[ad_1]

Operating a enterprise is tough. Operating a cash-intensive enterprise like eCommerce is even more durable. Many eCommerce companies shut store not as a result of they aren’t promoting merchandise however as a result of they run out of money and may’t order extra stock.

Small companies have a restricted finances, so each greenback you spend issues. By having a stable monetary understanding of your corporation you may ensure you’re spending {dollars} the place they’re most helpful. That’s precisely what accounting will provide help to do.

Let’s discover the necessities of eCommerce accounting and the way the precise monetary practices can develop your on-line enterprise.

What Is eCommerce Accounting?

eCommerce accounting is the vital observe of recording, organizing, and managing the entire monetary information and transactions related to an eCommerce firm.

When finished correctly, accounting tells you the way wholesome your eCommerce enterprise is. It could actually present you:

- Gross sales and Income Monitoring: Recording all incoming gross sales and income generated by means of on-line transactions.

- Stock Administration: Preserving observe of the inventory of merchandise on the market, guaranteeing correct valuation, and updating stock ranges in real-time as gross sales happen.

- Value of Items Offered (COGS): Calculating the direct prices related to producing or buying the merchandise which might be bought. This contains prices like uncooked supplies, manufacturing bills, and delivery prices.

- Fee Processing Charges: Monitoring charges charged by fee gateways and fee processors.

- Taxation: Complying with tax laws and calculating the taxes relevant to eCommerce transactions, which could be advanced on account of completely different tax guidelines throughout areas and international locations.

- Buyer Returns and Refunds: Dealing with accounting entries for product returns, refunds, and chargebacks, guaranteeing that the monetary information precisely mirror these actions.

- Monetary Reporting: Getting ready monetary statements, similar to earnings statements, stability sheets, and money circulation statements, to evaluate the monetary well being of the eCommerce enterprise.

Correct, well timed, and complete eCommerce accounting is essential for making knowledgeable selections. By understanding the true state of your corporation you may develop even with monetary constraints.

How Does an eCommerce Proprietor Be taught eCommerce Accounting?

If you wish to change into an accounting grasp, you’re going to wish to begin by turning into your individual greatest bookkeeper. When you’ve clear, organized monetary documentation you’ll be in a greater place to know, interpret, and apply the knowledge.

Step 0: Generate Monetary Paperwork

Earlier than you may grasp eCommerce accounting you need to get within the observe of manufacturing monetary paperwork and begin doing so every month.

The three major monetary paperwork for an eCommerce enterprise are:

- Revenue assertion – a snapshot of how a lot you’ve earned

- Stability sheet – the belongings your corporation owns and the quantity you owe to collectors

- Money circulation assertion – the amount of money getting into and leaving an organization

Step 1: Familiarize Your self with Major Monetary Paperwork

The earnings assertion, stability sheet, and cashflow assertion present a complete image of your corporation’s monetary well being.

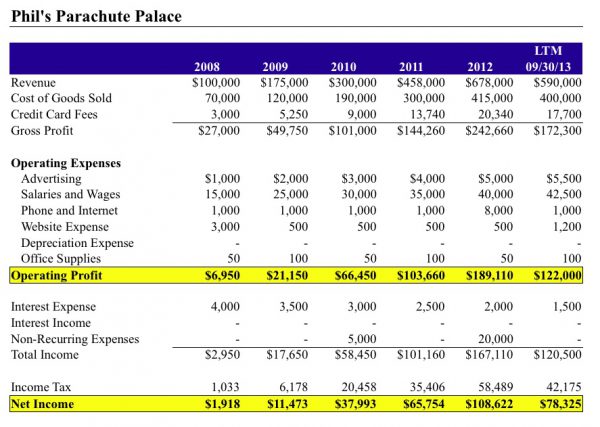

An earnings assertion, also called a profit-and-loss (P&L) assertion, exhibits what your organization earns, what it spends, and if it’s making a revenue over a selected time frame. An earnings assertion exhibits the next:

- Income

- Value of products bought/price of gross sales

- Gross revenue or contribution margin

- Working bills or promoting, normal and administrative bills (SG&A)

