[ad_1]

South Korea’s KEB Hana Financial institution is about to work with the central Financial institution of Korea (BOK) on the latter’s CBDC pilot and stablecoin options, reminiscent of tokenized deposits.

Per the newspaper Maeil Kyungjae, Hana Financial institution is now “actively taking part” within the BOK’s ongoing CBDC Proof of Idea challenge.

The newspaper famous that the BOK and Hana will “actively take part within the preparation” of a “forex system based mostly on blockchain know-how.”

The events are actually conducting “inside analysis” on “tokenized deposits.”

Central banks have regarded to in style stablecoins for inspiration in their very own CBDC tasks.

However they consider they will go one higher by bettering the design of standard stablecoins.

They’ve labeled such cash “non-public tokenized monies that flow into as bearer devices.”

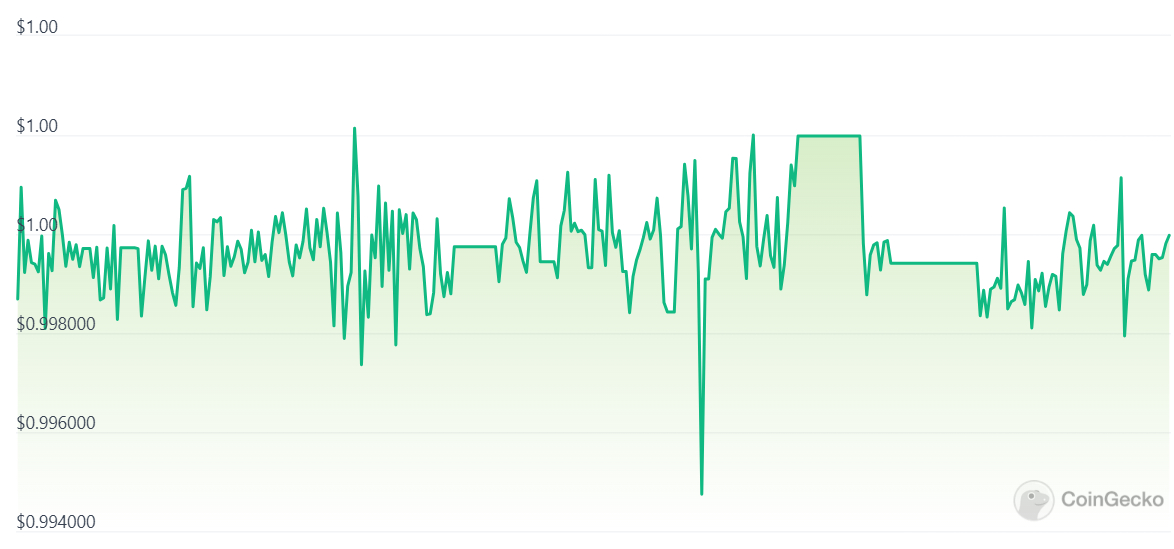

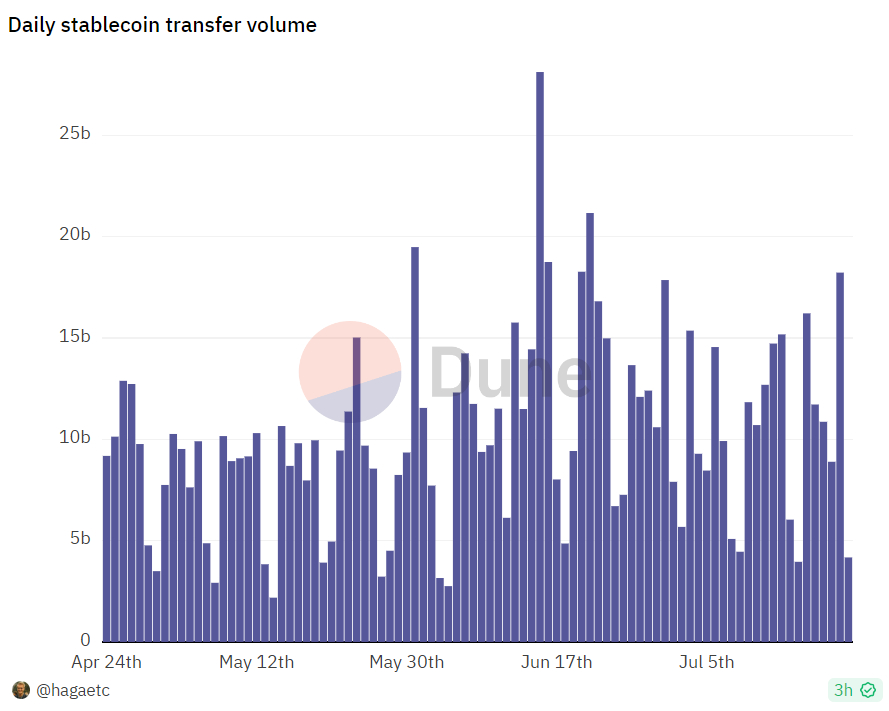

As De Blasis et al demonstrated earlier this yr, in style stablecoins just like the USD-pegged USDT expertise some degree of value volatility.

And this volatility is one thing central banks seem eager to keep away from in any respect prices with their CBDC tasks.

In April, the Financial institution for Worldwide Settlements (BIS) revealed a paper on tokenized deposits and their potential to displace stablecoins within the monetary and banking sectors.

The BIS claimed that stablecoins “could entail departures of their relative change values away from par in violation of the ‘singleness of cash.’”

Instead, tokenized deposits, additionally blockchain-powered, “don’t flow into as bearer devices, however fairly settle in central financial institution cash” and “are extra conducive to singleness,” the BIS wrote.

The BIS additionally claimed that tokenized deposits could “allow expanded performance by constructing on the capability of programmable ledgers to introduce contingent execution and composability of transactions.”

The BOK seems to have taken these suggestions to coronary heart.

And South Korean business banks, apparently apprehensive that they may very well be frozen out of the CBDC image, seem eager to carve out a distinct segment for themselves within the house.

Hana has been exploring the blockchain house for round half a decade.

It has been making inroads into blockchain-powered actual property and investing in crypto sector-related analysis.

The BOK, in the meantime, has been working with a lot of business banking companions on the digital KRW challenge.

South Korea’s Banking Sector Expresses Curiosity in ‘Tokenized Deposits’

Maeil Kyungjae known as tokenized deposits an “rising scorching subject” within the monetary world.

The BIS’ April paper was co-authored by Hyun Track Shin, a former financial advisor to the South Korean presidency.

The Hana rival Woori Financial institution’s Woori Monetary Administration Analysis Institute additionally not too long ago revealed a report on tokenized deposits.

And the media outlet famous that home business banks began “exhibiting nice curiosity in tokenized deposits” tokens when the BOK Governor Lee Chang-yong instructed attendees at a BIS occasion in March that “tokenized deposits are wanted” within the banking business.

Final month, Hana’s Administration Analysis Institute predicted that the home safety token market will develop to some $27 billion subsequent yr.

[ad_2]