[ad_1]

The comeback of the Stellar Lumens (XLM) value retains happening. Within the final 24 hours, XLM has risen by one other 15%, bringing the Ripple competitor’s value in step with XRP. Certainly, each tokens have risen by near 65% (at this stage) for the reason that abstract judgment in Ripple’s authorized battle with the U.S. Securities and Change Fee (SEC).

Remarkably, the connection between Stellar Lumens (XLM) and Ripple’s XRP has been an intriguing story of correlation and decoupling. Because the market reacted to the current developments within the Ripple-SEC battle, XLM adopted go well with, experiencing a outstanding value surge. Nonetheless, because the broader market situations forged their shadows, the query arises: Can Stellar Lumens keep its newfound independence and proceed its upward trajectory?

The Correlation Between XLM and XRP

It’s no secret that Stellar Lumens and Ripple’s XRP share many similarities of their blockchain applied sciences and use instances. Furthermore, the founder’s Jed McCaleb’s connection to Ripple provides one other layer of intrigue, as buyers hope that XLM is not going to be deemed a safety by regulators.

This connection has usually resulted in XLM mirroring the value actions of XRP. The market’s anticipation of developments for Ripple being equally impactful for Stellar has usually led to such correlated actions, identical to final week after the Ripple ruling. Nonetheless, in current days, Stellar Lumens has managed to face by itself toes, showcasing its skill to decouple from the fortunes of XRP.

One issue for this may occasionally have been its partnership with MoneyGram, which yielded the modern B2B service known as MoneyGram Entry. This service allows the conversion of the stablecoin USDC into money worldwide by MoneyGram’s department community, tapping into Stellar’s ledger for seamless execution. This strategic collaboration has not solely bolstered Stellar’s use case but additionally could catalyzed its current surge in value.

With the combination of Entry into numerous purposes and fiat ramps, XLM’s demand and utility is considerably boosted. As an example, the HoneyCoin app’s integration of Entry for easy money out in a number of African international locations and the UK may need contributed to Stellar’s outperformance relative to XRP in current days.

We’re excited to share @honeycoinapp customers can now money out of their USDC stability at supported @MoneyGram areas in Kenya, Uganda, Tanzania, Nigeria, Ghana, and the UK 🥳️

One other real-world use case for @Circle’s USDC on Stellar.https://t.co/0JKNhdJMx3

— Stellar (@StellarOrg) July 17, 2023

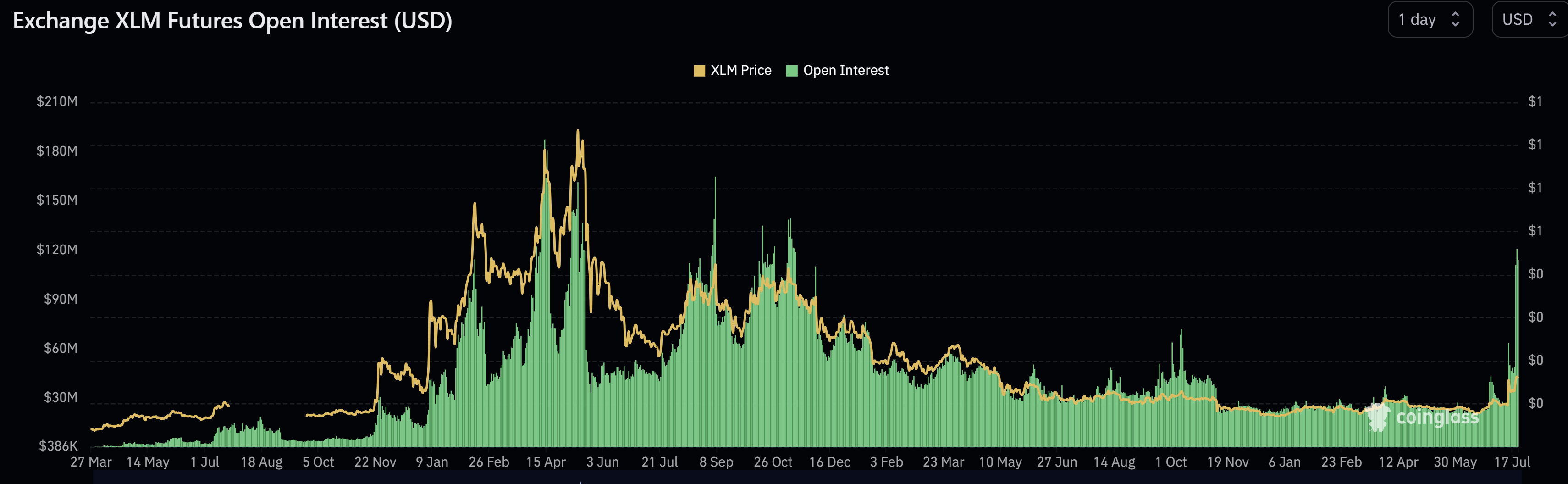

A second issue for XLM’s not too long ago sturdy efficiency could possibly be the extraordinarily excessive curiosity on the futures market. The open curiosity for Stellar Lumens has skyrocketed to over $120 million yesterday, a stage not seen for the reason that peak of the bull market in November 2021. Notably, this phenomenon is much like XRP which has additionally seen open curiosity soar to prior report ranges.

Stellar Lumens Worth Outlook

Regardless of experiencing a pointy rally, Stellar Lumens nonetheless stays in quite bearish territory when wanting on the 1-week chart. For this week, it’s essential that the XLM value regains the 23.6% Fibonacci retracement stage at $0,1583 in addition to the 200-week EMA at $0,1597 (blue line). With the weekly RSI at 73, one other leg up could possibly be attainable.

On the 1-day time-frame, XLM stays above all shifting averages (EMAs). For an extra bullish trajectory, it’s vital that Stellar maintain above the help at $0.1250. Ought to this occur, XLM might expertise an extra 35% rally in the direction of the 38.2% Fibonacci retracement stage. Nonetheless, a drop beneath the help stage at $0.1250 would problem the bullish view.

Featured picture from oranfireblade / Pixabay,, chart from TradingView.com

[ad_2]

I’m extremely inspired with your writing skills as neatly as with the layout in your blog. Is this a paid subject or did you modify it your self? Anyway stay up the nice quality writing, it’s uncommon to see a nice blog like this one nowadays!