nonetheless maintain a bonus.

The other is true for readings beneath 50. At the moment, the RSI is rising however stays above 50. These combined indicators indicate that the development’s course is unsure.

LINK Worth Prediction: Wave Counts Helps Enhance to Double Digits

Whereas the general development on the weekly chart is just leaning bullish, the day by day technical evaluation offers a extra decisively clear bullish perspective. The wave rely and the RSI each help this prediction.

After the June 10 low, the LINK worth has accomplished a five-wave improve (proven in black), suggesting a possible bullish development reversal. Nonetheless, it’s presently present process a corrective section inside an A-B-C construction.

Essentially the most possible stage for the correction to conclude is on the $5.73 help stage. This represents a 0.5 Fibonacci retracement of the earlier improve.

Elliott Wave concept analyzes recurring long-term worth patterns and investor psychology to find out development instructions.

The most certainly wave rely signifies that the present improve is simply the preliminary wave of a bigger five-wave upward motion (white). If this holds true, the value will ultimately surpass the resistance stage at $9 and transfer into double-digit territory.

A possible goal for the highest of the third wave is at $9.80, created by the two.61 extension of wave one.

Moreover, the day by day RSI rises above 50, indicating a bullish development.

Nonetheless, it is very important observe that if the value falls beneath the June 10 low of $4.69, it would point out a seamless bearish development.

In such a state of affairs, a lower to $4 turns into the most certainly end result.

For BeInCrypto’s newest crypto market evaluation, click right here.

Disclaimer

According to the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections.

[ad_2]