[ad_1]

Abstract:

- The rely of recent addresses buying and selling BTC has rallied.

- This bounce has occurred regardless of the sturdy resistance confronted at $30,000.

- As BTC’s value continues to commerce sideways, many holders have taken to coin distribution.

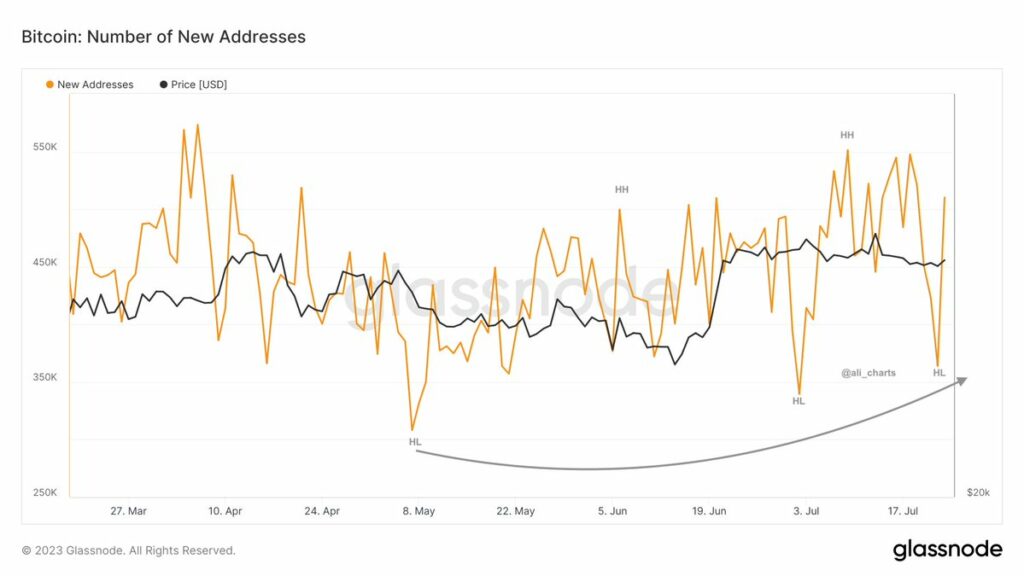

New demand for main coin Bitcoin [BTC], continues to climb regardless of its sideways value motion inside the $28,000 and $30,000 areas since April, knowledge from Glassnode revealed.

An evaluation of the coin’s day by day new addresses rely on a 30-day shifting common revealed an uptick since 22 Could. Since then, the day by day rely of recent addresses that accomplished BTC transactions has grown by 19%. In accordance with knowledge from Glassnode, as of 25 July, over 450,000 new addresses accomplished no less than one transaction that concerned BTC.

BTC accumulation dwindles because the coin struggles to interrupt resistance

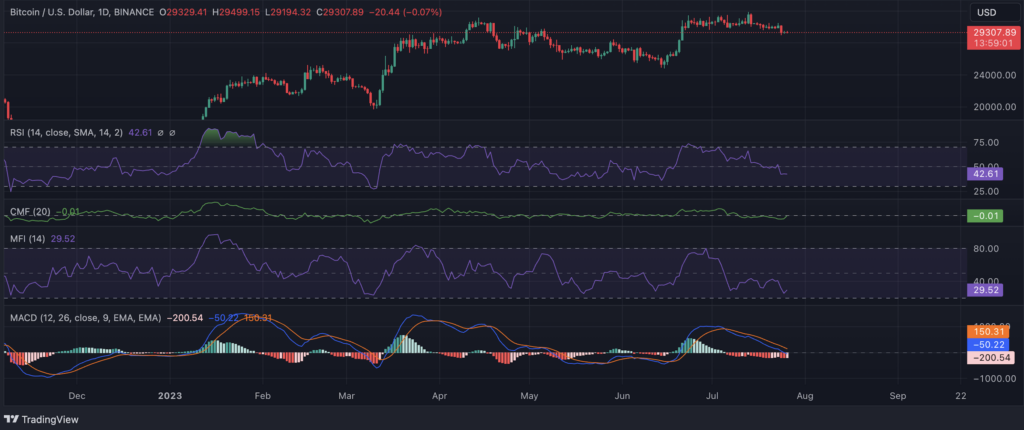

At press time, BTC exchanged arms at $29,212. With sturdy resistance confronted on the $30,000 value degree, damaging sentiments have returned to the day by day market.

