[ad_1]

Bitcoin’s worth could also be in extreme hazard of plummeting to $25,000 if assist at $30,000 fails as buying and selling quantity declines.

On Tuesday, the Bitcoin worth briefly surpassed $31,000. The prolonged weekend in the US rendered the cryptocurrency market tranquil, apart from the continuing sell-off within the non-fungible token (NFT) market, which has seen many property decline to extraordinarily low ground costs.

The Bitcoin worth is down 1% to $30,845 on the finish of the Asian buying and selling session. Equally, Ethereum’s worth dropped by 1% to $1,938. In gentle of the 1% decline in whole market capitalization to $1.25 trillion, it’s anticipated that crypto market efficiency will stay comparatively depressed over the weekend.

Find out how to Navigate the Technical Outlook for Bitcoin Worth

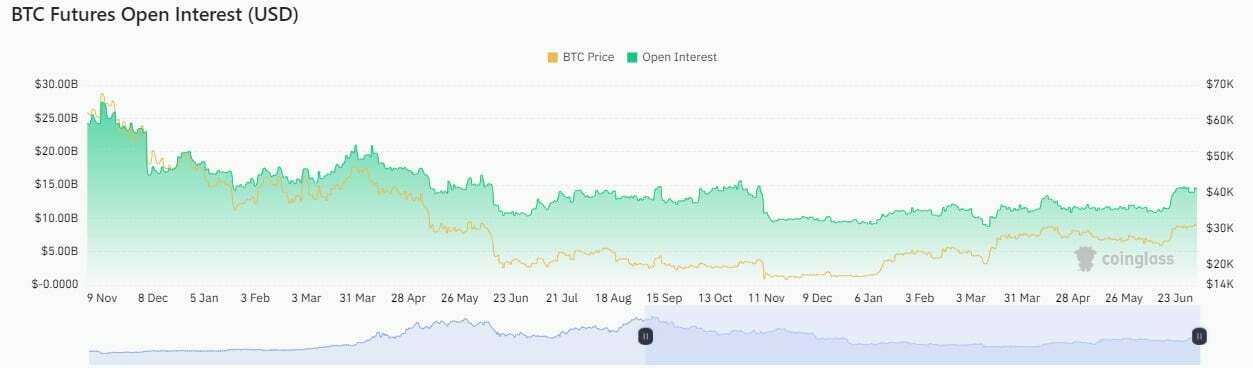

As quickly as buyers re-enter the market after a protracted weekend, they are going to discover that buying and selling quantity has decreased throughout the board. In response to knowledge from CoinGlass, all essential cryptocurrency exchanges proceed to report quantity declines between 15 and 20%.

This important decline in quantity had an affect on the variety of liquidations, which totalled $47.67 million prior to now 24 hours.

Curiously, the market has maintained open curiosity at $14.50 billion, and the lengthy/brief ratio means that lengthy merchants have a minor benefit over brief merchants.

Nevertheless, dealer sentiment stays a supply of concern, with a large proportion of impartial merchants balancing the bearish and bullish crowds.

The place Will The Bitcoin Worth Go?

In response to CoinDesk, the liquidity crunch out there is an ongoing problem that can not be wished away as a result of it stems from fiat. Cryptocurrency and different dangerous property, corresponding to expertise shares, are probably the most affected.

The abundance of necessary financial knowledge set for launch this week, nonetheless, implies that merchants have to be able to act proactively when mandatory.

