[ad_1]

Nationwide financial insurance policies are continuously formed by political will and exterior financial components. Nevertheless, Bitcoin represents a counterpoint, embodying a financial system the place coverage is essentially untouched by these influences due to the halving.

Encapsulating this concept, Constancy argues that Bitcoin’s financial coverage stays steadfastly unaltered by politics or exterior components.

Halving Which means: Decrease Provide for Increased Demand

Central to Bitcoin’s financial mannequin, the halving happens roughly each 4 years, or each 210,000 blocks mined. The Bitcoin “halving” denotes the discount by half of the reward miners obtain for including new blocks to the blockchain.

This course of impacts Bitcoin’s provide and demand dynamics by reducing the speed of recent BTC issuance but leaving the miners’ manufacturing prices unaltered. Every interval halves Bitcoin’s block subsidy, which is the compensation miners obtain.

“This financial coverage is about in code and unlikely to ever change. Merely put, Bitcoin’s financial coverage is just not depending on or impacted by politics or exterior financial components,” mentioned Daniel Grey, Analysis Analyst at Constancy.

The predictable and unalterable discount within the issuance price provides Bitcoin a novel financial coverage.

As an illustration, in Bitcoin’s preliminary 4 years, the mining reward stood at 50 BTC per block, declining to 25, then 12.5, and presently sits at 6.25 BTC per block. The following halving initiatives the reward to shrink to three.125 BTC, which suggests a median inflation price of roughly 0.8%.

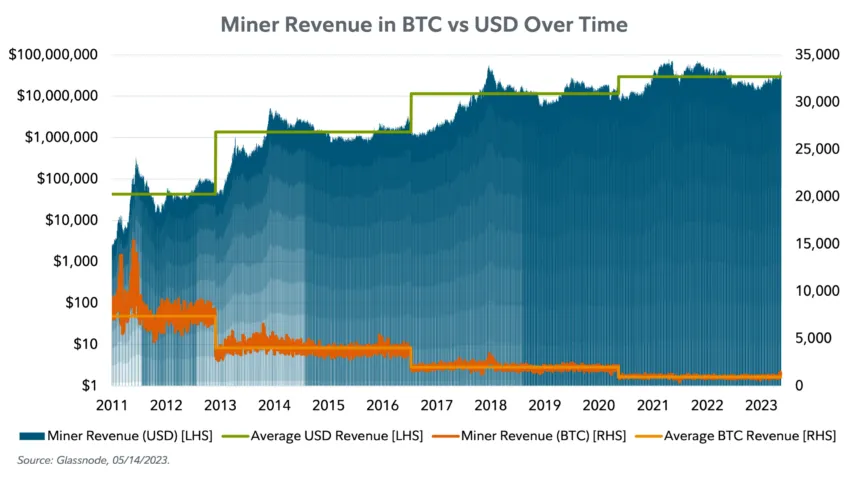

Apparently, even because the halving diminishes the miners’ native BTC rewards, it doesn’t essentially erode their USD-denominated returns. The underlying motive is that offer and demand predominantly affect Bitcoin’s value.

With the halving inflicting a lower in new provide, provided that demand stays fixed, the value could face upward strain. As Bitcoin’s issuance seems to be truly fizzling out, its USD-denominated income grows. Due to this fact, making the halving occasions useful for the miners and buyers.

“With none change to cost or demand, the halving reduces the issuance from 900 to 450, in the end halving the sell-side strain. To keep up a secure value of $28,000 with half of the brand new issuance, there solely must be $12.6 million of demand. If [the current demand of $25 million] stays unchanged, the value should quickly right to match the demand,” added Grey.

Is the Bitcoin Halving Priced In But?

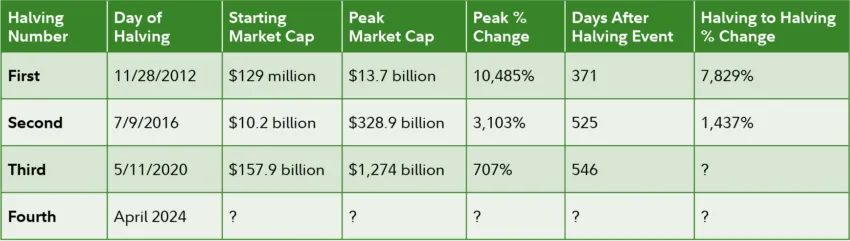

The halving additionally impacts Bitcoin’s market conduct. Historic tendencies recommend that Bitcoin experiences a surge in worth following a halving. Previous occasions have seen returns spike because the decreased provide meets a rising demand.

As adoption continues to rise, the simultaneous contraction of the issuance price may doubtlessly set off an upward correction in value. Bitcoin’s halvings have served as catalysts for substantial appreciation in market cap.

“Earlier than Bitcoin had reached a market cap of over $150 million, the primary halving befell. Roughly a yr later, Bitcoin’s value had rallied roughly 9,100%…. The second halving led to a value peak of two,913% roughly a yr and a half later…. The third halving’s value peak development was 686%, additionally round a yr and a half later,” concluded Grey.

Via mechanisms just like the halving, Bitcoin proves its resilience and self-sustaining nature. Subsequently forging a path as a really decentralized and self-regulated financial system.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material.

[ad_2]