[ad_1]

Cardano has leaped significantly within the realm of DeFi actions, notably when it comes to Complete Worth Locked (TVL), regardless of the considerably lackluster efficiency of ADA itself.

TVL refers back to the whole worth of property locked inside varied decentralized finance protocols and functions on the Cardano blockchain. An rising TVL can have a number of constructive implications for the Cardano ecosystem.

The importance of TVL lies in its reflection of the general engagement and adoption of DeFi tasks constructed on Cardano. A better TVL signifies larger belief and confidence in these decentralized monetary companies.

It demonstrates that customers are keen to lock their property inside the ecosystem, using varied DeFi protocols for lending, borrowing, staking, and different monetary actions.

Cardano TVL Surges Amid Worth Decline

ADA has skilled a current decline in its worth, with the most recent information from Coingecko displaying it at present stands at $0.305. Over the previous 24 hours, the value has confronted a modest 0.4% decline, and during the last seven days, it has decreased by a mere 0.3%. Regardless of these losses, there’s a notable silver lining within the type of Cardano’s TVL on the community.

Supply: Coingecko

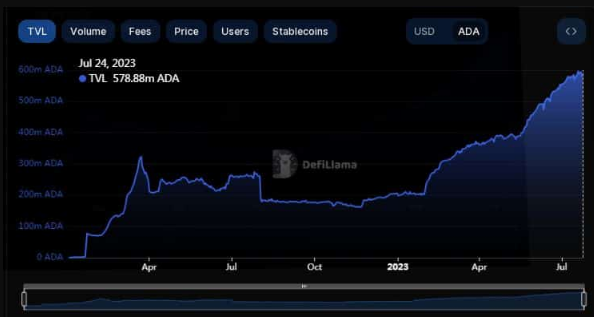

The surge in Cardano’s TVL by 28% within the final three months signifies a rising curiosity within the DeFi actions provided by the community. It displays rising confidence amongst customers keen to lock their property in decentralized functions, similar to lending platforms, decentralized exchanges, and liquidity swimming pools.

This elevated participation can foster the event of a vibrant and sturdy DeFi ecosystem on Cardano, providing customers a variety of economic companies.

Cardano whole worth locked. Supply: DefiLlama

Furthermore, the year-to-date (YTD) triple progress of Cardano’s TVL raises optimism for the undertaking’s potential restoration and a possible return to its earlier all-time excessive ranges achieved in 2022.

Because the DeFi ecosystem on Cardano expands, it could possibly entice extra builders, tasks, and traders, additional enhancing the community’s utility and worth proposition.

Cardano (ADA) market cap at present at $10 billion. Chart: TradingView.com

Cardano DeFi Lockup Surpasses Ethereum, However Market Cap Lags Behind

In the meantime, a current report sheds gentle on a noteworthy plunge within the whole tokens locked inside Ethereum, Cardano’s most important rival. Alternatively, Cardano has emerged as a powerful contender, outperforming Ethereum relating to particular person token lockup inside its DeFi ecosystem.

Whereas Cardano excels when it comes to token lockup, it nonetheless must catch up in different vital areas in comparison with Ethereum. One of the vital vital disparities lies available in the market capitalization of the 2 cryptocurrencies. Ethereum’s market capitalization stays significantly greater than Cardano’s, highlighting Ethereum’s long-standing dominance within the blockchain house.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing entails threat. While you make investments, your capital is topic to threat).

Featured picture from Weblog Tiền Ảo

[ad_2]