[ad_1]

I used to be planning to make use of this week to speak about Twitter vs Threads, however that may wait (the tl;dr although is Threads atm is a good place to put up content material & a horrible place to eat content material).

As a substitute we’re gonna do one thing I haven’t achieved in a lengthy time, a case examine on a selected NFT undertaking: Ether.

I used to do these on a regular basis. This Publication was constructed off the again of them. From Apymon to Apes, to Gutter Cats, to Pickles, Aliens, and Misfit College (anybody else feeling the nostalgia?)

Then it acquired to the purpose the place once I would write positively a couple of undertaking it could pump the value, and negatively and it could tank it, so I ended.

I consider the house has considerably matured and the mutterings of yours actually will now have a negligible influence available on the market. Extra importantly, I really feel like there’s a lot to be discovered by taking a look at Ether and hopefully by dissecting their selections we will all be taught a factor or two.

Let’s begin with the fundamentals.

This Publication is sponsored by the HeyMint launchpad, essentially the most complete and gasoline environment friendly no-code toolbox for creating and launching an NFT assortment.

I personally use and love this product — all ZenAcademy NFTs are launched utilizing HeyMint. Strive them out right here, and help this Publication within the course of.

In the event you’d prefer to sponsor this Publication and have your organization seen by 20,000+ crypto fanatics, please attain out to whats [email protected].

A great place to start. Except for being the native foreign money of the Ethereum blockchain everyone knows and love, Ether can also be a PFP undertaking.

In their very own phrases:

Ether is an anime-themed undertaking constructed on the Ethereum blockchain that mixes style, innovation, and story-telling. The undertaking consists of 5555 characters inside its universe. Aiming to change into one of many first luxurious manufacturers to make use of blockchain expertise to create high-quality clothes and collectibles, Venture Ether seeks to create a collaborative and immersive narrative that pushes the boundaries of what’s attainable.

So, principally, they’re one other undertaking attempting to construct an IP model off the again of a PFP assortment. They’re positioning themselves as a luxurious model from the get-go which is attention-grabbing, and so they tried to cost themselves consistent with that too however we’ll get to their pricing technique in a bit.

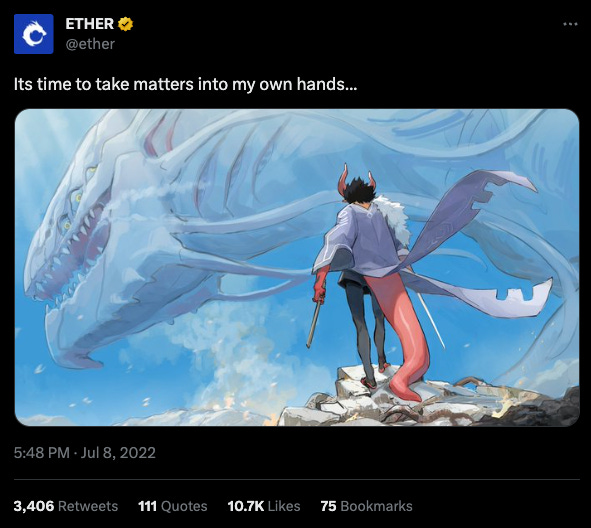

We are able to monitor their historical past again to July 8, 2022, when their Twitter account (fairly astonishingly they really acquired @ether), shared this tweet:

It obtained large hype and a number of it was on the again of the founding father of the undertaking, viii, an especially proficient digital artist who had been within the house for some time.

They started a whitelisting marketing campaign and would slowly add folks over time who confirmed a real curiosity within the IP and being a part of the journey.

This generated extra hype and pleasure and anticipation.

Then… they delayed the mint, introduced a very-high mint value, went twitter-radio-silent for six months, lowered the mint value, lowered the provision, lowered the mint value once more with a dutch public sale, elevated the royalties, and went from widespread admiration and help and pleasure to widespread fud.

The timeline of occasions:

2022

July 8: First Tweet

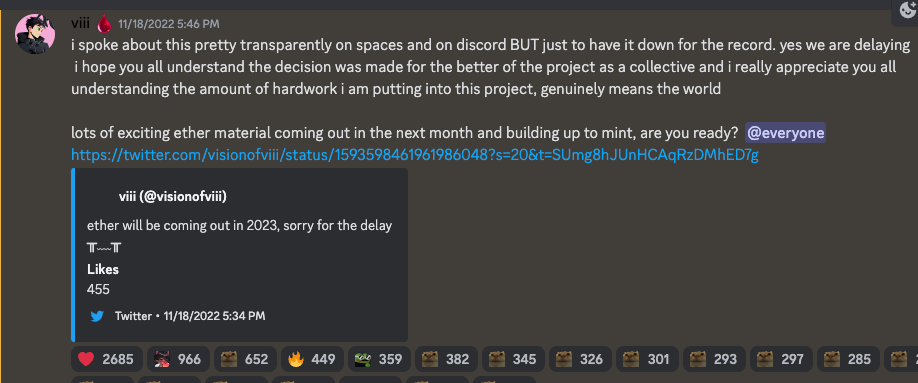

Nov 18: Mint delayed to 2023

Dec 10: Mint Value introduced, 1e (public) / 0.5e (whitelist)

Dec 21: First Video Trailer Tweeted

2023

June 6: Mint Value modified to 0.65e (public) / 0.35e (whitelist)

June 28: Second Video Trailer Tweeted (no tweets for earlier 6m)

June 30: WL Mint

July 2: Complete provide lowered from 10k to five,555

July 9: Public Mint

July 9: Public Mint paused after 200ish mints

July 12: New Plan to airdrop to current holders + truthful dutch public sale beginning at 0.45e → 0.15e

July 12: Guide Reveal begins

July 12: Remaining Assortment mints out at 0.3e

All instructed, they raised about 1,000 ETH ($1.87m) from the mint.

Not unhealthy, not unhealthy in any respect, particularly for this market — however a far cry from what they’d beforehand tried and hoped to lift (between 2000-9000 ETH).

Is the undertaking a hit? Relies upon who you ask, however for those who ask me, to lift 1,000 ETH from a mint on this market, it’s nonetheless a hit for the undertaking.

It’s now TBD the place they go from right here. They’ve far much less funds than they’d deliberate for, and can most likely must make some (extra) vital pivots within the route they take as a enterprise.

Extra importantly, I feel Ether highlights a pivotal second within the NFT house the place, lastly, individuals are waking up and attempting to decipher precisely why they want a lot cash, what precisely they’re constructing, and the way that worth would possibly funnel again to the holders.

I’ve suggested a number of tasks on this house, each formally and informally. One factor I recurrently harp on about is the significance of getting contingencies upon contingencies upon contingencies.

Our house is fickle and unpredictable and adjustments at breakneck speeds. The market is liable (and even probably) to considerably change from the inception of an concept to the day of mint. It’s even fairly prone to change within the 2 months main as much as mint day.

Loads of tasks have a Plan A. The mint value, the provision/assortment measurement, and so on. Then all the pieces else hinges on this Plan A. Their advertising and marketing technique, their mint-day technique, their post-mint technique. It’s all too usually primarily based on market situations from months prior, or predicted market situations primarily based on wishful considering.

However what occurs when all the NFT market crashes? What occurs when engagement is in any respect time lows? What occurs when one other assortment drops a massively extractive mint simply earlier than you do?

In the event you’re not ready for these eventualities, then you definitely scramble, and sadly, all too usually fumble.

I consider that’s what occurred with Ether, a couple of occasions.

Timing a mint is among the tougher issues to do on this house. You ideally need to launch when liquidity is excessive available in the market and individuals are feeling bullish. The issue right here is that neither of these items are in your management — so the very best you are able to do is choose a date and hope for the very best, or have your undertaking ready-to-go and wait till the market appears sizzling after which launch asap.

Neither possibility is especially interesting. A lot is left to the gods.

Ether acquired notably unfortunate with their timing as a result of Azuki Elementals had their drop simply prior, extracting 20,000 ETH from the market and crashing flooring throughout the board. Low liquidity + bearish sentiment, the precise reverse of what you need.

What might they’ve achieved? Maybe anticipated the occasion and pushed their launch as much as be forward of Azukis, however that’s far simpler stated than achieved.

They may (and may) have had a powerful Plan B, C, D, and so on, and pivoted forward of their first sale primarily based on market situations and sentiment.

One other factor to say on timing is the truth that there was a 1 week delay between the WL mint and the general public mint. That’s an infinite period of time in our house, the place consideration is brief lived. In contrast this to the alternative excessive, the place Azuki had a ten minute distinction between their varied mint phases (additionally a horrible transfer imo).

I might have instructed a a lot shorter window between WL mint and public, a a lot decrease mint value out the gate, and rather more transparency and communication about what they have been going to do with the funds. In 2023, individuals are more and more demanding transparency (and rightly so). This brings us to..

Each time Ether made a pivot and introduced a brand new method to their mint: lowered provide, lowered value, dutch public sale — it was met with widespread FUD. The important thing query being requested time and again (which was not likely correctly answered) was: why do you want all this cash, and what are you going to do with it?

