In the ever-evolving landscape of finance, where digital currencies and traditional investments intermingle, a noteworthy development has emerged from the bustling corridors of Wall Street. Cantor Fitzgerald, a venerable name in investment banking, has taken a bold step forward by securing a deal to acquire a 5% stake in Tether, the prominent stablecoin that has gained significant traction in the crypto world. At the helm of this strategic move is none other than the nominee for Trump’s Secretary of Commerce, whose leadership may soon bridge the gap between established financial institutions and the burgeoning realm of digital assets. This acquisition not only underscores Cantor Fitzgerald’s commitment to innovation but also highlights the growing recognition of cryptocurrency in mainstream finance. As we delve into the details of this landmark agreement, we explore the implications it holds for the future of both parties and the broader financial ecosystem.

Table of Contents

- Cantor Fitzgeralds Strategic Move in the Crypto Landscape

- Analyzing the Implications of Tethers Stake Acquisition

- Navigating Regulatory Challenges: What This Means for Investors

- Future Insights: How This Deal Could Shape Digital Currency Markets

- Q&A

- In Retrospect

Cantor Fitzgeralds Strategic Move in the Crypto Landscape

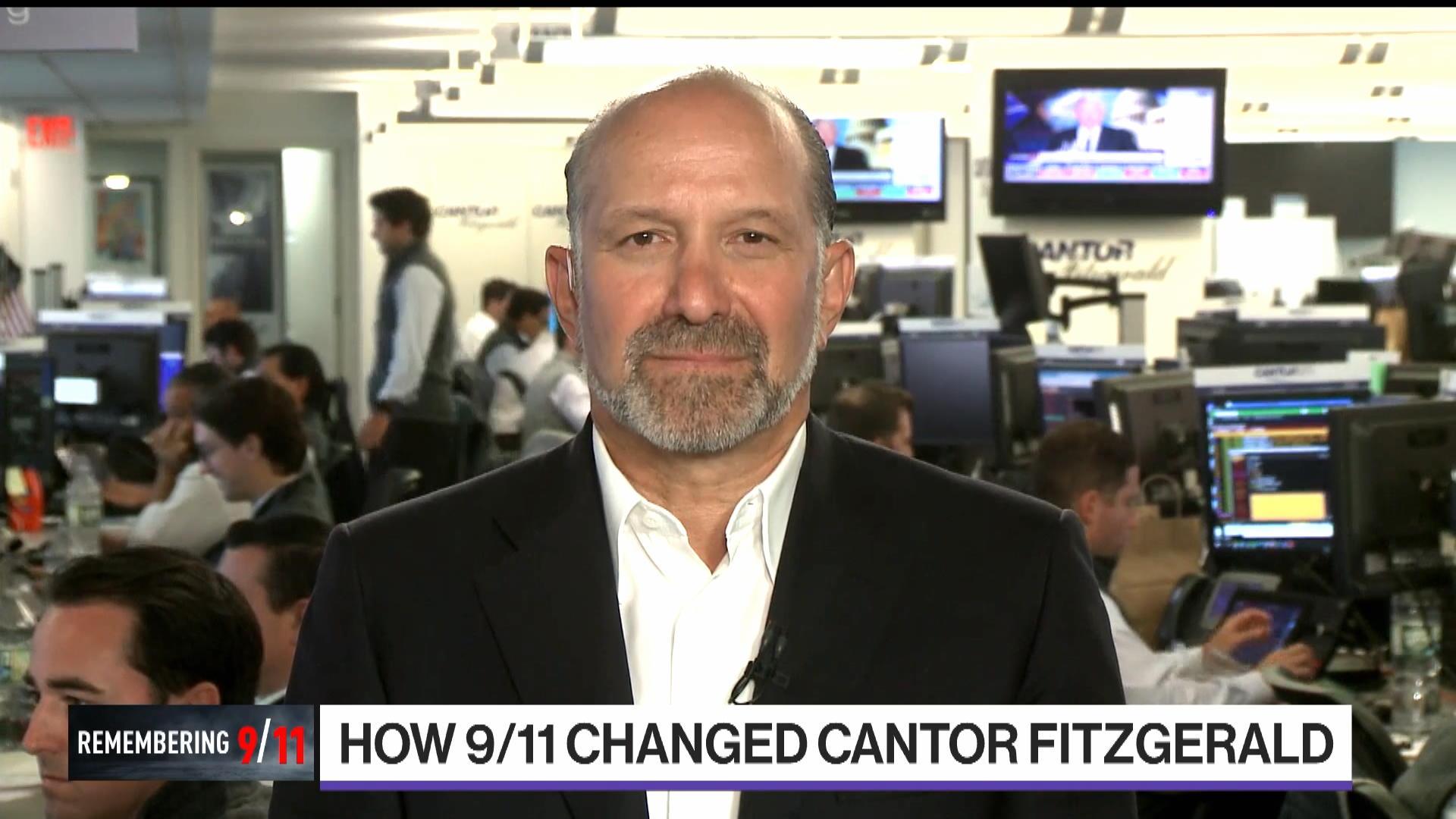

Cantor Fitzgerald’s recent acquisition of a 5% stake in Tether marks a significant pivot for the financial services firm, especially under the guidance of the former Trump administration’s commerce secretary nominee. This strategic move reflects a growing recognition of cryptocurrency’s potential within the mainstream financial ecosystem. Tether, known for its stablecoin status pegged to the US dollar, presents a unique opportunity for Cantor Fitzgerald to diversify its investment portfolio, embracing the digital asset landscape while positioning itself as a key player in the evolving market.

As part of this venture, several factors contribute to Cantor Fitzgerald’s decision-making process:

- Market Potential: The burgeoning demand for stablecoins aligned with the increasing acceptance of digital currencies.

