[ad_1]

The Shopper Worth Index (CPI) information for June, launched by the Bureau of Labor Statistics at present, has despatched ripples of optimism all through the Bitcoin and crypto market. The newest figures reveal a shocking cooling in inflation, which has ignited hopes of a constructive outlook.

In accordance with the information, the headline CPI year-over-year (YoY) inflation fell to three.0%, coming in beneath expectations of three.1%. This represents a noteworthy decline from the earlier month’s 4.0% determine.

Much more encouraging is the truth that core CPI YoY inflation dropped to 4.8%, surpassing market expectations of 5.0%. Notably, that is the primary time the core CPI has fallen beneath 5.0% since December 2021, main analysts at The Kobeissi Letter to comment, “The 26-month battle in opposition to inflation could lastly be nearing its finish.”

On a month-on-month (m/m) foundation, headline CPI got here in at 0.3%, selecting up barely in comparison with Might (+0.1%). In the meantime, core CPI m/m got here in decrease than anticipated, touchdown at 0.3% as a substitute of 0.4%.

BREAKING: US inflation beneath expectations #Bitcoin

Headline CPI YoY 3.0% (forecast 3.1%, final 4.0%)

Headline CPI MoM 0.2% (forecast 0.3%, final 0.1%)

Core CPI YoY 4.8% (forecast 5.0%, final 5.3%)

Core CPI MoM 0.2% (forecast 0.3%, final 0.4%)— Jake Simmons (@realJakeSimmons) July 12, 2023

Why The CPI Knowledge Is Essential For Bitcoin And Crypto

The Fed has raised rates of interest by 5.0 foundation factors since March 2022 to carry down the very best inflation within the US in 4 a long time. Through the June assembly, the Federal Open Market Committee (FOMC) introduced a pause for the primary time on this cycle to offer itself time to evaluate the still-evolving impression of the earlier hikes. Fed Chair Jerome Powell, as all the time, burdened information dependency.

Previous to the discharge of the CPI and core CPI, the market was anticipating a 92% chance (in response to the CME Fed Watch Software) that Fed policymakers would resolve in favor of a 0.25 foundation factors charge hike at their July 25-26 assembly, which might carry the coverage charge into the 5.25% to five.50% vary. As we speak’s figures are prone to affect the choice by the Fed. Nevertheless,

San Francisco Fed President Mary Daly just lately stated at a Brookings Establishment occasion that the Fed “could find yourself doing much less as a result of we’ve to do much less; we could find yourself doing simply that; we could find yourself doing extra. The info will inform us.”

Regardless of that, 20 minutes after the CPI launch, the CME Fed Watch Software nonetheless displayed a 89% of a 25 foundation level hike on the finish of July. Famend journalist Walter Bloomberg, citing “The Economists,” acknowledged that the surprisingly good CPI studying is unlikely to discourage the Fed from elevating rates of interest by 1 / 4 level later this month. However, he notes that this charge hike may doubtlessly be the final one within the present cycle.