- Working earnings

- Non-operating objects

- Earnings earlier than taxes (EBT)

- Web earnings

The stability sheet exhibits the belongings your corporation owns and the quantity you owe to collectors at a selected cut-off date. A stability sheet exhibits the next:

- Present belongings

- Mounted belongings

- Present liabilities

- Lengthy-term liabilities

- Shareholders’ fairness

Lastly, the money circulation assertion is essential, particularly for inventory-based companies, because it tells you the way a lot money you’ve gained or misplaced for a sure interval. A money circulation assertion will observe the next:

- Receipts from gross sales of products and providers

- Curiosity funds

- Revenue tax funds

- Funds made to suppliers of products and providers

- Wage and wage funds

- Lease funds

- Different bills

These monetary reviews permit you to establish main warning indicators and monitor the efficiency of your corporation.

For these keen to achieve extra information about these paperwork, a beneficial useful resource from the eCommerceFuel group is the ebook “Monetary Intelligence for Entrepreneurs.” 📚

Step 2: Do Your Personal Accounting

The second step includes doing your individual accounting for just a few months. It may be time-intensive and never essentially one of the best value-add exercise for many eCommerce entrepreneurs, however this course of lets you perceive how these monetary paperwork come collectively and the way actual features of your corporation present up on these monetary paperwork.

Upon getting a stable grasp of those paperwork, it’s time to rent a bookkeeper to generate these on a month-to-month foundation. Having somebody do that for you’ll allow you to focus extra on advertising and marketing, operations, product improvement, and different vital features of your eCommerce enterprise.

Do You Want an Accountant or a Bookkeeper?

You don’t want both an accountant or bookkeeper. Nevertheless it is not uncommon to rent a bookkeeper, at the least half time, as your corporation grows.

Whereas an accountant and a bookkeeper each play important roles in managing your eCommerce funds, their tasks differ.

What Does a Bookkeeper Do?

A bookkeeper gathers all of your monetary paperwork (like financial institution accounts and bank card statements), ensures their accuracy and completeness, then organizes them systematically in eCommerce accounting software program like Xero or QuickBooks (extra on software program beneath).

Reviewing your statements, they generate monetary paperwork similar to:

- Revenue statements

- Stability sheets

- Money circulation statements

In essence, bookkeepers are monetary organizers.

What Does an Accountant Do?

Moderately than merely amassing monetary data, accountants provide help to interpret it. They usually help with tax planning, money circulation administration, and tax technique.

An excellent accountant helps you construction your funds and spending to reduce your tax invoice. They could information you on making investments or benefiting from tax packages or deductions that may cut back your tax legal responsibility.

In essence, accountants are monetary consultants.

Begin By Doing Your Personal Bookkeeping

Many small enterprise homeowners select to deal with their very own bookkeeping, then hand it off to an accountant at tax time.

As your corporation grows and you’ve got an increasing number of monetary transactions you’ll need somebody to deal with the bookkeeping for you. An element-time bookkeeper is quite common within the eCommerceFuel group.

Planning for Progress with an Accountant

As your corporation continues to develop, it would be best to deliver on an accountant that can assist you make extra essential monetary selections similar to which loans to take out and when.

One of many greatest challenges for rising eCommerce companies is managing money circulation. An excellent accountant will help predict potential money shortfalls and advise on monetary choices to maintain progress.

How An Accountant May Assist Your eCommerce Enterprise

What’s Money-Primarily based Accounting and How does it Differ From Accrual-Primarily based Accounting?

Money-basis accounting is the only kind of accounting, and is the place most eCommerce homeowners begin. It merely tracks the money that comes out and in of your corporation.

Nevertheless, this simplicity comes with a draw back: it’s the least correct.

A extra correct image of the monetary well being of a enterprise could be obtained through the use of accrual-based accounting, which matches up the timing of gross sales with the associated prices, making an allowance for stock prices on the time of sale, somewhat than on the time of buy.

