[ad_1]

Obtain free Non-fungible tokens updates

We’ll ship you a myFT Day by day Digest e mail rounding up the most recent Non-fungible tokens information each morning.

The chief govt of OpenSea, the world’s main non-fungible token market, has sought to distance NFTs from cryptocurrencies because the sector is hit by the knock-on affect of a collection of scandals.

Devin Finzer, 32, instructed the Monetary Instances that the crypto trade had seen “some setbacks just lately”, referencing the autumn of FTX, the cryptocurrency change that collapsed into chapter 11 in November serving to to set off a fall within the worth of digital property.

OpenSea soared in worth as NFTs, which may be on-line collectibles and digital artwork constructed upon the identical blockchain expertise as cryptocurrencies turned a hype-fuelled market over the previous two years.

However the head of New York-based firm insisted that NFTs retain a vibrant future, believing that buyers will proceed to spend real-world cash to accumulate digital photos and show them of their properties and in on-line digital areas.

“It’s not essentially the case that NFTs will all the time be purchased and offered denominated in cryptocurrency as they’re at this time,” he mentioned. “There are a selection of the explanation why that is sensible within the present ecosystem, however as we get broader and extra accessible, there isn’t a motive that NFTs couldn’t at the very least be denominated in US {dollars}.”

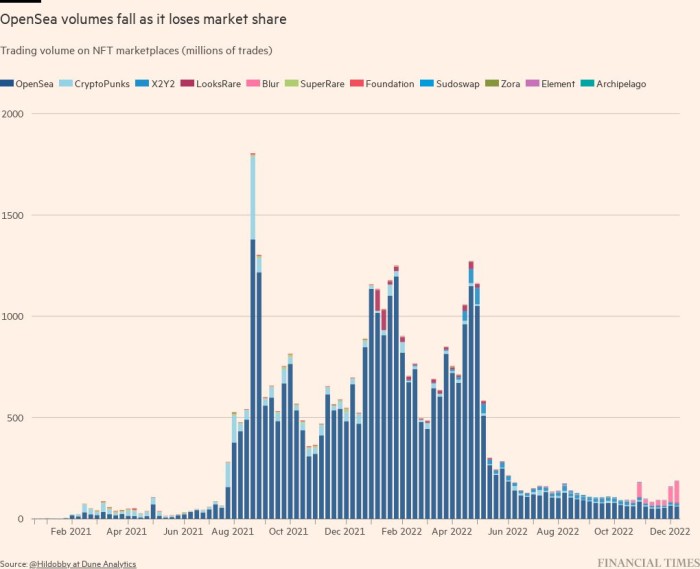

OpenSea has seen month-to-month buying and selling volumes in cryptocurrency ether fall 95 per cent from a $4.9bn peak in January final yr to $253mn in November, in keeping with information from a person named “rchen” on Dune Analytics, data that OpenSea directed the FT in the direction of because the personal firm doesn’t disclose its personal monetary figures. The day by day variety of NFTs offered in ether on the platform has dropped 68 per cent from a peak of two.3mn in January to 740,000 final month.

“NFTs don’t exist in a vacuum, there’s the general macro local weather which has modified dramatically, and that impacts shopper spending and the broader crypto local weather, which is experiencing a winter proper now,” Finzer mentioned.

The corporate lower 20 per cent of workers in July, with Finzer anticipating a “extended downturn” and leaving OpenSea with about 300 workers.

Finzer maintains that the corporate has a “wholesome runway”, having raised $423mn over a number of funding rounds since 2021, which noticed investments from enterprise capitalists Coatue and Andreessen Horowitz. Angels, together with Reddit founder Alex Ohanian, actor Ashton Kutcher and singer Shawn Mendes, additionally participated in earlier rounds.

OpenSea raised nearly all of its capital, $300mn, throughout its most up-to-date funding spherical introduced in January this yr, valuing the corporate at $13.3bn. It takes 2.5 per cent comission of the sale value on every transaction.

NFTs use blockchain expertise to certify possession of a digital asset, which is recorded on an immutable ledger of transactions. They use the identical expertise that underpins cryptocurrencies and are normally purchased and offered in cryptocurrencies equivalent to ether.

This yr, the crypto market has suffered a collection of scandals, together with the collapse of stablecoin terraUSD and a marketwide crash that noticed the worth of common tokens equivalent to bitcoin plummet. A raft of laws is being launched to control the risky trade, together with the UK’s Monetary Companies and Markets invoice and the EU’s Markets in Crypto-Belongings Regulation.

Governments and legislation enforcement our bodies worldwide are additionally deciding whether or not NFTs needs to be registered and disclosed as monetary securities.

“It’s actually necessary that regulators and authorities officers perceive that this isn’t the identical because the broader crypto trade the place there’s loads of focus round monetary use instances,” Finzer mentioned.

He mentioned the worth of NFTs needs to be determined by how folks have interaction with it, whether or not via utilizing tokens to attend unique occasions, play video games, or show digital paintings of their properties.

“It’s already the case that persons are utilizing Instagram [to share NFTs] with their mates,” Finzer mentioned. “[In future] increasingly more of your property could also be digital versus bodily artwork . . . proper now, it’s perhaps early adopters which might be displaying NFTs within their properties, however that could possibly be one thing that continues to occur increasingly more.”

[ad_2]