[ad_1]

Key Takeaways

- Crypto costs are rising sharply, with Bitcoin up 20% within the final three weeks

- The submitting of a variety of high-profile Bitcoin ETFs has pushed optimism out there

- Beneath the hood, liquidity stays low and a few worrisome developments emerge, nevertheless

- The regulatory woes are nonetheless current, with Coinbase and Binance going through a murky future

- The macro image additionally stays unsure, with the prospect of a lagged influence through tightening financial coverage looming massive

It wouldn’t be like crypto markets to get overly excited. Prior to now couple of weeks, positivity has returned to the house, led by the seminal filings for a Bitcoin spot ETF by two of the world’s largest asset managers, Blackrock and Constancy.

Moreover, Constancy have been amongst a cohort of enormous trad-fi operators, together with Schwab and Citadel, to again the brand new trade EDX, which provides buying and selling for Bitcoin, Ether, Litecoin and Bitcoin Money.

Bitcoin is up 20% within the final three weeks, breaching previous the $30,000 mark, whereas Ether is up 16% in the identical timeframe, approaching the $2,000 mark as soon as extra. A look on the Concern and Greed index, an fascinating metric which gauges general sentiment within the house, exhibits it’s markedly within the “greed” sector with a rating of 61 (0 represents excessive worry, 100 represents excessive greed).

And but, a glance beneath the hood betrays some concern. Firstly, if the submitting of the ETFs is the rationale for the current ramp, because it seems to be, is a 20% leap justified? The SEC has declared the current filings as “insufficient”, in response to the WSJ, informing the Nasdaq and CBOE (who filed the paperwork on behalf of the asset managers) that there’s not sufficient element with respect to “surveillance-sharing agreements”. The SEC had beforehand stated that sponsors of a Bitcoin belief are required to enter right into a surveillance-sharing settlement with a regulated market of serious dimension.

And but, a glance beneath the hood betrays some concern. Firstly, if the submitting of the ETFs is the rationale for the current ramp, because it seems to be, is a 20% leap justified? The SEC has declared the current filings as “insufficient”, in response to the WSJ, informing the Nasdaq and CBOE (who filed the paperwork on behalf of the asset managers) that there’s not sufficient element with respect to “surveillance-sharing agreements”. The SEC had beforehand stated that sponsors of a Bitcoin belief are required to enter right into a surveillance-sharing settlement with a regulated market of serious dimension.

Whereas the functions could be up to date and refiled (and the CBOE did certainly refile theirs since, with Nasdaq seemingly quickly to observe) the event hints at how tough it has been to get the much-coveted spot ETF over the road. There is no such thing as a assure that these are authorised, regardless of the massive names concerned – the SEC even rejected an utility from Constancy previously, turning it away in January 2022.

In reality, it feels inevitable that Bitcoin spot ETFs will someday be traded freely, however a 20% leap on a mere submitting within the final couple of weeks is an enormous ramp when contemplating what else has occurred within the house, and the state of markets, which we’ll delve into now.

Liquidity

Liquidity continues to lag, an element which can’t be overstated – and certainly one which the eventual approval of spot ETFs ought to assist.