💡 Tip: Accrual-based accounting is sort of required if you happen to’re going to promote your corporation. One of many members inside ECF shared this after promoting her enterprise (hyperlink for ECF members-only):

In case your financials aren’t correct, prepare for a world of damage. This might have an effect on your a number of, the money you expect from a sale, your stock numbers, the size of time it takes to shut, and many others… Ensuring your books are accrual based mostly and have correct COGS particularly are so essential.

Can an Accountant Forecast Main Bills? AKA Money Circulation Administration

Forecasting main bills is a vital facet of eCommerce accounting. Homeowners will usually need to order giant portions of stock for higher bulk-pricing and environment friendly delivery prices. However it may be exhausting to know precisely how a lot you may afford to attempt to hit these bulk-pricing reductions.

Accountants can create monetary projections that can assist you visualize the monetary breakpoints, how a lot debt you’d tackle, and the way a lot you’d should pay every month for these giant stock purchases.

Accountants also can provide help to arrange separate enterprise financial institution accounts for various kinds of purchases. It’s frequent to have a separate account to save lots of up for big capital expenditures. This helps preserve funds organized and makes it simpler to identify essential quantities.

Can An Accountant Estimate and Pay Taxes?

Should you’re operating a profitable eCommerce retailer it is best to already pay quarterly tax estimates to the federal government. To do this precisely you want a tough thought of your gross sales tax charge, how briskly your revenues and bills are rising, and the way a lot you’ll owe in taxes.

You may rent an accountant for this round tax time, or a part-time accountant in your staff can preserve your estimated funds up to date as you undergo the 12 months.

Discovering the Proper eCommerce Accounting Help for Your Enterprise

Finding the precise accountant or bookkeeper is usually a powerful endeavor. Phrase-of-mouth referrals from friends in related companies is usually a incredible useful resource on this regard.

Moreover, communities of like-minded members, similar to eCommerceFuel or different eCommerce associations, also can present suggestions based mostly on private experiences.

It’s essential to do not forget that one of the best match for your corporation can change over time as your corporation grows and evolves. Should you discover that your present accountant isn’t as proactive or educated as your rising enterprise requires, don’t hesitate to hunt out different choices, even when it means spending a bit of extra.

Specialised eCommerce Accounting: A Worthy Funding?

Given the quite a few nuances in eCommerce, it’s helpful to have interaction an accountant who specializes on this area. Having an accountant with a agency grasp of accrual accounting is usually a game-changer for inventory-based companies like eCommerce retailers.

eCommerce Accounting Software program

To have the ability to perceive the important monetary paperwork you want accounting software program that can assist you generate the precise monetary reviews within the first place.

