[ad_1]

Fast Take

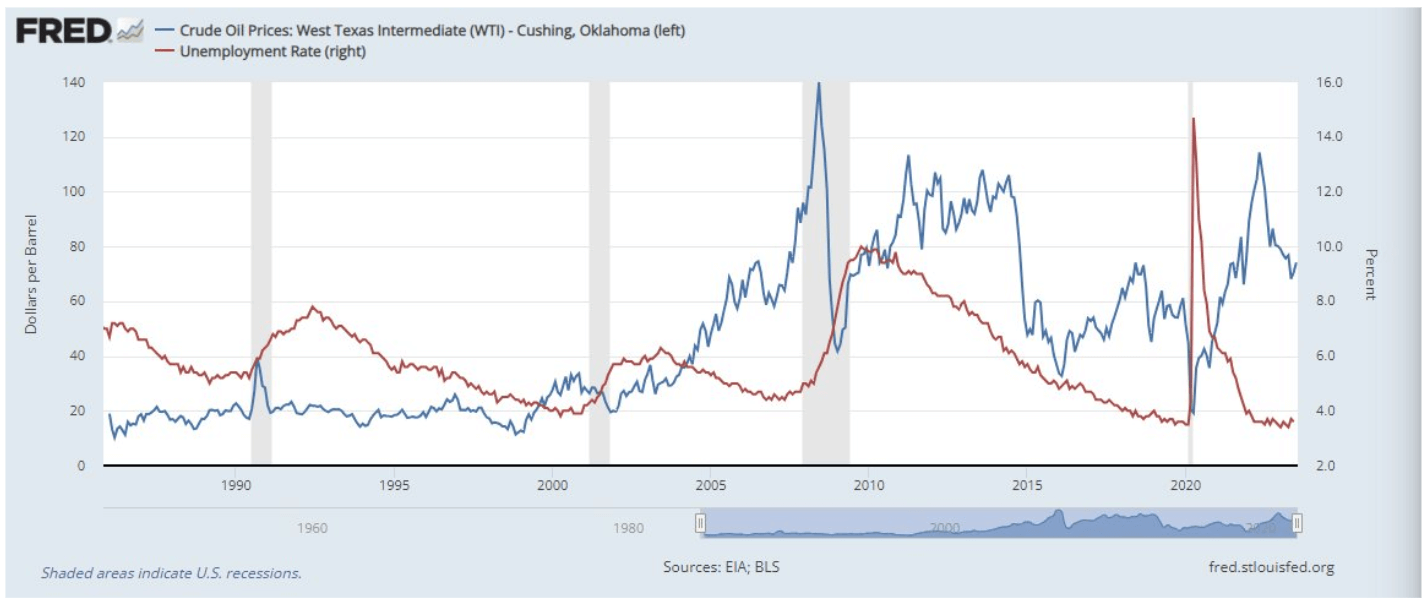

The intricate relationship between crude oil costs and unemployment is a topic of shut examination within the present financial panorama. Oil costs are on an upward trajectory, at present round $80 per barrel, a notable enhance from the $66 per barrel seen in March.

Such an increase in oil costs can induce a cascading impact, escalating the costs of products, significantly meals and power. This results in inflationary pressures, a priority for the Federal Reserve because it counteracts its purpose of preserving worth stability.

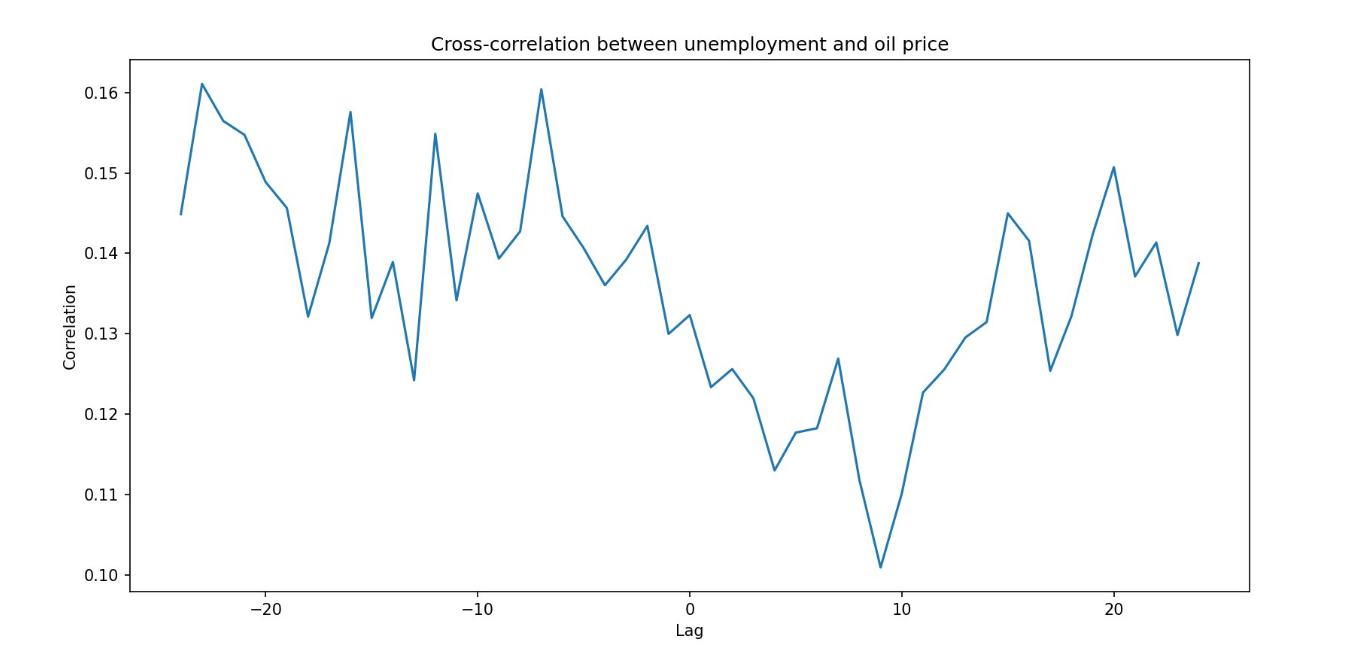

Fascinatingly, the interaction between oil costs and unemployment often follows a particular pattern. A rise in oil costs typically precedes an increase in unemployment, which, excluding the COVID-19 pandemic, has led to a recession three out of 4 occasions. This correlation usually takes about six months to manifest.

The market is at present observing a detrimental year-over-year comparability for oil, which bodes properly for the Shopper Worth Index (CPI) metric.

Nevertheless, given the present rising pattern of oil costs, this case calls for cautious monitoring. It’s essential for financial contributors to vigilantly monitor these shifts to foretell and reduce potential detrimental impacts on unemployment and inflation

This level is supported by Viraj Patel, FX & International Macro Strategist:

“Except oil will get again to $100/bbl it’s not ‘inflationary’. At finest latest rally in commodities is much less deflationary”

The submit Are the complicated interplays between crude oil costs and unemployment charges trigger for concern? appeared first on CryptoSlate.

[ad_2]

I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

Nice post. I learn something totally new and challenging on websites

very informative articles or reviews at this time.

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

You’ve explained it perfectly.

This should be featured everywhere.

You nailed it.

So glad I stumbled upon this.