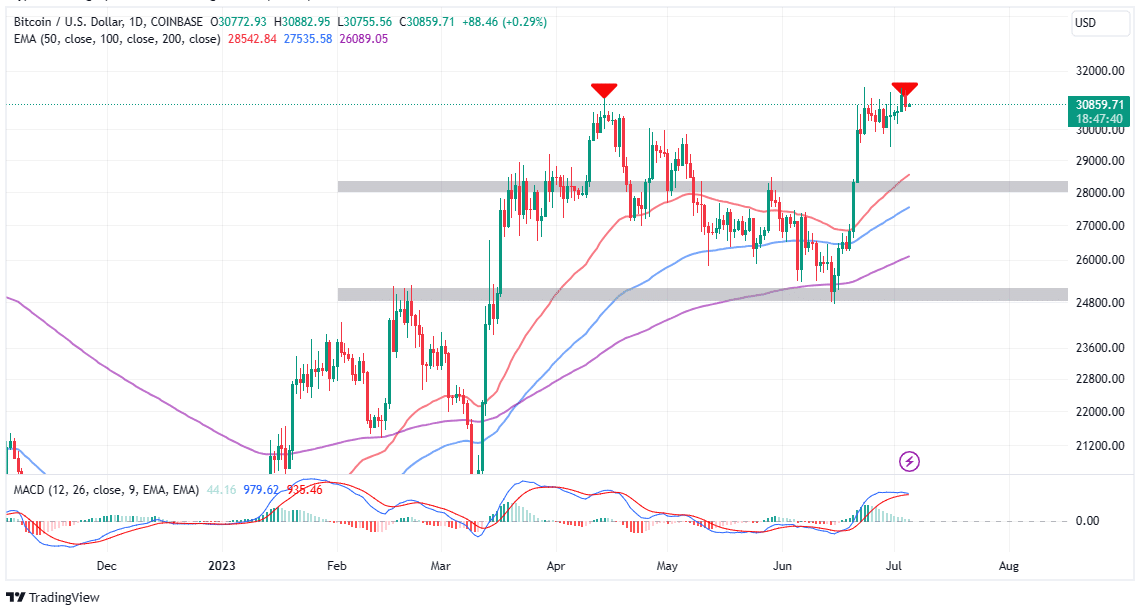

At the moment, the Bitcoin worth is encountering cussed resistance at $31,000, whereas its draw back seems to be protected at $30,500. The most important cryptocurrency’s choices are shrinking by the day, because it fails to keep up its upward trajectory previous the $31,000 barrier.

This means that overhead stress, significantly purchaser congestion at $30,000, will possible proceed to erode assist. A confirmed break beneath this worth degree would point out that the bullish entrance has been defeated.

However, it may well set off an aggressive bearish entrance, inflicting buyers to promote with the intention to protect income after the worth elevated from $25,000 to $31,500.

If brief merchants act on an incoming promote sign from the Shifting Common Convergence Divergence (MACD) indicator, stress is more likely to skyrocket. The MACD line in blue crossing beneath the sign line in purple would point out a promote sign for Bitcoin.

On the whole, the motion of the momentum indicator because it falls towards the imply line (0.00) and doubtlessly the damaging area would tighten the bearish grip, a transfer that may possible set off a sell-off beneath $30,000.

Notable ranges for speculators to bear in mind embody the resistance at $31,000 and the assist at $30,000. Notably, a break and maintain above $31,000 might encourage extra buyers to affix the development, focusing on a breakout to $35,000 and $38,000.

Bitcoin may very well be in grave peril of falling to $25,000 if assist at $30,000 breaks down. Merchants should consider the tentative purchaser congestion at $28,000, which might permit Bitcoin to surge by means of contemporary liquidity earlier than a kneejerk bullish response.

Disclaimer:

The previous article is for informational functions solely and shouldn’t be construed as monetary recommendation. It’s extremely really useful that readers fastidiously and independently examine the content material. The chance of capital loss when investing in cryptocurrencies exists, thus readers are urged to hunt skilled recommendation earlier than taking any resolution.

[ad_2]

https://t.me/site_official_1win/185

https://t.me/s/iGaming_live/4867

Хотите знать, кому можно доверять в мире онлайн-казино? Наш справочник проводит независимую экспертизу: проверяем лицензии, процесс выплат и качество игр. Рейтинги объективны — мы не торгуем позициями. Принципы оценки открыты для всех. Подойдёт как новичкам, так и опытным игрокам. Следим за изменениями и регулярно обновляем информацию. Узнать о рейтингах казино