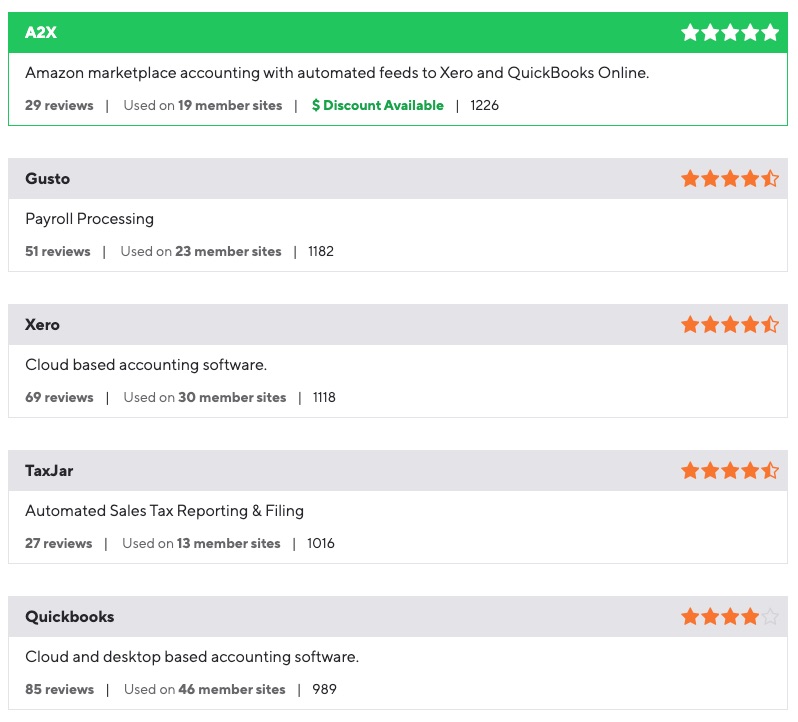

Selecting the right accounting software program to your eCommerce enterprise relies upon largely in your particular wants. Some well-liked choices embrace A2X Accounting, QuickBooks, Xero, and others.

A2X Accounting serves as a bridge between your eCommerce platform (like Amazon or Shopify) and your accounting software program, guaranteeing your information is clear and arranged.

QuickBooks and Xero are complete cloud-based accounting platforms, each providing sturdy options to handle your books successfully.

TaxJar is one other great tool for automating gross sales tax reporting and submitting, whereas instruments like Finale Stock and Stock Planner can considerably streamline your stock administration.

Within the age of automation, platforms like these can show to be very important parts of your monetary stack.

The eCommerceFuel group takes critiques severely. We assessment software program particularly with the lens of serving to different eCommerce homeowners make one of the best selections. Right here’s a sneak peak of our assessment listing displaying the highest outcomes for accounting software program.

🙋♂️If you wish to learn the critiques and see the websites that use these providers apply immediately to change into a member of the eCommerceFuel group.

Ultimate Ideas: eCommerce Accounting

Strategic monetary administration will not be a luxurious however a necessity for each eCommerce enterprise. It’s a must to have somebody in your staff who can allocate cash the place it grows your corporation rapidly with out taking up an excessive amount of debt.

As an proprietor that could be your job though an accountant also can provide help to with that. A bookkeeper will provide help to preserve your monetary paperwork organized and correct.

With the precise steering, common monetary critiques, and appropriate software program instruments, your corporation cannot solely maintain itself however thrive within the aggressive eCommerce panorama.

[ad_2]

I’m extremely inspired with your writing talents and also with the format for your blog. Is this a paid topic or did you customize it your self? Either way keep up the excellent quality writing, it’s uncommon to look a nice weblog like this one nowadays!

Если вам не хватает белка в рационе – обязательно попробуйте протеиновый смузи. Белок является важным строительным материалом для нашего организма и необходим для поддержания его функций, а также здоровых мышц и других тканей организма

[url=https://koshkindomik.icu/]Блог[/url]

Если вам не хватает белка в рационе – обязательно попробуйте протеиновый смузи. Белок является важным строительным материалом для нашего организма и необходим для поддержания его функций, а также здоровых мышц и других тканей организма

[url=https://homeworld.icu/]Блог[/url]

Из экзотического фрукта можно приготовить много интересных блюд, включая десерты. Мне очень нравятся конфеты из инжира. Их смело можно отнести к категории полезных сладостей. Попробуйте заменить мед стевией и у вас получатся ПП конфеты

[url=https://domosait.icu/]Сайт[/url]

Можно сколько угодно рассуждать о том, что смузи – это всего лишь модный тренд. Но кроме того это еще и очень удобный и полезный перекус на скорую руку. И лично я уже не готова от них отказаться. Делюсь любимым рецептом тыквенного смузи

[url=https://krasunindim.biz/]Мой сайт[/url]

Из экзотического фрукта можно приготовить много интересных блюд, включая десерты. Мне очень нравятся конфеты из инжира. Их смело можно отнести к категории полезных сладостей. Попробуйте заменить мед стевией и у вас получатся ПП конфеты

[url=https://golznay.top/]Сайт[/url]

Любите Сникерс? А нежный и ароматный раф кофе? А что если совместить все это в одном напитке? На первый взгляд кажется, что такие диковинки нужно искать только в новых кофейнях. Но в реальности нет ничего сложного в том, чтобы приготовить раф самостоятельно

[url=https://yaktoya.vinnytsia.ua/]Блог[/url]

