[ad_1]

CoinPayments is a cryptocurrency gateway providing crypto fee options for companies and people. As a part of our ongoing dedication to enterprise and consumer security procedures and authorized compliance, we require companies to partake in KYB (Know Your Enterprise). KYB is necessary and ensures CoinPayments complies with monetary laws and reduces dangers to its purchasers.

KYB entails verifying the identification of enterprise entities, assessing their fame, and evaluating potential dangers. By conducting KYB checks, companies can shield themselves in opposition to monetary losses, authorized penalties, and reputational injury.

We’ve partnered with main verification platforms, resembling SumSub and RiskScreen, that are trusted by main monetary establishments globally, to make sure information security and privateness. These platforms are absolutely compliant with GDPR and different information safety laws, making certain that your info is in secure palms.

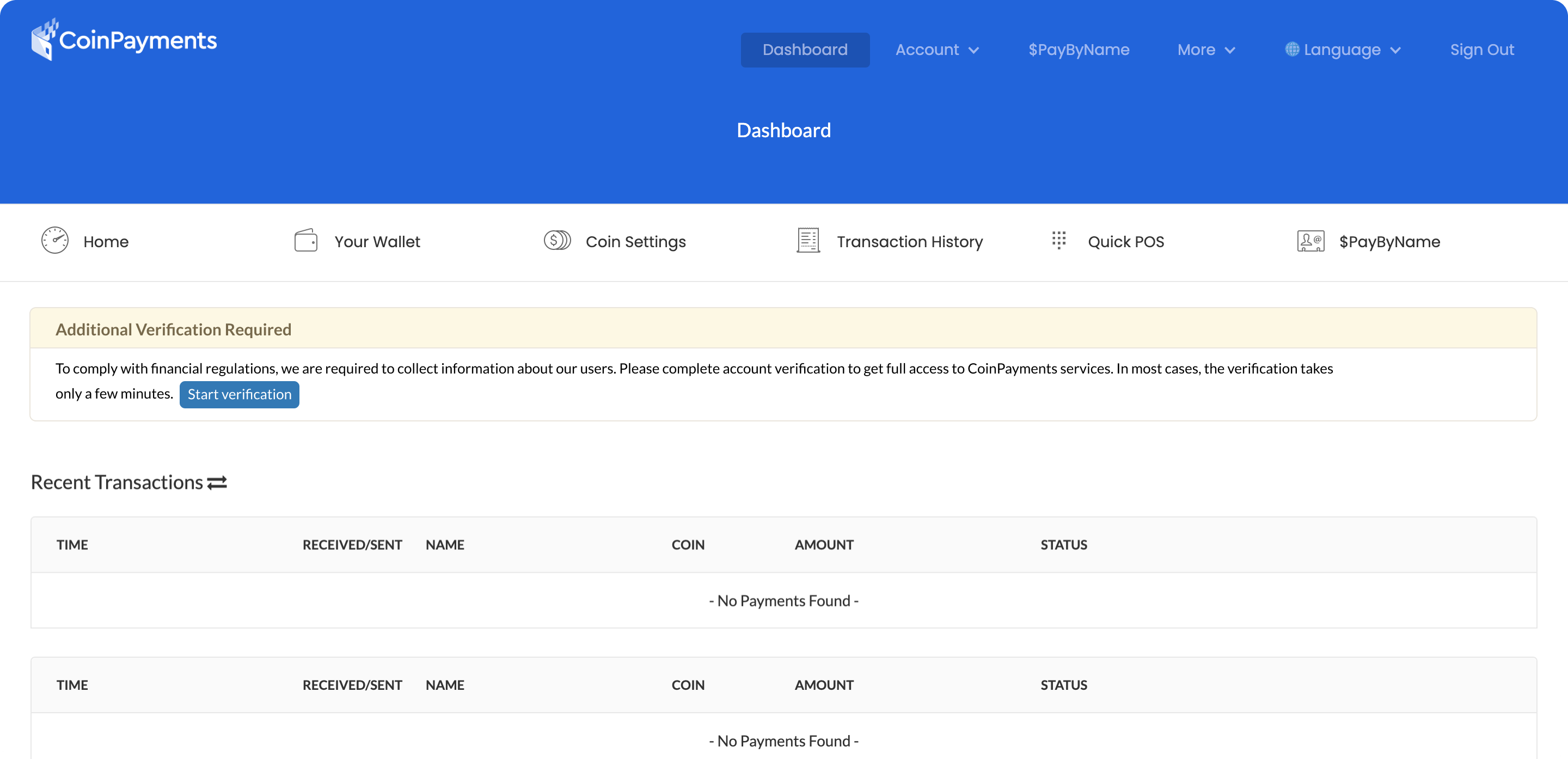

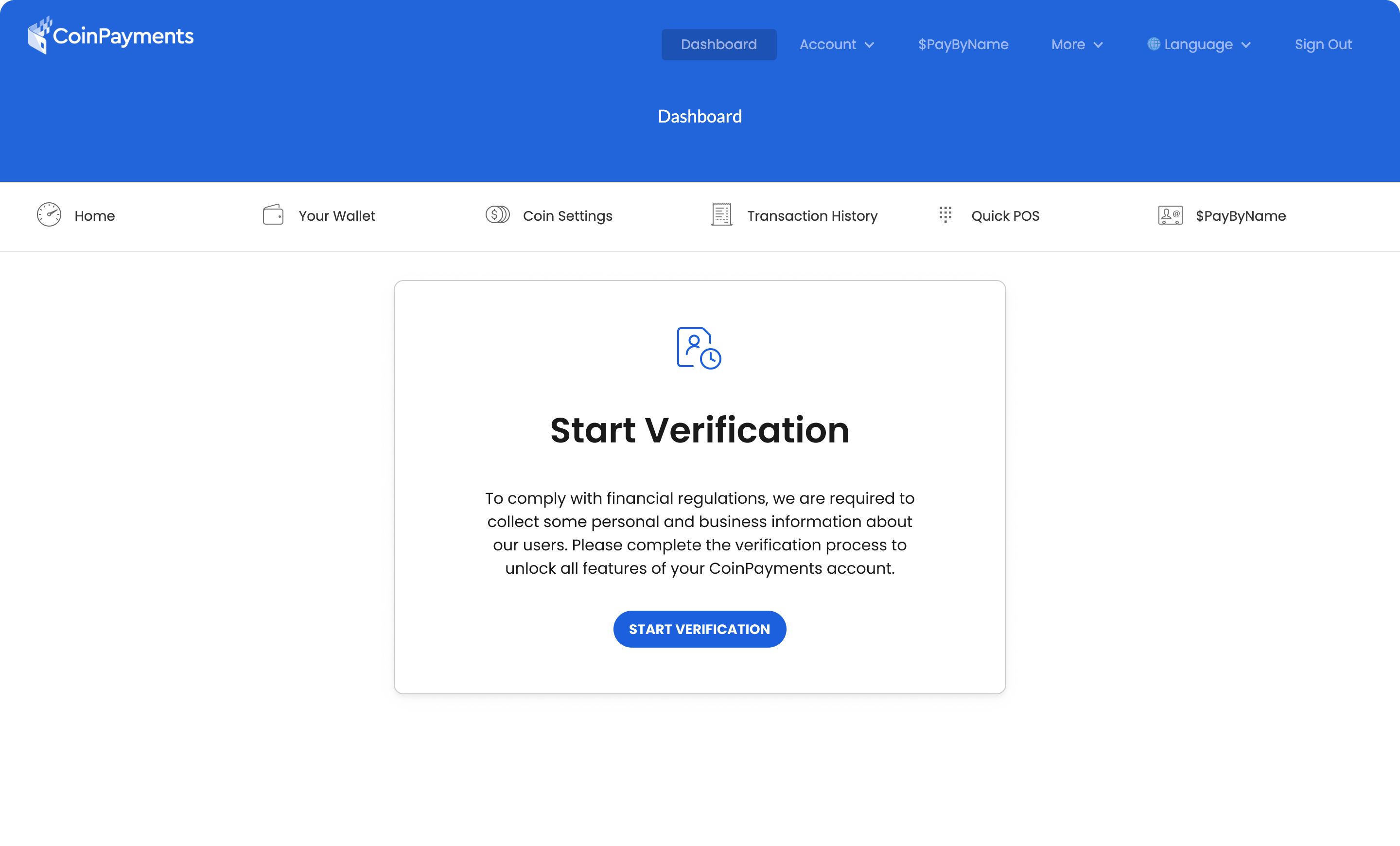

CoinPayments makes use of KYB to make sure that companies utilizing its platform are legit and secure. After creating an account, the verification course of may be initiated by choosing START VERIFICATION.