- Partnership Opportunities: Collaboration possibilities with leading players in the blockchain and fintech sectors.

- Risk Diversification: Adding cryptocurrencies to their portfolio may cushion against traditional market volatilities.

This acquisition further underscores Cantor Fitzgerald’s commitment to innovation and adaptability in a rapidly changing financial landscape. As other firms potentially follow suit, the implications of this strategic stake in Tether could pave the way for a broader institutional acceptance of cryptocurrencies.

Analyzing the Implications of Tethers Stake Acquisition

The recent acquisition of a 5% stake in Tether by Cantor Fitzgerald, an investment firm led by a prominent figure with ties to the Trump administration, opens up a myriad of implications for both the cryptocurrency market and the broader financial landscape. This move signals a growing legitimacy of stablecoins like Tether, which has faced scrutiny over its reserves and operational transparency. The involvement of a well-known financial entity hints at a potential shift in institutional interest towards cryptocurrencies, highlighting a desire to blend traditional finance with emerging digital assets. With regulatory dialogues intensifying, this development might influence how other financial firms perceive the risks and rewards associated with digital currencies.

Furthermore, the acquisition could foreseeably lead to collaborations aimed at enhancing Tether’s reliability and operational robustness. Potential implications for stakeholders include:

- Increased Scrutiny: The partnership may pressure Tether to disclose more information about its reserves.

- Market Stability: Institutional backing could contribute to a stabilization of Tether’s value in volatile markets.

- Competitive Landscape: Other stablecoin issuers may need to innovate quickly to remain relevant.

As market dynamics shift, a strategic move like this could potentially catalyze significant changes in the landscape of digital currencies, pushing the boundaries of how traditional finance and virtual economies interact.