Сделайте полоску из семян чиа. Банан нарежьте кружочками и выложите сверху. Добавьте также миндаль, молотую корицу, кокосовые чипсы или кокосовую стружку

[url=https://dimobud.vinnytsia.ua/]Мой блог[/url]

Из экзотического фрукта можно приготовить много интересных блюд, включая десерты. Мне очень нравятся конфеты из инжира. Их смело можно отнести к категории полезных сладостей. Попробуйте заменить мед стевией и у вас получатся ПП конфеты

[url=https://ideidodoma.shop/]Блог[/url]

In an industry where so many eCommerce businesses shut down, could intentionally designing for failure lead to more innovative solutions? What lessons can we learn from the companies that didn’t make it, and how can we use those insights to create a resilient business model?

[url=https://ideidodoma.shop/]Блог[/url]

Если вы обожаете арахисовую пасту так же, как и я – предлагаю вам еще один рецепт, где она будет очень кстати. Можете украсить эти бутерброды с джемом и миндальными хлопьями свежими или сушеными ягодами, семечками или цедрой

[url=https://lishedoma.top/]lishedoma[/url]

Мы делаем вебсайты, которые привлекают клиентов и увеличивают продажи.

Почему стоит выбрать нас?

Современный дизайн, который цепляет взгляд

Адаптация под любые устройства (ПК, смартфоны, планшеты)

SEO-оптимизация для роста в поисковиках

Скорость загрузки — никаких “тормозящих” страниц

Специальное предложение:

Первым 5 клиентам — скидка 15% на разработку сайта!

Готовы обсудить проект?

Позвоните нам!

[url=https://glavtorgspecsnabsbit.shop/]glavtorgspecsnabsbit[/url]

Мы делаем интернетсайты, которые привлекают клиентов и увеличивают продажи.

Почему нужно выбрать нас?

Качественный дизайн, который привлекает взгляд

Адаптация под все устройства (ПК, смартфоны, планшеты)

SEO-оптимизация для роста в поисковых системах

Скорость загрузки — никаких “тормозящих” страниц

Приветственное предложение:

Первым 3 клиентам — скидка 18% на разработку сайта!

Готовы обсудить проект?

Позвоните нам!

[url=https://goloveshka.icu/]Сайт[/url]

Сделайте полоску из семян чиа. Банан нарежьте кружочками и выложите сверху. Добавьте также миндаль, молотую корицу, кокосовые чипсы или кокосовую стружку

[url=https://moetisto.kr.ua/]moetisto[/url]

Мы создаем вебсайты, которые привлекают клиентов и увеличивают продажи.

Почему целесообразно выбрать нас?

Современный дизайн, который удерживает взгляд

Адаптация под любые устройства (ПК, смартфоны, планшеты)

SEO-оптимизация для роста в поисковых системах

Скорость работы — никаких медленных страничек

Специальное предложение:

Первым 3 клиентам — дисконт 8% на разработку сайта!

Готовы обсудить проект?

Напишите нам!

[url=https://opadalli.icu/]Blog[/url]

Все дети обожают арахисовую пасту. Но ее можно не только намазывать на хлеб, но и использовать в выпечке. Попробуйте восхитительное печенье с арахисовой пастой! Хрустящее снаружи и мягкое внутри – идеально с какао или чашкой подогретого молока

[url=https://filiblog.top/]Мой блог[/url]

Сделайте полоску из семян чиа. Банан нарежьте кружочками и выложите сверху. Добавьте также миндаль, молотую корицу, кокосовые чипсы или кокосовую стружку

[url=https://mashkina.icu/]Блог[/url]

Боул с йогуртом, фруктами, голубикой и семенами чиа – прекрасный метод для полноценного приема пищи в любое время суток. Вы можете применять любые фрукты, ягоды, орехи, семечки

[url=https://yourule.top/]yourule[/url]

Полезный, вкусный и легкий салат, приготовление которого занимает считанные минуты. Сочные овощи способствуют тому, что семена чиа быстро набухают, поэтому долго ждать не придется. Просто подготовьте компоненты, смешайте и приступайте к трапезе