There are two main KYB pathways with CoinPayments:

- New service provider path – enterprise step-by-step information

- Present accounts with lively (60 days) and expired grace interval

Let’s dive in!

New Service provider Path – Enterprise Step-by-Step Information

Step 1

First, join a CoinPayments account and choose Begin Verification to supply the mandatory particulars.

Having created your account, the Account Verification Required immediate will probably be displayed on all dashboard pages. Clicking the banner affirmation button will direct you to Step 2.

You’ll be able to check the fee processes utilizing the Litecoin Testnet (LTCT) digital asset. LTCT is a demo asset permitting customers to check the appliance performance. Customers can simulate withdrawals, deposits and check their APIs utilizing the asset.

Different property will probably be unavailable till the KYC/KYB verification course of is full.

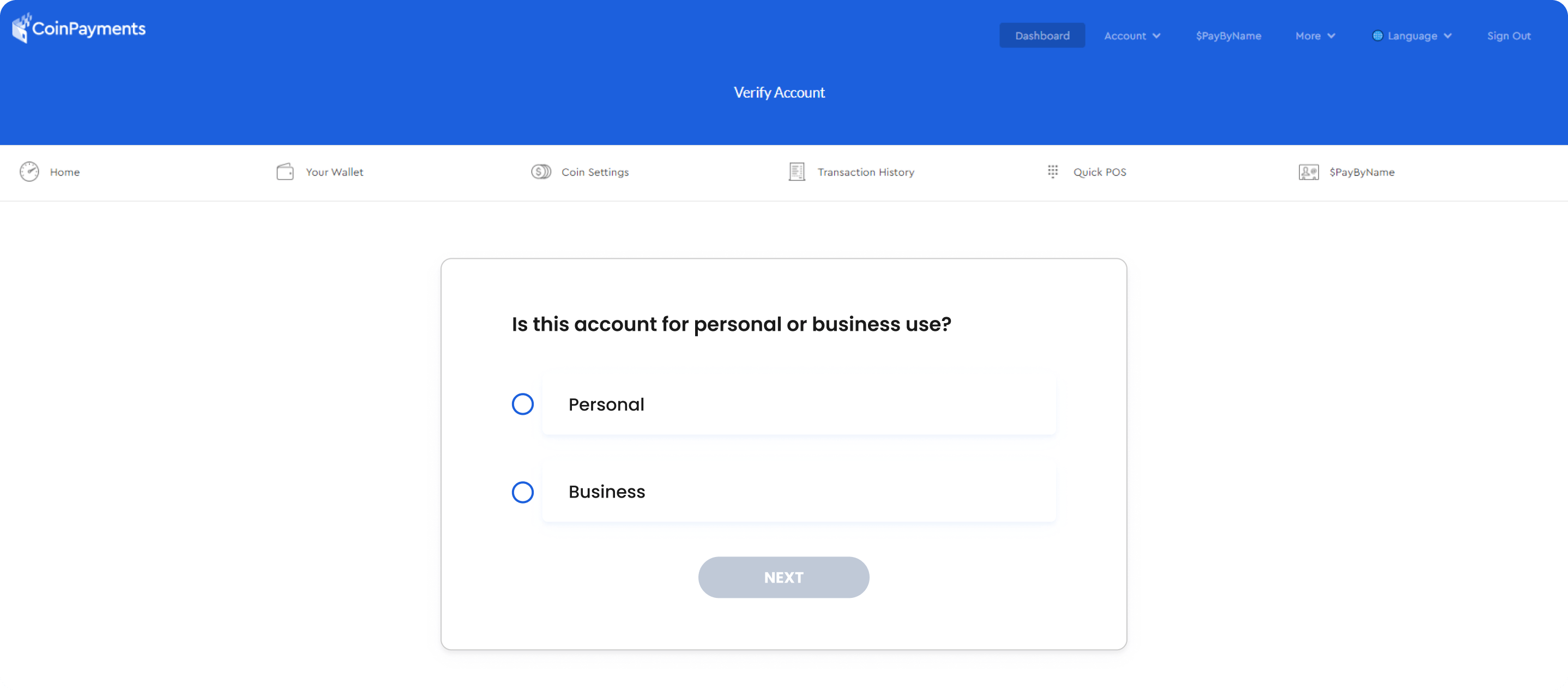

As soon as the verification is began, you need to select between a Enterprise and a Private account.

