[ad_1]

Bankrupt lender Celsius’s plan to liquidate its altcoins for Bitcoin (BTC) and Ethereum (ETH) may exert extra strain on the crypto market, in response to a July 10 report from blockchain analytical agency Kaiko.

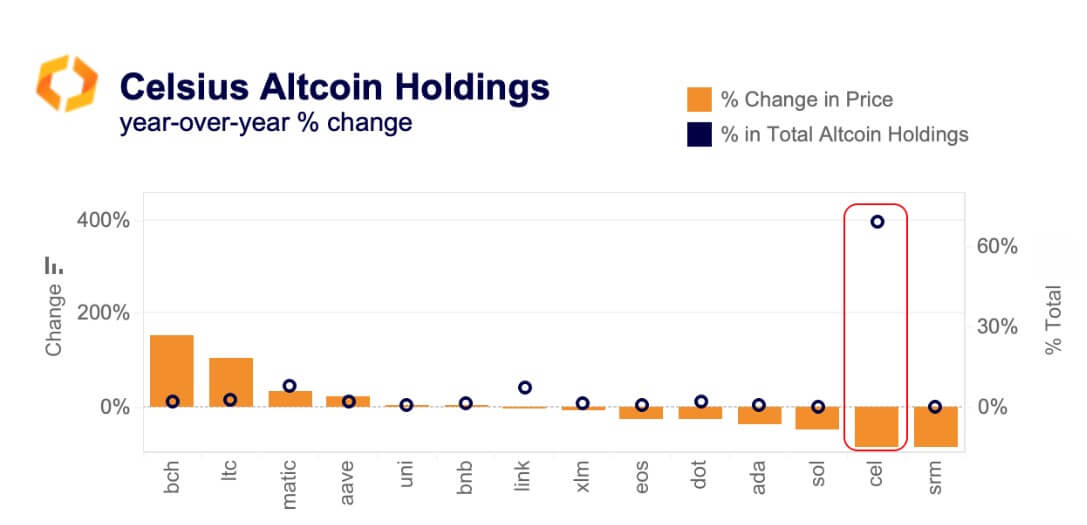

Kaiko famous that almost all altcoins held by Celsius had recorded important drops, starting from 6% to as excessive as 84%, of their liquidity over the previous yr.

“The aggregated market depth for Celsius’ altcoin holdings has declined by 40% since 2022, totalling round $90mn in early July.”

Per the chart under, solely Litecoin (LTC), Bitcoin Money (BCH), Polygon (MATIC), and Aave (AAVE) noticed pronounced modifications of their liquidity conditions over the previous yr, whereas others principally declined.

BCH and LTC, particularly, noticed a surge of their liquidity state of affairs after EDX, a crypto alternate backed by conventional monetary establishments, enabled assist in June.

The crypto firm additional famous that Celsius’s complete altcoin holding exceeded $90 million, “which suggests will probably be troublesome for the corporate to liquidate with out incurring excessive value slippage.” It added:

“Greater than 60% of altcoin market depth is targeting Binance and different off-shore exchanges whereas 30% is on U.S. exchanges.”

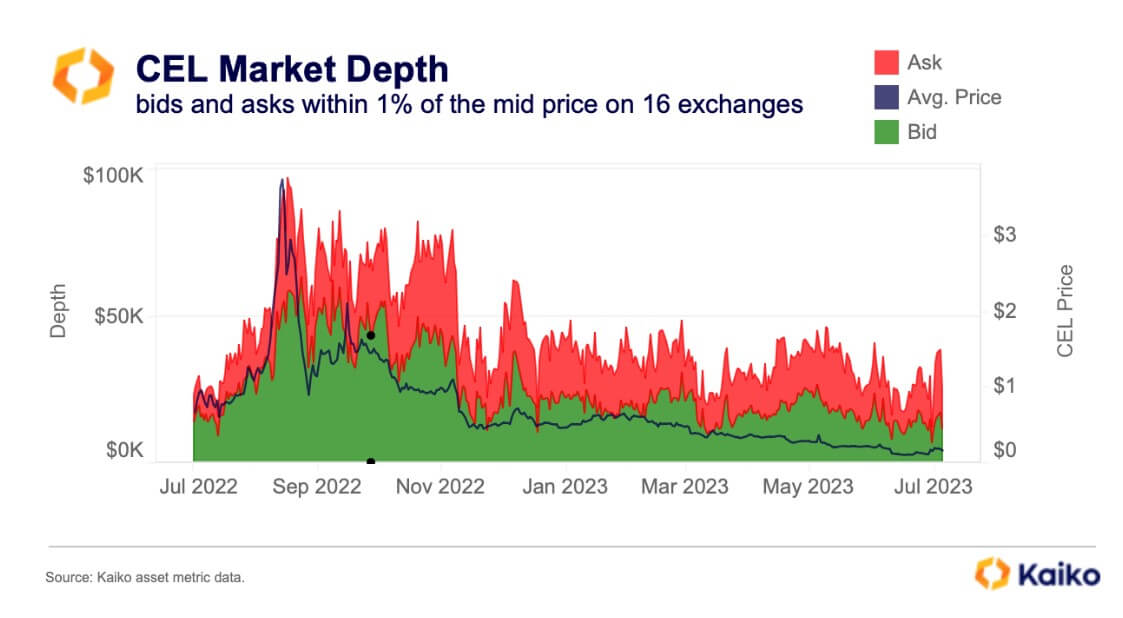

CEL token liquidity is nearly non-existent

In keeping with Kaiko, Celsius faces an issue as there’s nearly no liquidity for its most important altcoin holding, CEL.

CEL is Celsius’s native token, accounting for practically 65% of the bankrupt agency’s complete altcoin holdings.

“There may be just about no liquidity for CEL as measured by market depth, which has collapsed to only $30k, concentrated totally on OKX and Bybit.”

Since Celsius filed for chapter, the lender’s native token has seen waned curiosity, with its worth dropping to underneath $1 after peaking at over $8 in 2021, in response to CryptoSlate’s information.

The publish Celsius’s bankruptcy-induced liquidation plans may strain total crypto market: Kaiko appeared first on CryptoSlate.

[ad_2]