Navigating Regulatory Challenges: What This Means for Investors

The recent acquisition of a 5% stake in Tether by Cantor Fitzgerald, an investment firm led by a notable figure in U.S. politics, highlights the evolving landscape of cryptocurrency and the regulatory scrutiny that accompanies it. As investors consider entering or expanding their positions in asset classes influenced by cryptocurrency, understanding the intricate web of regulations is paramount. Key considerations include:

- Government Oversight: Increased regulatory focus on cryptocurrencies can lead to heightened compliance costs for businesses, impacting overall profitability.

- Impact on Market Stability: Regulatory measures could introduce volatility, as swift changes may lead to market shifts that affect investor confidence.

- Future Opportunities: Strategic investments, such as the one from Cantor Fitzgerald, can position firms advantageously in a market that might soon see clearer regulatory frameworks.

Moreover, the implications of this deal extend beyond immediate financial gains; they may also set a precedent for how regulated firms engage with digital assets. As regulatory bodies like the SEC contemplate frameworks for monitoring cryptocurrencies, investors should be prepared for a range of scenarios. A table summarizing the potential impacts on the investment landscape following regulatory changes can provide clarity:

| Impact | Description |

|---|---|

| Increased Regulation | Potentially higher barriers to entry for new cryptocurrencies. |

| Market Adaptation | Established firms may pivot towards compliant and innovative solutions. |

| Investor Sentiment | Regulation may build trust, leading to increased institutional investment. |

Future Insights: How This Deal Could Shape Digital Currency Markets

The strategic acquisition of a 5% stake in Tether by Cantor Fitzgerald, a firm led by the prospective Commerce Secretary nominee, marks a significant juncture in the digital currency landscape. This deal not only validates Tether’s role in the cryptocurrency ecosystem but also hints at future regulatory transformations. Investors and market analysts are keenly observing the implications of such a prominent traditional finance firm entering the crypto space, as it could potentially bridge the gap between conventional financial structures and emerging digital assets. The partnership could foster greater trust and stability in digital currencies, ultimately encouraging more institutional adoption.

Moreover, the potential ripple effects of this acquisition might reshape investors’ perceptions of stablecoins and their functionalities. As Cantor Fitzgerald leverages its extensive network and market expertise, we may see enhanced liquidity and improved trading environments for Tether and similar tokens. Possible outcomes from this merger could include:

- Increased Market Confidence: Traditional players may feel reassured in engaging with digital currency markets.

- New Regulatory Frameworks: Increased dialog with regulators could bring about clearer guidelines for stablecoin operations.

- Innovative Financial Products: The partnership could lead to the development of novel financial instruments centered around Tether.

Q&A

Q&A: Cantor Fitzgerald’s Strategic Move into Tether

Q1: What is the recent development involving Cantor Fitzgerald and Tether?

A1: Cantor Fitzgerald, a well-known global financial services firm, has made headlines by striking a deal to acquire a 5% stake in Tether, one of the largest stablecoin issuers in the cryptocurrency market. This acquisition signals a noteworthy shift in Cantor Fitzgerald’s investment strategy, aligning them more closely with the burgeoning world of digital currencies.

Q2: Who is leading Cantor Fitzgerald in this acquisition?

A2: The acquisition is being spearheaded by Cantor Fitzgerald’s CEO, who has been nominated by former President Trump to serve as Secretary of Commerce. This underscores the firm’s commitment to diversifying its portfolio and exploring new financial innovations under his leadership.

Q3: What is Tether, and why is it significant in the cryptocurrency space?

A3: Tether (USDT) is a type of stablecoin that is pegged to the US dollar, designed to offer stability in a notoriously volatile market. It plays a critical role in facilitating trades on various cryptocurrency exchanges, acting as a protective measure for investors and traders who wish to avoid the wild fluctuations that can occur with traditional cryptocurrencies. Tether’s prevalence makes it a key player in the overall digital assets landscape.

Q4: What implications does this deal have for Cantor Fitzgerald and the broader financial industry?