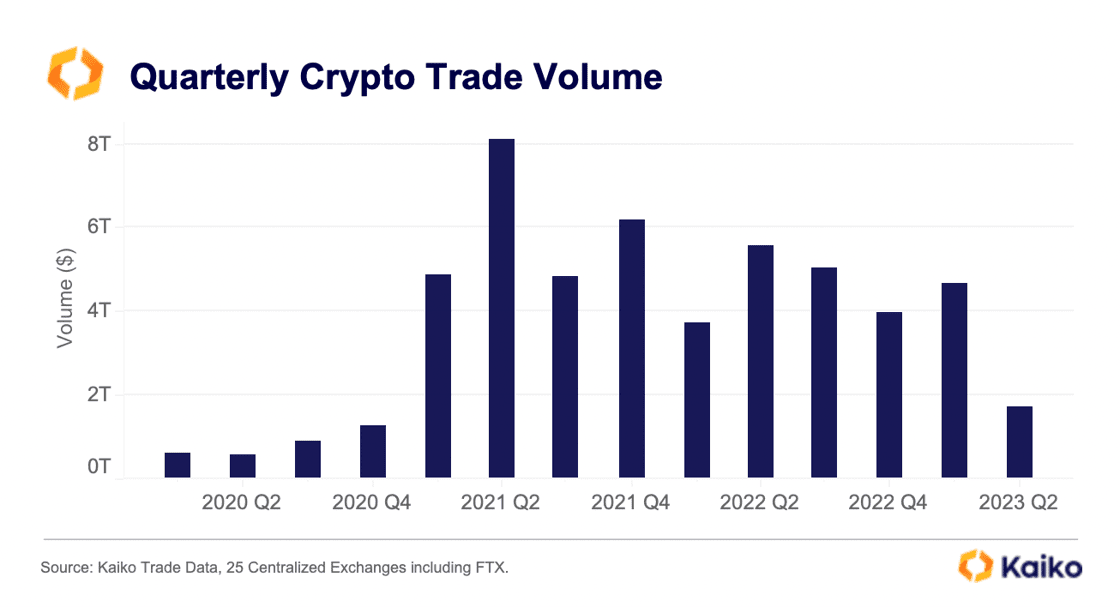

centralised exchanges per information from Kaiko as we shut out the second quarter of 2023, quantity over the previous three months was decrease once more, coming in on the lowest quantity since 2020, earlier than Bitcoin and crypto launched into their inexorable value rises and took the monetary world by storm.

However with decrease liquidity, strikes to each the upside and draw back are exacerbated. This has maybe contributed to Bitcoin’s steep rise previously few weeks, and likewise year-to-date, with it presently up 83%.

However liquidity and volumes being so low ought to be alarming for market individuals. A lot of the inroads made through the pandemic, with regard to Bitcoin taking its place subsequent to bona-fide asset lessons from a buying and selling perspective, have slowed if not reversed – a minimum of from a liquidity perspective.

As additional proof of this, within the under chart, I’ve offered the full stability of stablecoins throughout exchanges, which has fallen a staggering 60% previously six months – an outflow of $26 billion.