Step 2

Select between a Private or Enterprise account.

When choosing the Private account choice, a affirmation immediate will seem.

The next steps are defined within the KYC weblog.

The Enterprise account registration course of is described beneath.

Step 3

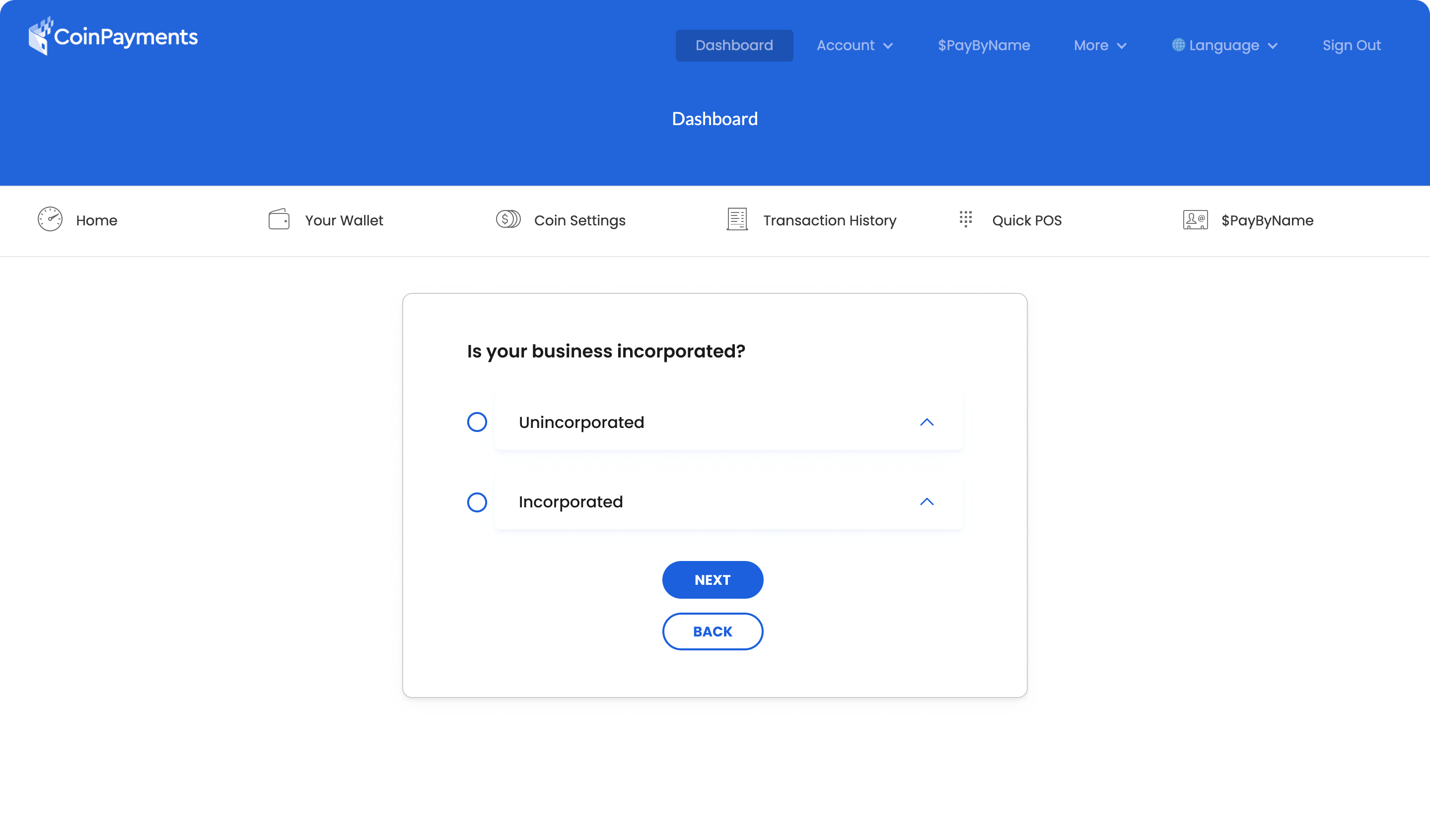

Select what you are promoting sort (included or unincorporated) and full the KYB software.

One of many key distinctions between the 2 is that non-incorporated firms are owned by people who’re personally accountable for money owed. The verification necessities for such accounts are the identical as for Private accounts and may be discovered within the KYC weblog.

