[ad_1]

One of many largest items of stories impacting crypto markets at present is that Coinbase has requested the dismissal of a lawsuit filed towards them by america Securities and Alternate Fee (SEC), in line with an announcement made at present by Paul Grewal, the corporate’s Chief Authorized Officer.

Grewal disseminated the information on X, stating, “Coinbase filed our temporary asking the Courtroom to dismiss the SEC’s case towards us.”

With this newest improvement in thoughts, what are the very best cryptos to purchase now?

Coinbase has emphasised in its important argument that it doesn’t promote funding contracts.

These are a specific sort of securities, as outlined by a number of Supreme Courtroom circumstances and authorized precedents through the years.

Grewal sharply criticized the SEC for allegedly overstepping its bounds, bypassing due course of, and neglecting its personal interpretations of securities legal guidelines.

He additionally argued that the SEC has gone past its authority, as granted by Congress, by overlooking different binding authorized precedents.

It is a important replace in a sequence of authorized back-and-forths that started with the SEC’s lawsuit towards Coinbase in June.

The SEC’s preliminary lawsuit accuses Coinbase of buying and selling unregistered securities, together with ADA, and working an unregistered securities change.

This authorized motion adopted a Nicely Discover that the SEC had despatched to the corporate earlier within the yr.

Regardless of dealing with accusations, Coinbase has reiterated that it has by no means listed securities on its platform.

The corporate has persistently argued that the SEC lacks the regulatory authority to supervise cryptocurrencies.

Trying forward, Grewal has expressed confidence in Coinbase’s capacity to efficiently counter the SEC’s lawsuit. He anticipates that the courtroom will contemplate the case by the tip of October.

Authorized specialists are intently monitoring the Coinbase/SEC case, because it might have important ramifications for the regulation of cryptocurrencies and potential crypto market worth fluctuations.

Regardless of regulatory uncertainty surrounding Coinbase, GMX, Cowabunga, XDC Community, Chimpzee, and Injective stay a number of the finest cryptos to purchase now, due to their robust fundamentals and/or promising technical evaluation.

GMX Sees Optimistic Turnaround: Is Momentum Shifting?

