[ad_1]

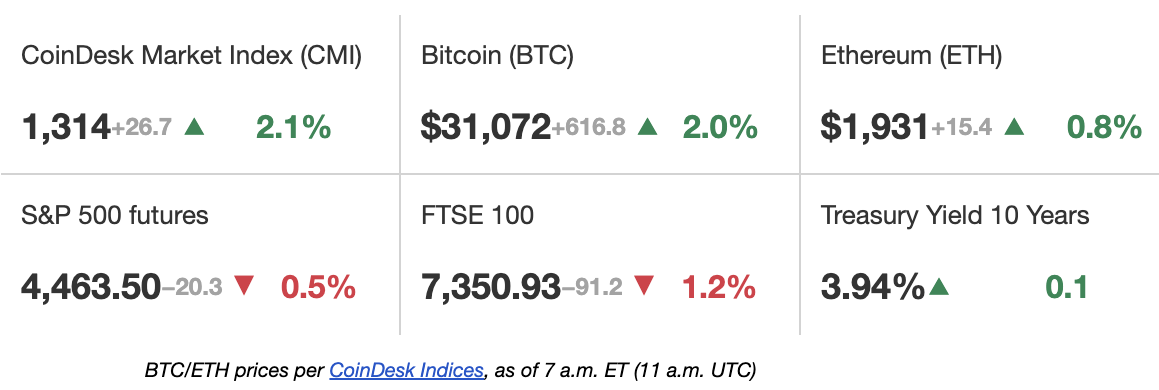

Bitcoin (BTC) rallied to a brand new 13-month excessive above $31,500 early Thursday morning earlier than a pullback to the present $31,100, up greater than 2% for the day. The world’s largest cryptocurrency by market worth has traded above $30,000 for a few weeks, however has struggled to achieve the $32,000 degree. “For the bitcoin rally to proceed, we might want to get affirmation that the SEC will grant permission for a spot-Bitcoin ETF within the U.S,” mentioned Edward Moya, senior analyst at Oanda. The highest gainer amongst large-cap cryptos on Thursday, nonetheless, is bitcoin money (BCH), up greater than 12%, and persevering with a giant run greater following its itemizing on EDX Markets which is backed by Constancy, Charles Schwab and Citadel Securities. Positive factors may proceed in July as knowledge from TradingView reveals this month is traditionally a very good one for cryptos. One 12 months in the past in July, BCH rose 34%, whereas BTC superior 17%.

BlackRock CEO Larry Fink mentioned crypto, particularly bitcoin, may revolutionize the monetary system in an interview with Fox Enterprise on Wednesday. “We do imagine that if we are able to create extra tokenization of property and securities – that’s what bitcoin is – it may revolutionize finance,” he mentioned. Beforehand recognized to be a skeptic of crypto, Fink years in the past urged followers of the asset class closely used it for “illicit actions.” Fink continued: “As an alternative of investing in gold as a hedge towards inflation, a hedge towards the onerous issues of anybody nation, or the devaluation of your forex no matter nation you’re in – let’s be clear, bitcoin is a world asset, it’s not based mostly on anybody forex and so it could actually symbolize an asset that individuals can play instead.”

Circle is contemplating issuing a stablecoin in Japan following laws governing stablecoins in that nation that took impact on June 1, the cost providers firm’s co-founder and CEO Jeremy Allaire mentioned. In an interview with CoinDesk Japan, Allaire mentioned that if stablecoins turn into extra broadly used for cross-border commerce, overseas forex transactions and world commerce, Japan will turn into a particularly giant market. Japan’s stablecoin invoice makes it one of many first nations to determine a framework for the usage of abroad stablecoins, which Allaire considers “crucial factor the federal government and the Monetary Providers Company have carried out.”