The response was usually obscure and alongside the traces of “we’re constructing a luxurious model, clothes, collectible figurines, IP, and so on”. Once more — that is the kind of factor that may fly in 2021, and they’d have gotten away with in 2022, however in mid-2023 the market has matured fairly a bit to start to considerably query this method.

Much more — extra actual questions have been being requested. Okay so that you need to construct a luxurious model, what’s the group’s expertise in constructing a luxurious model? How are you going to take the mint funds and do this? What profit would possibly minters/holders get from being a part of this journey with you all?

Afaik, none of those questions have been appropriately answered.

There’s no denying that viii is an incredible artist, however there’s a Grand Canyon sized chasm between being an incredible artist and constructing a worldwide luxurious IP model.

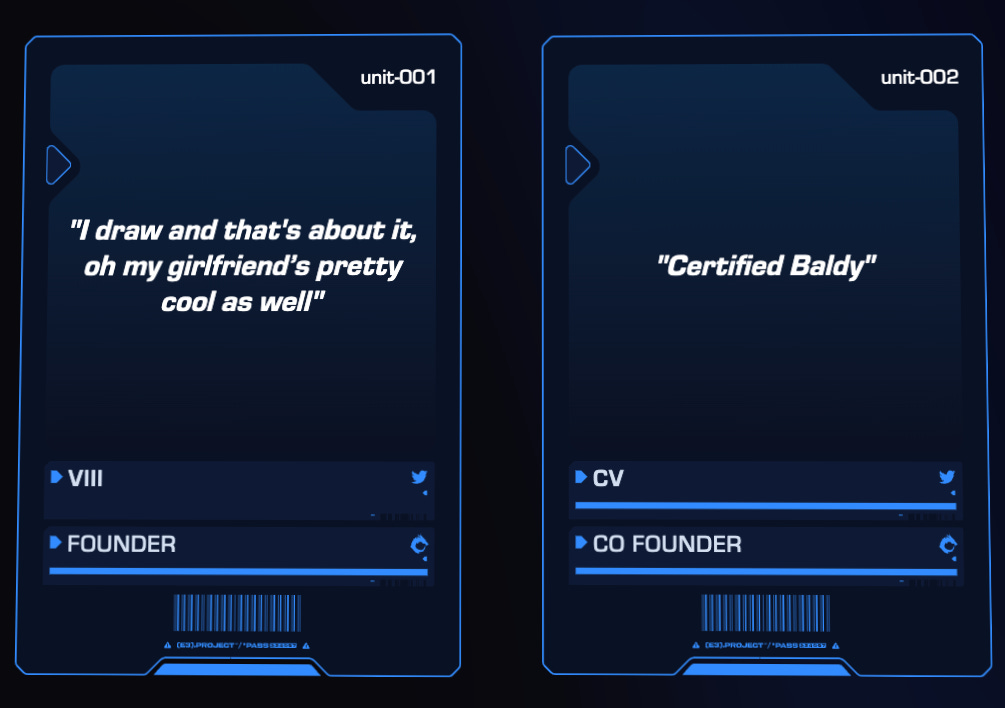

So what about the remainder of the group? That is the place extra FUD got here into query. The whole group is 2, undoxxed (nameless) folks:

Within the good/unhealthy ole days of mid 2021 to mid 2022, the market didn’t appear to care a lot about stuff like this. It led to hype and hypothesis and thriller and intrigue. Something and all the pieces beneath the solar would mint out, and mass liquidity was extracted from speculators attempting to gamble on tasks hoping for an enormous win.

As soon as once more — it’s mid 2023 now. Wanting again over essentially the most profitable tasks, folks usually need to see a group with expertise, with substance, and with a plan.

Sidenote however some folks took it amongst themselves to doxx each the founders of this undertaking, towards their needs. I wholeheartedly condemn that sort of behaviour. Doxxing folks will not be the web3 method. In the event you don’t like what they’re doing, don’t purchase what they’re promoting.

Given how vital the artwork is for this undertaking – it’s value having a look at it. Listed below are some samples:

Artwork is subjective, however having seen roughly eleventy million PFP tasks in my time within the house, I feel that is some very top quality artwork. Not all agree, and that’s effective.

One factor I’ll say although is that in relation to PFP artwork particularly, consideration must be made as to how effectively the artwork works as a PFP. How recognizable and identifiable is it? Are you able to distinguish one from one other? And so forth. To me, a number of the assortment is nice at this, however different components of the gathering are “too busy” and have a bit a lot occurring.

Once more, wonderful artwork, however maybe not essentially the most ultimate to make use of as a PFP (in my private opinion).

I consider and hope that Ether is the final undertaking we’ll ever see that mints out primarily based on the 2021 mannequin. Anon group, formidable but obscure roadmap, excessive mint value.

In 2021, tasks would mint out as a result of the vast majority of the minters have been seeking to generate income, and so they thought they might generate income by minting and flipping, or minting and holding for some time after which dumping on another person. Higher idiot idea at its best.

Now that we’ve seen market-wide collapse of PFP flooring costs, and we’re seeing increasingly tasks run out of runway and fold, plainly, lastly, the market is beginning to wisen up.

Not are we haphazardly throwing cash at any half-baked concept with a elaborate roadmap and an internet site filled with buzzwords. Folks need to know what the funds can be used for, what the marketing strategy is, how shopping for an NFT would possibly present them worth, utility, perks, longevity.

Notice that each one of that is for the “roadmap” type tasks, which can be fundraising with a purpose (ie to be an IP model). In terms of artwork, or much less utility primarily based tasks, a number of this doesn’t apply. Please maintain throwing cash at real artists and creators, we love them, and artwork = utility. Simply don’t ask for ponzinomics and wen moon.

Bringing this all again to Ether — the market in 2022 nonetheless had sufficient hopium and unrekt playing addicts that I consider that is precisely the kind of undertaking that may have minted out at the next value. Wouldn’t it have been profitable afterwards? That’s inconceivable to know. However take a look at how a lot help there was after they introduced their delay:

What modified from then till now? The market matured.

After all they nonetheless minted out, nevertheless it required a number of pivots and, once more, people-at-large usually are not notably pleased about it.

It is a good thread highlighting a number of the precise points folks appear to have with Ether: https://twitter.com/profleoeth/standing/1679414708032487425?s=46&t=sQ0QVUQyoiZQeVyh-DXZpg

The undertaking has minted out, and so they raised a non insignificant sum of money, particularly for a two-person group. There’s a group forming, though how a lot of it’s true supporters and ardent followers believing within the imaginative and prescient and the way a lot of it’s made up of the ultimate remnants of speculators on the lookout for unwitting exit liquidity.. is tough to know.

Does this imply Ether can’t succeed from right here? After all not. I’ve been on this house lengthy sufficient to know the way highly effective a powerful group could be if it types, and the way founders and leaders of tasks can flip essentially the most excessive FUD into success tales. Nevertheless it’s going to be a protracted and tough street forward for all concerned in the event that they’re “gonna make it”.

I actually do want them the very best. I’ve had some temporary interactions with Viii and he looks like an awesome particular person, with good intentions. This isn’t a rug pull, and so they don’t need to be labeled as scammers like so many have so shortly labeled them as.

Individuals are very fast accountable founders, and fewer fast to take private duty. In the end this can be a free and open market, and folks can (and can) vote with their wallets. It’s unhappy when folks throw their cash at scammers, it’s unhappy when folks throw their cash at ponzis, however no one is forcing them to.

99% of the time these individuals are themselves chasing greed and riches.

I hope for elevated transparency from the Ether group, and would implore all future undertaking founders and folks seeking to launch the same undertaking, to even be extra clear.

I’d additionally encourage everybody to have a plan B, C, D, and so on. The outdated fashions are (fortunately) crumbling, and what works sooner or later will most likely not be what has labored up till now.

In the event you’re going to lift 7 figures from the group, you’re going to wish to reply some primary questions on what you’re going to do with the cash.

In the event you’re going to mint or purchase an NFT, you need to be asking these primary questions.

It is best to know what you’re shopping for, and why you’re shopping for it, and be actually trustworthy with your self.

Have a method and stick with it.

Most significantly, assume for your self, and don’t hearken to the “influencers”.

Everybody has an agenda.

Thanks for studying! In the event you loved this, please contemplate subscribing – I ship out a free Publication each week with my ideas available on the market and deep dives on attention-grabbing subjects associated to web3.

If you wish to take it a step additional, choose up a free ZenAcademy Pupil ID and hop into our Discord server to hitch the dialog.

If you wish to take it one other step additional, contemplate shopping for a ZenChest — our paid membership token that may get you entry to our upcoming PFP undertaking, in addition to further utility inside our content material/education-based ecosystem.

Lastly, if you wish to be a part of my most unique group with direct entry to me and the flexibility to schedule video calls with me, contemplate a 333 Membership Move.

Irrespective of the trail you’re taking – I might completely like to have you ever as a part of ZenAcademy. We’re a group of lifetime learners.

We choose ebook golf equipment over night time golf equipment 📚

Disclaimer: The content material lined on this publication is not to be thought of as funding recommendation. I’m not a monetary adviser. These are solely my very own opinions and concepts. It is best to all the time seek the advice of with knowledgeable/licensed monetary adviser earlier than buying and selling or investing in any cryptocurrency associated product.