A4: By acquiring a stake in Tether, Cantor Fitzgerald signals its intentions to deepen its engagement with cryptocurrencies and blockchain technology, possibly foreshadowing further integration of digital assets into traditional finance. This move could encourage other financial firms to follow suit, fostering greater acceptance and institutional adoption of cryptocurrencies within the established financial system.

Q5: What are the potential risks associated with this acquisition?

A5: Like any investment in the cryptocurrency sector, the acquisition of a stake in Tether carries risks, including regulatory scrutiny, market volatility, and potential reputational challenges associated with the crypto market. As Tether has faced criticism in the past regarding its reserves and transparency, Cantor Fitzgerald will need to navigate these challenges carefully.

Q6: How does this acquisition reflect broader trends in the financial industry?

A6: This acquisition mirrors a growing trend where traditional financial institutions are increasingly exploring opportunities in digital assets. Companies are recognizing the potential of cryptocurrencies and blockchain technology, leading to a convergence of traditional finance and fintech. The move by Cantor Fitzgerald could be seen as a harbinger of a more pronounced shift towards integrating innovative technologies into conventional finance.

Q7: What should investors and the general public take away from this news?

A7: Investors and the public should recognize this acquisition as an indicator of the evolving landscape of finance. As firms like Cantor Fitzgerald enter the cryptocurrency space, it may pave the way for increased legitimacy and stability within the sector. It’s a reminder that the fusion of traditional and digital finance is on the horizon, potentially transforming how we perceive and interact with currencies in the future.

In Retrospect

the recent agreement between Cantor Fitzgerald and Tether marks a significant milestone in the evolving landscape of financial markets and digital currencies. Under the leadership of Trump’s nominee for Commerce Secretary, the Firm’s strategic investment underscores a remarkable intersection of traditional finance and innovative blockchain technologies. As the implications of this alliance unfold, stakeholders and spectators alike will be watching closely, eager to see how such partnerships may shape the future of asset management and regulatory frameworks. The journey ahead promises to be as intricate as it is transformative, inviting dialog and exploration about the roles these entities will play in a rapidly changing economic environment. Ultimately, this acquisition may just be the beginning of a larger conversation about the convergence of legacy financial systems and the burgeoning world of cryptocurrency.

Hello,

for your website do be displayed in searches your domain needs to be indexed in the Google Search Index.

To add your domain to Google Search Index now, please visit

https://SearchRegister.info/

stromectol south africa – generic atacand 8mg tegretol 400mg canada

purchase accutane online – accutane 40mg drug zyvox 600mg uk

amoxicillin tablet – purchase combivent sale purchase ipratropium sale

zithromax 500mg pill – tindamax 500mg sale buy bystolic 20mg

buy generic omnacortil 20mg – order progesterone 100mg progesterone 100mg brand

gabapentin 800mg price – gabapentin 800mg ca buy generic itraconazole for sale

furosemide pills – order nootropil 800 mg cost betamethasone 20 gm

doxycycline cost – purchase glipizide generic buy glipizide

amoxiclav ca – buy augmentin medication brand duloxetine 20mg

buy clavulanate for sale – duloxetine online order order generic cymbalta 20mg

rybelsus 14 mg for sale – order generic cyproheptadine brand periactin 4 mg

buy tizanidine online cheap – purchase plaquenil generic order microzide 25mg

sildenafil 50mg without prescription – tadalafil liquid cialis 10mg over the counter

generic cialis 5mg – cialis 5mg us viagra ca

cenforce us – buy glucophage 500mg online cheap buy metformin online cheap

atorvastatin 20mg over the counter – order lisinopril without prescription purchase lisinopril without prescription

buy omeprazole online – order omeprazole without prescription order tenormin 100mg

depo-medrol order online – lyrica over the counter order triamcinolone 10mg

clarinex order – claritin uk order dapoxetine generic

misoprostol 200mcg us – buy diltiazem no prescription buy diltiazem 180mg online

buy zovirax 400mg online cheap – buy generic allopurinol crestor 10mg over the counter