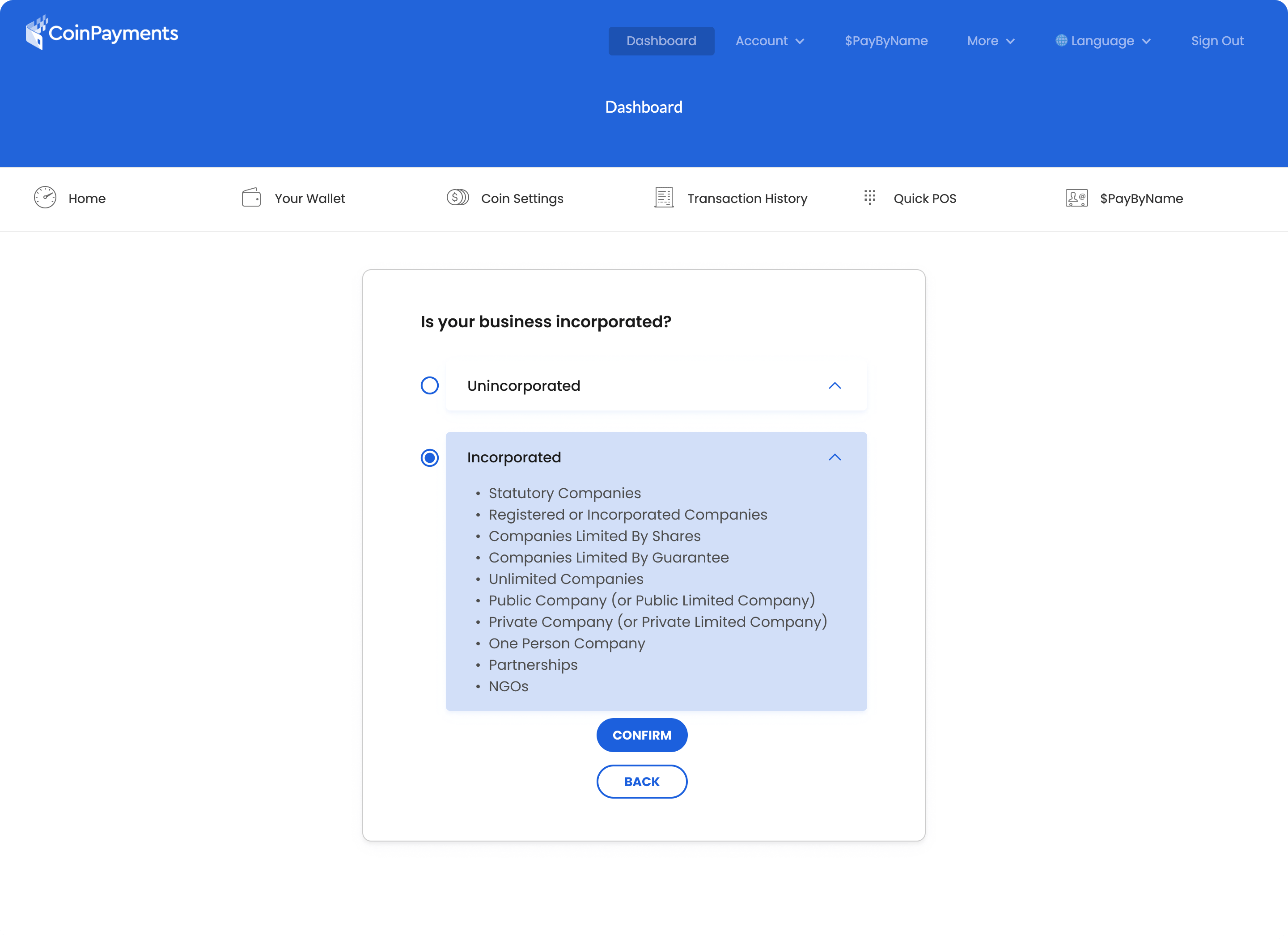

Integrated firms, resembling statutory firms, restricted firms (public or personal), one-person firms, partnerships, and NGOs, provide safety in opposition to liabilities as separate authorized entities from their homeowners.

The enterprise sort choices are displayed as proven within the picture beneath:

Step 4

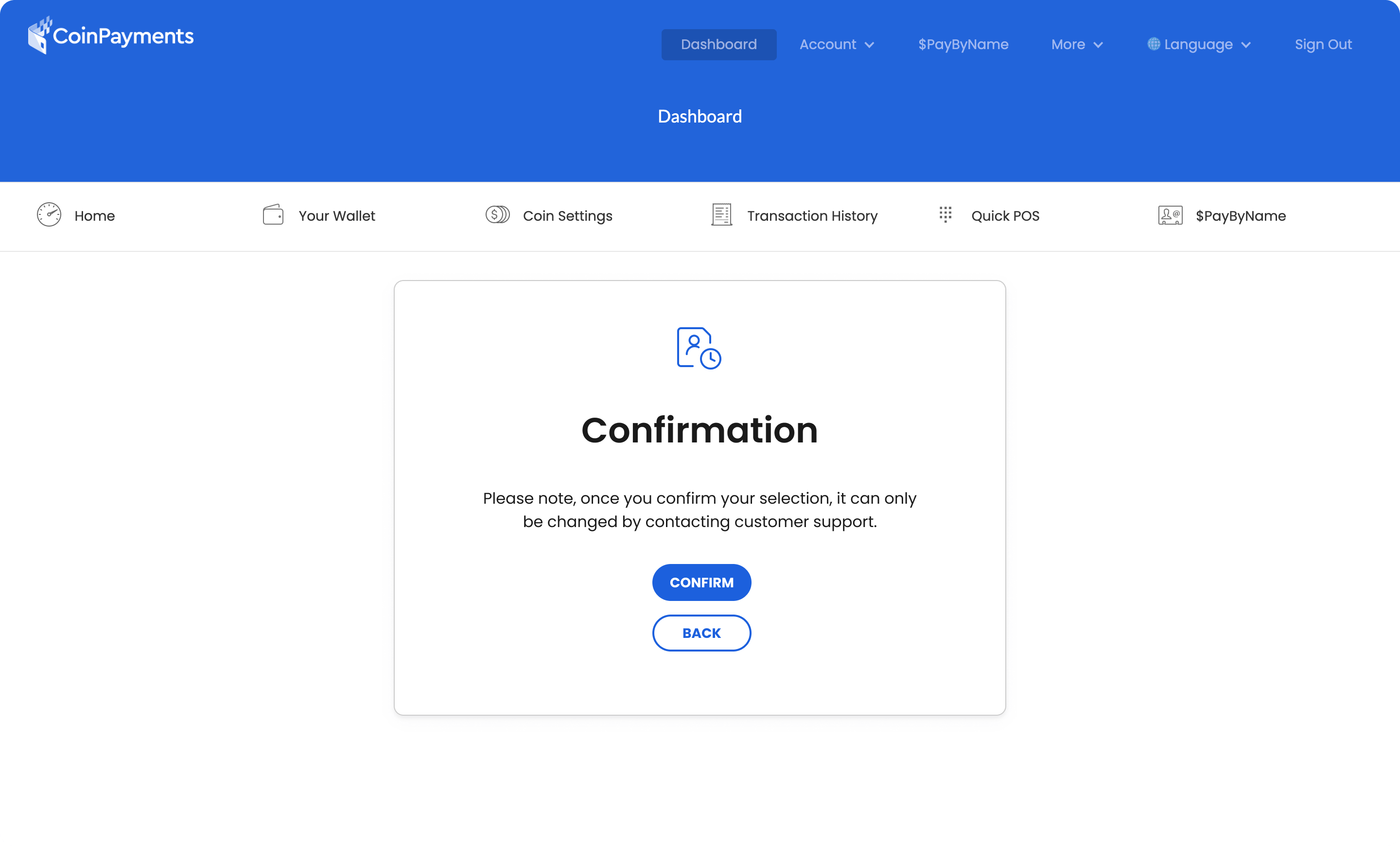

When you select the suitable choice, a CONFIRMATION SCREEN will probably be displayed as proven beneath. Solely the buyer assist group can modify your collection of the enterprise sort as soon as it’s submitted.

