[ad_1]

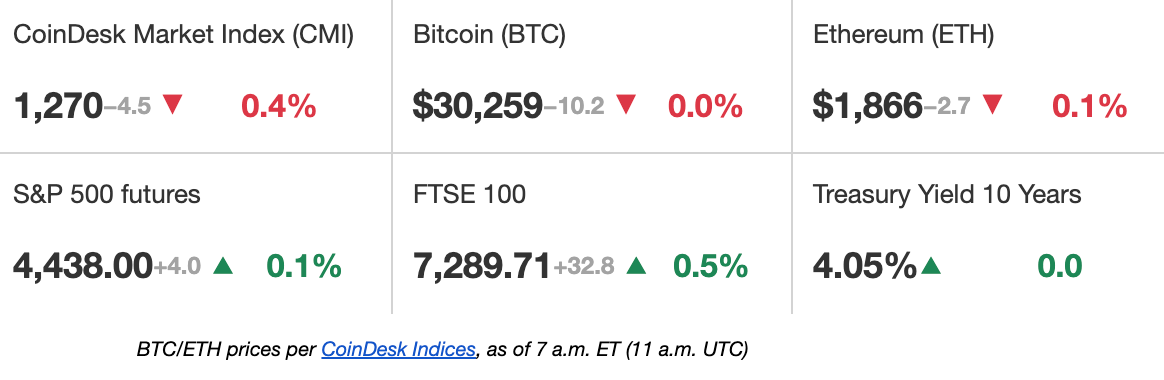

Bitcoin (BTC) and ether (ETH) have been little-changed on Monday, however quite a lot of crypto gainers from final week have been pulling again. In macro information to come back this week, traders might be specializing in U.S. inflation figures on Wednesday for alerts relating to the Federal Reserve’s subsequent transfer. Since breaking above $30,000 in June, bitcoin has traded between $29,500 and $31,500. “These ranges could possibly be essential within the near-term,” stated SEBA Financial institution in a morning be aware. “With U.S. CPI anticipated this week, a break of both stage may see a pattern emerge.” Amongst these cryptos giving again a few of final week’s positive aspects have been Avalanche’s AVAX, down 5% over the previous 24 hours, and Solana’s SOL, which dipped 4% over the identical timeframe.

Coinbase (COIN) acknowledged the chance that federal securities legal guidelines would apply to its listings years in the past, the U.S. Securities and Alternate Fee (SEC) argued in a brand new submitting Friday. The company was responding to a Coinbase submitting which claimed the SEC doesn’t have enough jurisdiction to deliver a lawsuit in opposition to it. The SEC sued Coinbase a month in the past, alleging it was working as an unregistered dealer, clearinghouse and alternate, having listed no less than 13 totally different cryptocurrencies which might be unregistered securities. In Friday’s court docket submitting, the SEC stated that it could oppose any movement for judgment Coinbase may submit, and requested a court docket to strike the alternate’s arguments that the go well with violated the key questions doctrine and different considerations. “Coinbase, a multi-billion-dollar entity suggested by subtle authorized counsel, argues it was unaware that its conduct risked violating the federal securities legal guidelines, and means that by approving Coinbase’s registration assertion in 2021 the SEC confirmed the legality of Coinbase’s underlying enterprise actions – at the moment and forever,” the SEC stated in its submitting.

Round 15 retail central financial institution digital currencies (CBDCs) could possibly be in circulation the world over by the top of this decade, in line with a survey carried out by the Financial institution for Worldwide Settlements (BIS). A Switzerland-based physique owned by 63 central banks representing round 95% of the world economic system, the BIS stated 9 central banks had additionally indicated they’re “very probably” to problem a CBDC for wholesale use in monetary markets throughout the subsequent six years. Of the 86 central banks surveyed by BIS, 93% at the moment are enterprise CBDC work, the research stated, with main jurisdictions comparable to India, the U.Okay. and the European Union all severely exploring issuing a digital model of their fiat currencies.