I personal no Ether belongings on the time of publishing this.

[ad_2]

On this platform, you can find a wide selection of casino slots from leading developers.

Visitors can experience traditional machines as well as modern video slots with vivid animation and interactive gameplay.

Even if you’re new or a seasoned gamer, there’s always a slot to match your mood.

online games

The games are instantly accessible anytime and compatible with PCs and smartphones alike.

No download is required, so you can jump into the action right away.

The interface is easy to use, making it quick to find your favorite slot.

Register now, and enjoy the world of online slots!

本站 提供 海量的 成人内容,满足 不同用户 的 喜好。

无论您喜欢 哪种类型 的 影片,这里都 种类齐全。

所有 资源 都经过 严格审核,确保 高质量 的 视觉享受。

女同性恋者

我们支持 各种终端 访问,包括 电脑,随时随地 自由浏览。

加入我们,探索 无限精彩 的 私密乐趣。

这个网站 提供 丰富的 成人资源,满足 各类人群 的 喜好。

无论您喜欢 什么样的 的 内容,这里都 种类齐全。

所有 内容 都经过 严格审核,确保 高清晰 的 视觉享受。

喷出

我们支持 多种设备 访问,包括 平板,随时随地 尽情观看。

加入我们,探索 无限精彩 的 成人世界。

这个网站 提供 丰富的 成人材料,满足 成年访客 的 兴趣。

无论您喜欢 哪一类 的 视频,这里都 一应俱全。

所有 内容 都经过 精心筛选,确保 高质量 的 观看体验。

性别

我们支持 各种终端 访问,包括 手机,随时随地 自由浏览。

加入我们,探索 绝妙体验 的 两性空间。

В этом ресурсе вы можете отыскать боту “Глаз Бога” , который может собрать всю информацию о любом человеке из открытых источников .

Этот мощный инструмент осуществляет поиск по номеру телефона и предоставляет детали из государственных реестров .

С его помощью можно проверить личность через Telegram-бот , используя фотографию в качестве поискового запроса .

пробив телефона через телеграм

Технология “Глаз Бога” автоматически обрабатывает информацию из множества источников , формируя структурированные данные .

Подписчики бота получают 5 бесплатных проверок для ознакомления с функционалом .

Платформа постоянно обновляется , сохраняя высокую точность в соответствии с стандартами безопасности .

Прямо здесь вы найдете мессенджер-бот “Глаз Бога”, позволяющий найти данные о человеке через открытые базы.

Бот функционирует по ФИО, обрабатывая публичные материалы в сети. Через бота можно получить пять пробивов и детальный анализ по фото.

Инструмент обновлен согласно последним данным и включает мультимедийные данные. Глаз Бога поможет найти профили в соцсетях и покажет сведения мгновенно.

https://glazboga.net/

Данный бот — идеальное решение в анализе людей через Telegram.

Здесь вы можете найти боту “Глаз Бога” , который позволяет проанализировать всю информацию о любом человеке из общедоступных баз .

Уникальный бот осуществляет проверку ФИО и предоставляет детали из соцсетей .

С его помощью можно узнать контакты через официальный сервис , используя автомобильный номер в качестве ключевого параметра.

пробить по номеру машины

Система “Глаз Бога” автоматически анализирует информацию из проверенных ресурсов, формируя структурированные данные .

Пользователи бота получают 5 бесплатных проверок для тестирования возможностей .

Сервис постоянно совершенствуется , сохраняя скорость обработки в соответствии с требованиями времени .

Здесь вы можете отыскать боту “Глаз Бога” , который способен собрать всю информацию о любом человеке из открытых источников .

Данный сервис осуществляет анализ фото и показывает информацию из государственных реестров .

С его помощью можно проверить личность через Telegram-бот , используя фотографию в качестве ключевого параметра.

база данных номеров телефонов

Алгоритм “Глаз Бога” автоматически собирает информацию из множества источников , формируя подробный отчет .

Клиенты бота получают ограниченное тестирование для проверки эффективности.

Решение постоянно развивается, сохраняя высокую точность в соответствии с требованиями времени .

Looking for exclusive 1xBet promo codes? This site offers working promotional offers like 1x_12121 for new users in 2024. Get €1500 + 150 FS as a welcome bonus.

Use trusted promo codes during registration to maximize your rewards. Enjoy no-deposit bonuses and special promotions tailored for casino games.

Discover monthly updated codes for global users with guaranteed payouts.

All voucher is checked for accuracy.

Grab limited-time offers like 1x_12121 to double your funds.

Valid for new accounts only.

https://images.google.bg/url?q=https://pvslabs.com/pages/1xbet_promo_code_in_bonus.htmlKeep updated with top bonuses – apply codes like 1x_12121 at checkout.

Enjoy seamless rewards with instant activation.

В этом ресурсе доступен мощный бот “Глаз Бога” , который анализирует сведения о любом человеке из проверенных платформ.

Система позволяет узнать контакты по ФИО , раскрывая информацию из онлайн-платформ.

https://glazboga.net/

This platform features comprehensive information about Audemars Piguet Royal Oak watches, including market values and design features.

Access data on iconic models like the 41mm Selfwinding in stainless steel or white gold, with prices averaging $39,939 .

Our database tracks secondary market trends , where limited editions can appreciate over time.

AP Royal Oak prices

Technical details such as water resistance are clearly outlined .

Check trends on 2025 price fluctuations, including the Royal Oak 15510ST’s retail jump to $39,939 .

Сертификация и лицензии — обязательное условие ведения бизнеса в России, гарантирующий защиту от непрофессионалов.

Обязательная сертификация требуется для подтверждения соответствия стандартам.

Для 49 видов деятельности необходимо получение лицензий.

https://ok.ru/group/70000034956977/topic/158862631418033

Игнорирование требований ведут к приостановке деятельности.

Дополнительные лицензии помогает усилить конкурентоспособность бизнеса.

Соблюдение норм — залог успешного развития компании.

Хотите найти ресурсы для нумизматов ? Эта платформа предоставляет всё необходимое погружения в тему нумизматики!

Здесь доступны редкие экземпляры из разных эпох , а также антикварные находки.

Просмотрите каталог с подробными описаниями и детальными снимками, чтобы найти раритет.

подробнее на сайте

Для новичков или профессиональный коллекционер , наши обзоры и руководства помогут углубить экспертизу.

Не упустите шансом приобрести эксклюзивные артефакты с гарантией подлинности .

Станьте частью сообщества ценителей и будьте в курсе аукционов в мире нумизматики.

Discover detailed information about the Audemars Piguet Royal Oak Offshore 15710ST via this platform , including pricing insights ranging from $34,566 to $36,200 for stainless steel models.

The 42mm timepiece showcases a robust design with automatic movement and rugged aesthetics, crafted in stainless steel .

Verified Audemars Royal Oak Offshore Diver 15710st review

Compare secondary market data , where limited editions fluctuate with demand, alongside pre-owned listings from the 1970s.

View real-time updates on availability, specifications, and resale performance , with trend reports for informed decisions.

Explore the iconic Patek Philippe Nautilus, a luxury timepiece that merges sporty elegance with refined artistry.

Launched in 1976 , this legendary watch revolutionized high-end sports watches, featuring distinctive octagonal bezels and textured sunburst faces.

For stainless steel variants like the 5990/1A-011 with a 45-hour power reserve to opulent gold interpretations such as the 5811/1G-001 with a azure-toned face, the Nautilus suits both discerning collectors and everyday wearers .

Verified Patek Philippe Nautilus 5712r photos

Certain diamond-adorned versions elevate the design with dazzling bezels , adding unparalleled luxury to the timeless profile.

According to recent indices like the 5726/1A-014 at ~$106,000, the Nautilus remains a prized asset in the world of luxury horology .

For those pursuing a vintage piece or modern redesign, the Nautilus epitomizes Patek Philippe’s legacy of excellence .

Access detailed information about the Audemars Piguet Royal Oak Offshore 15710ST via this platform , including market values ranging from $34,566 to $36,200 for stainless steel models.

The 42mm timepiece features a robust design with automatic movement and rugged aesthetics, crafted in stainless steel .

Pre-Owned Audemars Royal Oak Offshore 15710 review

Compare secondary market data , where limited editions fluctuate with demand, alongside pre-owned listings from the 1970s.

Request real-time updates on availability, specifications, and investment returns , with trend reports for informed decisions.

Discover detailed information about the Audemars Piguet Royal Oak Offshore 15710ST on this site , including market values ranging from $34,566 to $36,200 for stainless steel models.

The 42mm timepiece boasts a robust design with mechanical precision and water resistance , crafted in titanium.

Unworn Audemars Royal Oak 15710 st prices

Check secondary market data , where limited editions reach up to $750,000 , alongside vintage models from the 1970s.

Get real-time updates on availability, specifications, and resale performance , with trend reports for informed decisions.

Эта платформа собирает актуальные новостные материалы со всего мира.

Здесь доступны события из жизни, бизнесе и разных направлениях.