Step 5

Click on “START VERIFICATION” to confirm the corporate particulars as beneath.

After selecting the suitable choice, you’ll be redirected to our associate platforms for firm verification.

START VERIFICATION for “Non-Integrated” retailers will direct you to our associate (SumSubstance platform) for firm verification, an identical to the KYC course of for private accounts.

START VERIFICATION for “Integrated” retailers will redirect you to our associate (RiskScreen platform) to carry out firm verification.

Anticipate a novel verification code to be despatched to your electronic mail.

Step 6

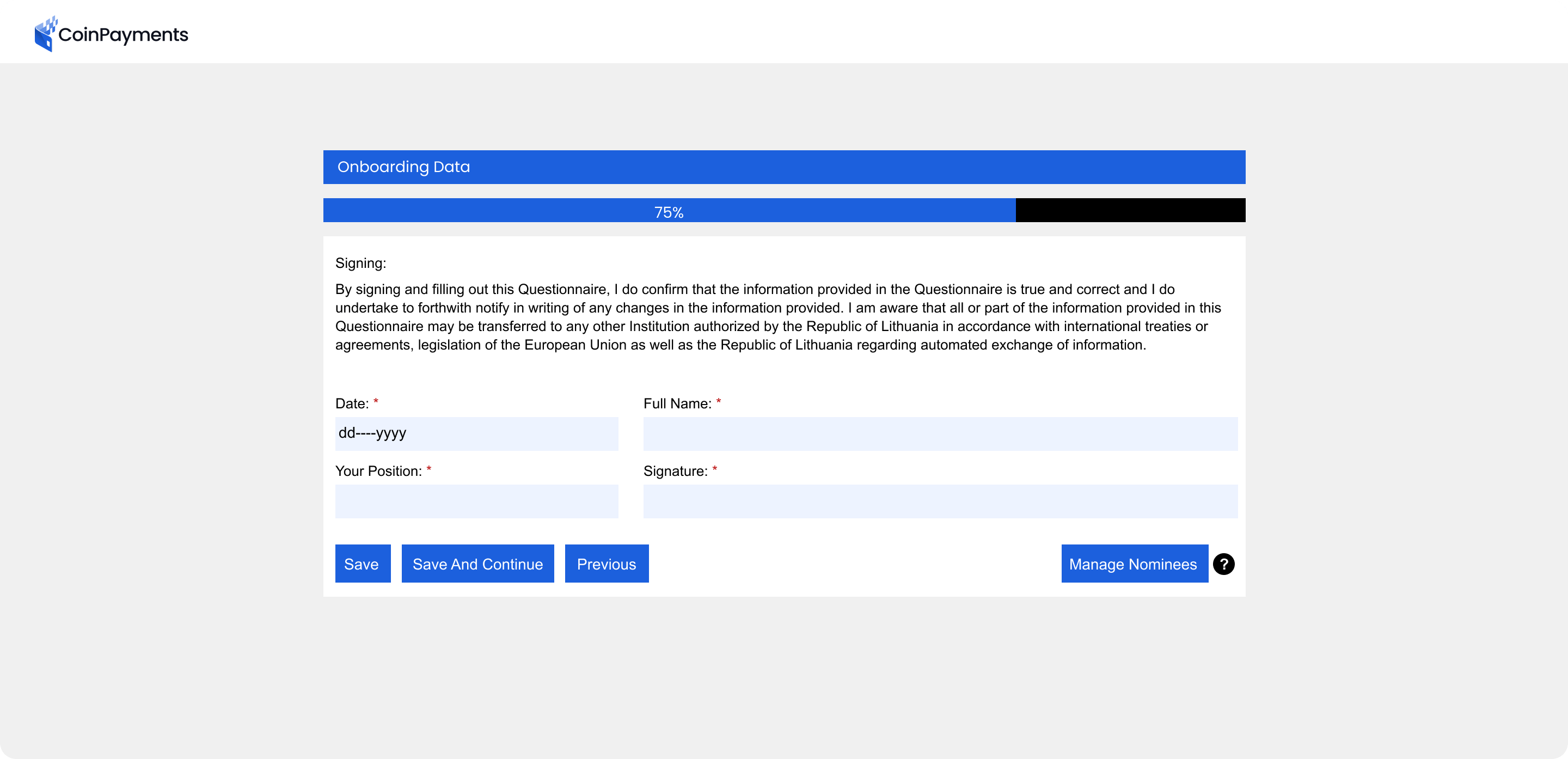

After receiving the verification code out of your registered electronic mail, present the required normal, personnel, enterprise, and monetary info, together with particulars of administrators and supreme helpful proprietor(s).

Disclose political publicity and full KYC steps for every Director or UBO.

Signal to verify the information submitted by your organization/group is genuine.

Step 7

Add legitimate paperwork which are no older than three months and in English.

For included retailers, the required paperwork embrace incorporation papers, proof of handle, commerce registry extract, shareholder and director lists, firm construction, and the newest monetary assertion.

