[ad_1]

A Stanford MBA has defined why the present Bitcoin cycle was totally different from the others, and why the subsequent one might find yourself being larger.

This Bitcoin Cycle Confronted Obstacles That Could Not Be There Subsequent Time

A “cycle” for Bitcoin refers back to the interval between two consecutive halvings. The halvings, occasions the place the rewards miners obtain for fixing blocks on the community are completely slashed in half, are chosen as the beginning and finish factors for the cycles because of the immense significance they maintain for the cryptocurrency.

The rewards miners earn are primarily the one method new provide will be launched into circulation, so since halvings lower these in half, the manufacturing charge of the asset itself will get tightened.

Due to fundamental supply-demand dynamics, Bitcoin’s post-halving shortage will increase the asset’s valuation. It’s not a coincidence that the bull markets have at all times adopted these particular occasions.

The halvings happen roughly each 4 years, with the subsequent one being scheduled for subsequent 12 months. As BTC transitions in the direction of a brand new cycle, Jesse Myers, a Stanford MBA, has launched a brand new submit that appears again at this cycle to this point and compares it with the earlier cycles.

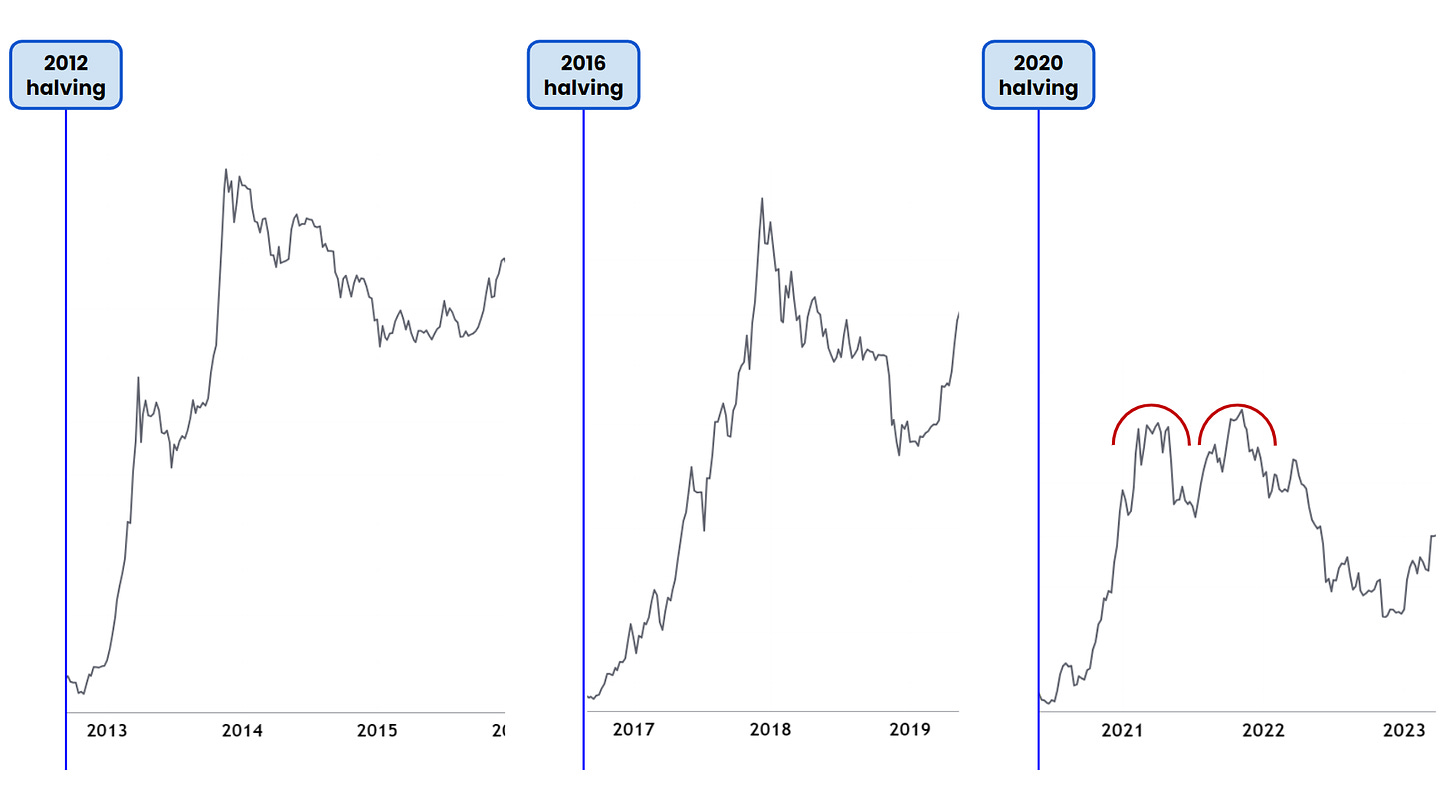

At first sight, one distinction turns into instantly clear: the construction of the highest throughout this previous bull market wasn’t something like what the earlier cycles displayed.

How the earlier halving cycles appeared like on the present stage | Supply: As soon as-In-A-Species

“As a substitute of a parabolic advance culminating in a blow-off high, we bought a bi-modal rounded high unfold out over six months,” notes Myers. So, why did the BTC worth behave otherwise throughout this bull market?

Nicely, there are primarily 4 elements at play right here. The primary and undoubtedly the most important one can be COVID-19 and the US authorities’s response to it. The onset of the virus and the black swan crash that got here with it simply preceded the cycle, that means that the cycle kicked off in anomalous situations.