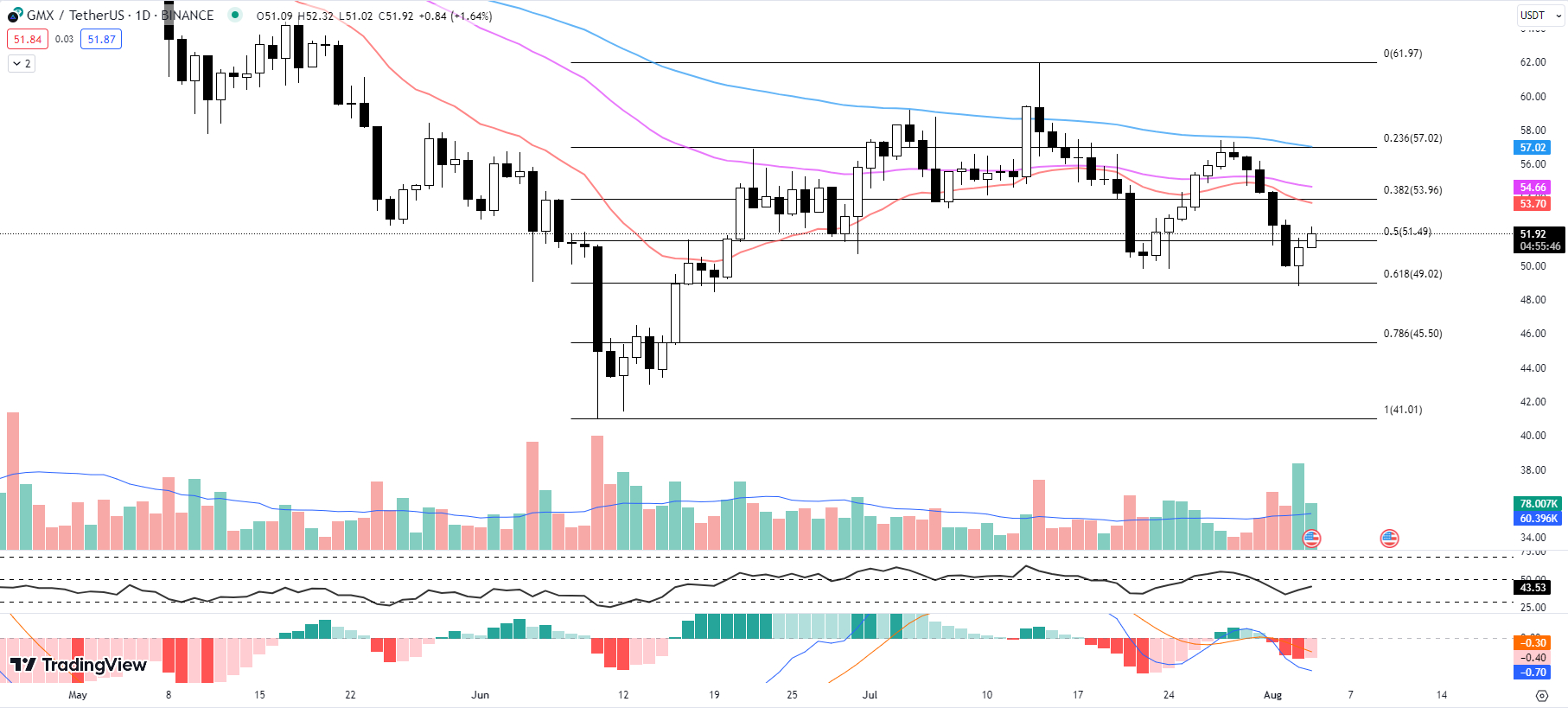

After being rejected from the Fib 0.236 degree at $57.02 and enduring a four-day slide, GMX discovered much-needed assist on the Fib 0.618 degree at $49.02 on August 3.

This optimistic turnaround has continued into at present, with GMX at present buying and selling within the inexperienced and seemingly trying to regain the Fib 0.5 degree at $51.49.

Notably, the 20-day EMA for GMX stands at $53.70, barely beneath the 50-day EMA at $54.66, and effectively beneath the 100-day EMA at $57.02.

This sequence, the place shorter-period EMAs are beneath longer ones, usually factors to a bearish pattern. Nevertheless, the present worth of GMX at $51.92, together with a 1.64% rise to date at present, could sign a possible shift in momentum.

Turning our consideration to the RSI, we see a minor upward motion from 40.54 to 43.54.

Whereas that is nonetheless beneath the mid-point of fifty, indicating a prevailing bearish pattern, the rise means that promoting strain could also be weakening.

The Shifting Common Convergence Divergence (MACD) histogram has additionally moved barely upwards from -0.43 to -0.40.

This optimistic momentum signifies that the bears could also be dropping their grip, offering a possible alternative for the bulls.

Nevertheless, there are key ranges to look at. The primary suggests degree is on the 20-day EMA at $53.70, which coincides with the Fib 0.382 degree at $53.96. Overcoming this twin resistance can be a big bullish sign.

In the meantime, the quick assist degree lies on the Fib 0.5 degree at $51.49, barely beneath the present worth. If GMX slips again beneath this degree, it might set off additional promoting strain and doubtlessly ship the inventory again towards its current assist at $49.02.

Whereas the general pattern stays bearish for GMX, current actions, and technical indicators recommend a doable momentum shift.

Merchants are suggested to maintain an in depth eye on the aforementioned resistance and assist ranges. The overcoming of resistance or failure to carry assist will seemingly provide essential insights into GMX’s quick future.

Cowabunga Coin: One of many Greatest Cryptos to Purchase Now for Teenage Mutant Ninja Turtles Followers

Replete with nostalgia for a lot of, the phrase “Cowabunga!” is now leaping from the Teenage Mutant Ninja Turtles universe into the cryptocurrency market with the upcoming launch of Cowabunga Coin.

Corresponding with the current field workplace success of the most recent Teenage Mutant Ninja Turtles movie, the brand new cryptocurrency seeks to seize the keenness sparked by the movie’s recognition.

Cowabunga Coin’s creators are pursuing a funding aim of $500,000 by providing 35% of the coin’s complete provide for presale.

With solely six days left earlier than the presale’s conclusion, early crypto fans could understand a chance to interact with a culturally important challenge.

Earlier endeavors by the identical advertising and marketing group, such because the SpongeBob Coin, have seen profitable returns, doubtlessly indicating the same path for Cowabunga Coin.

What distinguishes Cowabunga Coin additional is its tokenomics.

