[ad_1]

Prime Minister Fumio Kishida of Japan made a resolute assertion immediately that may very well be a boon to crypto markets, reiterating the nation’s ambition to be on the forefront of Web3 innovation.

His remarks coincided with information that main cryptocurrency change Binance plans to launch operations in Japan starting August 2023. This supplies a brand new on-ramp for Japanese traders to entry cryptocurrencies, regardless of Binance’s ongoing jurisdictional battles with American regulators.

In mild of this, what are the very best cryptos to purchase now?

The BInance change made headlines this week for its plans to file a movement dismissing a lawsuit introduced towards it by the U.S. Commodity Futures Buying and selling Fee.

Binance stands accused of illegally providing derivatives buying and selling to U.S. clients, amongst different expenses. This swimsuit comes along with an ongoing securities fraud lawsuit levied towards Binance by the SEC.

Throughout the Pacific, Coinbase CEO Brian Armstrong believes U.S. lawmakers really feel a heightened sense of urgency round crafting cryptocurrency rules.

In a latest assembly with members of Congress, he famous reinvigorated engagement on crypto points following latest authorized developments like Ripple’s partial victory in its battle with the SEC.

Armstrong believes many lawmakers are actually reconsidering their earlier hands-off method to the crypto house.

With adoption accelerating and authorized precedents being set in real-time, regulators face immense strain to supply guardrails with out stifling innovation.

Regardless of swirling uncertainty, one factor stays clear – from Tokyo to Washington, there isn’t a denying that cryptocurrencies are nonetheless commanding consideration and unlocking unprecedented prospects.

Maker, Evil Pepe Coin, GMX, Chimpzee, and Belief Pockets are among the finest cryptos to purchase now given their sturdy fundamentals and optimistic technical analyses.

Maker (MKR) Resurfaces from Dip, Eyes Horizontal Resistance Stage

Following a brand new YTD excessive of $1,250 on July 21, MKR has retraced to the Fib 0.236 stage at $1,076. MKR is now buying and selling at $1,148, up 7.49% to date immediately because it rebounds from the latest dip. Nevertheless, MKR faces a big problem within the type of the $1,153 to $1,188 horizontal resistance zone.

The present worth is signaling a robust uptrend, with the 20-day Exponential Shifting Common (EMA) standing at $986, effectively above it. This bullish outlook is additional confirmed by the 50-day and 100-day EMAs at $872 and $798 respectively, which proceed to path far under the worth.

Moreover, the RSI has risen to 71.12 from yesterday’s 65.64, denoting rising shopping for strain. Nevertheless, because it enters overbought territory above 70, a possible worth correction may happen quickly.

Equally, the MACD histogram has grown to 11 from 9, pointing to constructing bullish momentum that aligns with the optimistic EMA and RSI readings.

The market cap of MKR is at present at $1.124 billion, up by 8.24% to date immediately, whereas the quantity stands at $109 million, up by 27.85% to date immediately. This improve in each quantity and market cap suggests a rising curiosity within the token, which may doubtlessly gasoline additional worth will increase

Nonetheless, merchants ought to train warning. The resistance zone from $1,153 to $1,188 could halt MKR’s climb. If the worth fails to exceed this barrier, a pullback to the assist across the Fib 0.236 stage at $1,076, close to the horizontal assist of $1,055 to $1,086, may transpire.

Whereas MKR’s technicals largely point out the potential for extra beneficial properties, the close by resistance poses a key check.

Merchants are suggested to observe how the worth acts round that stage, because it may decide if MKR retains rising or sees a near-term retracement.

Embrace Your Evil Aspect: Evil Pepe Coin Is One of many Finest Cryptos to Purchase Now

Because the Pepe worth encounters obstacles, Evil Pepe Coin is choosing up steam and has already raised over $800,000 to date in investments from keen consumers.

Regardless of being a comparatively new addition to the Pepe clan, Evil Pepe Coin ($EVILPEPE) has been posting spectacular statistics.

Whereas Pepe’s worth declined 12% final month to $0.00000100, Evil Pepe is quickly approaching its bold presale goal of $1,996,002 with only one week remaining.

This up-and-coming meme coin has a complete provide of 6.66 billion tokens, with every token valued at $0.000333.

At this worth level, the whole market capitalization comes out to $2,217,780 – a comparatively modest quantity within the cryptocurrency market.

With its interesting options and affordable market cap, Evil Pepe Coin presents an fascinating alternative for potential consumers.

As soon as it will get listed on decentralized exchanges, traders stand to doubtlessly notice substantial returns as buying and selling exercise picks up momentum.

The coin’s present accessibility and low valuation make it well-positioned for vital development.

The provocative advertising tagline “Embrace your evil facet” promotes Evil Pepe tokens to potential consumers.

However past the promotional hype, specialists see actual potential for worth development after the token is listed on exchanges. Key elements assist this optimistic outlook.

First, 90% of the whole token provide is offered within the presale, making certain a good distribution.

Second, the remaining 10% will likely be locked in liquidity for one month, eliminating issues a few rip-off “rug pull” the place builders rapidly money out.