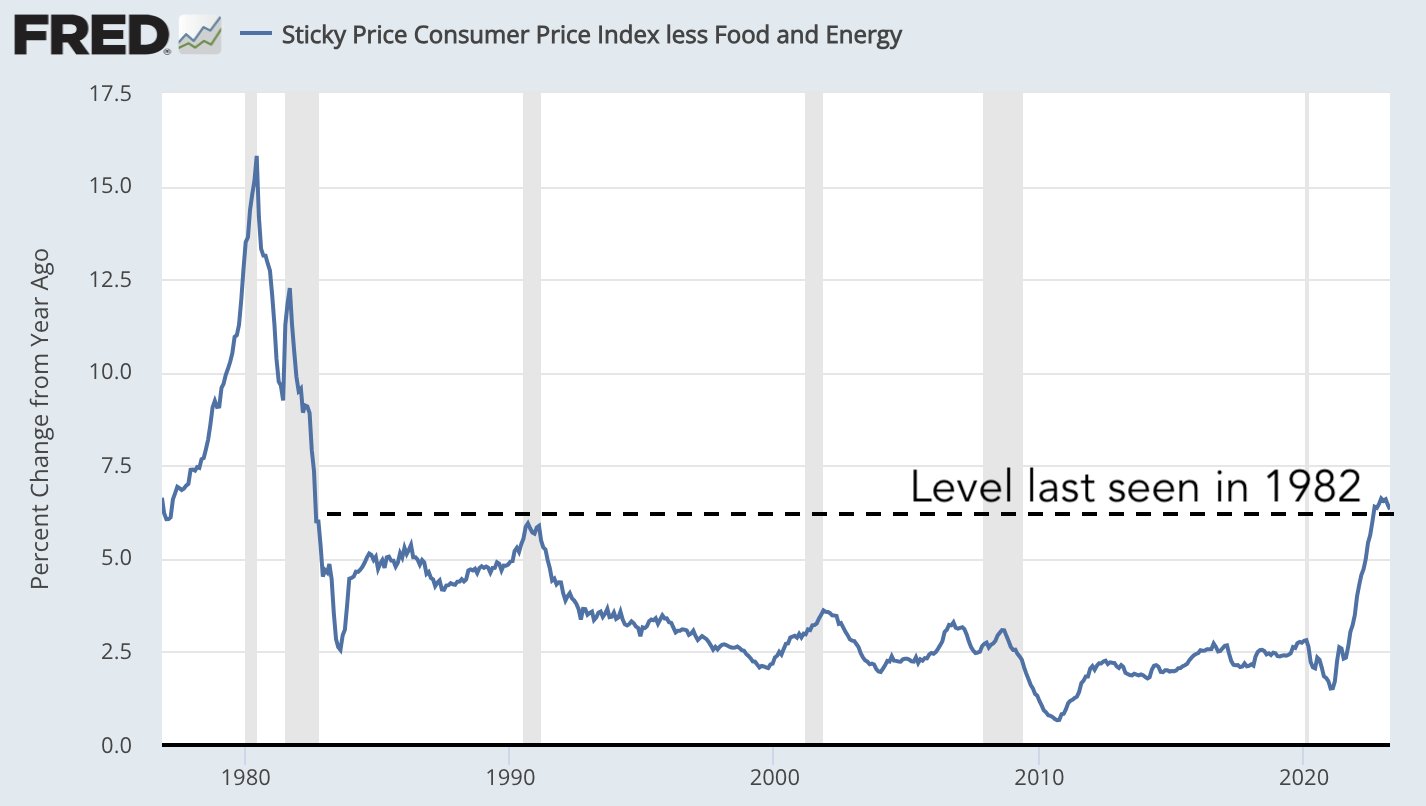

In that vein, it’s necessary to notice that he Fed’s inflation job won’t be carried out but. Regardless of headline inflation trending decrease and approaching the two% goal quick, sticky inflation continues to be at ranges final seen in 1982, as the next chart reveals. The sticky worth client worth index much less meals and power continues to be extremely elevated, inflicting worry of a re-emergence of upper headline inflation.

Fed analysis revealed two days in the past by economist Michael Kiley confirmed that core CPI information in 2022 and early 2023 had been according to fashions exhibiting larger persistence. “Updating forecasts from these fashions suggests core CPI inflation is prone to stay above 3.5% through 2024,” writes Kiley.

BTC Worth Reacts Cautiously

At press time, the Bitcoin worth rapidly jumped above $31,000 earlier than retracing beneath $30,800. Within the coming hours, the market’s true valuation of the information stays to be seen.

As analyst Daan defined by way of Twitter, there may be typically an preliminary constructive market response to constructive CPI releases. This rally typically lasts between 5 and quarter-hour, after which it begins to roll over. The value then tends to search for liquidity just under the “information launch candle”.

Featured picture from iStock, chart from TradingView.com

[ad_2]