[ad_1]

Bitcoin could also be at a choice level proper now as investor sentiment is strictly impartial. Which approach will the market tip within the coming days?

Bitcoin Worry & Greed Index Suggests Market Is Impartial

A number of days again, Bitcoin had noticed a pointy plunge that had taken the cryptocurrency’s worth in the direction of the $29,000 stage. Within the days that adopted, the asset had solely consolidated round these comparatively low ranges, however over the past 24 hours, issues seem to have modified a bit.

The impetus for this newest volatility seems to have been the US Federal Reserve (Fed) climbing rates of interest by an anticipated 25 bps. Shortly after the FOMC assembly had introduced this enhance, Bitcoin began to surge, giving traders hope that the coin could also be touring again towards the $30,000 stage.

This new rise, nevertheless, appears to have already run out of steam, as BTC has fallen again to decrease ranges. On the time of writing, Bitcoin is buying and selling round $29,400, down 2% previously week.

BTC's restoration hasn't been a lot but | Supply: BTCUSD on TradingView

Whereas Bitcoin has retraced from its peak throughout the previous day, the cryptocurrency remains to be up a web quantity on this interval, that means that the asset has managed to carry onto some restoration nonetheless.

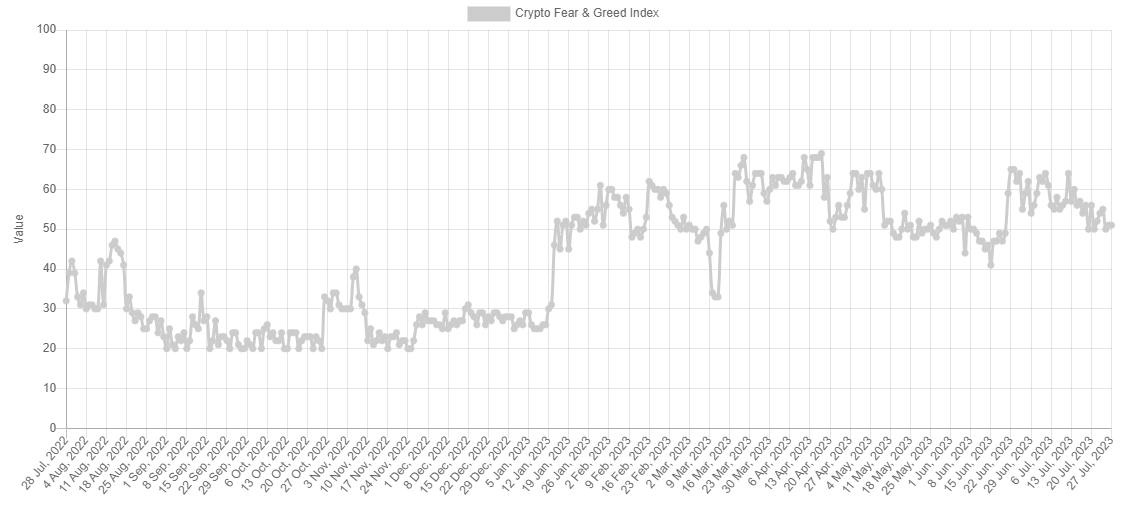

The very fact stays, although, that the coin has been unable to maintain up its upward development, an indication that the market remains to be maybe indecisive about its course. That is mirrored within the common funding sentiment within the area, because the “Worry & Greed Index” reveals.

Appears to be like just like the needle is pointing immediately within the center at the moment | Supply: Various

The Worry & Greed index makes use of varied market-related metrics (like volatility, dominance, and quantity) to evaluate what the more than likely sentiment of the common participant within the sector is at the moment.

This index has a price of 51 proper now, which signifies that the Bitcoin investor sentiment is nearly precisely within the stability. This lack of course out there isn’t a brand new growth; the traders have been leaning in the direction of neutrality for every week or so now.