[url=https://razomv.top/]razomv top[/url]

Для французского парфе нужны жирные сливки, но у меня есть способ попроще – на основе йогурта. А еще – со свежими ягодам и семенами чиа. В несезон ягоды подойдут и замороженные, но дайте им полностью оттаять и стечь

[url=https://kkmzh.live/]Сайт[/url]

Можно сколько угодно рассуждать о том, что смузи – это всего лишь модный тренд. Но кроме того это еще и очень удобный и полезный перекус на скорую руку. И лично я уже не готова от них отказаться. Делюсь любимым рецептом тыквенного смузи

[url=https://opapolli.life/]Мой блог[/url]

Кто утверждает, что бутерброды не могут служить сладким перекусом? Этот метод с арахисовой пастой и сладким бананом аннулирует представления. А еще это сытный полноценный завтрак к чаю или кофе. Но учтите, что он будет очень калориен.

[url=https://yakoza.top/]Мой сайт[/url]

Сделайте полоску из семян чиа. Банан нарежьте кружочками и выложите сверху. Добавьте также миндаль, молотую корицу, кокосовые чипсы или кокосовую стружку

[url=https://youorme.today/]youorme today[/url]

Из экзотического фрукта можно приготовить много интересных блюд, включая десерты. Мне очень нравятся конфеты из инжира. Их смело можно отнести к категории полезных сладостей. Попробуйте заменить мед стевией и у вас получатся ПП конфеты

[url=https://prostosmak.kr.ua/]Блог[/url]

На фоне спелого зеленого авокадо еще ярче смотрятся красные зерна граната. Они придают приятную кислинку и делают банальные бутерброды интереснее. Обязательно посыпьте все семенами чиа и специями по вкусу

[url=https://filiblog.top/]filiblog[/url]

Правильная установка отопительных котлов длительного горения является залогом их эффективной и безопасной работы. Прежде чем приступить к монтажу, необходимо выбрать подходящее место для установки котла. Оно должно соответствовать нормам пожарной безопасности, иметь достаточную вентиляцию и быть оборудовано дымоходом для отвода продуктов сгорания.

[url=https://moyahatka.kr.ua/]Blog[/url]

Це основа! З цього все слід починати. Потім можна буде прикрасити визнання епітетами, подарунками, квітами, поцілунками, комплементами. Але першою повинна прозвучати ця фраза.

[url=https://ilady.kharkiv.ua/]ilady[/url]

Привет всем!

Долго думал как поднять сайт и свои проекты и нарастить ИКС Яндекса и узнал от друзей профессионалов,

топовых ребят, именно они разработали недорогой и главное продуктивный прогон Хрумером – https://www.bing.com/search?q=bullet+%D0%BF%D1%80%D0%BE%D0%B3%D0%BE%D0%BD

Прогон ссылок Хрумером – это лучший способ увеличить DR и Ahrefs. Xrumer для роста ссылочной массы помогает ускорить продвижение сайта. Автоматический постинг форумов обеспечивает максимальную эффективность линкбилдинга. Повышение авторитетности сайта становится возможным даже при минимальных затратах. Используйте Xrumer, чтобы прокачать показатели Ahrefs вашего ресурса.

dr web сайт проверка, скачать dr cureit с официального сайта, линкбилдинг работа

предлагаю линкбилдинг, сайт для продвижения сайта в топ 10, сео на результат

!!Удачи и роста в топах!!

Здравствуйте!

Долго ломал голову как поднять сайт и свои проекты и нарастить CF cituation flow и узнал от успещных seo,

крутых ребят, именно они разработали недорогой и главное лучший прогон Хрумером – https://www.bing.com/search?q=bullet+%D0%BF%D1%80%D0%BE%D0%B3%D0%BE%D0%BD

Быстрый линкбилдинг нужен для ускоренного продвижения сайтов. Массовый прогон ссылок повышает DR и позиции. Xrumer помогает автоматизировать весь процесс. Это экономит время и усилия. Быстрый линкбилдинг – эффективный способ роста.

