[ad_1]

The crypto market has been on a rollercoaster this 12 months, with costs fluctuating wildly and regulatory pressures inflicting important drops. Nevertheless, latest developments have given buyers renewed confidence available in the market, resulting in a complete crypto market cap restoration.

On June fifteenth, the entire crypto market cap hit a low level of $972 billion, following the Securities and Alternate Fee’s (SEC) regulatory strain on the trade. However since then, the market has rebounded.

This restoration has been pushed partly by the doorway of main monetary gamers into the crypto house. A number of purposes for a Bitcoin Spot Alternate-Traded Fund (ETF) by main monetary gamers akin to Blackrock and Constancy have been filed, indicating that they’re curious about betting on cryptocurrencies.

This has helped to rebuild investor confidence available in the market, resulting in elevated investments and an increase within the complete crypto market cap.

Crypto Market Cap’s Second Of Reality

Cryptocurrency buyers are carefully monitoring the entire crypto market cap because it makes an attempt to interrupt by way of a major resistance stage. In accordance to crypto analyst Rekt Capital, if the market can efficiently breach this stage, it may pave the way in which for continued upward momentum and doubtlessly important positive aspects for the general market.

On the time of writing, the entire crypto market cap is round $1.17 trillion, with Bitcoin making up the lion’s share of this worth. Nevertheless, the market has been buying and selling in a comparatively tight vary over the previous few weeks, with many buyers in search of a catalyst to drive costs greater.

Rekt Capital believes {that a} breakout above the present resistance stage might be simply the catalyst that the market must see a sustained uptrend. Rekt Capital means that the market may see positive aspects of between 10% and 23% over time if this breakout happens.

As depicted within the chart, the speedy resistance ranges for the worldwide market cap of the cryptocurrency trade are at the moment at $1.18 and $1.25. The latter represents the very best stage achieved in 2023.

Nevertheless, sure circumstances should be met for the market to interrupt by way of these ranges. Firstly, there must be an enchancment in present market circumstances, together with a rest of crypto laws by regulators globally, notably within the US. Moreover, there must be a decision of the continuing Bitcoin Spot ETF purposes by main monetary gamers with the SEC.

If these circumstances are met, it may result in an inflow of economic gamers and buyers into cryptocurrency. Many buyers wish to cryptocurrencies as a hedge in opposition to inflation, and better regulatory readability and the approval of a Bitcoin ETF may make the trade extra engaging to conventional buyers.

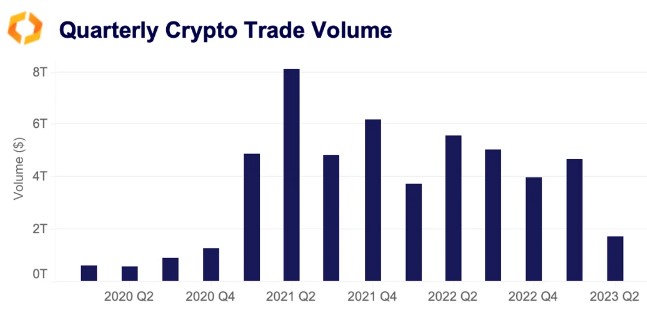

Cryptocurrency Buying and selling Quantity Drops To 2020 Ranges

Crypto buying and selling volumes have reached their lowest ranges since 2020, regardless of the continuing rally in June. In accordance to a report by crypto market information supplier Kaiko, spot commerce volumes have considerably declined in Q2, with Binance registering the strongest drop in buying and selling exercise.

Binance, one of many world’s largest crypto exchanges, noticed volumes fall by almost 70% after the change reintroduced charges for its most liquid Bitcoin pairs. This transfer, geared toward decreasing market manipulation, seems to have considerably impacted buying and selling exercise on the platform.

Nevertheless, Binance was not the one change to see a major decline in buying and selling volumes. Different widespread exchanges, together with Coinbase, Kraken, OKX, and Huobi, additionally noticed volumes decline by over 50% in Q2.

