[ad_1]

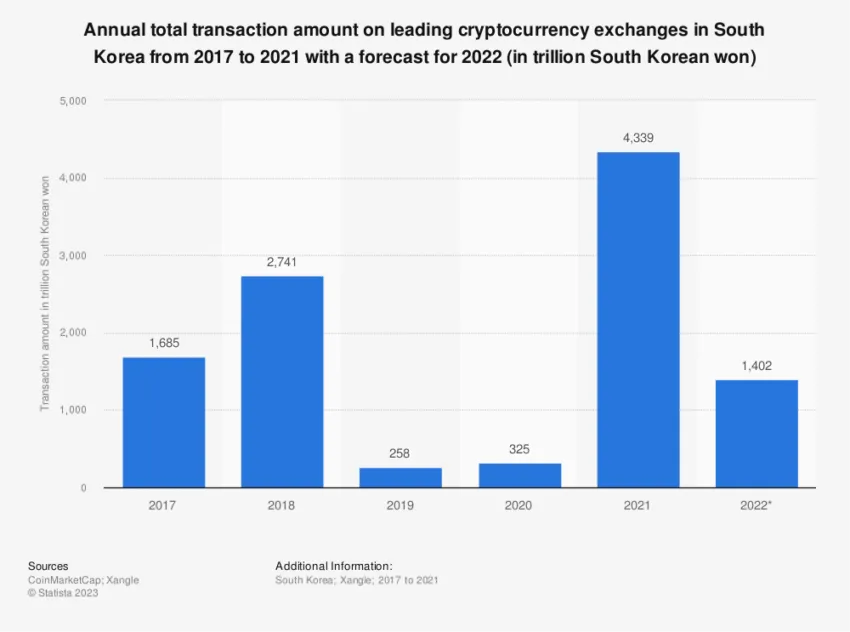

South Koreans’ curiosity in cryptocurrency is famous. In 2017, the nation, with simply over 50 million inhabitants, contributed to a staggering 20% of all Bitcoin trades and emerged as the biggest marketplace for Ethereum (ETH).

Nonetheless, many don’t understand that whereas South Korea’s love for crypto is fervent, their distaste for decentralized finance (DeFi) is equally pronounced.

Embracing the Digital Gold, Not DeFi

Bitcoin’s phenomenal rise discovered its echo chambers in South Korea, the place a populace steeped in speedy tech adoption eagerly took to crypto. From college students checking Bitcoin costs between lectures to aged grandparents hedging their retirement on crypto, the digital wave swept throughout generations.

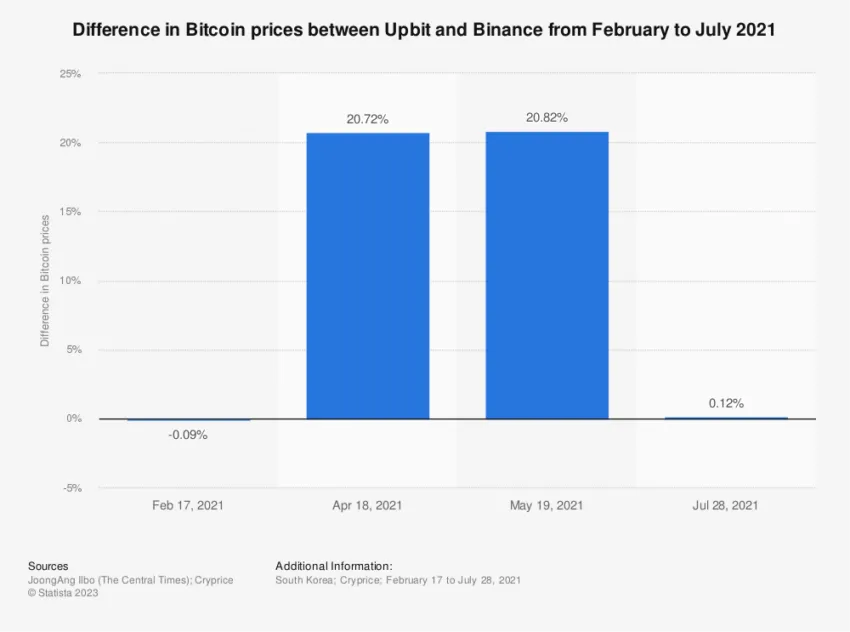

The surging demand led to what was termed the “Kimchi premium.” This can be a phenomenon the place the native value of Bitcoin soared as much as 40% greater than its United States counterpart.

Learn extra: The Finest Crypto Buying and selling Bots for Arbitrage

South Korea’s speedy tech adoption helped the nation remodel from an impoverished nation to a worldwide financial powerhouse. This meteoric rise is attributed to family-owned conglomerates referred to as chaebols, emphasis on exports, and a diligent workforce.