The present presale pricing values the coin’s market capitalization at $1,428,571, offering ample development alternatives.

With a finite provide and a sexy presale worth, it is doable that prime demand might incite a decentralized change (DEX) launch for the challenge.

Cowabunga Coin additionally seeks to foster group spirit by way of rewards and incentives.

They plan to allocate 25% of the token provide for group rewards and airdrops, motivating early supporters to carry onto their tokens.

Moreover, 20% of the token provide is reserved for DEX liquidity, with one other 10% put aside for centralized change (CEX) liquidity, indicating the challenge’s dedication to creating stability for its token holders.

XDC Community (XDC) Experiences Sudden Pullback After YTD Excessive

XDC Community (XDC) just lately skilled a big improvement because it reached a brand new year-to-date excessive of $0.09450 earlier at present.

Nevertheless, shortly after reaching this milestone, the asset rapidly skilled a sudden pullback from the horizontal resistance zone between $0.08907 and $0.09028.

This retraction triggered XDC to interrupt beneath the Fib 0.786 degree at $0.08048, with the cryptocurrency now buying and selling at $0.07590, marking a 16.58% lower to date at present.

The 20-day EMA for XDC stands at $0.05827, comfortably beneath the present worth, indicating a prevailing bullish momentum within the quick future.

That is additional corroborated by the 50-day and 100-day EMAs at $0.04672 and $0.04108, respectively, that are additionally beneath the present worth.

Nonetheless, the current downturn in worth is mirrored in XDC’s RSI, which has dropped to 67.78 from yesterday’s excessive of 87.86.

This drop suggests a possible cooling off of beforehand overbought circumstances and may point out {that a} interval of consolidation or additional retracement might be on the horizon.

The MACD histogram additionally presents a decrease determine at present at 0.00263, down from yesterday’s 0.00304.

The reducing MACD histogram means that bearish momentum is creeping in, doubtlessly paving the best way for a short-term downtrend.

By way of the market stature, XDC’s market cap has seen a discount of 5.38% for the day, standing at $1.059 billion, whereas the 24-hour quantity can also be down by 7.64% to $37.9 million.

This lower in buying and selling quantity might signify dwindling dealer curiosity, including one other layer of concern for bullish prospects.

For merchants eyeing potential entry or exit factors, the quick resistance is on the Fib 0.786 degree at $0.08048, which lies in confluence with the horizontal resistance zone of $0.07913 to $0.08054. Any important transfer upwards should breach this resistance for the bulls to regain management.

In the meantime, quick assist lies on the Fib 0.618 degree at $0.06952, which can function a important line within the sand for stopping additional draw back.

Whereas XDC has proven promising efficiency previously few days, at present’s technical indicators recommend warning.

Merchants ought to intently monitor these key ranges and market indicators to make knowledgeable choices.

Chimpzee: The Charity-Centered Web3 Undertaking Making a Actual-World Distinction

Chimpzee is seeing a rising curiosity in its ongoing presale, because it continues to draw buyers whereas celebrating elevating over $1.1 million in funds.

The presale is now in stage 8, permitting buyers to mint Chimpzee Gold Passport NFTs, which provide the holder a wholesome 18% annual yield.

The challenge plans to construct a singular ecosystem, full with a shop-to-earn merchandise retailer, trade-to-earn NFT market, and a play-to-earn recreation named “Zero Tolerance.”

This challenge’s mixture of philanthropy and a variety of options make it one of many finest cryptos to purchase now.

Chimpzee just lately made a considerable donation of $20,000 to the WILD Basis and has already been concerned in quite a few reforestation efforts in Brazil and Guatemala.

The challenge’s roadmap features a sequence of donations to varied organizations, demonstrating a agency dedication to creating a real-world distinction.

The challenge’s merchandise retailer will permit customers to contribute to charitable causes whereas procuring.

The upcoming t-shirt line, which Chimpzee just lately previewed, will see a portion of the earnings donated to listed charities.

Chimpzee’s $CHMPZ token stands out for its deflationary mannequin.

The challenge burns tokens used to buy Chimpzee Passport NFTs, together with any leftover tokens from every presale stage.

The plan is to burn no less than 70% of the preliminary 200 billion token provide, lowering the $CHMPZ provide to lower than 60 billion.

An allocation of 45% of the $CHMPZ provide is accessible to the general public throughout the presale, whereas the remainder of the tokens are designated for exchanges and liquidity, advertising and marketing, improvement, group rewards, the group, and charity.