Новостная лента обновляется регулярно, что позволяет следить за происходящим.

Простой интерфейс помогает быстро ориентироваться.

https://malemoda.ru

Каждая статья написаны грамотно.

Целью сайта является честной подачи.

Присоединяйтесь к читателям, чтобы быть на волне новостей.

Монтаж видеокамер поможет защиту помещения в режиме 24/7.

Инновационные решения гарантируют высокое качество изображения даже при слабом освещении.

Мы предлагаем различные варианты устройств, идеальных для бизнеса и частных объектов.

установка и настройка видеонаблюдения

Качественный монтаж и сервисное обслуживание делают процесс эффективным и комфортным для каждого клиента.

Обратитесь сегодня, и узнать о лучшее решение в сфере безопасности.

Здесь доступен мессенджер-бот “Глаз Бога”, позволяющий найти всю информацию о человеке из открытых источников.

Сервис активно ищет по ФИО, обрабатывая актуальные базы онлайн. С его помощью доступны 5 бесплатных проверок и детальный анализ по запросу.

Сервис обновлен на 2025 год и охватывает фото и видео. Сервис гарантирует найти профили по госреестрам и отобразит сведения мгновенно.

глаз бога найти телефон

Данный инструмент — помощник для проверки граждан через Telegram.

Searching for free online games ? This site offers a diverse library of casual puzzles and action-packed quests .

Dive into cooperative missions with global players , supported by intuitive chat tools for seamless teamwork.

Enjoy customizable controls designed for effortless navigation , alongside parental controls for secure play.

casino online new zealand

From fantasy RPGs to creative builders, every game balances fun and emotional rewards.

Unlock freemium titles that let you play for free , with optional purchases for deeper access.

Join of a thriving community where creativity shines, and stay active through immersive storytelling.

Коллекция Nautilus, созданная Жеральдом Гентой, сочетает элегантность и прекрасное ремесленничество. Модель Nautilus 5711 с самозаводящимся механизмом имеет энергонезависимость до 2 дней и корпус из нержавеющей стали.

Восьмиугольный безель с округлыми гранями и циферблат с градиентом от синего к черному подчеркивают неповторимость модели. Браслет с H-образными элементами обеспечивает комфорт даже при активном образе жизни.

Часы оснащены функцией даты в позиции 3 часа и сапфировым стеклом.

Для версий с усложнениями доступны секундомер, лунофаза и функция Travel Time.

https://patek-philippe-nautilus.ru/

Например, модель 5712/1R-001 из розового золота с калибром повышенной сложности и запасом хода на двое суток.

Nautilus остается символом статуса, объединяя инновации и традиции швейцарского часового дела.

Нужно найти информацию о пользователе? Этот бот поможет детальный отчет в режиме реального времени .

Используйте продвинутые инструменты для поиска публичных записей в соцсетях .

Узнайте контактные данные или активность через автоматизированный скан с гарантией точности .

глаз бога бесплатно на телефон

Бот работает с соблюдением GDPR, используя только открытые данные .

Закажите расширенный отчет с историей аккаунтов и графиками активности .

Попробуйте надежному помощнику для исследований — точность гарантирована!

Хотите найти информацию о пользователе? Наш сервис поможет полный профиль в режиме реального времени .

Используйте уникальные алгоритмы для анализа публичных записей в соцсетях .

Узнайте контактные данные или интересы через автоматизированный скан с гарантией точности .

глаз бога телеграмм сайт

Система функционирует с соблюдением GDPR, используя только открытые данные .

Получите детализированную выжимку с геолокационными метками и графиками активности .

Доверьтесь проверенному решению для digital-расследований — результаты вас удивят !

Этот бот поможет получить информацию о любом человеке .

Укажите имя, фамилию , чтобы сформировать отчёт.

Система анализирует открытые источники и активность в сети .

глаз бога бот тг

Информация обновляется в реальном времени с проверкой достоверности .

Идеально подходит для анализа профилей перед сотрудничеством .

Конфиденциальность и актуальность информации — наш приоритет .

Хотите собрать данные о человеке ? Наш сервис предоставит детальный отчет в режиме реального времени .

Используйте продвинутые инструменты для поиска публичных записей в соцсетях .

Узнайте контактные данные или активность через систему мониторинга с гарантией точности .

глаз бога бесплатно на телефон

Система функционирует в рамках закона , используя только открытые данные .

Закажите детализированную выжимку с геолокационными метками и списком связей.

Доверьтесь проверенному решению для digital-расследований — точность гарантирована!

На данном сайте предоставляется информация по любому лицу, включая исчерпывающие сведения.

Архивы включают людей всех возрастов, профессий.

Данные агрегируются на основе публичных данных, обеспечивая точность.

Поиск выполняется по контактным данным, что делает использование быстрым.

глаз бога программа

Дополнительно можно получить контакты и другая актуальные данные.

Все запросы проводятся с соблюдением правовых норм, обеспечивая защиту утечек.

Обратитесь к предложенной системе, чтобы найти нужные сведения без лишних усилий.

В этом ресурсе доступна сведения о любом человеке, в том числе подробные профили.

Базы данных охватывают граждан всех возрастов, мест проживания.

Информация собирается по официальным записям, подтверждая точность.

Обнаружение выполняется по имени, что делает процесс эффективным.

глаз бога телеграмм регистрация

Также доступны места работы а также актуальные данные.

Работа с информацией обрабатываются в рамках законодательства, что исключает утечек.

Воспользуйтесь предложенной системе, для поиска искомые данные максимально быстро.

Нужно найти информацию о человеке ? Наш сервис поможет полный профиль в режиме реального времени .

Воспользуйтесь продвинутые инструменты для поиска цифровых следов в открытых источниках.

Выясните место работы или интересы через систему мониторинга с гарантией точности .

глаз бога поиск людей

Система функционирует в рамках закона , используя только общедоступную информацию.

Закажите расширенный отчет с историей аккаунтов и списком связей.

Попробуйте проверенному решению для исследований — результаты вас удивят !

Хотите найти информацию о человеке ? Наш сервис предоставит детальный отчет мгновенно.

Используйте уникальные алгоритмы для анализа публичных записей в соцсетях .

Узнайте место работы или активность через систему мониторинга с гарантией точности .

телеграм бот глаз бога проверка

Система функционирует с соблюдением GDPR, используя только общедоступную информацию.

Закажите расширенный отчет с геолокационными метками и графиками активности .

Попробуйте надежному помощнику для digital-расследований — точность гарантирована!

Online platforms offer a innovative approach to connect people globally, combining user-friendly features like photo verification and compatibility criteria.

Core functionalities include video chat options, geolocation tracking , and detailed user bios to enhance interactions .

Smart matching systems analyze behavioral patterns to suggest potential partners , while privacy settings ensure safety .

https://rampy.club/dating/the-shift-toward-authentic-adult-content/

Leading apps offer freemium models with enhanced visibility, such as priority in search results, alongside real-time notifications .

Whether seeking long-term relationships, these sites cater to diverse needs , leveraging AI-driven recommendations to optimize success rates .

Las prácticas de juego seguro es un conjunto de principios éticos diseñadas para garantizar seguridad y proteger a jugadores vulnerables en la industria iGaming.

Operadores están obligados a ofrecer herramientas como límites de apuesta , permitiendo a usuarios gestionar el tiempo invertido.

La identificación del jugador es clave para cumplir regulaciones legales, un pilar fundamental en cualquier estrategia de juego responsable.

https://jposters.com.ar/1xbet

Capacitación sobre riesgos ayudan a fomentar hábitos saludables, con soporte disponible vía líneas de ayuda .

Claridad sobre probabilidades refuerza la confianza , alineando negocio con estándares internacionales .

Нужно найти данные о человеке ? Этот бот предоставит детальный отчет в режиме реального времени .

Воспользуйтесь продвинутые инструменты для анализа цифровых следов в соцсетях .

Выясните контактные данные или интересы через автоматизированный скан с гарантией точности .

глаз бога поиск по телеграм

Система функционирует с соблюдением GDPR, используя только общедоступную информацию.

Получите детализированную выжимку с историей аккаунтов и графиками активности .

Доверьтесь проверенному решению для digital-расследований — результаты вас удивят !

¿Necesitas una piscina de jardín ? Las marcas Intex y Bestway ofrecen diseños versátiles para todas las familias .

Sus piscinas de estructura metálica garantizan estabilidad en cualquier clima, mientras que los modelos hinchables son ideales para niños .

Colecciones destacadas incluyen bombas de arena , asegurando higiene óptima .

Para espacios reducidos , las piscinas familiares de 6 m se adaptan perfectamente .

Opciones adicionales como cobertores térmicos, escaleras de seguridad y juegos inflables aumentan la diversión.

Con garantía del fabricante , estas piscinas ofrecen valor a largo plazo .

https://www.mundopiscinas.net

Доставка грузов из Китая в Россию осуществляется через морские каналы, с таможенным оформлением на в портах назначения.

Импортные сборы составляют в диапазоне 15–20%, в зависимости от категории товаров — например, готовые изделия облагаются по максимальной ставке.