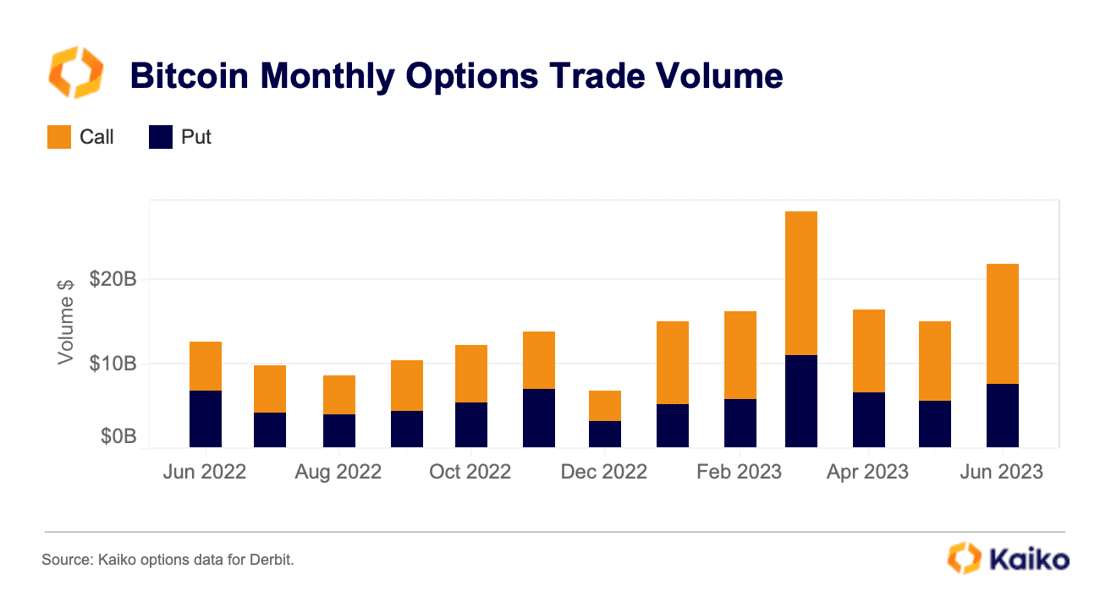

Having stated that, there are pockets of optimism which trace at a brighter future if/when these spot ETFs do get authorised. quantity in derivatives markets, it has been somewhat constant. In truth, it’s markedly up on the second half of 2022. Maybe this implies the spot market has been larger affected by the regulatory crackdown. Both means, it’s a much less ugly image than what we’re seeing in spot markets.

Regulation

Proper now, with regard to crypto-specific danger, it actually all comes again to regulation. Now we have mentioned the ETF filings, however June additionally introduced two seminal moments: formal costs introduced in opposition to Coinbase and Binance.

The 2 circumstances are extraordinarily totally different, thoughts you. Binance’s lawsuit couldn’t be much less stunning, with the trade consistently skirting pointers and legal guidelines. The fees quantity to a laundry record of various offences, together with buying and selling in opposition to clients, manipulating commerce quantity, encouraging customers to avoid geographical restrictions and securities violations.

It’s the latter cost which is the centre of the swimsuit in opposition to Coinbase, nevertheless, and essentially the most pivotal of the lot. Additionally it is why the Coinbase swimsuit is way more intriguing. Don’t forget that the allegations are coming from the SEC, the identical physique which presided over Coinbase’s IPO in April 2021. Why did the SEC let an unregistered securities trade float on a US inventory trade? You inform me.

However let’s get again to the purpose: what this all means for crypto markets. Whereas Bitcoin seems to be carving its personal place out within the eyes of the regulation, a slew of different tokens have been named as securities by the SEC. Regardless of this, they’ve risen sharply since off the Bitcoin ETF information. Does this make sense?

Conclusion

On the finish of the day, crypto goes to crypto. Costs transfer, and attempting to pinpoint causes is commonly a idiot’s errand. The final month, nevertheless, looks like we’ve seen an especially aggressive value rise regardless of some dangerous information on the regulatory entrance.

Moreover, the macro image has not modified a lot, even with the pause on the final Fed assembly. Fed chair Jerome Powell’s feedback made it clear that this was a pause somewhat than an about-turn in coverage.

“Wanting forward, almost all committee individuals view it as seemingly that some additional price will increase might be acceptable this yr,” Powell stated when saying the pause.

The market believes him. I backed out chances from Fed futures within the subsequent chart, which present that there’s presently an 86% likelihood of a 25 bps hike on the subsequent Fed assembly in three weeks time, with solely a 14% likelihood of charges being left unchanged once more. I’ve offered this subsequent to the identical chances conveyed by the market precisely a month in the past (Bitcoin is up 20% within the time since), exhibiting softer forecasts don’t clarify the sharp value (the possibility of no hike has really come down).

As I stated, crypto going to crypto. However with belongings as notoriously unstable as what we see on this sector, it could be clever to cease and take into consideration whether or not the sudden wave of positivity is justified. When contemplating the liquidity image and the regulatory bother, there are many causes to hesitate.

Then when one layers within the macro image, the image turns into murkier once more. Allow us to not neglect that we’re within the midst of one of many swiftest price mountaineering cycles in trendy historical past, with charges rising all the way in which from zero to above 5%, and the prospect of them rising even additional later this month.

Financial coverage operates with a lag, and the size of that tightening is big. Sentiment might really feel prefer it has flipped dramatically, however there’s a lengthy highway forward but.

Share this text

Classes

Tags

https://coinjournal.web/information/crypto-prices-rising-and-sentiment-flipping-but-liquidity-macro-picture-are-ominous/

[ad_2]

https://t.me/s/officials_pokerdom/3401

https://t.me/s/lex_officials

https://t.me/dragon_money_mani/15