[ad_1]

Share this text

Coinbase has introduced the gradual discontinuation of its lending service, Coinbase Borrow. The choice follows a suspension of recent mortgage functions initiated in Could, in accordance to an announcement on July 20:

“Coinbase introduced that we are going to start the gradual technique of closing Coinbase Borrow. Clients are unable to take out new traces of credit score towards their crypto and present Coinbase Borrow clients could have till November 20, 2023 to pay again their present loans.”

As soon as a big a part of Coinbase’s portfolio, Coinbase Borrow had enabled customers to safe fiat loans of as much as $1 million, utilizing as much as 40% of their Bitcoin holdings as collateral. The service carried an annual rate of interest of 8.7%.

Coinbase cited low adoption of the service as the first trigger for its resolution. The precise variety of customers affected by this transfer, nevertheless, has not been disclosed.

Because the cryptocurrency platform redirects its consideration, present mortgage holders have been given till November 20 to clear any excellent balances. Failure to settle loans by the stipulated date will lead to Coinbase liquidating the BTC collateral to recuperate the money owed.

To facilitate a seamless transition, Coinbase is providing affected clients a prioritized buyer help by way of its service, Coinbase One. Customers will retain entry to their mortgage historical past and Borrow dashboard till Could 1, 2024, as detailed in an e-mail dispatched to customers:

“We’re additionally waiving the everyday 2% liquidation payment in the event you select to make use of your BTC collateral to pay again the mortgage or take no motion and we promote the BTC for you.”

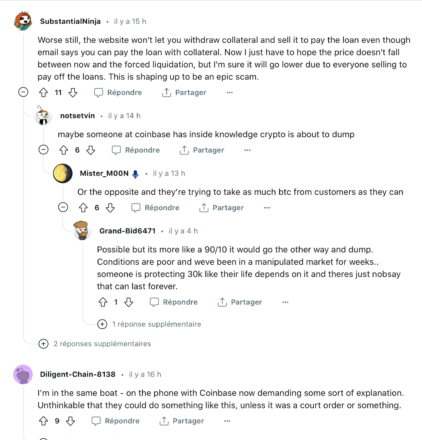

A Reddit thread confirmed the shock of this system ending, with some speculating market situations as the true motive why.

One Redditor acknowledged within the thread that, “they [Coinbase] have a report of shifting too rapidly and overlooking vital particulars of launches which may very well be detrimental to your safety or your satisfaction as a buyer.”

Closing Coinbase Borrow comes amid regulatory scrutiny of the platform’s companies. The SEC charged Coinbase in June for working as an unregistered securities alternate and for failure to register the provide and gross sales of its cryptoasset staking-as-a-service program.

Coinbase, nevertheless, has not attributed the SEC expenses with the tip of its Borrow program.

Share this text

[ad_2]

https://t.me/s/be_1win/916