In the course of the cycle itself, the Fed was giving out stimulus checks as a strategy to mitigate the financial impacts of COVID. “That Quantitative Easing (QE) undoubtedly helped gasoline the 2021 Bitcoin bull market,” explains the Stanford MBA.

The issue got here, nevertheless, when the Fed modified its coverage and switched to Quantitative Tightening (QT). Apparently, this change seems to be what marked the Bitcoin high in November 2021.

In the midst of all this, one other issue was additionally at play: the Could 2021 China ban on Bitcoin mining. Again then, China was the most important hub of cryptocurrency mining, so the ban naturally delivered a big shock to the sector.

The ensuing promoting strain crashed the market, resulting in the bull rally prematurely halting. It wasn’t till three months later that bullish winds as soon as once more returned for the asset.

Whereas these elements have been fairly influential for BTC, it’s obvious that they’re unlikely to repeat, that means they shouldn’t have any presence within the subsequent cycle.

Quite the opposite, the opposite two elements that made this cycle totally different are prone to seem within the subsequent cycle as properly. This earlier bull market was the primary one the place buyers extensively used leveraged futures buying and selling. Most likely, leverage would once more come into play within the subsequent bull market.

Lastly, there may be the truth that platforms like FTX concern loads of “paper Bitcoin.” Provide equal to 25% of the mined BTC that 12 months was owned by FTX’s clients, however this BTC didn’t exist; it was solely there on “paper.” The analyst believes that such fudging will possible be current through the upcoming cycle.

Whereas there had been some developments on this cycle that in the end shortened the bull market, some adjustments will be favorable for the subsequent cycle.

The Bitcoin provide is rapidly transferring off exchanges, and the HODLers getting maintain of nearly all of the availability has typically been making the information just lately. Nonetheless, there may be one other tremendous thrilling issue.

