As the financial landscape evolves at an unprecedented pace, the cryptocurrency market remains at the forefront of investment enthusiasm and speculation. Recent trends indicate a compelling narrative forming around Bitcoin, with projections suggesting it could soar past the $110,000 mark by January. Meanwhile, the significant influx of $20 billion into TRON (TRX) signals a potential resurgence of altcoins, hinting at the long-awaited ‘altseason’ that many investors have eagerly anticipated. In this article, we delve into the factors driving these developments, explore the implications for investors, and analyze what this might mean for the broader cryptocurrency ecosystem. Join us as we navigate this dynamic landscape, bringing clarity to the excitement and uncertainty surrounding the future of digital currencies.

Table of Contents

- Bitcoin Price Surge: Factors Driving Anticipated Gains Ahead of January

- The Role of TRX in Shaping Market Trends and Signaling Altseason

- Investment Strategies for Navigating the Cryptocurrency Landscape

- Analyzing Market Sentiment: What Historical Data Says About Current Trends

- Q&A

- The Conclusion

Bitcoin Price Surge: Factors Driving Anticipated Gains Ahead of January

The outlook for Bitcoin’s price has sparked a flame of bullish sentiment among investors as we approach January 2024. Several compelling factors are converging to set the stage for what many are predicting could be a significant surge, potentially pushing Bitcoin prices beyond $110K. Among these factors are:

- Increased Institutional Adoption: More institutions are allocating resources to Bitcoin, contributing to heightened market confidence.

- Halving Anticipation: The upcoming Bitcoin halving event is causing a frenzy, as historical data suggests prices typically appreciate in the run-up to the event.

- Streamlined Regulatory Clarity: Recent movements in legislation are paving the way for more robust market structures.

Moreover, the infusion of $20 billion into the enigmatic TRX market hints strongly at a potential ‘altseason.’ With altcoins likely to ride the coattails of Bitcoin’s impending rally, the diversifying interests by investors could amplify market dynamics. As public interest grows, we may witness a cascading effect across various cryptocurrencies, leading to a more vibrant ecosystem. This sentiment is further bolstered by:

- Revived Retail Interest: With broad market coverage, more retail investors are entering the space, seeking opportunities.

- Enhanced Exchange Liquidity: Recent upgrades and partnerships have strengthened liquidity provisions on major exchanges.

The Role of TRX in Shaping Market Trends and Signaling Altseason

The cryptocurrency landscape is witnessing a significant surge in interest as TRX emerges as a pivotal player in shaping market trends. With over $20 billion in market capitalization, TRX is not just a cryptocurrency to watch, but a potential harbinger of exciting shifts in market dynamics. As the market psychology evolves, observations from trading patterns and indicators reveal that substantial movements in TRX are often correlated with burgeoning altcoin activity. Investors and market analysts are closely monitoring these trends, recognizing that a robust performance from TRX could signal the onset of a more extensive altseason, characterized by widespread gains across various altcoins.

Historically, when TRX shows signs of strength, it tends to ripple through the altcoin market, inviting new capital and participation. This is particularly relevant as the anticipation grows around Bitcoin’s potential to breach the $110K mark by January, which could further bolster altcoin enthusiasm. To better understand the influence of TRX in this context, the following table illustrates the past instances where TRX rallies coincided with significant altseason phases:

| Period | TRX Price Change (%) | Altcoin Market Growth (%) |

|---|---|---|

| Q1 2021 | 250% | 150% |

| Q3 2021 | 180% | 200% |

| Q2 2022 | 160% | 120% |

As illustrated, each significant increase in TRX has been accompanied by notable growth in the altcoin sector, suggesting that traders would do well to keep a keen eye on TRX’s performance as a potential precursor to the next major altseason.

Investment Strategies for Navigating the Cryptocurrency Landscape

As the cryptocurrency market continues to evolve, investors are exploring diverse avenues to capitalize on potential gains. A well-rounded approach can involve a blend of traditional and innovative strategies to mitigate risks while maximizing returns. Key methods to consider include:

- Diversification: Spreading investments across various digital assets can reduce exposure to volatility and enhance opportunities for profit.

- Dollar-Cost Averaging: This strategy involves regularly purchasing a fixed dollar amount of cryptocurrency to lower the impact of price fluctuations over time.

- Staking and Yield Farming: Engaging in staking or yield farming can provide passive income through rewards, further enhancing return potential.

