[ad_1]

Ethereum worth has been hovering round its highest degree since Could 2023 as traders brace themselves for additional rate of interest hikes by international central banks this month. Ethereum, the most important altcoin by market cap, has staged a robust restoration previously few days, leaping by greater than 3% previously week and 64% within the yr to this point. On the time of writing, ETH was buying and selling at $1,953.70.

Basic Evaluation

Ethereum worth has been hovering above the essential degree of $1,920 for the previous few days amid elevated bullish sentiment within the crypto market by traders. Bitcoin’s temporary make out with the numerous $31,000 degree has seen the crypto market edge increased. In accordance with Coinmarketcap, the worldwide crypto market cap has elevated to $1.21 trillion, with the overall crypto market quantity leaping by 14.60% during the last day.

The crypto worry and greed index, which measures the present temper inside the crypto market, signifies a shift in sentiment within the sector. Over the previous few days, the index has improved to a greed degree of 61, hinting at a continued bullish market correction.

The sudden curiosity within the cryptocurrency market by bigwigs reminiscent of Constancy, BlackRock, Cathie Wooden, and Charles Schwab buoyed the crypto market in June. Wall Road heavyweights, Charles Schwab, Citadel Securities, and Constancy launched a crypto alternate platform known as EDX Markets. Upon its launch, the high-profile crypto alternate introduced the itemizing of solely 4 digital belongings, together with Bitcoin, Ethereum, Litecoin, and Bitcoin Money.

BlackRock lately filed an software for Bitcoin EFT with the US Securities and Alternate Fee (SEC), a transfer that noticed crypto costs bounce. Nevertheless, on Friday, The Wall Road Journal reported that the SEC informed Nasdaq and Cboe World Markets, each of which filed for the Bitcoin exchange-traded funds purposes on behalf of varied establishments, that the filings weren’t sufficiently complete. After the report, BlackRock submitted a contemporary software for a Bitcoin spot market ETF, which if profitable, would be the first Bitcoin spot ETF to win approval.

Focus is now on the worldwide central banks, per week after the Federal Reserve Chair, Jerome Powell, introduced that he expects a number of rate of interest hikes for the remainder of this yr. Different banks, together with the Financial institution of Japan, the European Central Financial institution, and the Financial institution of England, have additionally signaled their assist for additional hikes.

Ethereum Worth Outlook

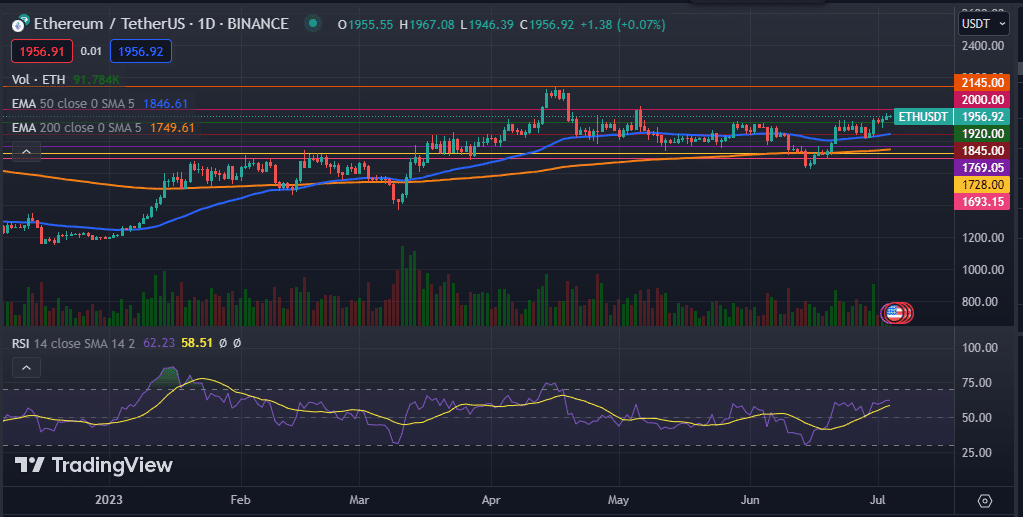

Ethereum worth has been holding regular above the important thing $1,920 degree for the previous few days as bulls battle to push the worth previous the vital resistance degree of $2,000. The altcoin has managed to maneuver above the 50-day and 200-day exponential shifting averages, whereas its Relative Power Index (RSI) strikes above the impartial zone.

Due to this fact, regardless of the macroeconomic headwinds forward, the Ethereum worth is prone to proceed rising as consumers goal the following resistance at $2,000. Alternatively, a transfer beneath the 50-day EMA at $1,920 may push the worth decrease to search out assist at $1,845.

[ad_2]

https://t.me/s/Top_BestCasino/173

https://t.me/dragon_money_mani/35