[ad_1]

As broadly anticipated by market individuals, the US Federal Reserve simply lifted rates of interest by 25 bps, taking them to their highest stage in 22 years at 5.25-5.5%.

In his post-policy announcement press convention, Fed Chair Jerome Powell signaled that the Fed is sustaining the optionality to hike rates of interest additional, relying on incoming US financial knowledge.

Most analysts appear to assume that was most likely the final curiosity hike from the Fed of this tightening cycle.

Key Personal Financial institution’s managing director of fastened revenue Rajeev Sharma informed the monetary press that “in our opinion, the speed climbing cycle is completed and the Fed will now pause for the remainder of the 12 months”.

Manulife Funding Administration’s world chief economist Frances Donald stated that “we now imagine that the Fed is on a chronic ‘hawkish maintain’… their subsequent transfer will possible be a lower however it can take till 2024 till we see it”.

“That stated”, he added, “Powell may have no alternative however to maintain the specter of hikes alive, lest he encourage markets to prematurely worth in cuts and reignite inflation expectations”.

Inflation within the US stays properly above the Fed’s 2% goal and the labor market stays scorching, which explains their reluctance to permit a untimely easing in monetary circumstances.

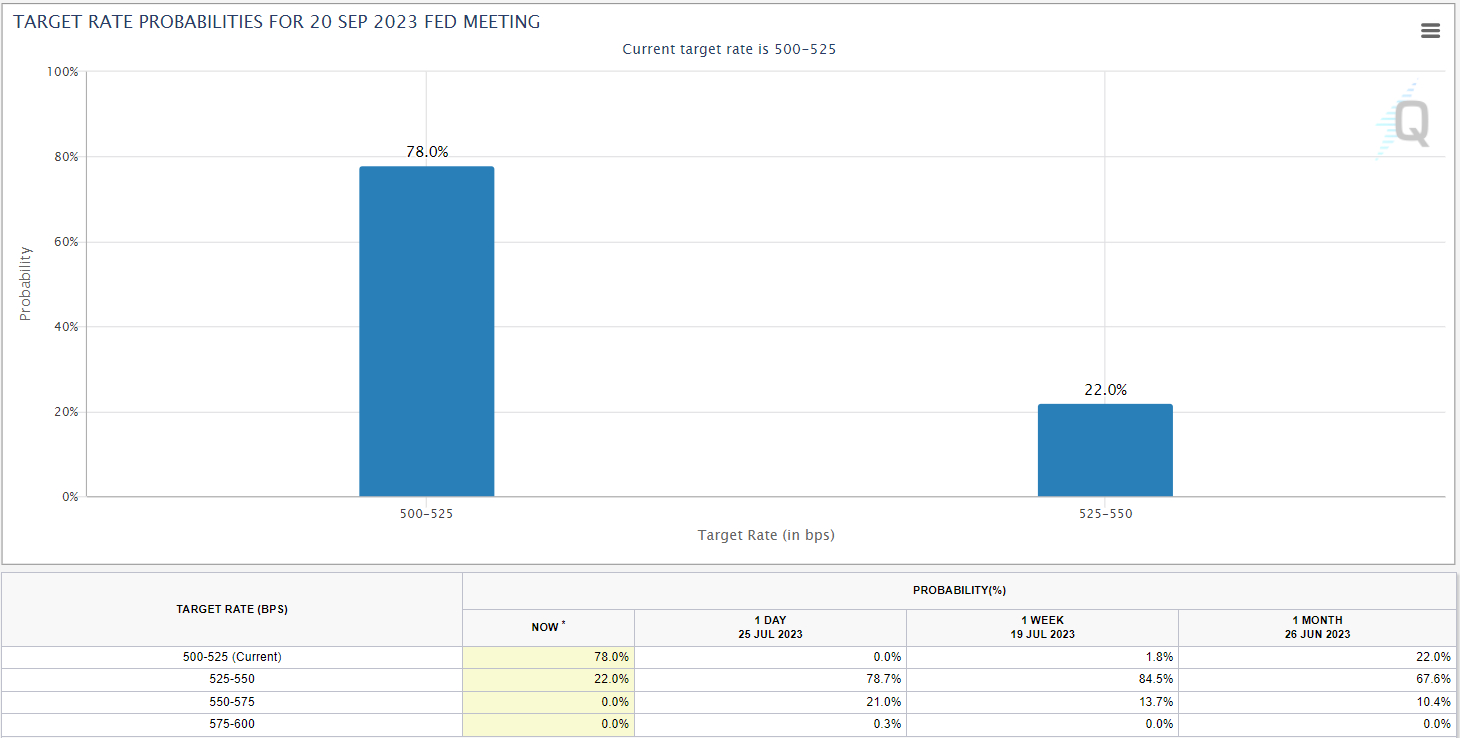

Regardless of the Fed sustaining its bias towards extra hikes and analysts broadly not saying they anticipate any price cuts this 12 months, US cash markets shifted to cost in a powerful chance that the Fed cuts rates of interest in September.

As per the CME’s Fed Watch Instrument, the cash market-implied chance of a 25bps rate of interest reduce to five.0-5.25% in September leaped from zero this time yesterday to 78%.

US yields slipped just a few bps throughout the curve consequently, as did the US Greenback Index (DXY).

Main US fairness benchmarks just like the S&P 500, Nasdaq 100 and Dow Jones Industrial Common have been broadly flat.

Right here’s How Crypto Reacted

Crypto costs have been uneven however are at present larger versus their pre-Fed coverage announcement ranges.

Bitcoin (BTC) was final buying and selling round $29,500, up round 1% on the day.

Ether (ETH) was simply over 1% larger within the higher $1,800s.

Solana (SOL) is the most important mover within the prime 10 by market cap, up near 10% on the day.

Bitcoin is at present retesting resistance within the type of its late-June/early to mid-July lows at $29,500, with a break above this stage doubtlessly set to open the door to a push larger in the direction of the 21DMA simply above $30,000, with the 50DMA having not too long ago acted as robust resistance.

BTC’s medium-term technical bias continues to look very optimistic, with the BTC worth nonetheless in a powerful uptrend for 2023 and properly above its 200DMA.

[ad_2]