Lastly, whereas rumors hyperlink Evil Pepe to the unique Pepe staff, it’s the plain advertising momentum and widespread media consideration that’s actually driving capital inflow into the challenge.

With intelligent promotion and fundamentals aligned for development, Evil Pepe could ship beneficial properties if neighborhood curiosity continues after the presale.

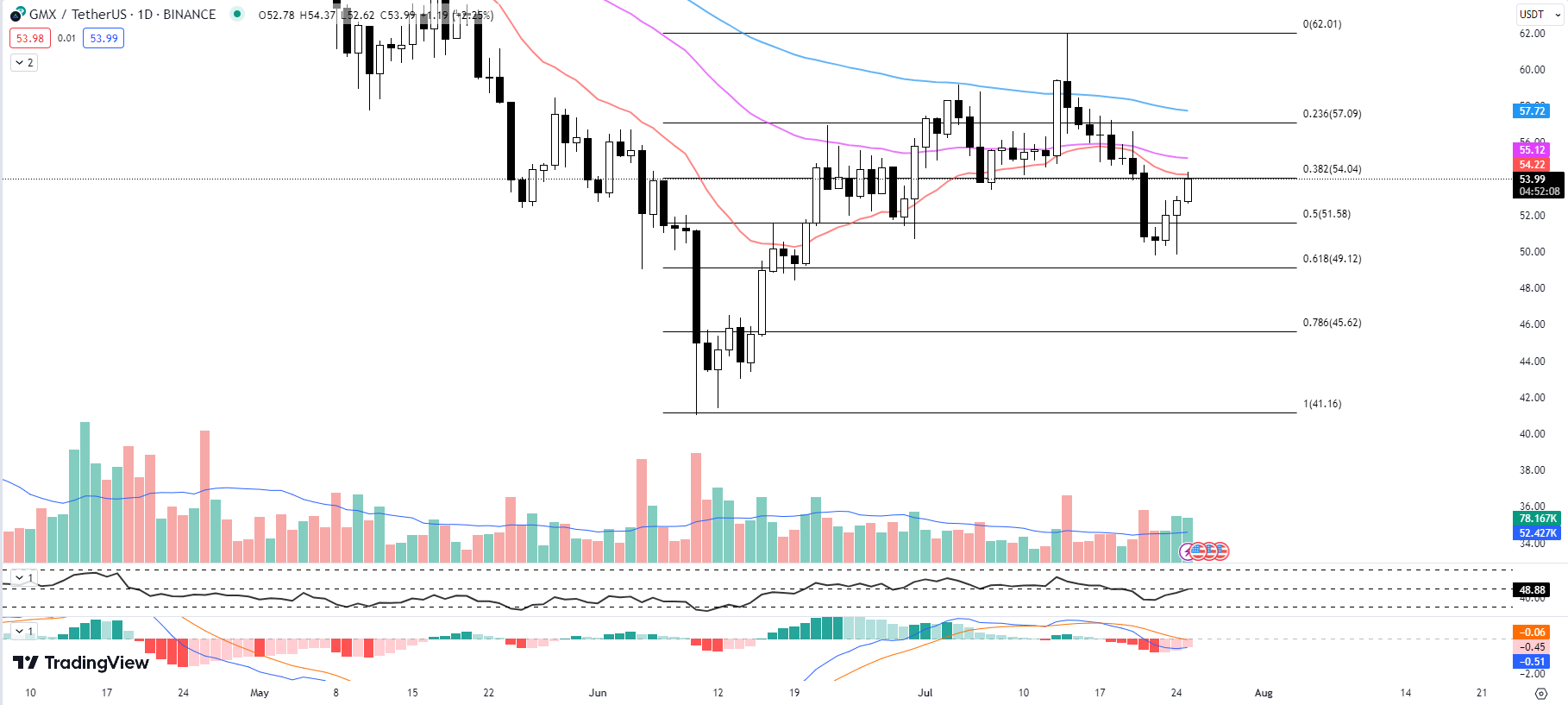

GMX’s Current Worth Motion: Indicators of a Potential Turnaround?

GMX fell for eight days from July 14 to July 22 till discovering assist on the Fib 0.5 stage of $51.58. Since then, it has rebounded strongly with beneficial properties for 3 days in a row.

Traders, nevertheless, should be cautious as GMX heads again towards a crucial resistance stage.

Having recovered from its latest lows, GMX is at present priced at $53.99, marking an uptick of two.25% to date immediately.

Because it hovers close to the Fib 0.382 stage at $54.04, it is also developing towards the 20-day EMA at $54.22. This confluence of resistance ranges may show a formidable barrier to additional upward momentum.

The 20-day EMA, typically utilized by merchants to determine short-term market traits, is only a hair above the present worth. This implies that GMX is in a crucial zone the place it may both affirm a bullish reversal or resume the prior downtrend.

Additional including to the complexity of the state of affairs is the 50-day EMA at $55.12 and the 100-day EMA at $57.72. These longer-term development indicators recommend that the general development has been bearish, however the latest worth motion exhibits indicators of a possible turnaround.