The development within the Worry & Greed Index over the previous 12 months | Supply: Various

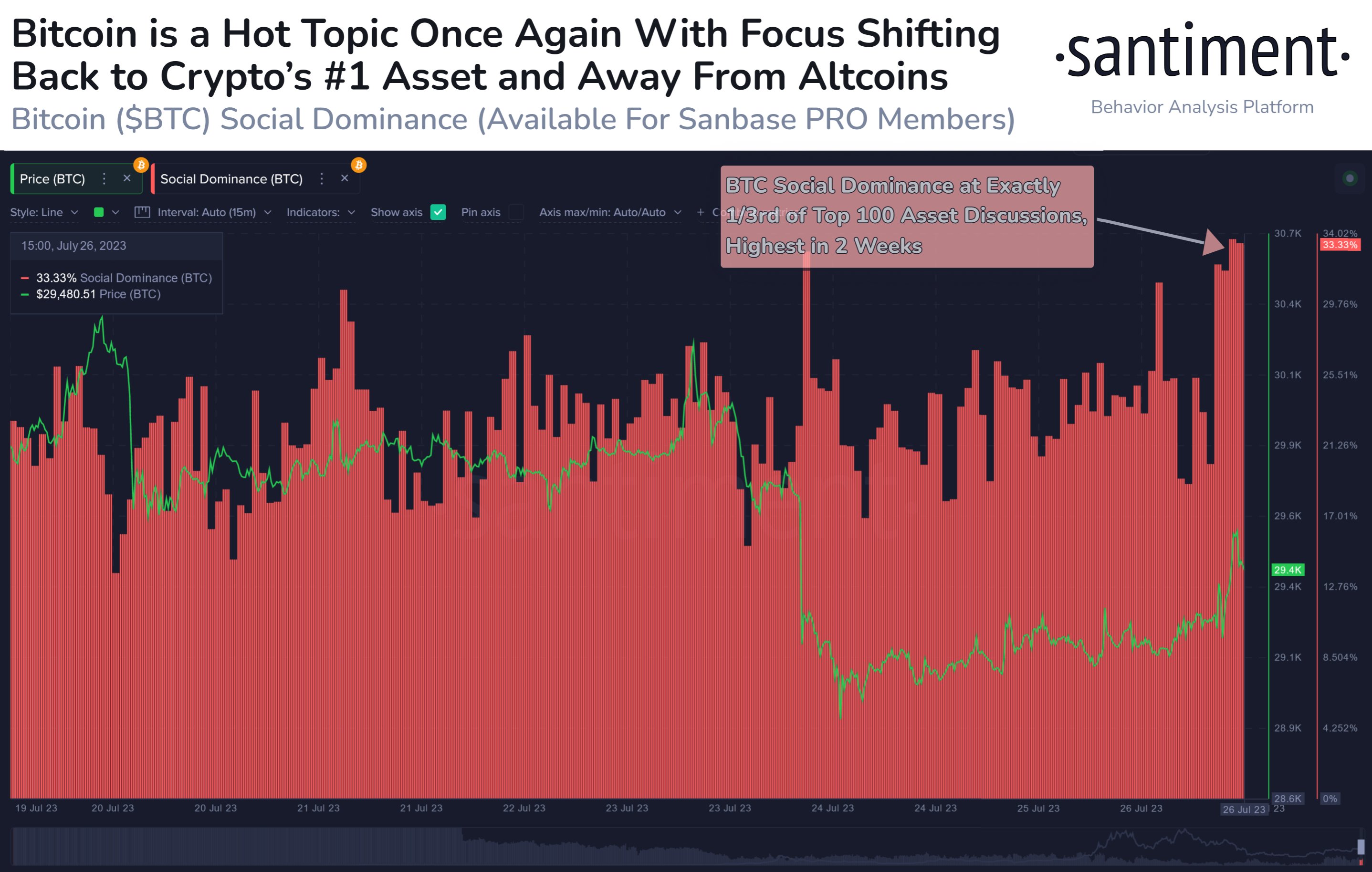

The present impartial sentiment should not be confused with an absence of curiosity in Bitcoin, nevertheless, as information from the on-chain analytics agency Santiment reveals that the share of social media discussions associated to the 100 largest belongings within the cryptocurrency sector occupied by BTC alone (the “social dominance“) is now at a two-week excessive.

BTC-related talks make up for 33% of all discussions associated to the highest 100 cash | Supply: Santiment

The merchants look to have an energetic curiosity in Bitcoin for the time being, however their collective opinion isn’t favoring anybody aspect. In conditions like these, it’s usually laborious to say which approach the cryptocurrency would possibly go in subsequent.

Associated Studying: Bitcoin Alternate Provide Solely Slips Additional Regardless of Worth Decline

If this indecisiveness out there stays within the coming days, although, it’s probably that BTC’s stagnation will proceed additional, as strikes in both course (if any) could not have the ability to go on for lengthy.

Featured picture from iStock.com, charts from TradingView.com, Various.me, Santiment.web

[ad_2]