With its verification by Cyberscope and auditing by Solidity Finance, the challenge group has made important strides within the crypto group.

As Chimpzee advances by way of its presale phases, it solidifies its place as a inexperienced cryptocurrency that mixes a variety of options with a charitable philosophy.

INJ Struggles with Resistance: Will It Break By?

INJ has been caught in a consolidation part over the previous few weeks, with resistance persisting on the 20-day EMA at $8.181 and the Fib 0.618 degree at $8.225.

This resistance, fortified by these two key technical indicators, has to date rejected any makes an attempt to push previous this barrier, thus making a persistent wrestle for upward worth motion for the previous 10 days.

Including complexity to the scenario is the declining buying and selling quantity that has been noticed. This is a vital issue to watch, because it might be indicative of a serious worth motion on the horizon.

A decline in quantity usually precedes important worth swings as merchants have a tendency to attend on the sidelines in periods of uncertainty.

The pattern of the market can also be depicted by the RSI and the MACD histogram. The RSI, which at present sits at 46.83, is down from yesterday’s 48.74, suggesting that INJ is neither overbought nor oversold. Nevertheless, the slight lower hints at a possible decline in shopping for strain.

The MACD histogram can also be showcasing a bearish sign, with its worth shifting from -0.086 to -0.072, indicating a possible unfavorable momentum out there.

The worth of INJ has been in a slight downtrend, at present buying and selling at $8.025, down by 1.21% to date at present.

Trying on the assist degree, the 50-day EMA at $7.969, intently adopted by the Fib 0.5 degree at $7.686, offers the quick buffer for any potential downward worth motion.

Merchants ought to intently monitor these ranges as a breach of those helps might doubtlessly result in a extra pronounced worth decline.

The technical indicators for INJ level to a market that is on edge. The decline in buying and selling quantity, mixed with the fluctuating RSI and MACD histogram, suggests {that a} decisive worth transfer could also be imminent.

As such, merchants needs to be ready for potential volatility within the coming days, whether or not it’s a breakout to the upside, triggering a brand new upward pattern, or a breakdown beneath present assist ranges, setting the stage for additional downward motion.

Disclaimer: Crypto is a high-risk asset class. This text is supplied for informational functions and doesn’t represent funding recommendation. You would lose all your capital.

[ad_2]

Your article helped me a lot, is there any more related content? Thanks!

oral ivermectin cost – brand carbamazepine tegretol 200mg ca

buy isotretinoin 10mg online cheap – dexamethasone pills zyvox online order

buy generic amoxicillin online – buy amoxil sale order ipratropium 100mcg without prescription

order azithromycin 250mg generic – buy generic nebivolol 20mg nebivolol usa

purchase omnacortil online – buy azithromycin 500mg generic prometrium order

gabapentin cost – sporanox 100mg generic order sporanox 100 mg online

lasix over the counter – betnovate for sale3 order betnovate 20 gm without prescription

order augmentin pills – cymbalta 40mg cost cymbalta ca

doxycycline us – cheap albuterol order glucotrol 5mg pills

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

augmentin 625mg sale – buy cymbalta medication order cymbalta 40mg generic

tadalafil 40mg drug – sildenafil price buy generic sildenafil 100mg

order sildenafil generic – order cialis 5mg pills price of cialis

brand lipitor 20mg – order lisinopril 2.5mg pill order generic lisinopril 5mg

how to buy cenforce – purchase chloroquine generic order glycomet online cheap

lipitor online buy – buy lisinopril 10mg for sale lisinopril 10mg pill

lipitor for sale – buy lipitor 10mg sale zestril 10mg us

order omeprazole 20mg online cheap – order metoprolol for sale atenolol tablet

buy generic medrol – buy lyrica online cheap buy triamcinolone pill

purchase clarinex – desloratadine over the counter dapoxetine 90mg canada

cytotec online – order diltiazem sale purchase diltiazem for sale

zovirax 400mg usa – acyclovir 800mg without prescription cheap crestor 20mg

buy motilium online – buy generic tetracycline flexeril 15mg tablet

domperidone 10mg cheap – purchase tetracycline pills oral flexeril

order generic inderal – inderal canada purchase methotrexate online cheap

order coumadin 2mg pill – buy cheap reglan purchase cozaar pills

brand levofloxacin 250mg – buy levofloxacin 250mg online cheap buy zantac pill

buy esomeprazole without prescription – purchase imitrex online cheap buy generic sumatriptan online

buy mobic – buy cheap generic meloxicam order tamsulosin 0.2mg generic

brand ondansetron 4mg – order simvastatin without prescription order zocor online cheap

order valtrex online cheap – finasteride 5mg cost fluconazole pills

buy provigil generic provigil 100mg drug provigil cost modafinil where to buy brand modafinil 100mg provigil ca buy generic modafinil