The RSI at present stands at 48.88. This determine, barely under the impartial 50, signifies an almost balanced market with neither the bulls nor the bears having a transparent higher hand.

The MACD histogram exhibits a price of -0.45. Whereas this detrimental determine signifies a bearish sign, the bettering development suggests the momentum may very well be shifting in favor of the bulls.

In mild of those indicators, merchants ought to tread rigorously. GMX’s instant assist lies on the Fib 0.5 stage at $51.58. If the worth fails to interrupt by means of the resistance and falls under this assist, it may sign a continuation of the bearish development.

However, a profitable break above the Fib 0.382 stage and the 20-day EMA could be a bullish sign, doubtlessly opening the door for additional beneficial properties.

The present technical indicators painting a pivotal second for GMX. The result of this retest on the confluence of the Fib 0.382 stage and the 20-day EMA may set the route for the instant future.

Merchants would do effectively to maintain a detailed eye on these ranges and regulate their methods accordingly.

Chimpzee’s Charitable Chase: Finest Crypto to Purchase for a Trigger?

Chimpzee’s crypto-focused charity challenge is rapidly gaining momentum within the midst of the present crypto hype.

With the presale complete approaching $1 million, it is clear that the challenge is resonating with people who’re all in favour of utilizing their crypto for charitable functions.

Staying true to its roadmap, the challenge launched the Chimpzee Gold Passport NFT that includes eight distinctive designs.

Eco-minded traders shopping for in in the course of the “gold stage” of the presale can mint one in every of these NFTs in change for 750,000 $CHMPZ tokens, which guarantees a formidable 18% staking yield.

Nevertheless, monetary incentives are usually not Chimpzee’s sole focus. Aligning with its core mission of contributing to environmental causes, Chimpzee not too long ago donated $20,000 to the WILD Basis, defending the black jaguar.

They’ve additionally planted hundreds of bushes in Brazil and Guatemala whereas pledging $15,000 to elephant conservation.

Except for its admirable goals, Chimpzee represents a promising crypto funding alternative.

At present, in stage 8 of its presale, Chimpzee urges potential consumers to behave quick. With stage 9 quick approaching, the $CHMPZ worth will rise to $0.00085.

With plans to launch on main exchanges at $0.00185, far above its present worth of $0.000775, the long run seems vibrant.

Being a deflationary token, the worth of $CHMPZ will progressively improve as time goes on.

Propelled by endorsements from crypto influencers, Chimpzee’s momentum appears unstoppable. Traders looking for revenue paired with objective ought to take into account leaping aboard.

Belief Pockets Token (TWT) Strives to Set up Foothold on 50-Day EMA

Marking a big transfer to the upside, the Belief Pockets Token (TWT) broke out of its three-week consolidation under the Fib 0.236 stage of $0.8684 with a sturdy 7.95% surge yesterday.

This bullish momentum, nevertheless, met a tricky resistance on the Fib 0.382 stage of $0.9656, which is in confluence with the horizontal resistance zone of $0.9635 to $0.9809.

Regardless of the resistance, a glimmer of hope stays for TWT’s continued bullish development because it makes an attempt to determine a foothold on the 50-day EMA at $0.9022.

The 20-day EMA, a short-term development indicator, is at present at $0.8688, carefully aligned with the Fib 0.236 assist stage. This additional reinforces the $0.8684-0.8688 zone as a crucial assist space.

The 50-day EMA, a medium-term development indicator, sits at $0.9022, marking the extent the place TWT is at present striving to consolidate.

Equally, the 100-day EMA, a long-term development indicator, stands at $0.9892, barely above the aforementioned resistance zone. This implies that if TWT manages to breach the instant resistance, it may encounter additional opposition earlier than making vital upside strides.

The RSI has cooled barely to 59.73 from yesterday’s 67.05. This implies a slight lower in shopping for strain. Nevertheless, because the RSI stays above the mid-line 50, the general bullish momentum continues to be intact.

The MACD histogram has elevated barely to 0.0128 from 0.0118, indicating a slight bullish bias within the brief time period.

In the meantime, the market cap and quantity have seen a lower. The market cap is down by 3.68% to $383 million, and the quantity, too, has decreased by 26.87% to $38 million. This contraction in buying and selling quantity could suggest a lower in investor curiosity, doubtlessly resulting in decrease volatility within the close to future.

TWT is at present buying and selling at $0.9161, down by 2.82% to date immediately. This locations it in a precarious place between the instant resistance on the Fib 0.382 stage at $0.9656 and the assist on the 50-day EMA at $0.9022.

TWT is at present in a tug-of-war between the bulls and bears. The important thing ranges to observe are the 50-day EMA for assist and the Fib 0.382 stage for resistance. A profitable maintain above the 50-day EMA may pave the way in which for an additional try at breaching the resistance.

Conversely, a break under may see TWT revisit the stronger assist on the 20-day EMA and Fib 0.236 confluence zone.

Disclaimer: Crypto is a high-risk asset class. This text is supplied for informational functions and doesn’t represent funding recommendation. You would lose your entire capital.

[ad_2]