-

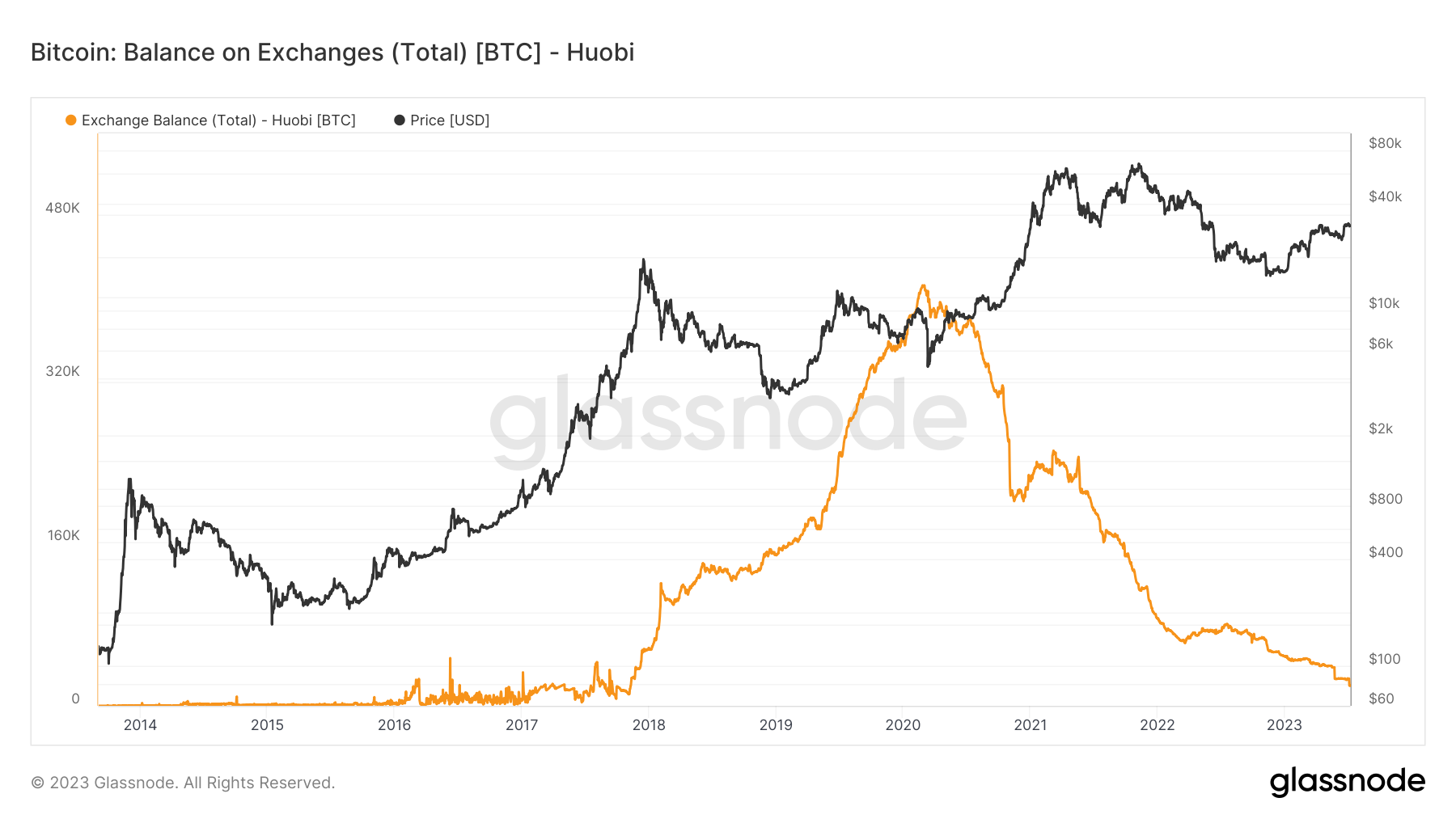

The variety of bitcoin held in wallets tied to cryptocurrency alternate Huobi has dropped beneath 20,000 BTC, the bottom since 2017.

-

The stability has declined to ranges which change into more and more crucial to keep up on-exchange liquidity, in line with Deutsche Digital Belongings.

-

“Huobi’s stablecoin reserves in Tether (USDT) additionally seem comparatively low. This might change into a supply of additional uncertainty for crypto markets down the street if Huobi skilled additional outflows,” analysts at Deutsche Digital Belongings stated in a weekly report.

Disclaimer: This text was written and edited by CoinDesk journalists with the only function of informing the reader with correct info. When you click on on a hyperlink from Glassnode, CoinDesk could earn a fee. For extra, see our Ethics Coverage .

Edited by Stephen Alpher.

https://www.coindesk.com/markets/2023/07/10/first-mover-americas-bitcoin-holding-above-30k-after-quiet-weekend/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

[ad_2]