[ad_1]

BlackRock, the world’s largest asset supervisor with greater than $9 trillion in property underneath administration, has despatched ripples by way of the cryptocurrency market with its current submitting for a Bitcoin Trade-Traded Fund (ETF). Regardless of being dwelling to a number of the largest cryptocurrency exchanges, the USA doesn’t have any ETFs monitoring Bitcoin’s spot value attributable to regulatory constraints.

An ETF is a basket of securities—corresponding to shares—that tracks an underlying index. Within the case of a Bitcoin ETF, it might be designed to trace the spot value of Bitcoin. This gives a big benefit to buyers because it permits them to achieve publicity to the value of Bitcoin with out worrying in regards to the challenges of shopping for and storing the cryptocurrency themselves. Like different ETFs, the Bitcoin ETF may very well be purchased and bought on conventional inventory exchanges.

The anticipation of an business titan like BlackRock launching a Bitcoin ETF has sparked a renewed wave of Bitcoin accumulation inside the U.S., as evidenced by on-chain information from Glassnode.

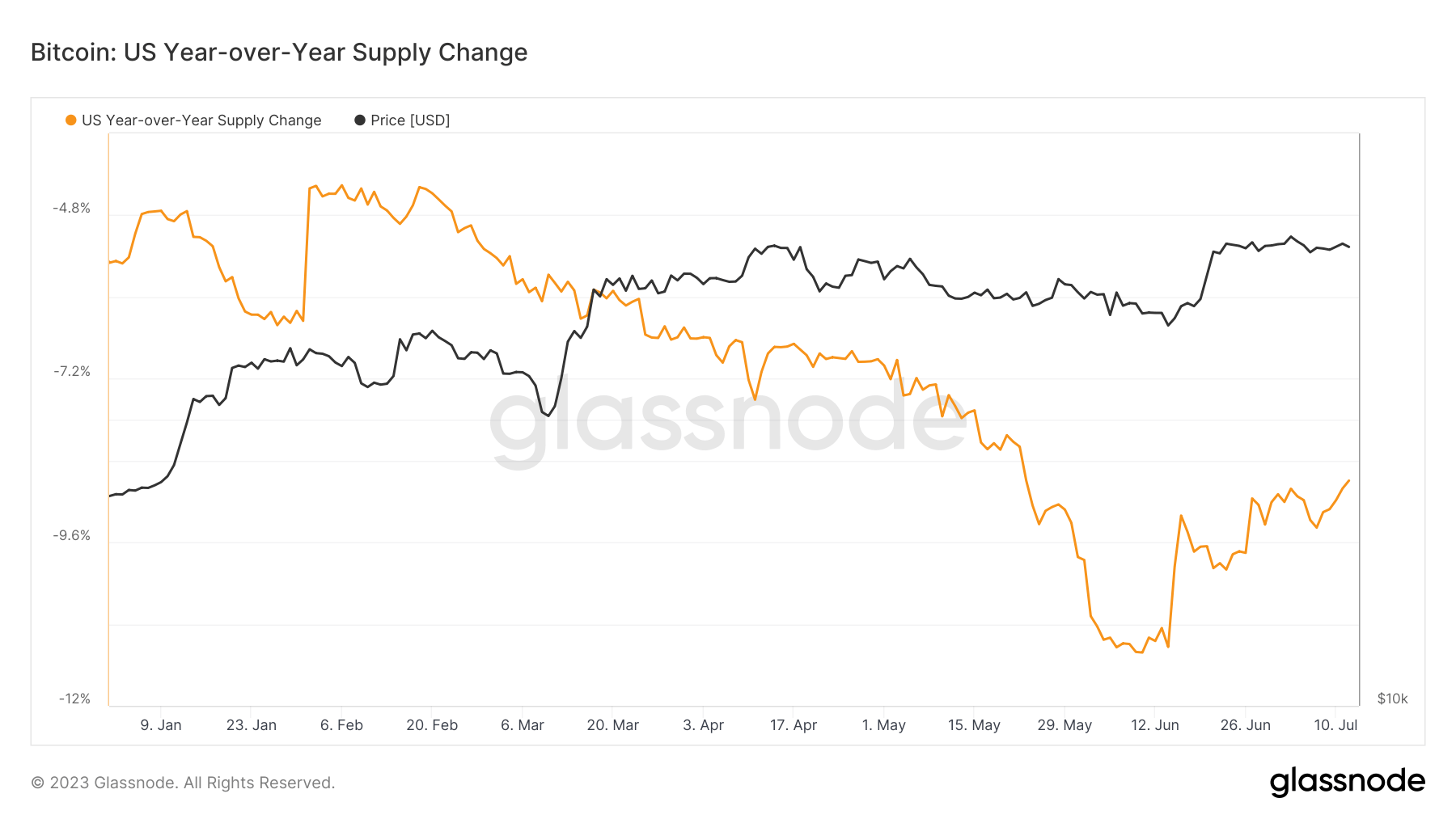

Glassnode’s information reveals a rise within the steadiness of Bitcoin held by U.S. entities for the reason that begin of this month, regardless of a downward development noticed year-on-year. Notably, the initiation of this surge seems to align with the announcement of BlackRock’s Bitcoin ETF submitting.