Furthermore, keeping an eye on emerging trends and market indicators can provide valuable insights into timing investment decisions effectively. For instance, monitoring sentiment in social media channels and crypto news can signal upcoming trends. Key indicators include:

| Indicator | Significance |

|---|---|

| Bitcoin Price Movements | Often signals the overall market sentiment and can affect altcoin pricing. |

| Trading Volume | Increased volume can indicate a potential shift in market conditions or the start of an altseason. |

| Market Capitalization | Tracking shifts in total market cap can help assess market health and investor confidence. |

Analyzing Market Sentiment: What Historical Data Says About Current Trends

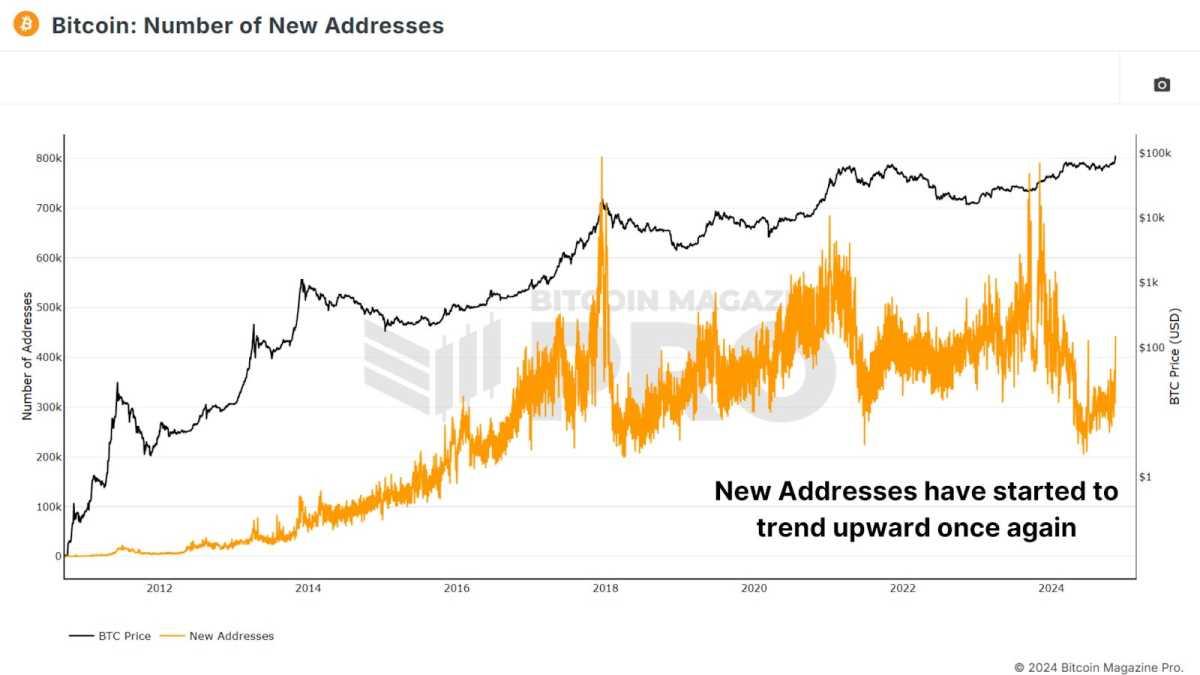

As analysts turn their eyes towards the evolving landscape of cryptocurrency, historical data provides crucial insights into market movements and sentiment. The Bull Run of late 2017 serves as a pivotal reference point, showcasing how momentum driven by Bitcoin’s surge often triggers altseason, wherein various altcoins experience significant price increases. Recent trends indicate that Bitcoin, buoyed by institutional investment and heightened public interest, is poised to surpass the $110K mark by January. This forecast aligns with past patterns where surges in Bitcoin prices led to increased activity and investment in altcoins, hinting at a cyclical nature of the market driven by investor sentiment.

The scenario is further emphasized by the staggering $20 billion influx into TRX (TRON), suggesting that traders are strategically positioning themselves ahead of an anticipated altseason. Unlike previous cycles, this surge showcases a more diversified investment approach among crypto enthusiasts, often prompted by the search for higher returns in a broader array of tokens. Understanding the correlation between Bitcoin’s momentum and subsequent altcoin rallies is essential; hence, historical patterns indicate numerous opportunities for traders to capitalize on cyclical market behaviors. The following table summarizes key periods of altseason in relation to Bitcoin’s price peaks:

| Bitcoin Price Peak | Altseason Start | Altseason Duration |

|---|---|---|

| $19,700 (Dec 2017) | Jan 2018 | 3 Months |

| $64,000 (Apr 2021) | May 2021 | 4 Months |

| $69,000 (Nov 2021) | Dec 2021 | 2 Months |

| $110,000 (Projected Jan 2024) | Upcoming | To be determined |

Q&A

Q&A: Bitcoin’s Road to $110K and Implications for Altseason with TRX

Q1: What is the main prediction regarding Bitcoin in this article?