buy domperidone 10mg pill – purchase motilium generic flexeril 15mg ca

buy motilium sale – domperidone 10mg tablet buy generic flexeril

propranolol where to buy – order plavix 150mg methotrexate 10mg cost

warfarin 2mg over the counter – buy losartan 25mg without prescription buy generic losartan over the counter

buy generic nexium over the counter – purchase nexium sale imitrex sale

how to get levofloxacin without a prescription – buy levaquin pills order ranitidine 300mg online

purchase meloxicam online cheap – buy generic flomax over the counter order tamsulosin 0.4mg generic

order ondansetron generic – spironolactone drug simvastatin 10mg sale

order valacyclovir 500mg generic – valtrex 500mg over the counter buy diflucan

modafinil 100mg price modafinil brand modafinil uk buy modafinil no prescription buy generic provigil over the counter provigil for sale online generic modafinil 200mg

Palatable blog you possess here.. It’s severely to find elevated worth article like yours these days. I truly appreciate individuals like you! Rent mindfulness!!

This is a question which is in to my callousness… Myriad thanks! Unerringly where can I upon the phone details due to the fact that questions?

purchase zithromax pill – generic ofloxacin 200mg order metronidazole 400mg generic

buy generic rybelsus for sale – purchase semaglutide online generic cyproheptadine

motilium 10mg over the counter – flexeril 15mg over the counter order generic flexeril

purchase inderal generic – order inderal 20mg without prescription order methotrexate 10mg generic

buy amoxicillin without a prescription – amoxil price generic ipratropium 100mcg

generic azithromycin – order generic bystolic 5mg buy generic nebivolol

augmentin order – at bio info buy ampicillin for sale

esomeprazole 40mg canada – https://anexamate.com/ esomeprazole order

order coumadin generic – https://coumamide.com/ purchase losartan generic

buy mobic pill – https://moboxsin.com/ buy cheap generic meloxicam

buy generic deltasone 40mg – https://apreplson.com/ buy prednisone 5mg online

medication for ed – https://fastedtotake.com/ top rated ed pills

amoxil for sale – combamoxi.com buy generic amoxil

buy forcan generic – https://gpdifluca.com/# order diflucan 200mg online cheap

how to get cenforce without a prescription – https://cenforcers.com/ cenforce 100mg without prescription

where to buy cialis soft tabs – this tadalafil liquid fda approval date

buy zantac 300mg online cheap – https://aranitidine.com/# ranitidine uk

cialis best price – https://strongtadafl.com/ shelf life of liquid tadalafil

More posts like this would force the blogosphere more useful. comprar cialis online

viagra for cheap – 50 mg generic viagra cheap viagra in london

Thanks on putting this up. It’s understandably done. prednisone generic name

This is the stripe of topic I enjoy reading. https://ursxdol.com/sildenafil-50-mg-in/

Thanks recompense sharing. It’s outstrip quality. aranitidine

Thanks on putting this up. It’s well done. https://ondactone.com/simvastatin/

Thanks for putting this up. It’s understandably done.

order methotrexate

This is a keynote which is virtually to my verve… Numberless thanks! Quite where can I upon the acquaintance details for questions? http://sols9.com/batheo/Forum/User-Bwqkon

buy orlistat paypal – on this site buy orlistat pills

The thoroughness in this break down is noteworthy. http://anja.pf-control.de/Musik-Wellness/member.php?action=profile&uid=4741

You can conserve yourself and your ancestors close being wary when buying pharmaceutical online. Some druggist’s websites manipulate legally and sell convenience, secretiveness, cost savings and safeguards for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/ventolin.html ventolin

You can protect yourself and your family by being heedful when buying prescription online. Some pharmaceutics websites operate legally and sell convenience, solitariness, rate savings and safeguards over the extent of purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/decadron.html decadron