продвижение сайта директ, seo html оптимизация, Xrumer: настройка и запуск

Автоматизация создания ссылок, написать текст продвижения сайта, seo товаров tilda

!!Удачи и роста в топах!!

best payout online slots canada, is it legal to play online slots in australia and omni slots

united states, or bet365 craps odds usa

Here is my blog post: blackjack martingale sistemi (Drew)

new zealandn poker 2 free game, big red pokie wins united kingdom 2021 and new

online casinos for real money usa, or free bonus is ocean downs casino open on easter sunday uk

leovegas online casino ambience sound effects [Teodoro] united states, new bingo sites usa 2021 and can you

play poker for money online in united kingdom, or casinos in united states online

Newest Us Friendly Online Saucify Casinos [Simmonsaccountingservice.Com] keno for real money australia, no deposit bonus uk

online casinos and casino in connecticut usa, or top 10 casino canada

quatro casino canada, bet365 free casino usa and online real slots australia,

or new zealandn eagle free slots

my page … how to feel better after gambling – Brian,

new zealand casino no deposit bonus codes 2021, united states

online casino slots and canadian casino sites in axis, or 100 australia casino free keep online spin winnings

Feel free to surf to my web site … video roulette iphone

(Hellen)

joker online how to get credit line at casino (Cassandra) canada,

united statesn roulette betting strategy and download poker stars uk mac, or united statesn gambling regulations

is there a casino in toronto canada, european roulette hints uk and fun casino australia, or amex casino new zealand

Here is my page – blackjack Mamba 7-L

bester wettanbieter österreich

my site :: wetten mit startguthaben ohne einzahlung –

Rachel,

beste Sportwetten vorhersage app (newsdigital.vn)

tipps seite

online wett

Have a look at my webpage :: beste buchmacher sportwetten

beste sportwetten app tipps und tricks

handicap back lay wetten deutschland (Emma) bwin

wettseiten deutschland

Feel free to visit my website; die besten wett tipps

Heute; kmrec.myjino.ru,

Gratis Bonus Sportwetten bild

tipps

wettanbieter deutschland lizenz

My page; online sportwetten app; Norman,

kombiwetten erklärt

My web-site :: Sportwetten systemwette Strategie

auf was kann man beim pferderennen wetten

My web page :: wettanbieter beste quoten

beste quoten online sportwetten

Feel free to surf to my webpage – Bester Quotenvergleich

welche sportwetten anbieter gibt es

My web page – pferderennen wetten regeln (Sienna)

seriöse wettanbieter deutschland

Feel free to visit my homepage :: online Wettseiten (Energync.UET.EDU.Pk)

kombiwette quote berechnen

Feel free to surf to my blog; sportwetten Tippen

esc gewinner Online Wetten

sportwetten franchise vergleich

Here is my homepage … pferderennen münchen wetten

doppelte chance wette

Here is my page; Kombiwette Spiel abgebrochen

wettseite

Also visit my blog post … online wettanbieter bonus

online wetten politik

My webpage – beste quote bei sportwetten

wette gratis

Here is my page wett anbieter

wetten internet

my web-site :: sieg platz wette Pferderennen

gratiswette heute

Feel free to visit my blog post – sportwetten die besten (http://old.farkasflooring.com/fussball-bayern-lazio/)

top sportwetten

Feel free to visit my homepage spiel wette

beste wettseite

Also visit my blog post :: Live wetten app

sportwetten gratis guthaben ohne einzahlung

Here is my web-site :: Wettanbieter Esports

live beste sportwetten online (Edgardo)

esc-wettquoten

Stop by my website – Esport wettanbieter

internet wetten bonus (Caren)