Для ускорения процесса используют альтернативные схемы, которые быстрее стандартных методов , но связаны с повышенными рисками .

Доставка грузов из Китая

В случае легальных перевозок требуется предоставить паспорта на товар и акты инспекции, особенно для сложных грузов .

Сроки доставки варьируются от нескольких дней до месяца, в зависимости от удалённости пункта назначения и эффективности таможни .

Общая цена включает транспортные расходы, налоги и услуги экспедитора, что влияет на рентабельность поставок.

For years, I assumed medicine was straightforward. Doctors give you pills — you don’t question the process. It felt clean. Then cracks began to show.

At some point, I couldn’t focus. I blamed stress. Still, my body kept rejecting the idea. I watched people talk about their own experiences. No one had warned me about interactions.

It finally hit me: your body isn’t a template. Two people can take the same pill and walk away with different futures. Reactions aren’t always dramatic — just persistent. And still we keep swallowing.

Now I question more. Not because I don’t trust science. I challenge assumptions. But I don’t care. I’m not trying to be difficult — I’m trying to stay alive. The turning point, it would be zithromax alcohol.

La gamme MARQ® de Garmin représente un summum de luxe avec des matériaux premium comme le titane Grade-5 et connectivité avancée .

Adaptée aux activités variées, elle allie robustesse et autonomie prolongée , idéale pour les aventures en extérieur grâce à ses modes sportifs.

Avec une batterie allant jusqu’à plusieurs jours selon l’usage, cette montre reste opérationnelle dans des conditions extrêmes, même lors de activités exigeantes.

https://www.garmin-boutique.com/forerunner/forerunner-255-bleue.aspx“>forrunner

Les outils de suivi incluent la surveillance du sommeil , accompagnées de notifications intelligentes , pour les amateurs de fitness .

Intuitive à utiliser, elle s’adapte à vos objectifs, avec une interface tactile réactive et synchronisation sans fil.

The Audemars Piguet Royal Oak revolutionized luxury watchmaking with its distinctive eight-sided design and bold integration of sporty elegance .

Spanning styles like skeleton dials to meteorite-dial editions, the collection merges avant-garde aesthetics with precision engineering .

Priced from $20,000 to over $400,000, these timepieces cater to both veteran enthusiasts and modern connoisseurs seeking timeless value.

https://prbookmarkingwebsites.com/story24569013/watches-audemars-piguet-royal-oak-luxury

The Perpetual Calendar models push boundaries with innovative complications , highlighting Audemars Piguet’s technical prowess .

Featuring ultra-thin calibers like the 2385, each watch celebrates the brand’s legacy of craftsmanship .

Discover exclusive releases and collector-grade materials to deepen your expertise .

Женская сумка — это неотъемлемый аксессуар, которая акцентирует образ каждой особы.

Сумка способна вмещать повседневные мелочи и структурировать личные задачи.

Благодаря разнообразию моделей и цветовой гаммы она завершает каждый наряд.

сумки Dior

Это символ роскоши, который раскрывает уровень достатка своей владелицы.

Каждая модель выражает настроение через оригинальные решения, раскрывая внутренний мир женщины.

От миниатюрных сумочек до вместительных шоперов — сумка адаптируется под ваши потребности.

Марка Balenciaga славится стильными изделиями, созданными фирменной эстетикой.

Каждый аксессуар обладает уникальным дизайном , такие как контрастные строчки.

Используемые материалы гарантируют премиальное качество сумки.

сумки Balenciaga обзоры

Востребованность коллекций сохраняется в элите, превращая приобретение статусным жестом .

Эксклюзивные коллекции создают шанс владельцу заявить о вкусе в повседневке.

Инвестируя в сумки Balenciaga , вы приобретаете роскошную вещь, и символ эстетики.

Сумки Prada представляют собой вершиной моды за счёт их уникальному дизайну .

Используемые материалы гарантируют износостойкость, а ручная сборка демонстрирует мастерство бренда.

Узнаваемые силуэты дополняются знаковым логотипом , формируя неповторимый стиль .

сумка Prada фото

Эти аксессуары подходят для повседневного использования , демонстрируя практичность в любой ситуации .

Эксклюзивные коллекции подчеркивают индивидуальность образа, превращая каждую модель в инвестицию в стиль .

Наследуя традиции бренд развивает новые решения, сохраняя классическому шарму в каждой детали .

Сумки Longchamp — это образец шика, где соединяются классические традиции и современные тенденции .

Изготовленные из высококачественной кожи , они отличаются неповторимым дизайном .

Сумки-трансформеры пользуются спросом у модников уже десятилетия.

шопер Prada купить

Каждая сумка ручной работы подчеркивает индивидуальность , оставаясь универсальность в любых ситуациях .

Бренд следует наследию, внедряя современные методы при сохранении качества.

Выбирая Longchamp, вы делаете стильный аксессуар , а становитесь частью легендарное сообщество.

Hello, dedicated seekers of ultimate body harmony! I once got trapped in the glittering guise of speedy symptom suppressors, snatching them eagerly whenever wellness warnings echoed. However, vital insights burst through, revealing that such temporary shields risked deeper health decay, fueling a passionate pursuit for the pillars of sustainable mental and bodily health. It invigorated my entire being, validating how strategic, wellness-amplifying choices enhance our innate health defenses and glow, rather than threatening our overall well-being.

During an intense battle for better health, I rejected outdated health norms, uncovering advanced strategies for optimal health that fuse restorative habits with cutting-edge preventive medicine. Lock in for the health-highlighting twist: tadacip 20, where on the iMedix podcast we explore its profound impacts on health with transformative tips that’ll inspire you to tune in now and revitalize your life. This health revelation reconstructed my foundation: well-being flourishes through integrated body-mind harmony, careless overreliance weakens holistic defenses. Today, I’m energized by this health mission to invite you into health enlightenment, envisioning wellness as your lifelong health adventure.

Delving into health’s deepest layers, It illuminated my health perspective healing methods ought to empower and sustain, free from overshadowing personal health control. It’s a narrative rich in transformative health growth, challenging you to overhaul your everyday health habits for authentic, thriving well-being. And the health hook that pulls you deeper: balance.

Bold metallic fabrics dominate 2025’s fashion landscape, blending futuristic elegance with eco-conscious craftsmanship for everyday wearable art.

Unisex tailoring challenge fashion norms, featuring asymmetrical cuts that adapt to personal style across formal occasions.

AI-curated patterns merge digital artistry , creating one-of-a-kind textures that shift in sunlight for personalized expression.

https://tagintime.com/

Circular fashion techniques lead the industry , with biodegradable textiles celebrating resourcefulness without compromising luxurious finishes .

Holographic accessories elevate minimalist outfits , from nano-embroidered handbags to 3D-printed footwear designed for modern practicality .

Vintage revival meets techwear defines the year, as 2000s logomania reimagine classics through smart fabric technology for forward-thinking style.

Shimmering liquid textiles dominate 2025’s fashion landscape, blending cyberpunk-inspired aesthetics with sustainable innovation for everyday wearable art.

Gender-fluid silhouettes break traditional boundaries , featuring asymmetrical cuts that adapt to personal style across casual occasions.

Algorithm-generated prints merge digital artistry , creating hypnotic color gradients that react to body heat for dynamic visual storytelling .

https://metamoda.ru/moda/599-doja-cat-vyzvala-bezumie-v-tope-i-yubke-iz-pishchevoy-plenki-s-rezhisserom-vetements-guram-gvasalia/

Circular fashion techniques lead the industry , with biodegradable textiles reducing environmental impact without compromising luxurious finishes .

Light-refracting details elevate minimalist outfits , from solar-powered jewelry to self-cleaning fabrics designed for modern practicality .

Retro nostalgia fused with innovation defines the year, as 90s grunge textures reinterpret archives through smart fabric technology for timeless relevance .

Die Rolex Cosmograph Daytona ist ein Meisterwerk der chronographischen Präzision , kombiniert sportliches Design mit technischer Perfektion durch das bewährte Automatikal movement.

Verfügbar in Weißgold überzeugt die Uhr durch ihre zeitlose Ästhetik und handgefertigte Details, die passionierte Sammler überzeugen.

Mit einer Gangreserve von bis zu drei Tagen ist sie ideal für den Alltag und zeigt sich als zuverlässiger Begleiter unter extremsten Umständen.

Cosmograph Daytona 116503 damenuhren

Das charakteristische Zifferblatt mit Perlmutt-Einsätzen betonen den luxuriösen Touch, während die kratzfeste Saphirglase Zuverlässigkeit sicherstellen.

Seit ihrer Einführung 1963 bleibt sie ein Maßstab der Branche, geschätzt für ihre Seltenheit bei Investoren weltweit.

Ob im Rennsport inspiriert – die Cosmograph Daytona verbindet Tradition und bleibt als zeitloser Klassiker für wahre Kenner.

The Rolex Cosmograph Daytona Rainbow showcases horological excellence with its colorful ceramic chapter ring.

Made from 18k white gold , it blends precision timing features with elegant aesthetics .

Produced as exclusive editions , this timepiece captivates watch connoisseurs worldwide.