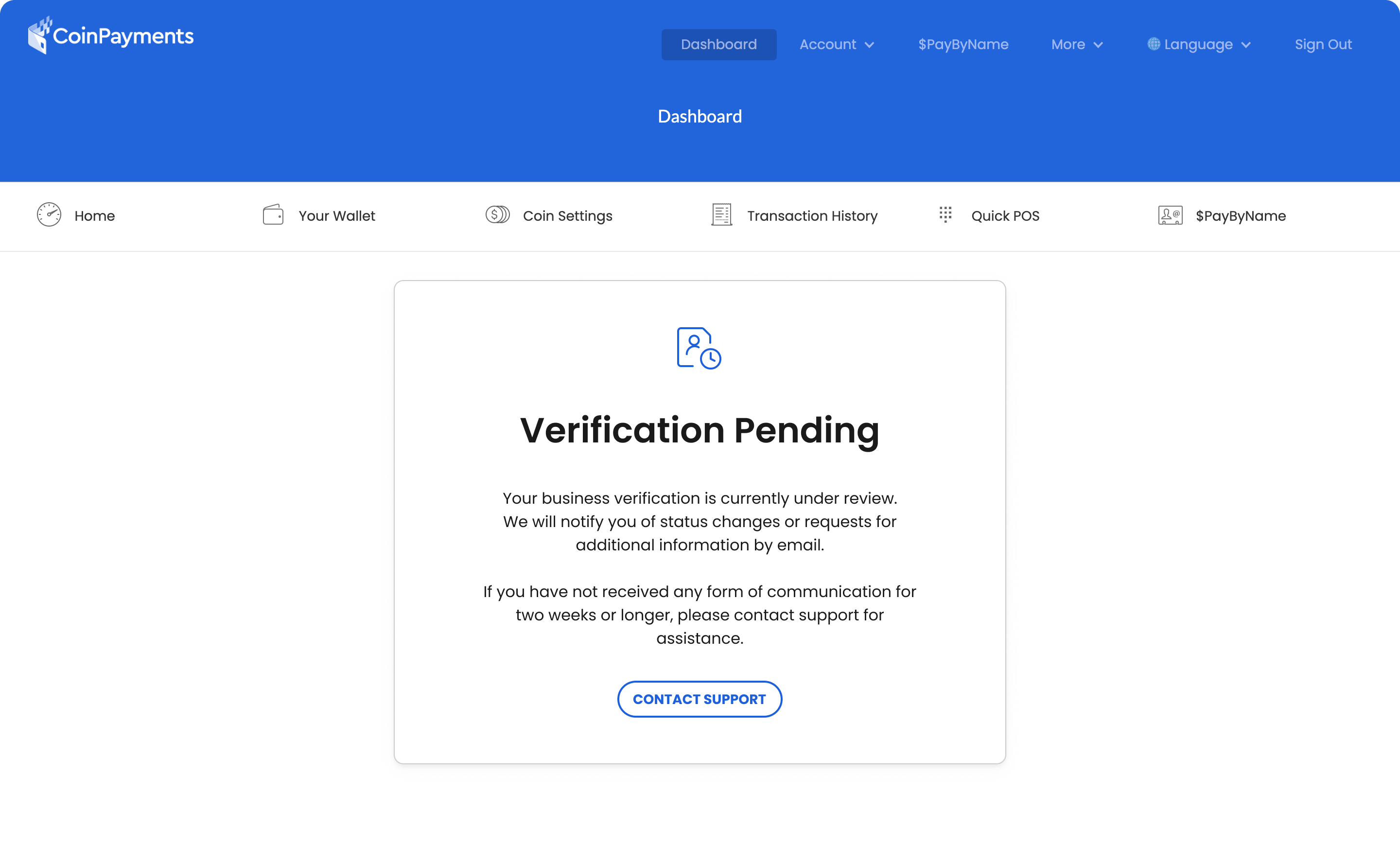

Your KYB software enters a processing interval which will last as long as 5 days. Throughout this era, the corporate’s info will probably be reviewed, and a response will probably be given to you.

Whereas ready for affirmation, you’ll be able to check the performance of the appliance utilizing the Litecoin Testnet (LTCT) demo asset, as outlined above.

After profitable verification, you’ll obtain an electronic mail notification confirming you will have full entry to all supported CoinPayments cryptocurrencies and options.

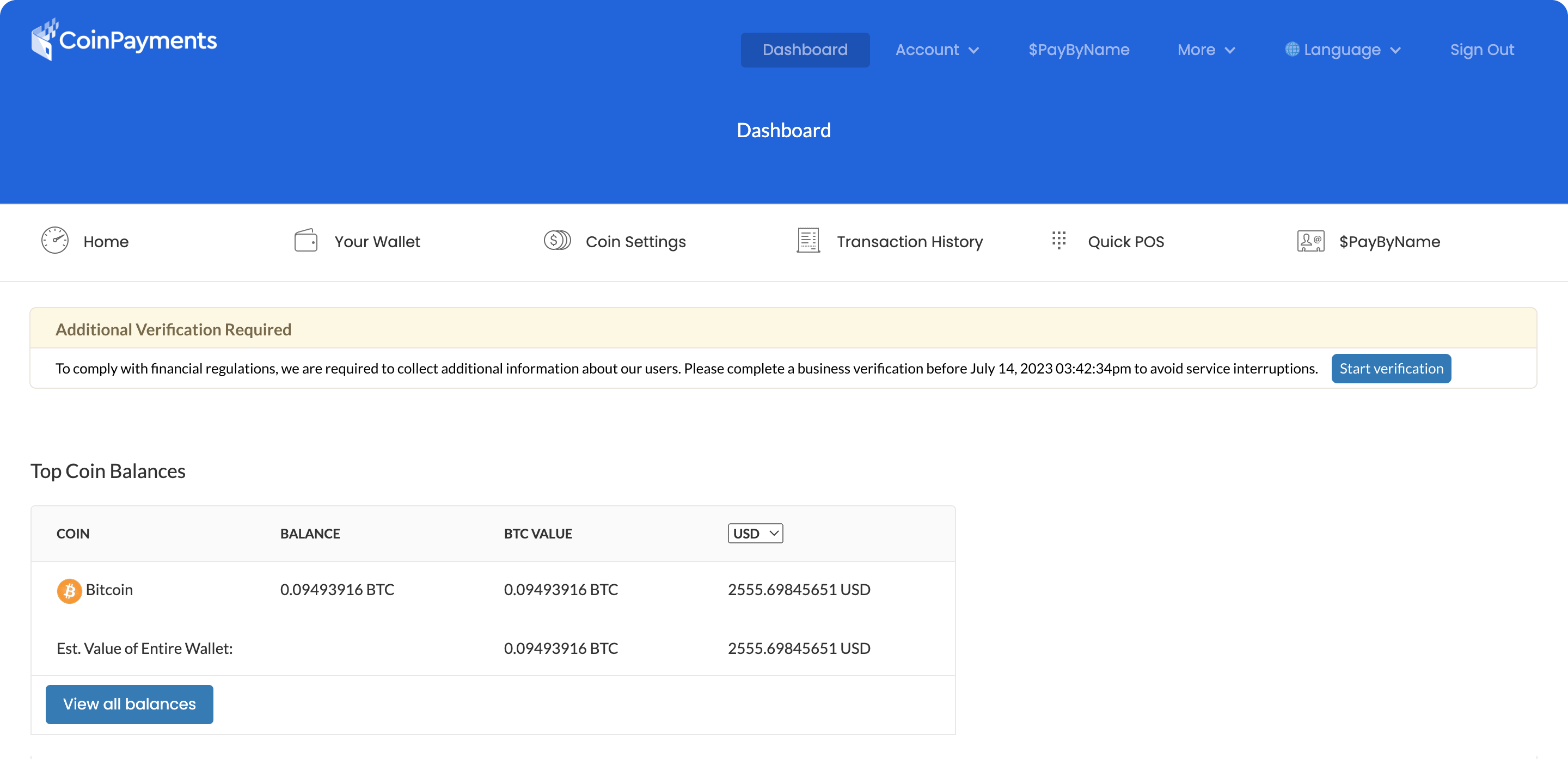

Present Accounts with Lively (60 days) or Expired Interval

All options stay out there for current CoinPayments customers with lively grace intervals till the grace interval ends.