Each side of Korean life, from meals supply to building, embodies the mantra of effectivity and velocity.

However as the normal avenues of amassing wealth like actual property and shares grew to become saturated and fewer profitable, Koreans sought different high-risk avenues. With playing closely restricted and stigmatized on account of addictive tendencies, crypto exchanges emerged as the brand new casinos.

Cryptocurrency, particularly altcoins, supplied the attract of instantaneous vital returns that different conventional belongings like gold couldn’t promise, in accordance to DeFi researcher Ignas. Nonetheless, the narrative adjustments with DeFi.

South Korea and the DeFi Disconnect

Regardless of its crypto craze, South Korea stays surprisingly averse to DeFi. However efforts by giant blockchain corporations like Klaytn, backed by the Korean tech big Kakao, DeFi has struggled to achieve traction. The explanations are multifaceted:

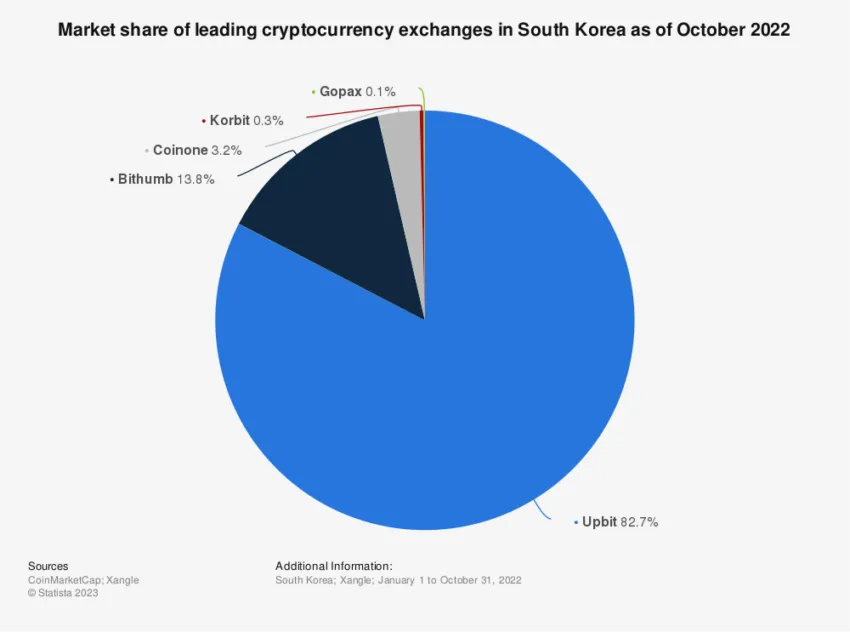

- Belief in Conventional Techniques: South Koreans extremely belief their monetary and banking sectors. Centralized exchanges like Upbit and Bithumb are acquainted entities with fewer complexities than DeFi platforms.

- Consumer Expertise Limitations: The typical Korean crypto fanatic finds navigating DeFi platforms tough. Establishing wallets, safeguarding non-public keys, and managing deposits and withdrawals are perceived as cumbersome.

- Academic Gaps: Most DeFi platforms primarily cater to English-speaking audiences. Because of language boundaries, most tutorial content material and sources stay inaccessible to the common Korean investor.

- Regulatory Hurdles: In 2021, stringent crypto laws got here into play in South Korea. Requiring real-name financial institution accounts and reporting all crypto-related transactions has added layers of forms, stifling the freewheeling nature that DeFi platforms sometimes supply.

Learn extra: Prime 6 DeFi Lending Platforms

Doo Wan Nam, COO at StableLab, identified that whereas Koreans present curiosity in DeFi parts, overarching boundaries like language and unfamiliarity with self-custody choices hinder widespread adoption.

“Although Korean customers present curiosity in DeFi parts resembling loans and earnings, using self-custody choices like Ledger and MetaMask just isn’t widespread,” mentioned Nam.

In the meantime, Garlam Received, Managing Companion at Momentum 6, concurred, citing structural rigidity, demanding work schedules, and timing points arising from the timezone distinction with the US as extra challenges. Nonetheless, Received believes that when Koreans begin earning money from DeFi platforms, “the frenzy begins.”

To bridge this disconnect, there’s a consensus on making DeFi extra accessible to Koreans. This contains translating sources, collaborating with native entities, and fostering schooling.

In any case, the potential of DeFi is common. And with the precise steps, Korea would possibly develop into its subsequent massive frontier.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.

[ad_2]

I’m extremely impressed with your writing skills and also with the layout on your weblog. Is this a paid topic or did you customize it your self? Either way keep up the excellent high quality writing, it is uncommon to see a great weblog like this one nowadays!