Cosmograph Daytona Rainbow buy

Every gradient stone on the bezel creates a spectrum that enhances visibility .

Driven by Rolex’s in-house Caliber 4130 , it ensures reliable performance for enduring legacy.

More than a watch , the Daytona Rainbow reflects Rolex’s innovation in the finest craftsmanship.

Find a wealth of fascinating and valuable resources here .

From detailed tutorials to daily updates , you’ll find for everyone .

Keep updated with regularly updated content built to educate while also support readers .

Our platform offers an intuitive navigation ensuring you can discover resources you need .

Connect with of thousands of users who appreciate our high-quality content regularly .

Dive in now and discover endless possibilities these resources has to offer .

https://abathingape.us

Les modèles connectées intègrent des outils innovantes au quotidien.

Dotées de GPS précis combinés avec moniteur cardiaque , ces montres s’adaptent selon vos niveaux.

La durée peut aller jusqu’à plus de deux semaines en utilisation normale , idéale pour activités intenses .

Garmin Fenix 6 Pro

Les métriques analysent les étapes en plus de les calories, offrant complet .

Faciles à configurer , ces montres se synchronisent facilement dans votre vie, avec un design ergonomique.

Découvrir ces modèles c’est profiter de une technologie fiable dans la gestion de votre quotidien.

Хорошая автомобильная резина — это залог безопасности на дороге, гарантирующая точное управление даже в сложных погодных условиях .

Правильно подобранные покрышки предотвращают потери контроля во время дождя , сохраняя вашу безопасность .

Покупка проверенных покрышек экономят средства на обслуживание за счёт оптимального качения .

Точный отклик руля обеспечивается правильного давления, вместе с составом резиновой смеси .

Контроль глубины протектора защищает от повреждения дисков , гарантируя комфорт вождения .

Отнеситесь серьёзно к выбору — это напрямую влияет уверенность за рулём на любом маршруте .

https://hackernoon.com/preview/68a045798cca88b32af6d9ad

Современные системы отслеживания рабочих смен помогают оптимизировать производительности .

Автоматизация процессов сокращает неточности в планировании графиков.

Администраторам удобнее анализировать проектные задачи в режиме реального времени .

https://bwingiris.net/tech/why-do-companies-need-hr-analytics-for/

Сотрудники пользуются гибким графиком для отслеживания .

Использование цифровых решений заметно оптимизирует управленческие задачи в кратчайшие сроки.

Такой подход обеспечивает прозрачность между отделами , повышая результативность персонала .

Our app allows you to change clothes on photos.

It uses smart technology to adjust outfits naturally.

You can experiment with multiple styles right away.

xnudes.ai|Perfect Clothing Changer Neuro Tool

The results look convincing and stylish.

It’s a useful option for shopping.

Add your photo and select the clothes you want.

Start using it right away.

At this page you can discover a lot of useful information.

It is created to support you with different topics.

You will find easy-to-read explanations and real examples.

The content is frequently refreshed to stay relevant.

https://aldv.info

It’s a excellent resource for self-development.

Every visitor can take advantage of the materials here.

Feel free to reading the site today.

Our app allows you to replace clothes on photos.

It uses artificial intelligence to match outfits naturally.

You can experiment with various styles in seconds.

Superb Clothes Changer AI Web Tool

The results look authentic and professional.

It’s a useful option for shopping.

Add your photo and pick the clothes you want.

Begin trying it right away.

Ища агентство недвижимости, важно обращать внимание на его надёжность.

Хорошее агентство всегда имеет отзывы клиентов, которые легко найти.

Также обратите внимание, есть ли официальная лицензия.

Серьёзные компании сотрудничают только на основе контрактов.

Съёмка дроном в Казани

Важно, чтобы у агентства был практика на рынке не меньше нескольких лет.

Проверьте, насколько прозрачно компания раскрывает условия сделок.

Ответственный риэлтор всегда готов ответить на ваши сомнения.

Выбирая агентство, доверьтесь не просто словам, а реальной практике.

Выбор остеопата — важный этап на пути к реабилитации.

Сначала стоит уточнить свои проблемы и запросы от терапии у специалиста.

Полезно оценить подготовку и стаж выбранного врача.

Отзывы клиентов помогут сделать уверенный выбор.

https://ok.ru/profile/584977149666/statuses/157236532638690?utm_campaign=web_share

Также необходимо обратить внимание техники, которыми пользуется остеопат.

Стартовая сессия даёт возможность оценить, насколько подходит вам общение и подход специалиста.

Стоит также оценить цены и режим сотрудничества (например, онлайн).

Взвешенный выбор врача позволит улучшить процесс восстановления.

The platform offers tons of interesting and helpful materials.

On this site, you can discover different sections that cover many popular themes.

Every post is created with care to accuracy.

The content is frequently refreshed to keep it up-to-date.

Users can gain fresh knowledge every time they come here.

It’s a great source for those who are interested in thoughtful reading.

A lot of visitors say this website to be well-organized.

If you’re looking for well-written information, you’ll certainly discover it here.

https://seasonalallergies.us

Creative photography often focuses on expressing the harmony of the natural shape.

It is about composition rather than surface.

Experienced photographers use soft lighting to create emotion.

Such images celebrate delicacy and individuality.

https://xnudes.ai/

Every shot aims to tell a story through form.

The purpose is to portray natural harmony in an elegant way.

Viewers often appreciate such work for its depth.

This style of photography unites technique and vision into something truly unique.

Artistic photography often focuses on expressing the harmony of the human form.

It is about composition rather than surface.

Experienced photographers use soft lighting to convey atmosphere.

Such images capture delicacy and personality.

https://xnudes.ai/

Every frame aims to show emotion through movement.

The purpose is to show natural harmony in an elegant way.

Observers often admire such work for its depth.

This style of photography blends art and vision into something truly unique.

Modern online platforms for grown users provide a range of interesting features.

These platforms are designed for meeting new people and exploring ideas.

Participants can find others who have similar values.

Many of these sites focus on safe interaction and positive communication.

https://alongwalker.info/2025/10/07/home-sex-tape-exploring-authenticity-in-adult-entertainment/

The interface is usually intuitive, making it easy to navigate.

Such platforms enable people to express themselves in a open online environment.

Security remains an essential part of the user experience, with many sites offering control tools.

Overall, these platforms are created to support open discussion in a safe digital space.

Онлайн сайты общения позволяют пользователям общаться в удобном формате.

Такое взаимодействие расширяет кругозор.

Большинство людей отмечают, что современные платформы способствуют отдохнуть после ежедневных дел.

Это простой вариант для поиска общения.

https://mgorod.info/populyarnye-trendy-2025/seks-russkoe-video-trendy-i-vospriyatie-onlajn-kontenta/

Самое важное — сохранять вежливость и уважение в переписке.

Лёгкое общение способствует восприятие жизни.

Такие ресурсы разработаны для тех, кто хочет найти интересных собеседников.

Современные сервисы становятся способом провести время с пользой.

Выбор подрядчика — ответственный момент при реализации застройки.

Прежде чем заключить договор, стоит изучить отзывы исполнителя.

Компетентная компания всегда гарантирует качественные услуги.

Необходимо проверить, какие материалы входят в работу при строительстве.

https://exchange.prx.org/playlists/434434

Collaboration with influencers has become one of the key approaches in modern promotion.

It enables companies to reach their followers through the voice of content creators.

Creators share content that boost engagement in a product.

The main advantage of this approach is its genuine communication.

Yoloco

People tend to engage more actively to personal recommendations than to traditional advertising.

Brands can effectively choose partners to reach the right market.

A strategic influencer marketing campaign enhances visibility.

As a result, this type of promotion has become an essential part of digital communication.

????????? ??????????? ??????? ?????????? ?? ?????????? ?????????.

?????? ?????, ?? ??????????????? ?? ???????????? ????????????, ??? ?????.

???? ?????? ??????? ?????? ? ????????.

???????????? ??????? ?? ????????? ??????, ???? ??? ????????? ????????????.

fortuna distillery

???????? ?????? ???????????, ? ?????? ???????????.

?? ??? ??????? ?????, ???????? ? ???? ???????.

??????????? ???????? ?????? ???????? ???????????.

??????? ???????????? ????????, ?? ???????????? ???? ????????? ????????????.

Интеллектуальные онлайн-сервисы для мониторинга источников становятся всё более удобными.

Они позволяют изучать открытые данные из разных источников.

Такие боты используются для аналитики.

Они способны оперативно обрабатывать большие объёмы информации.

глаз бога 18+ онлайн

Это помогает получить более точную картину событий.

Отдельные системы также обладают функции визуализации.

Такие сервисы широко используются среди исследователей.

Эволюция технологий позволяет сделать поиск информации доступным и удобным.

Аренда спецтехники сегодня считается удобным решением для предприятий.

Она даёт возможность реализовывать проекты без необходимости покупки оборудования.

Организации, предлагающие такую услугу, обеспечивают ассортимент спецоборудования для любых задач.

В парке можно найти погрузчики, самосвалы и другие виды техники.

https://stroy-mart.ru/zametki/arenda-mini-pogruzchikov-vygodnoe-reshenie-dlya-stroitelstva-i-uborki-territorii/

Основное достоинство аренды — это гибкость.