Listed here are the steps to observe to finish your KYB verification:

Step 1

Comply with steps 2 by 10 described in New Service provider Path – Enterprise Step-by-Step Information.

For private and unincorporated accounts with accomplished identification verification, the beforehand offered info will probably be routinely carried over. Subsequently, minimal further verification (or none) will probably be needed.

Step 2

Throughout this service provider assessment course of, all account options stay out there till the tip of the grace interval.

Step 3

- Test your electronic mail for directions on methods to proceed. You’ll obtain a notification on verification approval, lacking paperwork or different application-related info.

- . All relevant members of the enterprise will obtain an electronic mail invitation to finish their identification verification. Guarantee every director and supreme helpful proprietor (UBO) of the corporate passes the KYC course of. KYC, or Know Your Buyer, is a course of for consumer identification verification. KYC entails amassing and verifying private info and documentation to make sure compliance with anti-money laundering and counter-terrorism financing laws.

When you’d like to know the KYC course of and methods to confirm your self right here at CoinPayments, please click on right here to learn our tutorial information.

- We’ll assessment your submission and ship an electronic mail as soon as it’s accepted. If a submission is rejected, it’s not the tip, as you’ll be able to resubmit your software in conditions when the rejection foundation was a defective add or unsupported doc sort. Our assist group will probably be joyful to information you should you want help with recurring points.

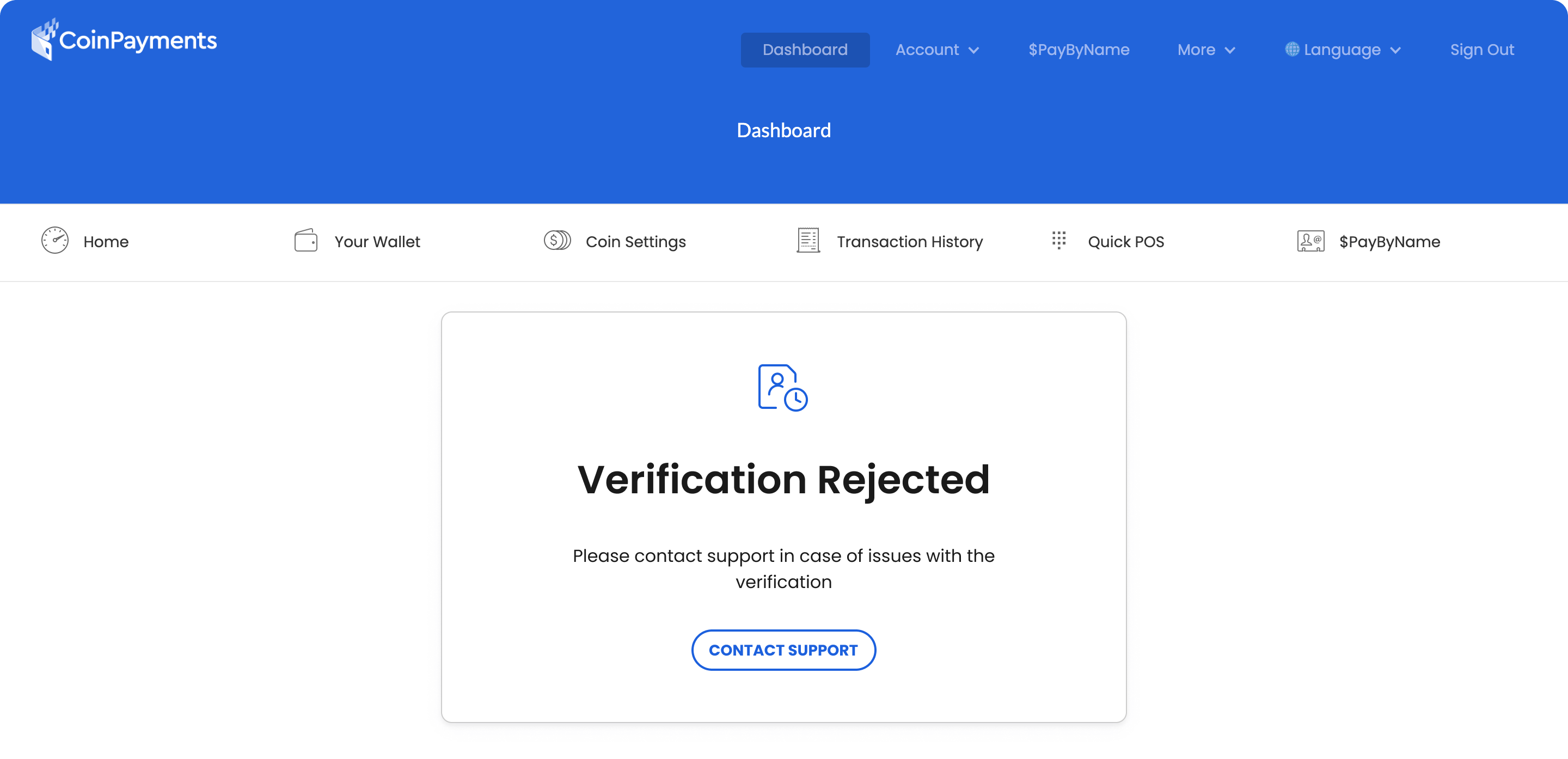

- As soon as our compliance group approves the appliance, all account options change into accessible. You may be notified if the appliance will get rejected.

- In case you lose entry to CoinPayments providers, observe the identical information to confirm your account.

When you’ve got any questions or issues throughout the verification course of, please contact the CoinPayments’ assist group for help.