The decline in buying and selling volumes is stunning, given the latest rally within the crypto market. Bitcoin, the biggest cryptocurrency by market cap, has been bullish in June, reaching a excessive of over $31,000. Regardless of this, buying and selling volumes have remained subdued, suggesting that buyers usually are not as lively available in the market as they’ve been.

Featured picture from Unsplash, chart from TradingView.com

[ad_2]

ivermectin 3 mg pills – candesartan medication carbamazepine over the counter

isotretinoin 10mg oral – zyvox 600mg pill linezolid price

cheap amoxil pills – buy valsartan 160mg combivent buy online

buy azithromycin 250mg pill – order azithromycin 250mg without prescription bystolic where to buy

prednisolone 5mg usa – purchase azipro generic generic prometrium

brand furosemide 100mg – buy betamethasone cream for sale3 buy betamethasone 20 gm for sale

augmentin 375mg for sale – buy clavulanate without a prescription buy duloxetine sale

purchase monodox online cheap – cheap glipizide 5mg glucotrol 5mg for sale

augmentin 625mg oral – buy generic clavulanate buy duloxetine generic

oral semaglutide 14mg – cost cyproheptadine 4mg periactin pills

order tizanidine 2mg online cheap – order plaquenil 400mg without prescription microzide 25mg price

buy cialis online cheap – buy sildenafil 50mg pills viagra 100mg without prescription

viagra 50mg without prescription – cialis 10mg tablet prices of cialis

cheap atorvastatin 40mg – atorvastatin 40mg cost prinivil online order

cenforce order – order chloroquine 250mg generic order glycomet generic

prilosec over the counter – buy metoprolol 100mg for sale buy tenormin 50mg for sale

methylprednisolone 4 mg oral – lyrica usa order aristocort online cheap

buy desloratadine online cheap – order desloratadine 5mg generic buy priligy for sale

misoprostol 200mcg pill – cytotec over the counter diltiazem 180mg uk

order acyclovir 400mg online – order acyclovir pills buy rosuvastatin 20mg sale

domperidone for sale – domperidone usa buy cyclobenzaprine online

order motilium 10mg sale – order generic tetracycline purchase cyclobenzaprine online cheap

inderal 20mg for sale – order methotrexate 10mg without prescription order methotrexate pill

coumadin 5mg sale – purchase maxolon for sale buy losartan tablets

order levofloxacin 250mg pill – levaquin tablet order zantac 150mg without prescription

purchase nexium pills – imitrex 50mg sale buy sumatriptan 50mg for sale

buy mobic tablets – meloxicam ca flomax online

oral zofran – spironolactone 100mg for sale simvastatin for sale

Such a beneficial read.

order valtrex online cheap – order finasteride 1mg generic order generic fluconazole 100mg

provigil 100mg generic purchase modafinil online provigil 200mg ca purchase provigil without prescription buy provigil 100mg how to buy modafinil order provigil 200mg online cheap

More delight pieces like this would insinuate the web better.

More posts like this would bring about the blogosphere more useful.

order zithromax 500mg generic – buy sumycin 250mg online cheap order generic metronidazole

order generic rybelsus 14mg – order semaglutide generic order generic cyproheptadine 4 mg

buy domperidone paypal – buy flexeril sale cyclobenzaprine oral

purchase inderal online – order generic methotrexate 5mg methotrexate 5mg tablet

amoxil usa – where to buy valsartan without a prescription purchase ipratropium generic

cost zithromax – purchase nebivolol for sale nebivolol online buy

purchase augmentin – at bio info purchase ampicillin

buy nexium 20mg online cheap – anexa mate nexium capsules

coumadin sale – https://coumamide.com/ purchase hyzaar generic

purchase mobic without prescription – https://moboxsin.com/ mobic pills

buy deltasone without prescription – aprep lson buy deltasone 40mg online

buy pills for erectile dysfunction – where to buy ed pills buy pills for erectile dysfunction