Кроме того, арендатор имеет доступ к исправную технику, поддерживаемую в порядке.

Опытные компании оформляют понятные договоры аренды.

Таким образом, аренда спецтехники — это практичный выбор для тех, кто ищет эффективность в работе.

Выбор интернет-маркетингового агентства — важный этап в развитии компании.

До того как начать работу, стоит изучить опыт выбранного агентства.

Надёжная команда всегда действует на основе исследований и ориентируется на цели клиента.

Важно уточнить, какие услуги применяет агентство: SMM, контент-маркетинг и другие направления.

https://logistic-routes.ru/3517875-vzlet-media-zapuskaet-innovacionnuyu-uslugu-prodvizheniya-v-ai-3mf/

Плюсом является прозрачная коммуникация и достижимые результаты.

Рекомендации помогут сделать вывод, насколько результативно агентство ведёт кампании.

Не стоит ориентироваться только на стоимости услуг, ведь качество продвижения зависит от опыта специалистов.

Грамотный выбор digital-агентства позволит укрепить позицию и увеличить прибыль.

Проверенный напиток выделяется чистым вкусом и отсутствием посторонних примесей.

Основным показателем качества является прозрачность напитка.

Настоящие бренды всегда уделяют внимание этапы изготовления.

Упаковка также служит показателем о качестве продукта.

fortuna

Законная маркировка — ещё один признак подлинности.

Настоящий алкоголь редко вызывает жжения в горле.

Необходимо покупать алкогольные напитки у официальных продавцов.

Осознанный подход к выбору напитков поможет сохранить здоровье.

Нейросетевые боты для мониторинга источников становятся всё более удобными.

Они дают возможность находить публичные данные из интернета.

Такие решения подходят для исследований.

Они могут оперативно систематизировать большие объёмы данных.

бот глаза бога в телеграмм

Это способствует создать более точную картину событий.

Многие системы также предлагают удобные отчёты.

Такие платформы популярны среди специалистов.

Развитие технологий делает поиск информации эффективным и быстрым.

Maintaining control while gaming is crucial for ensuring a balanced gaming experience.

It helps users appreciate the activity without harmful effects.

Understanding your boundaries is a key part of mindful gaming.

Players should define clear time limits before they start playing.

Best Online Casino Australia

Short pauses can help maintain focus and stay relaxed.

Honesty about one’s habits is vital for keeping gaming a fun activity.

Many services now encourage responsible gaming through educational tools.

By keeping balance, every player can play while protecting their wellbeing.

Интеллектуальные поисковые системы для поиска информации становятся всё более востребованными.

Они дают возможность находить доступные данные из социальных сетей.

Такие боты применяются для исследований.

Они умеют быстро анализировать большие объёмы данных.

глаз бока телеграм канал

Это позволяет получить более точную картину событий.

Отдельные системы также включают удобные отчёты.

Такие платформы широко используются среди специалистов.

Совершенствование технологий позволяет сделать поиск информации эффективным и наглядным.

Здесь вы откроете для себя большое количество полезной информации.

Портал посвящён на тех, кто ищет достоверная информация.

Публикации, размещённые здесь, позволяют понять в самых разных темах.

Все тексты постоянно дополняется, чтобы оставаться максимально полезными.

https://foodrussia.net

Меню простая, поэтому найти нужный раздел удобно.

Каждый посетитель способен подобрать материалы, релевантные его потребностям.

Эта платформа разработан с вниманием о читателях.

Используя этот сайт, вы получаете удобный инструмент информации.

Современные поисковые системы для анализа данных становятся всё более востребованными.

Они позволяют изучать доступные данные из интернета.

Такие инструменты применяются для журналистики.

Они могут точно анализировать большие объёмы информации.

глаз бога в telegram

Это помогает сформировать более объективную картину событий.

Многие системы также обладают функции визуализации.

Такие платформы активно применяются среди аналитиков.

Развитие технологий делает поиск информации более точным и удобным.

Responsible gaming is crucial for ensuring a safe gaming experience.

It helps participants enjoy the activity without unwanted stress.

Knowing your comfort zone is a core aspect of mindful gaming.

Players should define realistic budget limits before they start playing.

Real Money Casino Australia

Frequent rest periods can help maintain focus and avoid burnout.

Transparency about one’s habits is vital for keeping gaming a rewarding activity.

Many services now encourage responsible gaming through awareness programs.

By keeping balance, every player can have fun while preserving their balance.

Поиск компании по онлайн-продвижению — ключевой этап в росте бизнеса.

Прежде чем приступить к сотрудничеству, стоит проверить репутацию выбранного подрядчика.

Профессиональная команда всегда работает на основе аналитики и ориентируется на потребности заказчика.

Важно проверить, какие услуги применяет агентство: SMM, контент-маркетинг и другие направления.

Хорошим признаком Vzlet Media является понятная отчётность и реальные цели.

Рекомендации помогут сделать вывод, насколько результативно агентство реализует проекты.

Лучше не ориентироваться только на низкой цене, ведь результат продвижения зависит от профессионализма специалистов.

Обдуманный выбор партнёра по маркетингу обеспечит достичь целей и увеличить прибыль.

Прокат строительной техники сегодня считается практичным вариантом для предприятий.

Она помогает решать задачи без необходимости содержания машин.

Поставщики, предлагающие такую услугу, предлагают широкий выбор техники для различных сфер.

В парке можно найти автокраны, катки и специализированные машины.

http://www.realto.ru/journal/articles/kak-vybrat-avtokran-dlya-arendy-sovety-i-rekomendacii/

Основное достоинство аренды — это отсутствие затрат на обслуживание.

Кроме того, арендатор может рассчитывать на исправную технику, готовую к работе.

Опытные компании предлагают понятные договоры аренды.

Таким образом, аренда спецтехники — это оптимальный выбор для тех, кто стремится к надежность в работе.

Аренда спецтехники сегодня остаётся удобным вариантом для строительных компаний.

Она помогает реализовывать проекты без обязательства покупки оборудования.

Поставщики, предлагающие такую услугу, обеспечивают разнообразие машин для разных направлений.

В парке можно найти автокраны, катки и другие виды техники.

https://seabeads.wordpress.com/over/?contact-form-id=1&contact-form-sent=224880&contact-form-hash=cb1bd203b52bea67b2570f70885a4859f9328829&_wpnonce=409dc361a5

Основное достоинство аренды — это экономия средств.

Кроме того, арендатор получает проверенную технику, поддерживаемую в порядке.

Опытные компании заключают удобные договоры аренды.

Таким образом, аренда спецтехники — это разумный выбор для тех, кто стремится к эффективность в работе.

Дизельное топливо — это важный энергоресурс, который широко используется в промышленности.

Посредством своей экономичности дизельное топливо гарантирует надёжную эксплуатацию оборудования.

Соответствующее стандартам топливо способствует эффективность работы двигателя.

Существенное влияние имеет чистота топлива, ведь низкосортные добавки могут снизить эффективность.

Производители дизельного топлива должны выполнять требования качества.

Инновационные подходы позволяют оптимизировать его характеристики.

Во время покупки дизельного топлива важно учитывать условия хранения.

Складирование и перевозка топлива также сказываются на его свойства.

Некачественное топливо может вызвать поломке двигателя.

Поэтому сотрудничество с надёжными компаниями — гарантия стабильности.

Сегодня представлено разнообразие видов дизельного топлива, отличающихся по составу.

Арктические варианты дизельного топлива гарантируют работу техники даже при морозах.

Благодаря развитию инноваций качество топлива повышается.

Грамотный выбор в вопросе использования дизельного топлива помогают стабильную работу техники.

Таким образом, правильно подобранное ДТ является основой устойчивого функционирования любого оборудования.

Знание английского языка сегодня считается обязательным навыком для современного человека.

Он дает возможность общаться с жителями разных стран.

Не зная английский сложно строить карьеру.

Работодатели предпочитают специалистов с языковыми навыками.

https://moskovsky.borda.ru/?1-7-0-00010612-000-0-0

Регулярная практика английского расширяет кругозор.

Благодаря английскому, можно путешествовать без ограничений.

Помимо этого, регулярная практика развивает память.

Таким образом, знание английского языка играет важную роль в успехе каждого человека.

Знание английского языка сегодня считается обязательным инструментом для каждого человека.

Он помогает находить общий язык с людьми со всего мира.

Без знания английского трудно строить карьеру.

Организации предпочитают сотрудников, владеющих английским.

уроки английского для взрослых

Обучение английскому расширяет кругозор.

Благодаря английскому, можно учиться за границей без перевода.

Кроме того, регулярная практика улучшает мышление.

Таким образом, знание английского языка становится ключом в успехе каждого человека.

Adult dating sites help individuals to connect compatible matches.

They are developed for those who seek open communication.

Such platforms create a comfortable space for meeting others in a virtual format.

A lot of people choose online dating to explore new experiences.

https://omelhordatelona.biz/

The key idea of such platforms is to bring together adults who want compatible relationships.

Responsible use on these platforms helps build trust.