Step 4

As soon as our Compliance group approves the appliance, all account options change into accessible ✅

If the account is Rejected, the next banner will probably be displayed:

When you fall into the class of customers who’ve an current enterprise account with out KYB verification and have misplaced entry to our providers, observe the directions for brand spanking new retailers.

Upon completion of the steps outlined on this information, what you are promoting will full its KYB verification and luxuriate in full entry to all CoinPayments’ options.

[ad_2]

ivermectin 12mg tablets – atacand buy online tegretol 200mg tablet

buy isotretinoin 20mg generic – dexamethasone 0,5 mg usa linezolid 600mg drug

zithromax 500mg us – purchase azithromycin pills bystolic online buy

prednisolone 5mg oral – buy progesterone 100mg generic order progesterone 200mg

buy gabapentin 100mg pill – clomipramine 50mg canada itraconazole price

amoxiclav us – order duloxetine 40mg for sale order duloxetine 40mg online

monodox oral – order glucotrol 5mg online glucotrol online buy

order amoxiclav – duloxetine usa generic cymbalta 40mg

brand semaglutide – buy vardenafil for sale buy cyproheptadine 4 mg generic

tizanidine 2mg tablet – buy hydroxychloroquine 200mg online cheap order microzide

tadalafil buy online – order viagra generic sildenafil 100 mg

purchase viagra – tadalafil 5mg tadalafil 20mg tablet

cenforce order – buy chloroquine pills for sale buy glucophage online

buy lipitor 20mg without prescription – norvasc us lisinopril 10mg oral

order lipitor 40mg pill – norvasc 10mg tablet purchase lisinopril for sale

where can i buy omeprazole – prilosec pills atenolol medication

depo-medrol over the counter – lyrica sale triamcinolone 10mg drug

clarinex 5mg cost – buy claritin 10mg for sale cheap dapoxetine 60mg

buy generic cytotec over the counter – diltiazem without prescription diltiazem 180mg pills

zovirax tablet – buy rosuvastatin 20mg sale buy crestor online

domperidone without prescription – oral flexeril order cyclobenzaprine 15mg for sale

motilium tablet – order domperidone 10mg cost cyclobenzaprine

inderal 20mg brand – buy generic methotrexate 10mg cost methotrexate 2.5mg

warfarin tablet – coumadin 2mg sale brand losartan

order levofloxacin 250mg pills – buy levaquin pills for sale purchase ranitidine without prescription

nexium 40mg us – cost esomeprazole 20mg sumatriptan 50mg oral

buy meloxicam generic – tamsulosin 0.4mg without prescription order tamsulosin 0.2mg pills

zofran drug – buy ondansetron 8mg without prescription order zocor pill

modafinil online buy provigil 100mg over the counter modafinil 200mg sale modafinil 100mg brand provigil 200mg tablet modafinil 100mg uk cheap provigil

I couldn’t hold back commenting. Adequately written!

This is the kind of delivery I find helpful.

order zithromax 250mg online cheap – ciprofloxacin drug metronidazole 400mg oral

rybelsus 14mg tablet – rybelsus 14 mg us order cyproheptadine generic

buy motilium pills – cyclobenzaprine 15mg sale buy generic flexeril for sale

inderal 20mg for sale – propranolol us methotrexate 2.5mg pill

buy generic amoxicillin online – valsartan 80mg uk combivent pills

order zithromax 250mg pill – buy generic nebivolol 5mg buy generic bystolic 5mg

augmentin 1000mg oral – https://atbioinfo.com/ buy cheap generic ampicillin

buy nexium 20mg sale – anexamate order nexium 20mg online cheap

purchase warfarin online – cou mamide cost cozaar 50mg

mobic 15mg usa – https://moboxsin.com/ order meloxicam 7.5mg pill

brand prednisone 20mg – apreplson.com buy deltasone 10mg

erection pills online – https://fastedtotake.com/ best pills for ed

amoxil buy online – comba moxi amoxicillin without prescription

order diflucan 200mg sale – order forcan pill oral forcan

cenforce price – cenforce 100mg pills cenforce pill

canadian pharmacy cialis brand – https://ciltadgn.com/ cialis cheapest price

cialis for bph insurance coverage – strong tadafl where to buy cialis

buy ranitidine 300mg online cheap – on this site ranitidine pill

cuanto sale el viagra en uruguay – https://strongvpls.com/ order viagra pills

I am in truth enchant‚e ‘ to glitter at this blog posts which consists of tons of profitable facts, thanks representing providing such data. diurГ©ticos lasix

Such a helpful read.

More posts like this would create the online space more useful. https://buyfastonl.com/

Greetings! Extremely useful advice within this article! It’s the crumb changes which will obtain the largest changes. Thanks a quantity for sharing! https://ursxdol.com/sildenafil-50-mg-in/

This is the kind of serenity I enjoy reading. https://prohnrg.com/product/rosuvastatin-for-sale/

Thanks recompense sharing. It’s top quality. https://aranitidine.com/fr/acheter-cialis-5mg/

I couldn’t hold back commenting. Adequately written!

https://proisotrepl.com/product/baclofen/

This is the kind of enter I unearth helpful. http://3ak.cn/home.php?mod=space&uid=229259

order dapagliflozin 10 mg pills – click forxiga cost

how to buy xenical – buy xenical no prescription buy xenical for sale

This website really has all of the information and facts I needed about this thesis and didn’t comprehend who to ask. http://pokemonforever.com/User-Njuedp

You can protect yourself and your dearest nearby being heedful when buying medicine online. Some pharmacy websites control legally and offer convenience, secretiveness, sell for savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/reglan.html reglan

You can conserve yourself and your dearest close being wary when buying medicine online. Some pharmaceutics websites manipulate legally and offer convenience, reclusion, rate savings and safeguards over the extent of purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/zantac.html zantac

This is the kind of enter I unearth helpful. TerbinaPharmacy

You can keep yourself and your stock by way of being cautious when buying panacea online. Some druggist’s websites control legally and sell convenience, privacy, cost savings and safeguards to purchasing medicines. http://playbigbassrm.com/

This is the stripe of topic I take advantage of reading.

https://t.me/s/Volna_officials

mgm app betting betmgm РђРљ betmgm Idaho

mcluck KY online casino McLuck mcluck MS

As sole of the top-rated sweepstakes casinos, wow casino slots delivers thousands of high-quality slots from primary providers without any real-money deposits required. New players get a mountainous welcome case of WOW Coins and unshackled Sweepstakes Coins to start spinning right away.