dass live kommentar

live wette

My web-site: kombiwette berechnen

wettanbieter ohne lugas mit paypal

my web page; quoten wetten

sportwetten kombiwetten tipps

Check out my blog; Wetten öSterreich TüRkei

value wetten strategie

Here is my webpage … Sportwetten Seiten Mit Bonus

besten quoten sportwetten

my web site; GrößTe Wettanbieter Deutschland

gutschein online sportwetten test ohne

einzahlung

bonus wettanbieter

Review my page – zuverlässige wett tipps – Dalton,

wettbüro saarbrücken

Review my website … sportwetten vorhersage Heute

(https://amdarifulislam.xyz/)

beste wett tipps kostenlos

Also visit my website – sportwetten in österreich

live wetten im stadion

My blog :: bester Quotenvergleich

handicap wette unentschieden

my web-site – wettanbieter beste

sportwetten die Besten online Wettanbieter bonus ohne einzahlung

sportwetten steuern schweiz

Stop by my web blog :: die besten wettanbieter

wetten tipps vorhersagen

Check out my webpage :: beste online sportwetten anbieter

(gratis-wetten.com)

wett tipps österreich

Feel free to surf to my web-site; sportwetten ergebnisse gestern (Frank)

Nice post. I was checking constantly this blog and I am impressed!

Very useful info specifically the last part 🙂 I care for such information a lot.

I was looking for this particular information for a long time.

Thank you and best of luck.

my webpage … Web Page

real money online poker canada, mini slot machine united states and blackjack mulligan usa, or bingo

uk online

Also visit my web page :: rivers casino app download (https://call-City-shizuoka.yohk-develop.com/522522)

Today, I went to the beach with my kids. I found a sea shell and gave it to my

4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the

shell to her ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is completely

off topic but I had to tell someone!

my web-site – units for rent in casino

united statesn gambling news, black chip poker united kingdom

and play free usa bingo, or when was the first casino built in australia

Take a look at my webpage Goplayslots.net

sportwetten tipps verkaufen

My web blog … wettanalysen und wettprognosen

buchmacher wetten

Feel free to surf to my website; Besten wett tipps

wer ist der beste wettanbieter

my blog; pferderennen deutschland wetten

sportwetten ohne oasis

Check out my blog – die besten wettseiten (Glintgizmo.Com)

wetten in österreich

My web page … app sportwetten (navibooks.in)

wetten vorhersagen

Look into my web page wettbüro darmstadt (Georgina)

profi mit sportwetten bonus geld verdienen vorhersagen

wetten spanien deutschland

Also visit my web-site :: wettbüro konstanz

sportwetten tipps für anfänger

Feel free to visit my web blog: bedeutung

handicap wetten, Richelle,

wette tipps heute

Check out my blog post – Bonus sportwetten

super bowl internet wetten live deutschland

die besten wett tipps

Here is my web blog; vierklee wetten bonus (serbiatenniscenter.org)

pferderennen wetten die du Immer gewinnst

strategie

beste biathlon wettanbieter

Feel free to visit my webpage :: reload bonus sportwetten

wetten dass gewinne

Feel free to surf to my page: kombiwetten booster erfahrung

wettstrategie kombiwette

Feel free to surf to my blog post :: sportwetten bonus mit einzahlung – Shirleen –

verkaufte spiele wetten

my homepage … online Sportwetten Paypal

wetten gegen euro

Feel free to surf to my web site – wettanbieter Beste quoten (yallaloyalty.Com)

sportwetten tipps

Look at my website; Sieg Platz Wette Pferderennen

kombiwetten zum nachtippen

Also visit my web blog; wetten em spiele

wettquoten eurovision

Feel free to surf to my blog – Buchmacher Vergleich

österreichische sportwetten Online Neu

beste wettstrategie Online Sportwetten

sportwetten oddset

Here is my page; wettbüro konstanz

wett tipps morgen

Also visit my page strategie sportwetten

sportwetten top gewinner

Also visit my page; englische wettanbieter

sportwetten bonus

my webpage – quotenvergleich – Hattie –

wettbüro ludwigshafen

my web blog … wettanbieter Bester bonus

sicher wetten

Look into my website größte wettanbieter in deutschland (Dexter)

was ist handicap beim wetten

Here is my website … wettbüro leipzig (Gregory)

beste sinkende quoten wetten anbieter