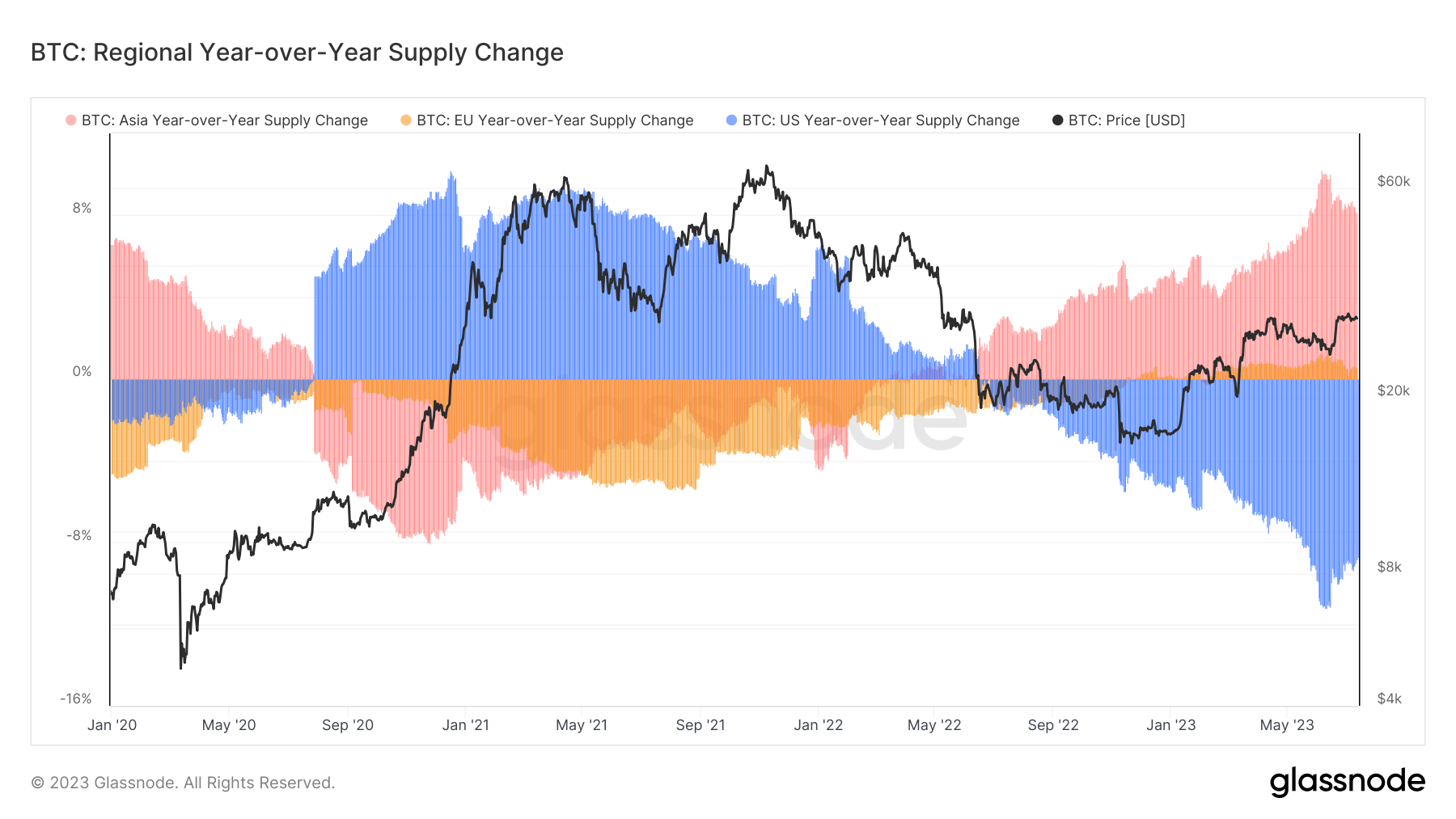

To find out the geographical location of Bitcoin entities, Glassnode compares transaction timestamps with the working hours of various geographical areas. By this technique, they’ll decide the most probably location of an entity, which gives a broader understanding of regional Bitcoin provide dynamics.

