[ad_1]

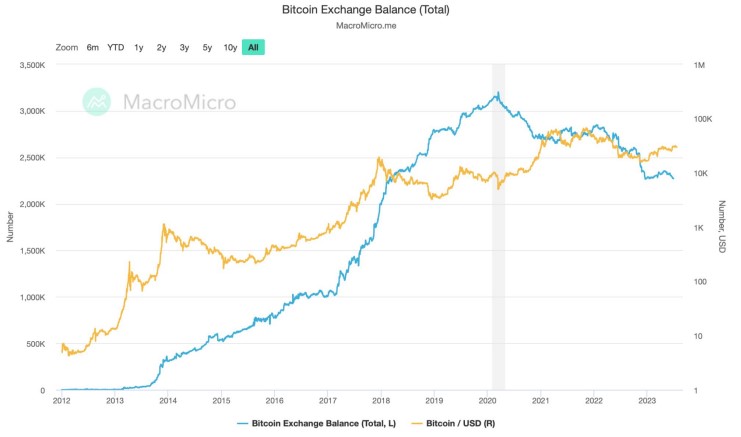

Bitcoin (BTC) continues to dominate the cryptocurrency market, as trade balances have dropped to ranges final seen in early 2018. This indicators a rising development of buyers transferring their Bitcoin holdings to chilly storage, which is taken into account to be safer.

In line with a current report by Bitfinex, whereas a few of this decline in trade balances could also be attributed to the utilization of decentralized exchanges and funds not coated within the knowledge, the overarching development seems to be a widespread motion of individuals withdrawing their Bitcoin from exchanges.

Bitcoin-Backed Funds Lead Crypto Funding Surge

This development can be mirrored within the current knowledge from CoinShares, which reveals that conventional fund buyers are demonstrating a renewed curiosity in Bitcoin.

Crypto-backed funding funds noticed a web influx of $137 million final week, with a staggering 99 % of this sum directed towards Bitcoin-backed funds.

In line with Bitfinex, this marks the fourth consecutive week of gross inflows into crypto funds, amassing a complete of $742 million over the interval, representing the most important run of inflows because the ultimate quarter of 2021.

The sustained inflows into Bitcoin-backed funds point out robust investor confidence within the asset, regardless of the volatility inherent within the crypto market. Moreover, the outflows from short-Bitcoin funds reinforce the bullish sentiment for the BTC worth amongst buyers, which has now been in a good vary for months.

This knowledge can thus be used as a proxy for institutional investor bias that the worth will get away of this vary towards the upside.

In the meantime, Ethereum funds had been the one different class to see outflows final week, dropping $1.6 million on a web foundation. Altcoin funds, alternatively, recorded slight inflows, with the most important going to multi-asset funds, adopted by funds backed by Solana’s SOL token and Polygon’s MATIC.

Total, this knowledge paints a transparent image of Bitcoin’s continued dominance within the crypto market. Whereas altcoins are making their presence felt, Bitcoin stays the popular asset for conventional fund buyers.

The sustained inflows into Bitcoin-backed funds counsel that buyers believe within the asset’s long-term development potential, regardless of the short-term volatility within the crypto market.

BTC Whales Elevated Exercise Signifies Bullish Market Sentiment

In line with a report by Glassnode, whales, or entities holding 1,000 or extra BTC, have been making vital strikes within the cryptocurrency market, with whale inflows to exchanges being traditionally massive and accounting for 41% of the entire.

The dominance of whale influx volumes to exchanges is important, with over 82% of whale inflows destined for Binance, the most important trade within the trade. This development highlights the significance of the function performed by whales within the cryptocurrency market, as their exercise can have a big affect on the worth and general sentiment of Bitcoin.

Whereas the report notes that many of those energetic whale entities are categorised as short-term holders, with notable exercise round native market peaks and troughs, it additionally highlights the long-term conduct of whales.

Glassnode’s Development Accumulation Rating by Cohort reveals that the smallest entities with lower than 100 BTC have slowed down their spending over the past month.

However, the whale subdivisions with greater than 1,000 BTC demonstrated divergent conduct, with these holding greater than 10,000 BTC distributing and people holding between 1,000 and 10,000 BTC accumulating at a considerably larger fee.

This conduct means that whales are actively reshuffling their holdings, transferring funds internally between entities. Whereas this could have short-term implications for the market, it additionally highlights the long-term potential for Bitcoin to stay a invaluable asset for buyers.

Featured picture from iStock, chart from TradingView.com

[ad_2]