[ad_1]

For the reason that abstract judgment within the Ripple vs SEC case, XRP has captured the highlight within the crypto market. Now the fourth-largest crypto by market capitalization, XRP, is at present experiencing a consolidation development. Nevertheless, this might simply be the calm earlier than the storm as each the exercise of huge traders aka whales and a growing bull flag sample counsel.

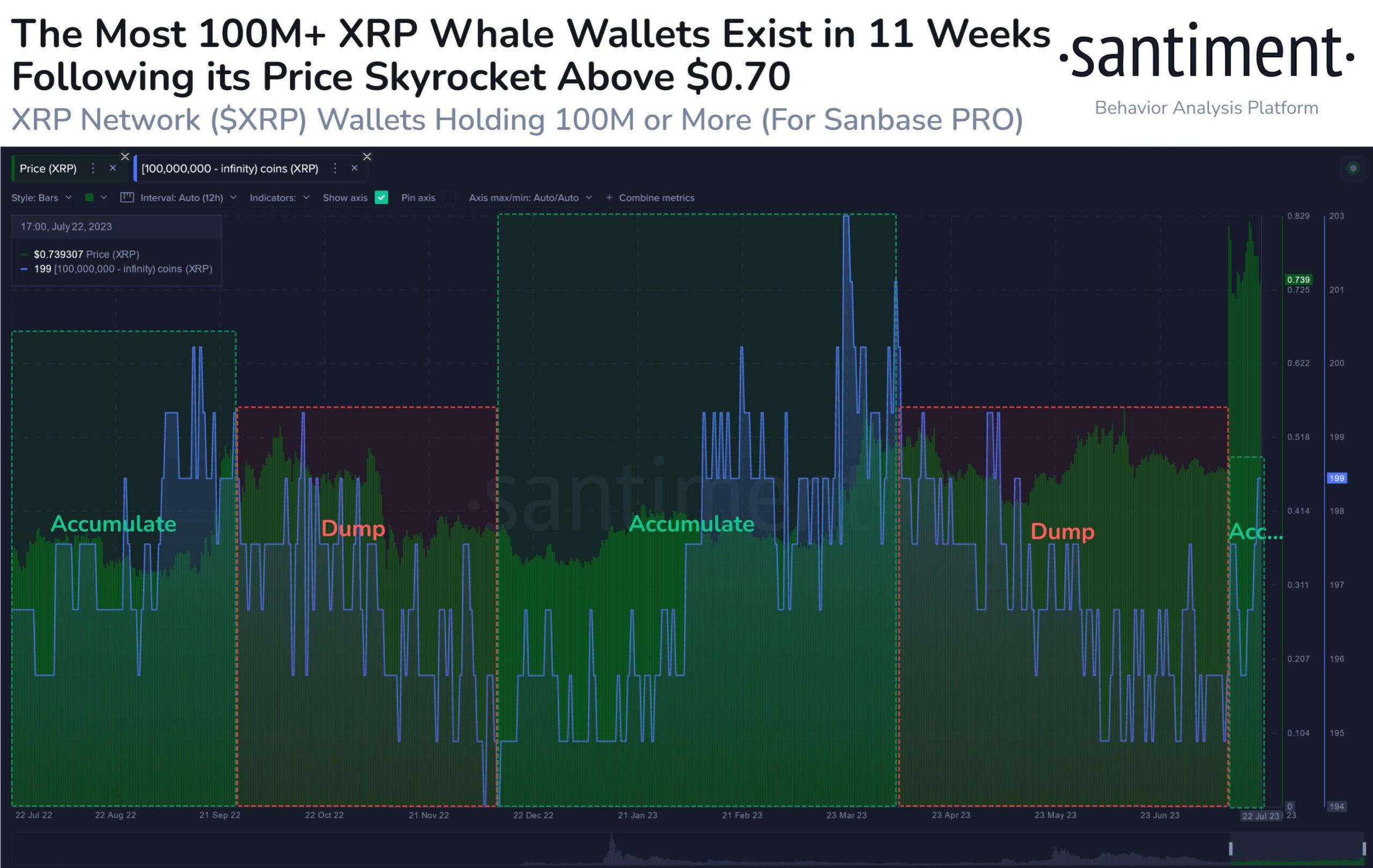

XRP Whale Wallets Attain New Heights

In accordance with an on-chain information evaluation by Santiment, a number one market intelligence platform, the variety of whale wallets holding a considerable 100 million or extra XRP has witnessed a major enhance lately, now standing at a formidable 199. These whales, every commanding a minimal worth of $74 million, have been carefully noticed over the previous 12 months, exhibiting strategic shopping for and promoting patterns that affect XRP’s worth actions.

This latest surge within the variety of whales is a noteworthy milestone, matching the very best determine recorded since Could 13. The Santiment chart beneath exhibits intimately the distribution patterns of those whales over the previous 12 months. As of July 2022, when XRP was buying and selling beneath $0.40, 200 whales have been in accumulation mode. Nevertheless, they offered when XRP exceeded $0.50 inside three months.

Equally, whales resumed accumulation between December and March 2023 when XRP was buying and selling at $0.41. In April, a bigger variety of the whales offered their XRP once more, bringing the quantity again beneath 200. At present, the start of a brand new accumulation section may very well be imminent, as Santiment exhibits.

Bull Flag Heralds New Rally

The latest meteoric rise in XRP’s worth following the Ripple vs. SEC abstract judgment has led to the formation of a bullish chart sample referred to as the bull flag. This sample consists of two rallies separated by a short interval of consolidating retracement. The preliminary rally involves a pause by means of profit-taking, resulting in a good buying and selling vary as consumers and sellers discover equilibrium.

XRP traders need to preserve a detailed eye on the essential worth ranges of the bull flag that would decide the long run trajectory of the cryptocurrency. To the draw back, the $0.685 mark is vital, representing the 23.6% Fibonacci retracement degree. Holding above this degree is essential for sustaining the consolidation development. If the decrease finish of the vary is damaged, a deeper correction may very well be imminent, with potential targets at $0.64 and $0.59.

To the upside, XRP faces resistance at $0.845. Breaking above this degree might set off one other sharp rally, although it’d require a catalyst, both from the continued Ripple case or the broader crypto market, to attain such a breakout. The closest goal would then be the 38.2% Fibonacci retracement degree the place the impulsive rally following the Ripple ruling ended. Apart from the psychologically essential $1 degree, the following bullish worth targets would then be $1.13, 1.33 and $1.61.

Featured picture from Binance Academy, chart from TradingView.com

[ad_2]