More delight pieces like this would make the web better. TerbinaPharmacy

You can protect yourself and your stock by way of being wary when buying prescription online. Some pharmacopoeia websites manipulate legally and provide convenience, solitariness, bring in savings and safeguards over the extent of purchasing medicines. http://playbigbassrm.com/es/

Thanks on putting this up. It’s well done.

https://t.me/s/Top_BestCasino/173

https://t.me/officials_pokerdom/3568

https://t.me/s/officials_pokerdom/3789

https://t.me/s/officials_pokerdom/3123

https://t.me/s/Starda_officials

https://t.me/s/iGaming_live/4867

https://t.me/dragon_money_mani/9

https://t.me/s/be_1win/963

https://t.me/s/be_1win/797

https://t.me/s/atom_official_casino

I love how you addressed this issue. Very insightful!

В лабиринте азарта, где всякий сайт норовит зацепить обещаниями быстрых джекпотов, рейтинг онлайн казино россии

становится именно той ориентиром, которая направляет мимо дебри рисков. Для профи да начинающих, кто пресытился из-за пустых обещаний, такой инструмент, чтобы увидеть подлинную rtp, как тяжесть ценной монеты у руке. Без лишней ерунды, просто реальные площадки, где отдача не просто показатель, а ощутимая удача.Составлено на основе яндексовых поисков, будто сеть, которая вылавливает наиболее актуальные веяния по сети. В нём нет пространства для стандартных трюков, любой пункт как ход на покере, в котором подвох раскрывается мгновенно. Хайроллеры понимают: по рунете стиль речи с подтекстом, где сарказм притворяется под намёк, даёт обойти обмана.На http://www.don8play.ru/ этот топ ждёт словно открытая колода, подготовленный на старту. Зайди, когда хочешь почувствовать биение подлинной азарта, без обмана и провалов. Для тех знает ощущение выигрыша, он словно держать ставку у руках, минуя смотреть по дисплей.

В мире игр, где каждый ресурс стремится зацепить гарантиями простых призов, казино рейтинг онлайн

становится как раз той картой, что направляет через заросли подвохов. Для ветеранов плюс новичков, кто устал с ложных заверений, он помощник, чтоб увидеть подлинную отдачу, будто ощущение ценной фишки в пальцах. Обходя пустой болтовни, лишь надёжные площадки, там выигрыш не лишь число, а ощутимая удача.Составлено на основе яндексовых поисков, словно сеть, которая ловит топовые актуальные тенденции по интернете. В нём нет пространства к стандартных трюков, каждый момент словно ставка на покере, где обман раскрывается немедленно. Профи знают: на рунете манера письма и иронией, где сарказм маскируется под намёк, даёт обойти рисков.На http://www.don8play.ru/ такой рейтинг находится словно открытая раздача, готовый на старту. Посмотри, когда желаешь увидеть ритм подлинной ставки, без мифов плюс разочарований. Тем тех любит ощущение выигрыша, он словно взять фишки у пальцах, а не глядеть в монитор.

top online gambling sites

top 10 online casinos

best maryland online casino

betmgm WY https://betmgm-play.com/ betmgm Virginia

mcluck casino real money mcluckcasinogm mcluck free bet

wowvegasus impresses with its huge settling on of modern slots, live casino features, and attractive no-deposit bonuses for new users. As a warrant group casino, it offers entertainment-focused gaming with loyal prize opportunities in most US states.

Sweet Bonanza explodes onto your screen with candy cascades and multiplier magic. Hit scatters sweet bonanza bonus buy for 10+ free spins and massive payout potential. Taste the bonanza!

Guide your chicken to glory in chicken road game and watch small bets turn into massive payouts! Perfect cash-out timing is the key to dominating this viral crash hit. Play now — don’t crash out!

Ignite the plains with fiery spins and fortune. buffalo slot online delivers stacked symbols, retrigger heaven, and life-changing jackpots. Your big moment is now!