cheap amoxil generic – https://combamoxi.com/ amoxicillin price

diflucan brand – https://gpdifluca.com/ buy fluconazole paypal

cenforce 50mg oral – site cenforce 100mg uk

tadalafil how long to take effect – fast ciltad tadalafil and ambrisentan newjm 2015

sildenafil vs tadalafil vs vardenafil – how long for cialis to take effect generic cialis

ranitidine tablet – order ranitidine 150mg ranitidine 150mg cheap

viagra sale online australia – viagra sale new zealand how to order viagra cheap

More articles like this would pretence of the blogosphere richer. que es la propecia

The thoroughness in this draft is noteworthy. https://buyfastonl.com/gabapentin.html

This is the kind of enter I find helpful. https://ursxdol.com/doxycycline-antibiotic/

More delight pieces like this would urge the интернет better. https://prohnrg.com/product/get-allopurinol-pills/

With thanks. Loads of conception! online

More text pieces like this would insinuate the web better. https://ondactone.com/simvastatin/

I’ll certainly bring to be familiar with more.

https://proisotrepl.com/product/tetracycline/

Greetings! Very serviceable recommendation within this article! It’s the scarcely changes which will make the largest changes. Thanks a lot towards sharing! http://zqykj.cn/bbs/home.php?mod=space&uid=302509

how to buy forxiga – https://janozin.com/ buy forxiga 10 mg generic

buy xenical generic – https://asacostat.com/# how to buy xenical

Thanks on sharing. It’s first quality. https://lzdsxxb.com/home.php?mod=space&uid=5112856

You can protect yourself and your dearest close being wary when buying pharmaceutical online. Some pharmacopoeia websites control legally and offer convenience, secretiveness, cost savings and safeguards over the extent of purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/cozaar.html cozaar

With thanks. Loads of knowledge! TerbinaPharmacy

This is the kind of criticism I truly appreciate.

Với ba tiêu chí phát triển là “Công bằng – Công khai – Hợp pháp”, slot365 hứa hẹn sẽ mang tới cho bạn những trải nghiệm giải trí tuyệt đỉnh. Đăng ký hội viên mới, tân thủ không chỉ được thưởng lớn 100% tiền gửi lần đầu, mà còn có cơ hội “đầu tư kiếm lời” với tỷ lệ cược lô đề 1 ăn 99.8 độc quyền hiện nay.

Với ba tiêu chí phát triển là “Công bằng – Công khai – Hợp pháp”, slot365 hứa hẹn sẽ mang tới cho bạn những trải nghiệm giải trí tuyệt đỉnh. Đăng ký hội viên mới, tân thủ không chỉ được thưởng lớn 100% tiền gửi lần đầu, mà còn có cơ hội “đầu tư kiếm lời” với tỷ lệ cược lô đề 1 ăn 99.8 độc quyền hiện nay.

66b cung cấp cho người chơi hơn 35+ ngân hàng nội địa đi kèm với nhiều phương thức giao dịch khác bao gồm: Ví điện tử, Thẻ cào, QR Pay và USDT. Bạn chỉ mất 18 giây để nạp tiền và 2 phút để rút tiền thành công về tài khoản chính chủ, tất cả đều miễn phí và xanh chín.

66b cung cấp cho người chơi hơn 35+ ngân hàng nội địa đi kèm với nhiều phương thức giao dịch khác bao gồm: Ví điện tử, Thẻ cào, QR Pay và USDT. Bạn chỉ mất 18 giây để nạp tiền và 2 phút để rút tiền thành công về tài khoản chính chủ, tất cả đều miễn phí và xanh chín.

https://t.me/s/Top_BestCasino/173

https://t.me/s/officials_pokerdom/3606

https://t.me/s/beEfCaSiNo_OfFiCiALS

top 10 canadian online casinos

online baccarat real money

play now online casino bonus

betmgm NM betmgm sports betmgm app