Palatable blog you possess here.. It’s hard to find great calibre script like yours these days. I truly respect individuals like you! Withstand mindfulness!!

More content pieces like this would create the интернет better.

buy generic azithromycin – sumycin 500mg pills order metronidazole 200mg generic

order semaglutide online – order periactin 4mg online cyproheptadine 4mg drug

buy motilium 10mg generic – flexeril 15mg over the counter cyclobenzaprine online

inderal price – buy generic inderal online order methotrexate 2.5mg sale

amoxicillin order online – buy generic valsartan order generic combivent

buy zithromax without a prescription – bystolic 5mg cheap oral nebivolol 5mg

buy augmentin pills – atbioinfo order generic ampicillin

buy generic esomeprazole 40mg – https://anexamate.com/ buy nexium generic

buy generic coumadin over the counter – anticoagulant buy cheap cozaar

purchase meloxicam generic – relieve pain buy meloxicam sale

deltasone 40mg usa – https://apreplson.com/ order generic deltasone 10mg

how to buy ed pills – https://fastedtotake.com/ natural pills for erectile dysfunction

buy generic amoxil – https://combamoxi.com/ purchase amoxicillin generic

order fluconazole 200mg generic – https://gpdifluca.com/# diflucan 200mg generic

order lexapro pills – https://escitapro.com/# purchase escitalopram pill

cenforce cost – cenforce over the counter order cenforce generic

where to buy cialis cheap – https://ciltadgn.com/ tadalafil prescribing information

buy cialis in las vegas – tadalafil tablets 20 mg side effects cialis soft tabs canadian pharmacy

order zantac 150mg sale – buy generic ranitidine 150mg buy ranitidine 300mg generic

sildenafil citrate 50mg tab – generic viagra buy uk cheap viagra in australia

More delight pieces like this would make the web better. https://gnolvade.com/

Thanks on sharing. It’s first quality. isotretinoin 20 mg

I’ll certainly return to skim more. https://ursxdol.com/get-cialis-professional/

I particularly enjoyed the approach this was written.

This website positively has all of the bumf and facts I needed to this case and didn’t know who to ask. https://prohnrg.com/product/lisinopril-5-mg/

Facts blog you have here.. It’s obdurate to find elevated calibre script like yours these days. I truly comprehend individuals like you! Go through guardianship!! https://aranitidine.com/fr/acheter-fildena/

Such a valuable read.

Such a helpful read.

I truly liked the approach this was laid out.

I took away a great deal from this.

The detail in this article is noteworthy.

The clarity in this article is commendable.

This is the kind of writing I find helpful.

More posts like this would make the internet a better place.

Such a valuable bit of content.

Such a valuable insight.

Such a practical read.

This piece is impressive.

Such a beneficial resource.

I particularly appreciated the approach this was presented.

This is the description of content I have reading. https://ondactone.com/product/domperidone/

I truly admired the style this was explained.

This is the gentle of literature I truly appreciate.

order generic sumatriptan 25mg

More posts like this would force the blogosphere more useful. http://www.fujiapuerbbs.com/home.php?mod=space&uid=3618560

buy generic forxiga online – https://janozin.com/ dapagliflozin canada

orlistat generic – https://asacostat.com/# buy orlistat pills for sale

This is the big-hearted of scribble literary works I positively appreciate. http://shiftdelete.10tl.net/member.php?action=profile&uid=205574

You can protect yourself and your stock by way of being cautious when buying pharmaceutical online. Some pharmacopoeia websites manipulate legally and offer convenience, solitariness, cost savings and safeguards over the extent of purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/levitra.html levitra

Thanks for putting this up. It’s well done. prix viagra professional

This is the kind of advise I recoup helpful.

https://t.me/s/ROX_officials

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/register?ref=IXBIAFVY

https://t.me/s/dragon_money_mani

**mitolyn**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.