[ad_1]

Bloom Cash, a U.Okay.-based fintech, has raised £1 million to digitize a casual monetary administration system employed by ethnic communities internationally.

Sometimes called “rotating financial savings and credit score affiliation” (ROSCA), the microcredit system varies within the particulars around the globe, however normally, it includes a casual gathering of individuals from a sure neighborhood who act as a financial institution, accumulating and saving cash that members can withdraw. The system known as completely different names internationally, similar to “hagbad” in Somalia or “pardna” in components of the Caribbean.

The purpose is to keep away from standard banking programs, lots of which discriminate towards minority communities, particularly within the U.Okay., CEO Nina Mohanty mentioned. “A few of it’s simply blatant racism. We don’t have clear red-lining like within the U.S., however there are positively postcode look-ups,” she mentioned.

The ROSCA system is a solution to conduct monetary issues with folks you belief, she mentioned, “whether or not that’s by race, nationality, we’ve even acquired folks right down to the tribe degree.” Bloom Cash desires to digitize this ROSCA course of.

A daughter of two immigrants to the U.S., Mohanty says she determined to work on this downside after she moved to the U.Okay. and discovered for herself simply how troublesome it may be for an immigrant to set themselves up financially. “I simply felt that there was not simply an financial justice level to this, but additionally an enormous alternative, the place folks solely consider the U.S. as a rustic of immigrants, however more and more throughout Europe, we all know migration is rising,” she mentioned.

Her co-founder and CTO Dan James believes within the system as a result of he’s seen how efficient it may be, rising up in an ethnic neighborhood in central Birmingham. “I noticed first-hand the advantages that utilizing ROSCAs can convey folks, particularly these getting into the U.Okay. who’ve traditionally been underserved by the present monetary sector,” he mentioned.

The corporate will use the funds from the pre-seed spherical to proceed constructing its digital financial savings options, which has all funds safeguarded by an digital cash establishment. The fundraising was led by Zinal Development, and noticed January Ventures, Pact VC, and angel traders Berenice Magistretti and June Angelides collaborating.

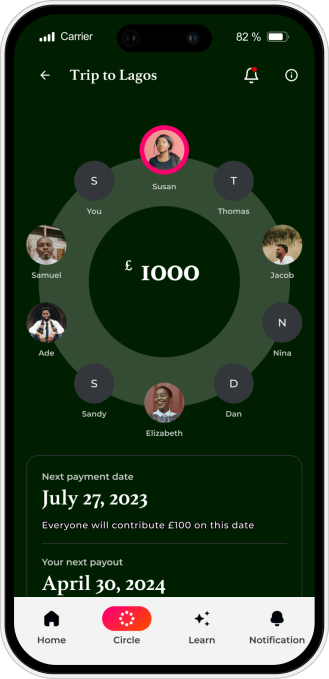

Bloom Cash lets folks create teams, generally known as Bloom Circles, to share and lower your expenses with. It additionally has instructional supplies on the fundamentals of life within the U.Okay., similar to learn how to get a driver’s license, organising a belief fund, and an explainer on credit score scores.

Mohanty described the fundraising course of as “actually fascinating.” She mentioned probably the most difficult half was explaining to traders that the corporate meant to focus on very underserved communities. At first, there was a variety of misunderstanding, she mentioned. “Some very racist, xenophobic issues have been mentioned to us,” she mentioned. “Even going by the regulation course of, there was a variety of prejudice that we needed to overcome.”

Mohanty and James say they needed ethnic and gender range on their cap desk, and so they appear to have managed that thus far: almost 70% of their cap desk identifies as ladies, nearly 50% comes from a minority ethnic background, and about half establish as first or second-generation immigrants.

Angelides, an angel investor, mentioned Bloom Cash was her first angel fintech funding, and she or he knew proper off the bat how large of an issue the corporate is making an attempt to unravel since she grew up in Nigeria, the place money is king. “Communities have struggled for generations with belief in monetary programs and have most well-liked to make use of community-based saving strategies, similar to Ajo (the Nigerian model of the ROSCA system).”

“This comes with its personal set of issues, from folks absconding with funds to folks being unable to considerably develop wealth. That is the place Bloom Cash is available in,” Angelidas added. “Quite a lot of migrant communities remit massive quantities to their house international locations every year. With Bloom, they now even have a possibility to construct stronger ties with the U.Okay., develop their wealth and qualify for added merchandise that they ordinarily would have struggled to entry.”

[ad_2]