A1: The article suggests that Bitcoin is likely to surpass the $110,000 mark by January. This bullish outlook is fueled by recent market trends, institutional interest, and the overall momentum in the cryptocurrency space.

Q2: What does the term ‘altseason’ refer to, and how is it linked to TRX?

A2: ‘Altseason’ refers to a period in the cryptocurrency market when alternative cryptocurrencies, or altcoins, outperform Bitcoin. The mention of TRX (Tron) as having a market capitalization of $20 billion suggests that it could be a key player in this upcoming altseason, hinting at increased trading volumes and price movements for altcoins in general.

Q3: What factors are contributing to the current positivity in the cryptocurrency market?

A3: Several factors are contributing to the current market optimism, including rising institutional investment in cryptocurrencies, advancements in blockchain technology, regulatory clarity in some regions, and a general bullish sentiment among retail investors. These elements create a conducive environment for both Bitcoin and altcoins like TRX to thrive.

Q4: How can investors interpret the potential rise in Bitcoin’s value?

A4: Investors may interpret the potential rise in Bitcoin’s value as a signal of renewed confidence in the cryptocurrency market. A significant increase in Bitcoin’s price could stimulate investment in altcoins, setting the stage for altseason, where traders might seek out emerging opportunities beyond Bitcoin.

Q5: What should investors consider before jumping into altcoins like TRX?

A5: Before investing in altcoins like TRX, investors should conduct thorough research, considering factors such as the project’s underlying technology, market trends, and their own risk tolerance. Additionally, it’s important to be aware of market volatility and the potential for price corrections following significant price movements.

Q6: What strategies might investors employ during this predicted altseason?

A6: Investors might consider a diversified investment strategy, spreading their capital across various promising altcoins to mitigate risk. They could also adopt a tactical approach by identifying emerging trends and taking advantage of lower-priced opportunities during the altseason, while keeping a close watch on market shifts.

Q7: How does the performance of TRX influence the broader market?

A7: The performance of TRX can serve as a barometer for the health of the altcoin market. If TRX demonstrates strong performance, it may encourage confidence among investors, potentially propelling other altcoins to gain traction and thereby driving the momentum of altseason.

Q8: What should readers keep in mind about cryptocurrency predictions?

A8: Readers should approach cryptocurrency predictions with caution. The market is inherently speculative and volatile, with prices influenced by a multitude of factors including market sentiment, regulatory changes, and technological developments. It’s essential to stay informed and make decisions based on well-rounded insights rather than solely on predictions.

Q9: what are the key takeaways from the article?

A9: The key takeaways are that Bitcoin is anticipated to reach $110,000 by January, which may trigger an altseason, with TRX positioned as a significant contender in this phenomenon. Investors should remain vigilant, conduct research, and consider their strategies as the market evolves.

The Conclusion

the cryptocurrency landscape remains as dynamic as ever, with Bitcoin potentially poised to break through the $110,000 barrier by January, signaling a renewed surge of interest and investment in digital assets. Meanwhile, the impressive $20 billion market capitalization of TRX serves as a beacon, hinting at the possibility of an impending ‘altseason’ where alternative cryptocurrencies could steal the spotlight. As market trends continue to evolve, investors and enthusiasts alike should stay vigilant, keeping an eye on the shifting tides of the crypto world. Whether you’re a seasoned trader or just dipping your toes into these digital waters, the next few months promise to be both intriguing and transformative in the realm of finance. As we navigate these changes, remember to approach the markets with both caution and curiosity, for the next chapter in cryptocurrency may be just around the corner.

https://t.me/s/be_1win/777

https://t.me/s/official_pokerdom_pokerdom

https://t.me/kazino_s_minimalnym_depozitom/16

В мире азарта, где любой площадка норовит привлечь обещаниями быстрых выигрышей, рейтинг лучших казино игр

превращается той самой путеводителем, что ведет через дебри подвохов. Тем ветеранов да новичков, кто устал с ложных заверений, такой инструмент, чтоб почувствовать подлинную отдачу, как вес ценной фишки в ладони. Минус пустой ерунды, просто надёжные сайты, где выигрыш не только показатель, а конкретная фортуна.Подобрано по яндексовых поисков, будто паутина, которая вылавливает топовые горячие веяния на сети. Тут отсутствует роли для стандартных приёмов, любой элемент будто ставка на покере, где обман выявляется немедленно. Профи знают: по рунете манера разговора на подтекстом, там сарказм маскируется словно намёк, помогает обойти рисков.В https://www.don8play.ru/ такой топ лежит как раскрытая карта, готовый для старту. Загляни, коли хочешь почувствовать ритм реальной игры, минуя обмана плюс неудач. Для кто ценит тактильность удачи, такое будто взять фишки у ладонях, а не смотреть в экран.