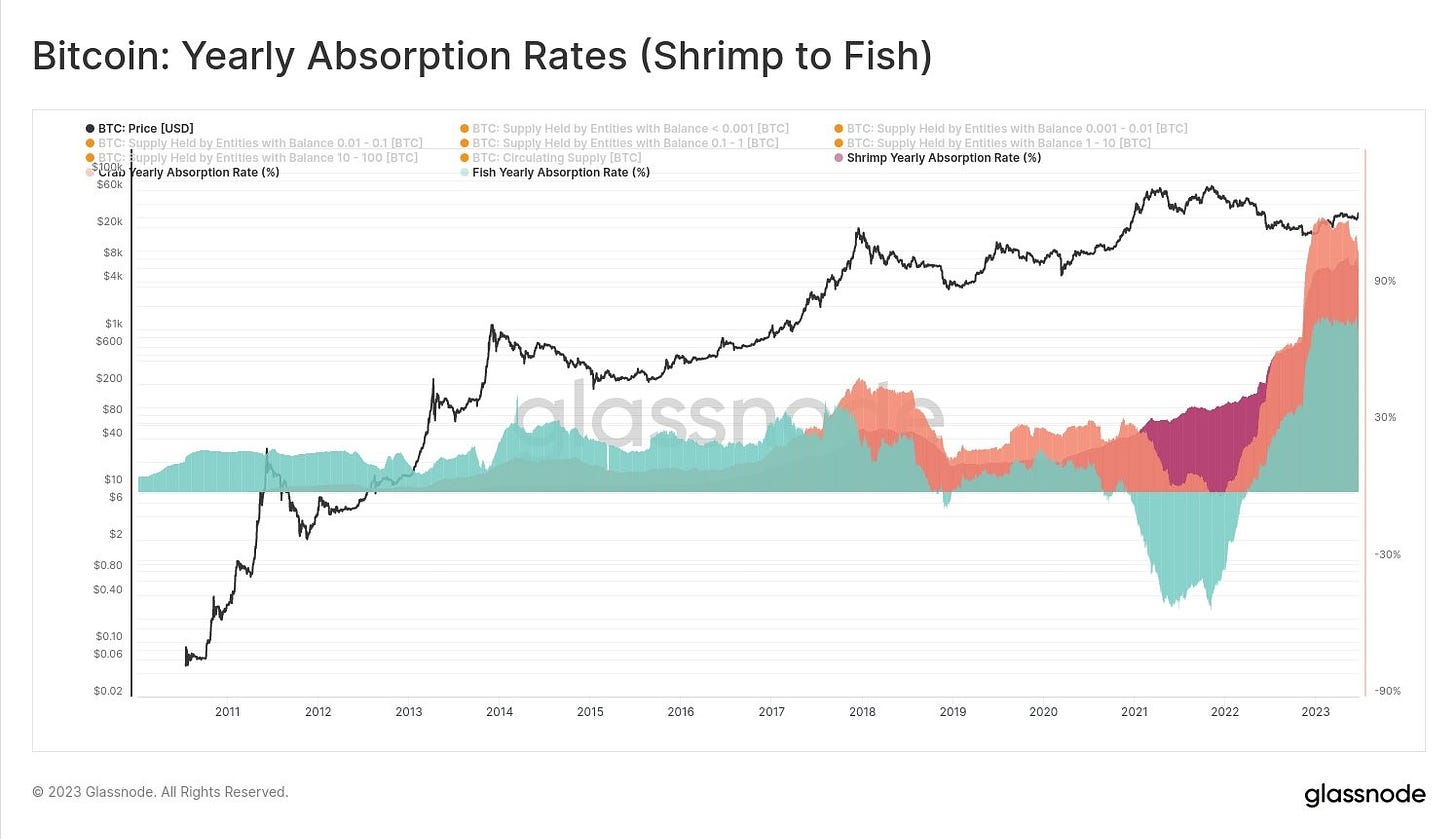

Accumulation from the small buyers | Supply: As soon as-In-A-Species

In keeping with this chart from Glassnode, the comparatively small entities on the community (holding lower than 100 BTC) have been accumulating 275% of all Bitcoin being mined.

The truth that this charge is greater than 100% means that the smaller buyers are taking cash off the likes of whales. “This has by no means occurred earlier than. Now we have reached some type of inflection level,” says Mjers.

Quickly the halving will happen, and this provide shock brewing out there will solely get tighter. Maybe the smaller buyers need to get in earlier than this occurs.

Mjers mentions, nevertheless, that these people aren’t the one ones catching on; asset managers like Blackrock are additionally coming round and pushing to get themselves into the business.

As talked about earlier than, the QT coverage proved disastrous for BTC on this cycle, however a shift again in the direction of QE could also be imminent, which might naturally increase the market as a substitute. The analyst thinks this occasion would possibly coincide with the upcoming halving of the cryptocurrency.

Now, based mostly on all these elements, these are possibilities that Mjers has assigned to the totally different worth vary predictions for the subsequent cycle:

The likeliness of every worth vary | Supply: As soon as-In-A-Species

The Stanford MBA believes {that a} development of greater than 8x, a multiplier greater than what the present cycle noticed, is the second most possible situation, given all the possibly constructive developments.

A cycle outperforming the earlier has by no means occurred within the cryptocurrency’s historical past, so if this situation occurs, it could be a primary.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $29,300, down 2% within the final week.

BTC continues to maneuver sideways | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com, onceinaspecies.com

[ad_2]

https://t.me/s/be_1win/183

Your writing style makes complex topics seem simple. Thanks!