-

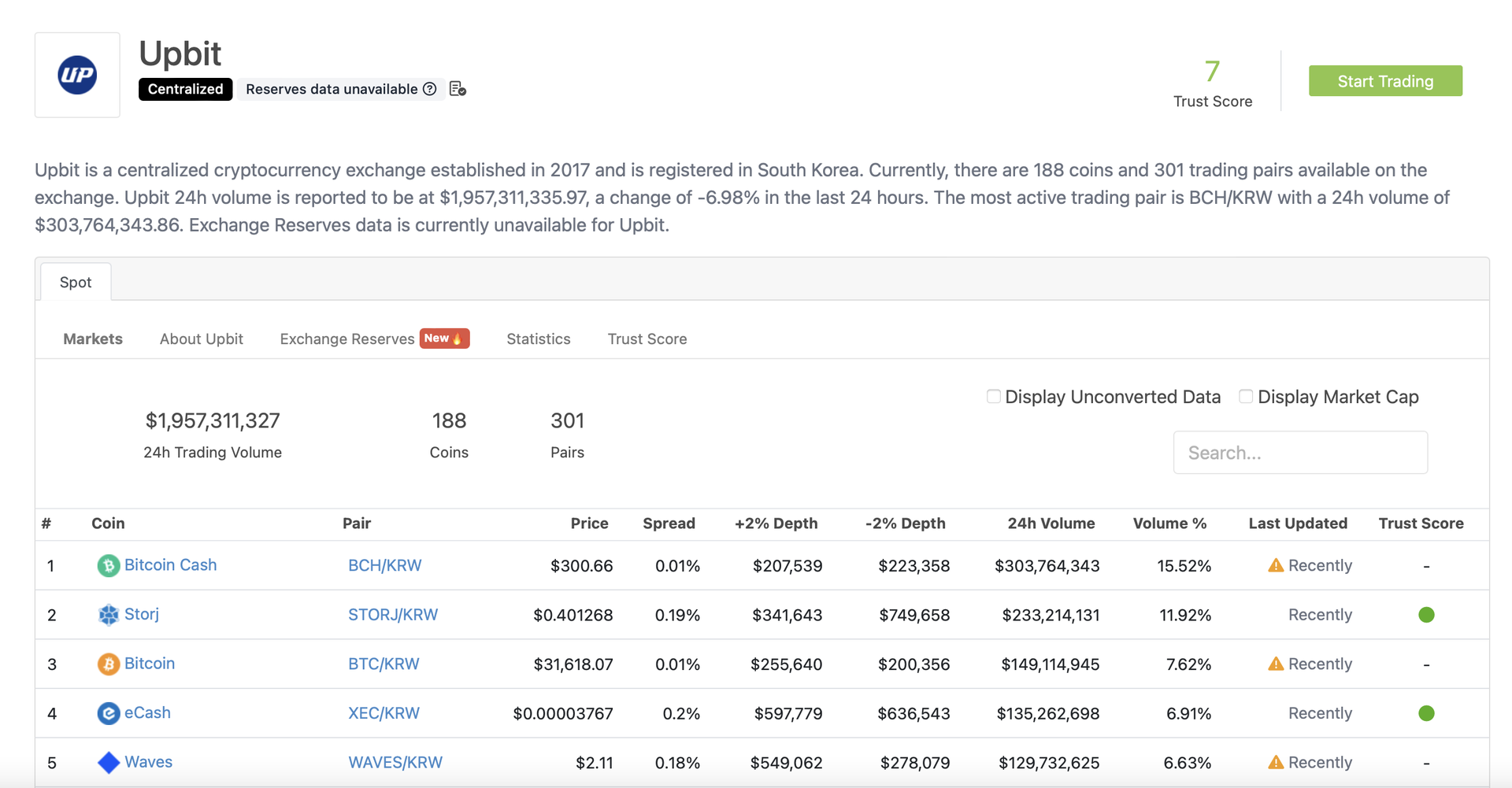

The chart reveals the 24-hour buying and selling quantity in cryptocurrency buying and selling pairs listed on South Korea’s largest digital property change Upbit.

-

The bitcoin money/Korean gained (BCH/KRW) buying and selling pair has registered a buying and selling quantity of $303 million the previous 24 hours, a major decline from $557 million seen every week in the past.

-

Whereas BCH has gained 12% in previous 24 hours, costs stay properly beneath June 30 excessive and inside the $250-$320 vary that persevered since Korean volumes peaked every week in the past.

-

“The Koreans have stopped shopping for BCH,” Matrixport’s head of analysis and technique Markus Thielen mentioned, noting the decline within the BCH/KRW buying and selling quantity on Upbit.

Edited by Stephen Alpher.

https://www.coindesk.com/markets/2023/07/06/first-mover-americas-bitcoin-cash-largest-big-cap-gainer-as-cryptos-move-higher/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

[ad_2]

I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

I like the efforts you have put in this, regards for all the great content.

Nice post. I learn something totally new and challenging on websites

This brought real value to my day.