[ad_1]

- Curve founder Michael Egorov has offered over 39 million CRV to traders and entities in over-the-counter offers.

- Egorov acquired $15 million in USDT to this point for promoting CRV at a reduced value of $0.40, per DeFi analysts LookOnChain.

- Sources mentioned the OTC offers embrace 3-6 month lock-up phrases with the consumers like Tron founder Justin Solar and market maker DWF Labs.

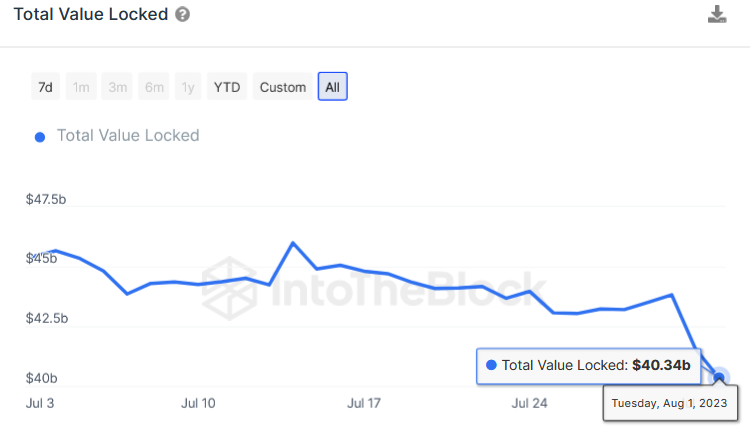

- Complete worth locked on Ethereum dipped by just a few billion following exploits on manufacturing unit swimming pools offered by Curve Finance and a hunch in CRV value.

Complete worth locked on throughout Ethereum DeFi protocols dipped by $3.55 billion since Sunday following exploits on Curve Finance manufacturing unit swimming pools, on-chain analytics supplier IntoTheBlock mentioned on Tuesday.

The 8% decline in TVL comes at a time when founder Michael Egorov is promoting discounted CRV tokens for USDT in a bid to stave off liquidation of his collateralized mortgage on Aave, a serious DeFi lender.

Tron’s Solar And Different Faucet Curve Low cost

Per DeFi analysts LookOnChain, Curve founder Michael Egorov has offered 39.25 million CRV in alternate for $15.8 million USDT. The transactions have been reportedly a part of OTC offers with traders like Tron founder Justin Solar, market maker DWF Labs, crypto dealer DCFGod, and DeFi platform Cream Finance.

In keeping with reviews, Egorov and the consumers agreed on lock-up intervals starting from three to 6 months. These traders also can promote their CRV ought to the value rise to $0.80.

Egorov’s flurry of OTC offers is purportedly a transfer to cushion his $60 million on Aave collateralized by $175 million in CRV tokens. Liquidation of the founder’s Aave mortgage may set off a domino impact of dangerous debt throughout a number of DeFi lending providers, doubtlessly plunging the decentralized lending ecosystem into disarray.

This situation solely performs out ought to CRV’s value plunge considerably under $0.3 thus liquidating Egorov’s huge Aave mortgage. Issues relating to the chance have been raised after manufacturing unit exploits on Curve Finance liquidity swimming pools and the following CRV value decline.

[ad_2]