As damaging sentiments ravage the market, accumulation amongst day merchants has plummeted. In accordance with value actions gleaned on a D1 chart, key momentum indicators launched into a downtrend on the time of writing.

The coin’s Relative Energy Index rested under its impartial line at 42.61. BTC’s Cash Stream Index (MFI) was 29.39 deep within the oversold territory.

Additional, BTC’s On-balance quantity (OBV) has trended downward since June finish. At press time, this was 102.15 million.

When BTC’s OBV declines, it signifies that the amount of property being bought outweighs the amount of property being purchased. It typically indicators a major shift in sentiment from constructive to damaging, the place extra merchants imagine promoting the king coin is safer than shopping for it.

Moreso, BTC’s Chaikin Cash Stream (CMF) was under the middle zero line on the time of writing. A CMF within the damaging territory suggests elevated liquidity exit from the market. When the BTC CMF is damaging, the promoting stress dominates the market over the desired interval.

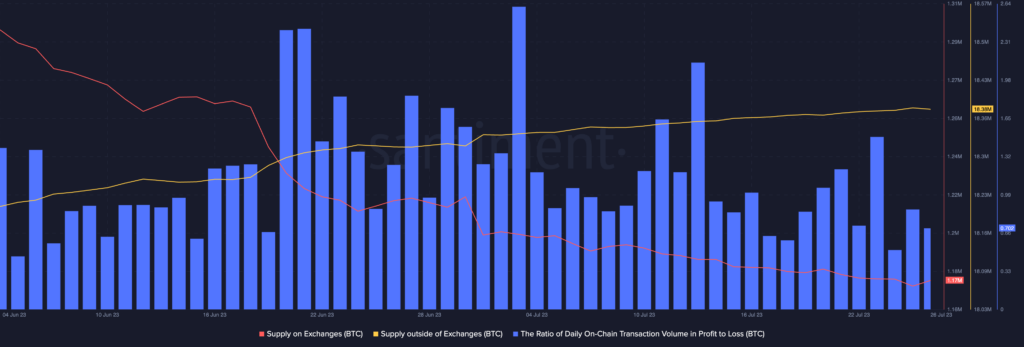

With many uncertain of the coin’s subsequent value course, its provide on exchanges climbed prior to now 24 hours. In accordance with info from on-chain knowledge supplier, Santiment, the BTC provide to cryptocurrency exchanges elevated by nearly 2% within the final 24 hours.

When the trade reserve of an asset will increase on this method, it suggests elevated sell-offs. This may very well be BTC merchants promoting off their coin holdings to hedge in opposition to future losses. Nevertheless, whereas BTC gross sales rallied prior to now 24 hours, the ratio of transactions in losses exceeded these in revenue.

[ad_2]

https://t.me/s/Top_BestCasino/173

https://t.me/s/officials_pokerdom/4063

https://t.me/s/Volna_officials

https://t.me/s/atom_official_casino

В лабиринте ставок, где каждый сайт стремится зацепить заверениями быстрых выигрышей, рейтинг топ онлайн казино

превращается той самой путеводителем, что ведет мимо заросли рисков. Тем профи и дебютантов, которые пресытился от ложных посулов, это инструмент, дабы ощутить реальную выплату, словно вес ценной ставки в руке. Минус пустой болтовни, лишь надёжные площадки, в которых отдача не только показатель, но ощутимая удача.Составлено из гугловых запросов, как ловушка, которая вылавливает наиболее актуальные веяния по сети. Здесь минуя пространства к клише фишек, любой момент словно карта на покере, там обман проявляется немедленно. Игроки понимают: на рунете тон письма и сарказмом, там ирония маскируется под рекомендацию, позволяет избежать рисков.В https://www.reverbnation.com/don8play/shows данный топ лежит словно открытая раздача, подготовленный на старту. Зайди, коли нужно почувствовать биение подлинной азарта, минуя иллюзий плюс провалов. Тем кто любит вес выигрыша, он словно держать фишки у руках, минуя глядеть в монитор.