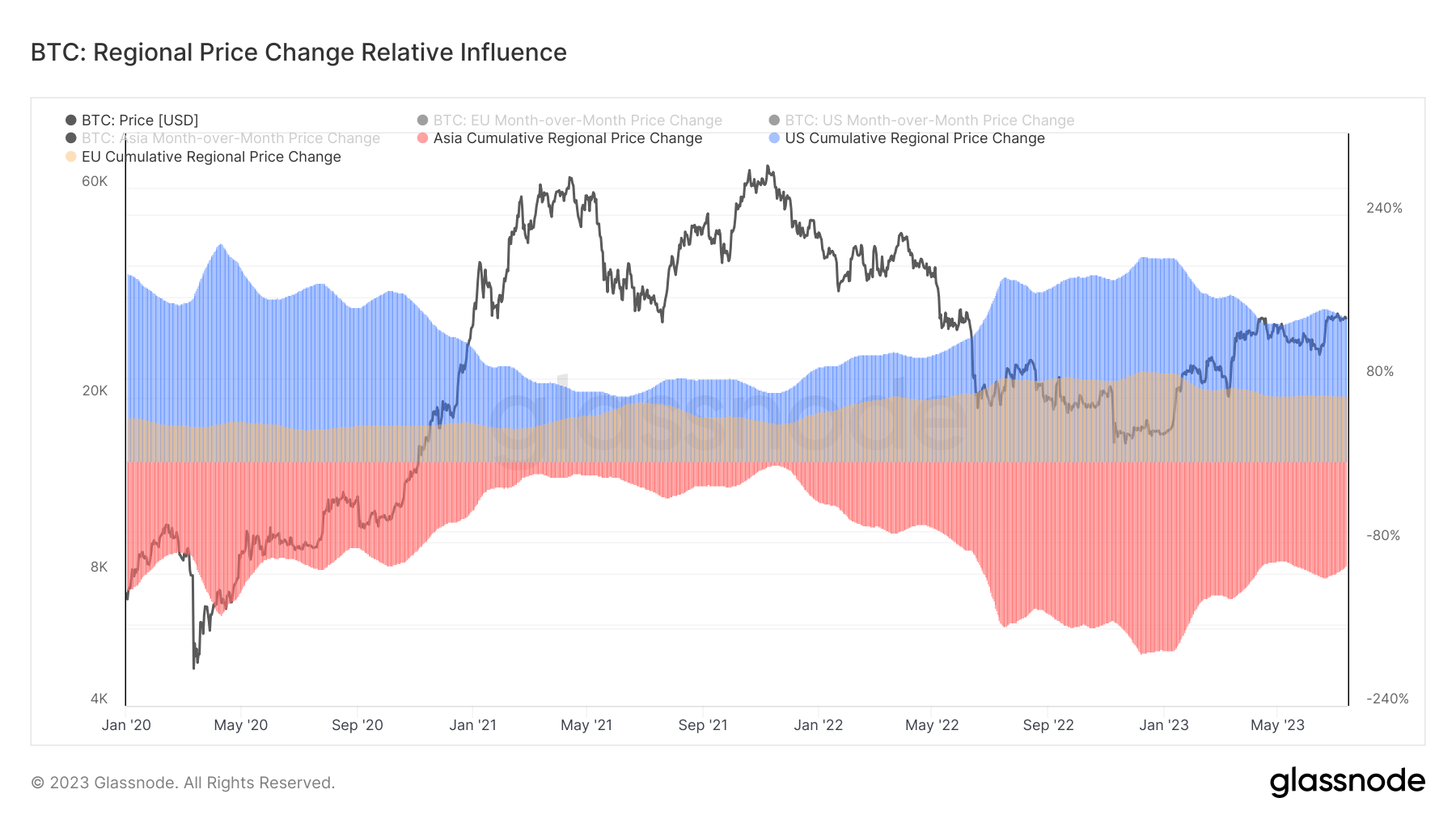

The revival of Bitcoin accumulation within the U.S. might sign a pivotal shift for the cryptocurrency market, contemplating the in depth affect of the U.S. market on Bitcoin’s value. Glassnode makes use of two fashions to calculate this affect: one examines cumulative value efficiency throughout buying and selling hours within the EU, U.S., and Asia; the opposite compares cumulative efficiency by area in opposition to the mixture whole. In response to these fashions, the U.S. exerts a regional market affect of 139.2%, a disproportionately excessive determine that underscores the outstanding position of the U.S. in world Bitcoin buying and selling.

The importance of BlackRock’s Bitcoin ETF submitting goes past simply value dynamics. Whereas a Bitcoin ETF, significantly one launched by a monetary behemoth like BlackRock, might doubtlessly usher in a brand new period of institutional and retail funding in Bitcoin, doubtlessly creating greater market liquidity, it’s additionally essential to think about potential regulatory challenges and dangers related to broader cryptocurrency adoption.

The submit BlackRock’s Bitcoin ETF submitting fuels U.S. accumulation appeared first on CryptoSlate.

[ad_2]