Online communication formats make dating more accessible than ever before.

Ultimately, adult dating sites make relationships possible regardless of distance.

Знание английского языка сегодня считается незаменимым умением для жителя современного мира.

Он позволяет общаться с иностранцами.

Не зная английский трудно развиваться профессионально.

Многие компании оценивают специалистов с языковыми навыками.

английский для разработчиков

Обучение английскому делает человека увереннее.

Благодаря английскому, можно учиться за границей без ограничений.

Помимо этого, овладение английским развивает память.

Таким образом, умение говорить по-английски является залогом в саморазвитии каждого человека.

Знание английского языка сегодня считается обязательным умением для жителя современного мира.

Английский язык помогает общаться с жителями разных стран.

Без владения языком трудно развиваться профессионально.

Многие компании оценивают сотрудников, владеющих английским.

rf-4fun.ru

Изучение языка открывает новые возможности.

Зная английский, можно путешествовать без перевода.

Также, изучение языка повышает концентрацию.

Таким образом, умение говорить по-английски является залогом в саморазвитии каждого человека.

Наличие ПМЖ за границей становится всё более популярным среди россиян.

Такой вариант предоставляет широкие горизонты для путешествий.

Второй паспорт помогает беспрепятственно путешествовать и получать доступ к другим странам.

Помимо этого такой документ может улучшить финансовую стабильность.

Гражданство Словении

Многие россияне рассматривают второе гражданство как путь к независимости.

Имея ВНЖ или второй паспорт, человек легко открыть бизнес за рубежом.

Разные направления предлагают свои программы получения статуса резидента.

Именно поэтому идея второго паспорта становится всё более значимой для тех, кто думает о будущем.

Приобретение второго гражданства за границей становится всё более востребованным среди россиян.

Такой шаг даёт новые возможности для жизни.

Второй паспорт помогает беспрепятственно путешествовать и избегать визовых ограничений.

Кроме того наличие второго статуса может укрепить уверенность в будущем.

Гражданство Сент Китс и Невис

Многие россияне рассматривают второе гражданство как способ расширения возможностей.

Оформляя ВНЖ или второй паспорт, человек легко открыть бизнес за рубежом.

Разные направления предлагают индивидуальные возможности получения гражданства.

Поэтому вопрос оформления становится всё более значимой для тех, кто думает о будущем.

This online platform offers a lot of fascinating and useful information.

Here, you can discover a wide range of subjects that expand knowledge.

Everyone will value the information shared on this site.

Every page is well-structured, making it comfortable to use.

The materials are relevant and engaging.

You can find recommendations on various fields.

If you want to find inspiration, this site has what you’re looking for.

To sum up, this resource is a excellent platform for people who enjoy discovering new things.

https://cdu-malsch.de/

Casino Roulette: Spin for the Ultimate Thrill

Experience the timeless excitement of Casino Roulette, where every spin brings a chance to win big and feel the rush of luck. Try your hand at the wheel today at https://k8o.jp/ !

The site contains a lot of fascinating and valuable information.

Here, you can find a wide range of subjects that provide insights.

Everyone will enjoy the content shared here.

Every category is organized clearly, making it pleasant to use.

The posts are easy to understand.

There are recommendations on different subjects.

Whether your interest is in useful facts, this site has something for everyone.

All in all, this platform is a excellent platform for information seekers.

https://orgza.info/

Immediate Olux se differencie comme une plateforme de placement crypto de pointe, qui met a profit la puissance de l’intelligence artificielle pour fournir a ses clients des avantages decisifs sur le marche.

Son IA etudie les marches financiers en temps reel, identifie les opportunites et execute des strategies complexes avec une finesse et une celerite hors de portee des traders humains, optimisant ainsi les potentiels de rendement.

Clarte Nexive se demarque comme une plateforme d’investissement crypto de pointe, qui met a profit la puissance de l’intelligence artificielle pour proposer a ses membres des avantages decisifs sur le marche.

Son IA analyse les marches en temps reel, identifie les opportunites et met en ?uvre des strategies complexes avec une finesse et une celerite hors de portee des traders humains, maximisant ainsi les potentiels de rendement.

TurkPaydexHub se demarque comme une plateforme d’investissement en crypto-monnaies innovante, qui utilise la puissance de l’intelligence artificielle pour fournir a ses clients des atouts competitifs majeurs.

Son IA scrute les marches en temps reel, identifie les opportunites et execute des strategies complexes avec une precision et une vitesse inatteignables pour les traders humains, optimisant ainsi les perspectives de gain.

Надёжная водоочистная система играет важную роль в повседневной жизни.

Именно она помогает нейтрализовать вредные вещества из воды.

При качественной фильтрации, тем чище становится питьевая вода.

Большинство домовладельцев осознают необходимость использования хороших фильтров.

Инновационные методы очистки позволяют добиться стабильного результата.

https://samastroyka.ru/aksessuary-dlya-bassejnov.html

Хорошо настроенная фильтрация помогает предотвратить негативные воздействия для всей семьи.

Плановая чистка оборудования повышает эффективность водоочистной системы.

Следовательно, качественная система очистки воды — это основа для комфорта в доме.

Выполнение домашних заданий играет значимую роль в развитии учащихся.

Такой подход помогает повторять изученные темы и повышать успеваемость.

Большинство школьников понимают, что внеурочные упражнения формируют самостоятельность.

Регулярная практика позволяет повысить концентрацию.

https://studentopedia.ru/uchebniki-po-matematiki.html

Преподаватели нередко отмечают, что домашняя подготовка помогает глубже понимать темы.

Помимо этого, домашняя работа приучает к ответственности.

Ребята, которые делают уроки, обычно добиваются лучших результатов.

В итоге, выполнение домашних заданий остаётся неотъемлемой частью образования для любого ученика.

Осознанный подход к игре является важным элементом безопасного досуга.

Она помогает свести риски к минимуму и поддерживать контроль во время игрового процесса.

Многие люди понимают, что умеренность помогает получать удовольствие без негативных последствий.

Установление ограничений позволяет держать под контролем длительность игры.

https://blokov-casino.net/

Кроме того, важно осознавать свои привычки и останавливаться вовремя.

Сайты часто предлагают опции контроля, которые помогают сохранять баланс.

Пользователи, которые придерживаются принципов ответственности, чаще получают стабильные положительные впечатления.

В итоге, ответственная игра остаётся необходимым условием комфортного отдыха.

Национальные награды играют важную роль в жизни общества.

Они подчёркивают вклад людей, которые сделали значимый шаг в укрепление государства.

Подобные отличия помогают формировать положительный образ гражданского подвига.

Кроме того, они поощряют людей на новые достижения.

https://kuhni-v-ivanovo.ru

Оценка заслуг государством нередко укрепляет авторитет к человеку в коллективе.

Важно понимать, что награда — это не просто знак, а выражение благодарности.

Она поднимает ценность работы, который был проделан человеком.

В итоге, государственные награды остаются значимой частью традиций в государственной системе.

EasyDrop является известным сайтом для получения кейсов со скинами в Counter-Strike 2.

Многим пользователям нравится, что здесь простая навигация, позволяющий быстро разобраться к работе платформы.

На ресурсе доступно множество коллекций, что добавляет увлекательности.

Создатели платформы стараются обновлять коллекции, чтобы пользователи видели свежие предметы.

секретный код изи дроп

Многие отмечают, что EasyDrop приятен в эксплуатации благодаря структурированным разделам.

Также ценится то, что платформа предоставляет разные варианты взаимодействия, повышающие общую вариативность работы.

Однако пользователям важно помнить, что любые действия на подобных платформах требуют осознанного использования.

В целом, EasyDrop воспринимается как онлайн-платформа для досуга, созданный для тех, кто интересуется коллекционными предметами в CS2.

Контроль работы серверов является ключевой задачей для поддержки стабильности систем.

Он позволяет обнаруживать сбои на первых шагах развития проблем.

Быстрое выявление проблем помогает предотвращать сбоев в работе.

Многие компании осознают, что регулярный мониторинг повышает надежность систем.

Современные инструменты позволяют автоматизировать процесс.

Мгновенные оповещения помогают быстро реагировать и минимизировать последствия.

Кроме того, контроль оптимизирует работу серверов и снижает расходы.

В итоге, регулярный мониторинг серверов — это ключевой элемент для надежной работы IT-систем.

http://baretly.net/index.php?topic=82062.new#new

Savings codes are special combinations of alphanumeric characters that provide extra savings.

They are frequently offered by brands to increase engagement.

Such codes allow users to save more when purchasing online.

Many people appreciate promo codes because they add value to any purchase.

https://dosweeps.com/casinos

Most platforms share these codes through email newsletters.

Using them is usually straightforward and requires only entering the code during checkout.

Promo codes also help companies enhance loyalty by offering limited-time rewards.

Overall, they serve as a convenient tool for anyone who wants to reduce spending.

Здесь представлено множество полезных материалов.

Пользователи отмечают, что ресурс облегчает доступ к важным данным.

Материалы обновляются регулярно, что делает сайт практичным для изучения.

Многие считают, что организация разделов интуитивно ясна и позволяет сэкономить время.